Canadian Dollar Firms As Oil Extends Gains

07 Février 2024 - 11:18AM

RTTF2

The Canadian dollar strengthened against its major counterparts

in the European session on Wednesday, as oil prices traded higher

for a third consecutive session after the U.S. Energy Information

Administration (EIA) said it expects U.S. output to remain largely

steady through 2025, easing worries of excess supply.

The EIA said on Tuesday in its latest Short-Term Energy Outlook

that the U.S. crude oil production reached an all-time high in

December of more than 13.3 million barrels a day but fell to 12.6

million barrels a day in January because of shut-ins related to

cold weather.

The Agency expects U.S. oil production to return in February to

levels just under the record and drop slightly thereafter for the

remainder of the year.

A weaker dollar and cautious optimism regarding U.S. economy's

trajectory also supported oil prices ahead the EIA's inventory

report due later in the session.

The loonie climbed to a 5-day high of 1.3454 against the

greenback and a 2-day high of 110.14 against the yen, off its early

lows of 1.3492 and 109.53, respectively. The currency is seen

facing resistance around 1.30 against the greenback and 113.00

against the yen.

The loonie recovered to 1.4497 against the euro and 0.8783

against the aussie, from an early low of 1.4524 and a 5-day low of

0.8814, respectively. Next key resistance for the currency may be

located around 1.42 against the euro and 0.86 against the

aussie.

Looking ahead, U.S. consumer credit for December will be

published in the New York session.

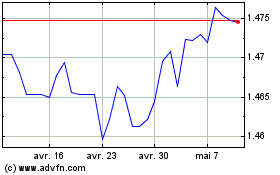

Euro vs CAD (FX:EURCAD)

Graphique Historique de la Devise

De Avr 2024 à Mai 2024

Euro vs CAD (FX:EURCAD)

Graphique Historique de la Devise

De Mai 2023 à Mai 2024