Yen Falls As Japan GDP Growth Slows In Q3

15 Novembre 2024 - 3:29AM

RTTF2

The Japanese yen weakened against other major currencies in the

Asian session on Friday, as weak GDP data dampened expectations for

more rate hikes by the Bank of Japan. Data from the Cabinet Office

showed that the Japan's gross domestic product expanded by a

seasonally adjusted 0.2 percent on quarter in the third quarter of

2024. That was in line with expectations and down from 0.7 percent

in the second quarter.

On an annualized basis, GDP was up 0.9 percent, down from 2.9

percent in the three months prior.

External demand was down 0.4 percent on quarter, missing

forecasts for an increase of 0.1 percent after slipping 0.1 percent

in the previous three months.

The GDP price index rose 2.5 percent on year, missing

expectations for 2.8 percent and slowing from 3.1 percent in the

second quarter. Private consumption was up 0.9 percent on quarter -

unchanged from Q2 and beating forecasts for 0.2 percent.

Asian stock markets traded higher, as traders react to a bunch

of upbeat economic data from the region, including upbeat GDP data

from Japan. Regional gains remained very modest after the U.S. Fed

said it would slash interest rates carefully amid inflation

pressures.

Federal Reserve Chair Jerome Powell signaled a cautious approach

on rate cuts, given persistent inflationary pressures. Powell

lauded the economy as "remarkably good", the labor market as

"solid" and noted that inflation was "running much closer" to the

bank's target.

Markets expect a hawkish Trump presidency, with focus on

expected changes in trade and tariff policy.

Trading later in the day may be impacted by reaction to the

latest U.S. economic data, including reports on retail sales and

industrial production.

In the Asian trading today, the yen fell to nearly a 4-month low

of 156.75 against the U.S. dollar and a 4-day low of 198.45 against

the pound, from yesterday's closing quotes of 156.25 and 197.89,

respectively. If the yen extends its downtrend, it is likely to

find support around 158.00 against the greenback and 200.00 against

the pound.

Against the euro, the Swiss franc and the NZ dollar, the yen

slid to 2-day lows of 165.04, 176.02 and 91.72 from Thursday's

closing quotes of 164.53, 175.50 and 91.39, respectively. On the

downside, 167.00 against the euro, 178.00 against the franc and

93.00 against the kiwi are seen as the next support levels for the

yen.

Against the Australia and the Canadian dollars, the yen edged

down to 101.20 and 111.14 from yesterday's closing quotes of 100.81

and 111.12, respectively. The next possible downside targets for

the yen are seen around the 103.00 against the aussie and 113.00

against the loonie.

Looking ahead, Canada manufacturing sales, new motor vehicle

sales and wholesale sales data, all for September, U.S. retail

sales data for October, import and export prices for October, U.S.

NY Empire State manufacturing index for November, U.S. industrial

and manufacturing production for October, business inventories for

September and U.S. Baker Hughes oil rig count data are slated for

release.

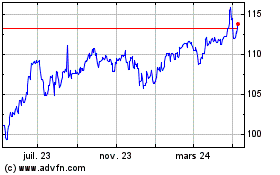

CAD vs Yen (FX:CADJPY)

Graphique Historique de la Devise

De Nov 2024 à Déc 2024

CAD vs Yen (FX:CADJPY)

Graphique Historique de la Devise

De Déc 2023 à Déc 2024