U.S. Dollar Extends Fall As Fed Signals Pause On Further Rate Hike

23 Mars 2023 - 4:24AM

RTTF2

The U.S. dollar extended its early slide against other major

currencies in the Asian session on Thursday, after the U.S. Federal

Reserve signaled a pause on future rate hike in the view of recent

turmoil in the banking industry.

In the FOMC statement released Wednesday, U.S. Federal Reserve

Chair Jerome Powell signaled that the Committee anticipates some

additional policy firming to attain its inflation target of 2

percent.

Meanwhile, the Fed raised its benchmark funds rate by 25 basis

points, as expected.

The U.S. dollar traded lower against other major rivals after

the Fed meeting, held in the late New York session on

Wednesday.

In the Asian session today, the U.S. dollar fell to nearly a

1-1/2 month low of 130.41 against the yen and an 8-day low of

0.9145 against the Swiss franc, from yesterday's closing quotes of

137.37 and 0.9173, respectively. On the downside, the U.S. dollar

is likely to find its support around 128.00 against the yen, and

0.90 against the franc.

Against the euro and the pound, the greenback dropped to 1.0905

and 1.2324 from yesterday's closing quotes of 1.0855 and 1.2262,

respectively. If the greenback extends its downtrend, it is likely

to find support around 1.10 against the euro and 1.25 against the

pound.

Against the Australia, New Zealand and the Canadian dollars, the

greenback traded lower to 0.6735, 0.6276 and 1.3663 from

yesterday's closing quotes of 0.6684, 0.6219 and 1.3732,

respectively. The greenback is likely to find support around 0.69

against the aussie, 0.63 against the kiwi, and 1.34 against the

loonie.

Meanwhile, the safe-haven yen rose against its major rivals, as

banking crisis is weighing on global yields.

The yen climbed to 2-day highs of 142.19 against the euro and

142.56 against the Swiss franc, from yesterday's closing quotes of

142.61 and 143.11, respectively. If the yen extends its uptrend, it

is likely to find resistance around 138.00 against the euro and

139.00 against the franc.

Against the pound and the Canadian dollar, the yen advanced to

3-day highs of 160.69 and 95.37 from yesterday's closing quotes of

161.11 and 95.67, respectively. The yen may find resistance around

158.00 against the pound and 94.00 against the loonie.

Looking ahead, the Bank of England is set to release its

monetary policy at 8:00 am ET. The economists expect the bank to

hike rates by 25 bps in March from 4.0 percent to 4.25 percent.

In the New York session, U.S. final building permits data, new

home sales data for February, U.S. weekly jobless claims data and

Eurozone flash consumer confidence index for February are due to be

released.

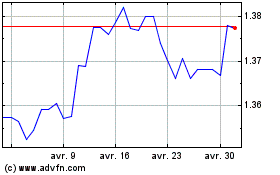

US Dollar vs CAD (FX:USDCAD)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

US Dollar vs CAD (FX:USDCAD)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024