Commodity Currencies Fall Amid Risk Aversion

05 Février 2024 - 4:09AM

RTTF2

The commodity currencies such as Australia, the New Zealand and

the Canadian dollars weakened against other major currencies in the

Asian session on Monday amid risk aversion, as U.S. data showing

much stronger than expected job growth in January and an

improvement in consumer sentiment further dimmed the possibility of

an interest rate cut in March. Mining and energy stocks were down

amid weaker commodity prices.

Traders also remain cautious ahead of the Reserve Bank of

Australia's monetary policy decision on Tuesday, where the RBA is

widely expected to hold interest rates steady.

In economic news, the services sector in Australia continued to

contract in January, albeit at a slower pace, the latest survey

from Judo Bank showed on Monday with a services PMI score of 49.1.

That's up from 47.1 in December, although it remains beneath the

boom-or-bust line of 50 that separates expansion from

contraction.

Meanwhile, Australia posted a merchandise trade surplus of

A$10.959 billion in December, the Australian Bureau of Statistics

said on Monday. That beat forecasts for a surplus of A$10.510

billion following the upwardly revised A$11.764 billion surplus in

November.

Exports were up A$847 million or 1.8 percent on month to

A$47.125 billion after rising 1.7 percent in the previous month.

Imports climbed A$1.652 billion or 4.8 percent on month to A$36,165

billion a month earlier.

Crude oil prices fell as hopes of an early rate cut by the

Federal Reserve faded after data showed a bigger than expected

increase in U.S. non-farm payroll employment in January. The

dollar's sharp uptick after the jobs data also weighed on oil

prices. West Texas Intermediate Crude oil futures for March ended

down $1.54 or about 2.1 percent at $72.28 a barrel. The contract

shed more than 7 percent in the week.

In the Asian trading today, the Australian dollar fell to nearly

a 3-month low of 0.6486 against the U.S. dollar, from Friday's

closing value of 0.6512. On the downside, 0.63 is seen as the next

support level for the aussie.

Against the euro and the Canadian dollar, the aussie slipped to

4-day lows of 1.6602 and 0.8748 from last week's closing quotes of

1.6553 and 0.8765, respectively. If the aussie extends its

downtrend, it is likely to find support around 1.67 against the

euro and 0.86 against the loonie.

The aussie edged down to 96.42 against the yen and 1.0713

against the NZ dollar, from Friday's closing quotes of 96.62 and

1.0733, respectively. The next possible downside target for the

aussie is seen around 93.00 against the yen and 1.06 against the

kiwi.

The NZ dollar slid to nearly a 2-1/2-month low of 0.6048 against

the U.S. dollar and a 1-week low of 1.7810 against the euro, from

last week's closing quotes of 0.6063 and 1.7775, respectively. The

kiwi may test support near 0.59 against the greenback and 1.81

against the euro.

The kiwi edged down to 89.86 against the yen, from Friday's

closing value of 89.96. On the downside, 88.00 is seen as the next

support level for the kiwi.

The Canadian dollar slipped to nearly a 2-week low of 1.3490

against the U.S. dollar, from Friday's closing value of 1.3460. The

loonie may test support near the 1.3460 region.

Against the yen and the euro, the loonie edged down to 110.06

and 1.4529 from last week's closing quotes of 110.20 and 1.4515,

respectively. The loonie is likely to find support near 107.00

against the yen and 1.48 against the euro.

Meanwhile, the safe-haven currency, or the U.S. dollar rose

against its major rivals amid risk aversion.

The U.S. dollar rose to nearly a 2-month high of 1.0768 against

the euro, nearly a 3-week high of 1.2599 against the pound and

nearly a 2-week high of 0.8688 against the Swiss franc, from

Friday's closing quotes of 1.0784, 1.2630 and 0.8664,

respectively.

Against the yen, the greenback advanced to more than a 2-month

high of 148.82 from last week's closing value of 148.37. The next

possible upside target for the greenback is seen around the 151.00

region.

Looking ahead, PMI reports from various European economies and

U.K. for January and Eurozone PPI for December are due to be

released in the European session.

In the New York session, U.S. and Canada PMI reports for January

are slated for release.

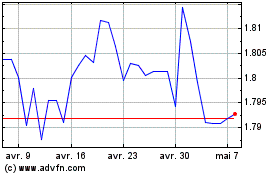

Euro vs NZD (FX:EURNZD)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

Euro vs NZD (FX:EURNZD)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024