TIDMCYAN

RNS Number : 2201X

CyanConnode Holdings PLC

19 December 2023

19 December 2023

CyanConnode Holdings plc

("CyanConnode" or the "Company")

Interim results for the six months ended 30 September 2023 (H1

FY 2024)

CyanConnode (AIM: CYAN), a world leader in narrowband radio

frequency (RF) mesh networks, announces its unaudited interim

results for the six months ended 30 September 2023 (H1 FY

2024).

John Cronin, CyanConnode Executive Chairman, commented:

"The Indian smart metering market and the Revamped Distribution

Sector Scheme (RDSS) continues to gather momentum with tenders for

more than 220 million smart meters having been sanctioned to

date.

CyanConnode is experiencing a period of rapid growth and has won

orders for a total of 5.3 million Omnimesh modules to date in India

alone, with a significant portion of these (4 million) having been

won during the past 18 months.

Orders have continued to be won in other territories too, such

as the order announced in October from the MENA region, which was a

follow-on order from the contract announced in April 2022.

We can confirm that revenue is expected to meet market

expectations and look forward to updating on further progress in

due course."

Financial Highlights

-- Revenue of GBP5.8m (H1 FY 2023: GBP1.3m) which is in line with management's expectations

-- Gross profit of GBP1.8m (H1 FY 2023: GBP0.7m)

-- Operating loss of GBP2.2m (H1 FY 2023: GBP2.4m)

-- Cash received from customers of GBP7.4m (H1 FY 2023: GBP4.5m)

-- Cash and cash equivalents at end of period GBP0.9m (FY 2023: GBP4.1m)

Operational Highlights

-- Three orders won from IntelliSmart Infrastructure Pvt Ltd

(IntelliSmart) for a total of 1.4 million Omnimesh RF Modules and

associated products, under the strategic agreement announced in

February 2023, taking the total order book for India to 5 million

Omnimesh modules

-- CyanConnode India recognised as Dun and Bradstreet 'Start-Up 50 Trailblazer'

-- Memorandum of Association (MOU) signed with Alfanar to

explore opportunities in Advanced Metering Infrastructure (AMI)

projects

-- 503,000 modules shipped in H1 of FY24 vs 391,000 shipped in the whole of FY 2023

-- Investment into recruitment, to scale up the business, and

research and development to develop further products in response to

market demand

Post-Period Highlights

-- Order won for a further 300,000 Omnimesh modules and

associated products from IntelliSmart, taking the Company's total

order book for India to 5.3 million modules, of which 3.1 million

are yet to be shipped

-- Letter of award (LOA) received for a follow-on smart metering

deployment in the Middle East and North Africa (MENA) region

-- Cash collected from customers since the period end of GBP2.4m

taking cash received for the financial year to date to GBP9.8m

-- Cash at end of November 2023 of GBP1.1m , with a further

GBP0.6m received from customers in December 2023

-- GBP2.7m (before expenses) raised in November 2023 through an

oversubscribed placing and subscription, together with the issue of

warrants at an exercise price of 15.0 pence per ordinary share,

which would provide a potential further GBP4.1m if fully

exercised

-- Current market share of installed smart metering base in India of approximately 25%

-- Win ratio in India in terms of tenders to date of 40%, and 25% in terms of volumes

-- CyanConnode India recognised as second fastest-growing UK

company in India according to the prestigious Britain Meets India

(BMI) 2023 report

-- CyanConnode ranked as 12th fastest-growing business in the

Midlands and East of England, according to the 2023 Fast Growth 50

index

-- Indian smart metering market continues to gather momentum -

current tenders for more than 220 million Smart Meters have been

sanctioned to the end of November 2023, with almost 100 million

being awarded to prime bidders, typically Advanced Metering

Infrastructure Service Providers (AMISPs)

-- Revenue for the financial year ending 31 March 2024 is forecast to meet market expectations

Enquiries:

CyanConnode Holdings plc Tel: +44 (0) 1223 865

750

John Cronin, Executive Chairman www.cyanconnode.com

Strand Hanson Limited (Nominated and Tel: +44 (0) 20 7409

Financial Adviser) 3494

James Harris / Richard Johnson / David

Asquith

Zeus Capital Limited (Broker) Tel: +44 (0) 20 3829

5000

Simon Johnson, Louisa Waddell

About CyanConnode

CyanConnode (AIM:CYAN.L) is a world leader in Narrowband Radio

Frequency (RF) Smart Mesh Networks, which are used for machine to

machine (M2M) communication. As well as being self-forming and

self-healing, CyanConnode's RF Smart Mesh Networks are designed for

rapid deployment, whilst giving exceptional performance and

competitive total cost of ownership.

In June 2018, CyanConnode launched its award-winning Omnimesh

Advanced Metering Infrastructure (AMI) platform, which has already

gained considerable commercial traction, especially in India which

is a key market for the Company.

Through a Global partner eco-system, which is vendor agnostic,

CyanConnode has several routes to market, therefore it is well

positioned to capitalise upon increasing Global demand for smart

metering solutions.

For more information, please visit www.cyanconnode.com .

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 which is

part of UK law by virtue of the European Union (Withdrawal) Act

2018.

Chairman's Statement

Financial review

Key figures

H1 FY 2024 H1 FY 2023

GBP'000 GBP'000 % Change

Revenue 5,775 1,347 + 329%

============ ============ ===============

Gross profit 1,810 665 + 172%

============ ============ ===============

Operating costs (3,987) (3,043) + 31%

============ ============ ===============

Operating loss (2,177) (2,378) - 8%

============ ============ ===============

EBITDA (2,008) (2,135) - 6%

============ ============ ===============

Adjusted EBITDA (1,916) (2,128) - 10%

============ ============ ===============

Cash 945 1,033 - 9 %

============ ============ ===============

Basic and diluted loss per share 0.72p 0.94p - 23%

============ ============ ===============

Revenue and Operating Costs

Revenue for the first six months of FY 2024 was in line with

management's expectations, and 4.3 times the revenue for the same

period of FY 2023. With orders having been won in India for 1.4

million Omnimesh modules during the period, and a further order for

0.3 million Omnimesh modules won since period end, as well as order

backlog from projects won in FY 2023, the Company expects a

significant increase in revenue during the second half of FY 2024.

Gross margins are weaker than H1 FY 2023 as H1 FY 2024 has been

hardware sales intensive, including lower margin sales of

third-party hardware in territories outside India. Gross margins

for hardware in India remain as expected. The increase in operating

costs was largely due to increased headcount to meet the growth of

the business.

Cash

During the period cash was utilised to both purchase stocks of

long lead-time components to support delivery during the remainder

of the financial year, (stock of 360,000 long lead-time components

were held at period end to allow H2 FY24 deliveries to be met) and

investing in recruitment to support growth.

Accounts receivable

A total of GBP7.4m cash was collected from customers during the

period (compared to GBP4.5m for the entirety of FY 2023), and a

further GBP2.4m since the period end. In the period, our contract

assets, reported in the non-current assets part of the balance

sheet, increased to GBP2.4m (FY 2023: GBP2.1m), where revenue has

been recognised in accordance with IFRS 15, and will be paid for

over the period of the contract. The remainder of trade receivables

included in non-current assets related to accrued income from

contracts. Approximately 44% of cash collection during H1 FY 2024

related to trade receivables from FY 2023 and a further 17% of FY

2023 trade receivables have been collected since period end.

GBP1,124k of trade receivables has been collected via invoice

discounting and reflected as short-term borrowings in the balance

sheet as required by IFRS. The net value of trade receivables in

the current section of the balance sheet after taking this into

account is therefore GBP8,056k less GBP1,124k = GBP6,932k (FY23

GBP7,224k less GBP426k = GBP6,798k) (see Note 4).

Operational Review

India

The Government of India plans to rollout 250 million smart

meters through tenders for large volumes, of which tenders for more

than 220 million smart meters had been sanctioned to the end of

November 2023.

The table further below is a summary taken from

https://www.nsgm.gov.in/en/sm-stats-all which lists all tenders

sanctioned, along with the numbers of meters awarded and deployed

to date. The highlighted sections in green show the utilities in

which CyanConnode has deployed Omnimesh modules. While contracts

for almost 100 million smart meters have been awarded to date,

these awards have been to prime bidders who are typically AMISPs,

and there can be a delay of a few months between the award of the

contract to the AMISP and the subsequent award to subcontractors

such as CyanConnode.

CyanConnode has seen its strategic agreement with IntelliSmart

(signed February 2023) begin to take effect, with three orders

placed in H1 FY 2024 under the agreement, and a fourth placed

following the end of the period as set out below. In addition to

the modules, the orders include advanced metering infrastructure,

standards-based hardware, services, Omnimesh head-end software,

perpetual license, and annual maintenance contracts.

-- In May 2023, an order was received for 600,000 Omnimesh RF

Modules, for the Pachimanchal Vidyut Vitran Nigam Ltd (PVVNL) smart

metering project in Uttar Pradesh

-- In July 2023, an order was received for 300,000 Omnimesh RF

Modules, for the Dakshin Gujarat Smart Metering Private Limited

(DGVCL) smart metering project in Gujarat

-- In August 2023, an order was received for 500,000 Omnimesh RF

Modules, for the Power Grid Corporation of India Limited (PGCIL)

smart metering project for Madhya Gujarat Vij Company Limited

(MGVCL) in Gujarat

-- In October 2023, an order was received for 300,000 Omnimesh

RF Modules, for the South Bihar Power Distribution Company Ltd

(SBPDCL) smart metering project

APAC and Middle East

The smart metering market in the APAC and Middle East continues

to mature and presents a significant opportunity for

CyanConnode.

During the period CyanConnode continued to deploy its contract

for the MENA region which was announced in April 2022. In October

2023, the Company was pleased to announce a follow-on order for

this project, and shipments for this order are now underway.

Additionally, the Metropolitan Electricity Authority (MEA) Smart

Grid Project, won in December 2019 continues to roll out in

Thailand. The Company has now also provided its Cellular Network

Interface Cards (CNICs) which are successfully connecting to the

network.

Post period end developments and outlook

Orders

In October 2023, an order for a further 300,000 Omnimesh modules

and associated products was won from IntelliSmart, taking the

Company's total order book for India to 5.3 million modules, of

which 3.1 million are yet to be shipped. In addition, a letter of

award was received for a follow-on smart metering deployment in the

MENA region. This follow-on contract builds upon the first MENA

order announced by the Company in April 2022 and is for

CyanConnode's cellular communications product, which will be

deployed to connect smart electricity and smart water meters. Under

the LOA, CyanConnode will supply cellular hubs, with a capacity to

connect 1.41 million devices. Delivery of the first hubs has now

commenced, with the full contract expected to be delivered over the

next 12 months.

As of the end of November 2023, CyanConnode has won orders for

5.3 million Omnimesh modules in India alone, with 2.2 million

shipped to the end of November 2023, leaving a backlog still to be

shipped of 3.1 million. CyanConnode's presence in the market

represents 25% of the total installed base, and its win rate is 25%

in terms of volumes and 40% in terms of tenders awarded.

Cash

On 9 November 2023 CyanConnode Holdings plc raised GBP2.7

million (before expenses) through an oversubscribed placing of

19,188,500 ordinary shares of 2.0 pence each and a subscription for

8,000,000 New Ordinary Shares. In addition, each subscriber in the

Placing and the Subscription has been issued one Investor Warrant

(as defined in the placing announcement of 8 November 2023) for

each new Ordinary Share subscribed for. Each Investor Warrant has

an exercise price of 15.0 pence per ordinary share. If exercised in

full, the Investor Warrants would result in the issue of a total of

27,188,500 further new Ordinary Shares, raising a further

GBP4.1m.

Cash as at the end of November 2023 was GBP1.1m. Cash collected

from customers since the period end was GBP2.4m taking cash

received for the eight-month period to the end of November 2023 to

GBP9.2m, plus GBP0.6m received from customers since the end of

November 2023.

Awards and recognition

In November 2023, CyanConnode was pleased to announce that its

subsidiary in India had been recognised as the second

fastest-growing UK company in India according to the prestigious

Britain Meets India (BMI) 2023 report. Additionally, the Company

was ranked as 12th fastest-growing business in the Midlands and

East of England, according to the 2023 Fast Growth 50 index.

Consolidated income statement

Note Unaudited Unaudited Audited

6 months 6 months to 12 months to

to 30 September 31 March

30 2022 2023

September GBP000 GBP000

2023

GBP000

====================================== =============== ========== ======================== ========================================

Continuing operations

Revenue 5,775 1,347 11,732

Cost of sales (3,965) (682) (7,518)

=================================================== ========== ======================== ========================================

Gross profit 1,810 665 4,214

Exceptional item: impairment of intangible assets - - (968)

Other operating costs (3,987) (3,043) (6,593)

Operating loss (2,177) (2,378) (3,347)

Amortisation and depreciation 169 243 489

Share based payments 100 100 224

Stock impairment - - 102

Impairment of intangible assets - - 968

Foreign exchange (gains)/losses (8) (93) 8

--------------------------------------------------- ---------- ------------------------ ----------------------------------------

Adjusted EBITDA (1,916) (2,128) (1,556)

--------------------------------------------------- ---------- ------------------------ ----------------------------------------

Finance income 8 11 35

Finance costs (72) (49) (136)

=================================================== ========== ======================== ========================================

Loss before tax (2,241) (2,416) (3,448)

Tax credit 367 302 1,042

--------------------------------------------------- ---------- ------------------------ ----------------------------------------

Loss for the period (1,874) (2,114) (2,406)

=================================================== ========== ======================== ========================================

Loss per share (pence)

Basic 3 (0.72) (0.94) (1.03)

Diluted 3 (0.72) (0.94) (1.03)

=================================================== ========== ======================== ========================================

Consolidated statement of comprehensive income

Derived from continuing operations and attributable to the

equity owners of the Company

Unaudited Unaudited Audited

6 months to 6 months to 12 months to

30 September 30 September 31 March

2023 2022 2023

GBP000 GBP000 GBP000

========================================================== ============== ================= ==============

Loss for the period (1,874) (2,114) (2,406)

Exchange differences on translation of foreign operations 37 425 21

========================================================== ============== ================= ==============

Total comprehensive income for the year (1,837) (1,689) (2,385)

========================================================== ============== ================= ==============

Consolidated statement of financial position

Unaudited Unaudited Audited

As at 30 September 30 September 31 March

2023 2022 2023

GBP000 GBP000 GBP000

========================================== ============= =============

Non-current assets

Intangible assets 3,798 3,988 3,433

Goodwill 1,930 1,930 1,930

Other financial assets 69 68 62

Property, plant and equipment 75 33 30

Right of use asset 108 152 122

Trade and other receivables (note 4) 2,456 520 2,076

------------------------------------------ ------------- ------------- ---------

Total non-current assets 8,436 6,691 7,653

========================================== ============= ============= =========

Current assets

Inventories 1,540 955 793

Trade and other receivables (note 4) 8,513 4,586 7,182

R&D tax credit receivables 374 884 748

Cash and cash equivalents 945 1,033 4,070

------------------------------------------ ------------- ------------- ---------

Total current assets 11,372 7,458 12,793

========================================== ============= ============= =========

Total assets 19,808 14,149 20,446

========================================== ============= ============= =========

Current liabilities

Short term borrowing (1,424) (800) (1,226)

Trade and other payables (4,734) (2,362) (3,833)

Corporation tax liabilities - (137) -

Lease liabilities (29) (15) (29)

------------------------------------------ ------------- ------------- ---------

Total current liabilities (6,187) (3,314) (5,088)

========================================== ============= ============= =========

Net current assets 5,185 4,144 7,705

========================================== ============= ============= =========

Non-current liabilities

Lease liabilities (80) (137) (94)

Deferred tax liability (465) (745) (452)

Other payables (43) (97) (42)

------------------------------------------ ------------- ------------- ---------

Total non-current liabilities (588) (979) (588)

------------------------------------------ ------------- ------------- ---------

Total liabilities (6,775) (4,293) (5,676)

========================================== ============= ============= =========

Net assets 13,033 9,856 14,770

========================================== ============= ============= =========

Equity

Share capital 5,438 4,728 5,438

Share premium account 78,671 73,895 78,671

Own shares held (3,611) (3,611) (3,611)

Share option reserve 904 1,168 804

Translation reserve 89 456 52

Retained losses (68,458) (66,780) (66,584)

========================================== ============= ============= =========

Total equity being equity attributable to

owners of the Company 13,033 9,856 14,770

========================================== ============= ============= =========

Consolidated statement of changes in equity

Share Own Shares Share

Share Premium Held Option Translation Retained Total

Capital Account GBP000 Reserve Reserve Losses Equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

----------------------- --------- ---------- ------------- ---------- -------------------- ----------- --------

Balance at 31 March

2022 4,726 73,883 (3,611) 1,068 31 (64,666) 11,431

Loss for the period - - - - - (2,114) (2,114)

Other comprehensive

income for the period - - - - 425 - 425

----------------------- --------- ---------- ------------- ---------- -------------------- ----------- --------

Total comprehensive

income for the period - - - - 425 (2,114) (1,689)

Issue of share capital 2 12 - - - - 14

Credit to equity for

share options - - - 100 - - 100

----------------------- --------- ---------- ------------- ---------- -------------------- ----------- --------

Total transactions

with owners 2 12 - 100 - - 114

----------------------- --------- ---------- ------------- ---------- -------------------- ----------- --------

Balance at 30

September

2022 4,728 73,895 (3,611) 1,168 456 (66,780) 9,856

----------------------- --------- ---------- ------------- ---------- -------------------- ----------- --------

Loss for the period - - - - - (292) (292)

Other comprehensive

income for the period - - - - (404) - (404)

----------------------- --------- ---------- ------------- ---------- -------------------- ----------- --------

Total comprehensive

income for the period - - - - (404) (292) (696)

Issue of share capital 710 4,776 - - - - 5,486

Credit to equity for

share options - - - 124 - - 124

Transfer - - - (488) - 488 -

----------------------- --------- ---------- ------------- ---------- -------------------- ----------- --------

Total transactions

with owners 710 4,776 - (364) - 488 5,610

----------------------- --------- ---------- ------------- ---------- -------------------- ----------- --------

Balance at 31 March

2023 5,438 78,671 (3,611) 804 52 (66,584) 14,770

----------------------- --------- ---------- ------------- ---------- -------------------- ----------- --------

Loss for the period - - - - - (1,874) (1,874)

Other comprehensive

income for the period - - - - 37 - 37

----------------------- --------- ---------- ------------- ---------- -------------------- ----------- --------

Total comprehensive

income for the period - - - - 37 (1,874) (1,837)

Credit to equity for

share options - - - 100 - - 100

----------------------- --------- ---------- ------------- ---------- -------------------- ----------- --------

Total transactions

with owners - - - 100 - - 100

----------------------- --------- ---------- ------------- ---------- -------------------- ----------- --------

Balance at 30

September

2023 5,438 78,671 (3,611) 904 89 (68,458) 13,033

----------------------- --------- ---------- ------------- ---------- -------------------- ----------- --------

Consolidated cash flow statement

Unaudited Unaudited Audited

6 months to 6 months to 12 months to

30 September 30 September 31 March

2023 2022 2023

GBP000 GBP000 GBP000

============================================================== ==============

Net cash outflow from operating activities (Note 5) (2,714) (143) (2,217)

Investing activities

Interest received 8 11 3

Purchases of property, plant and equipment (23) (6) (31)

Capitalisation of software development (498) (109) (734)

Purchase of investments (7) (10) (4)

============================================================== ============== ============== ==============

Net cash used in investing activities (520) (114) (766)

============================================================== ============== ============== ==============

Financing activities

Interest paid on borrowings (67) (43) (125)

Cash inflow from borrowing - - 500

Cash net inflow/(outflow) from debt factoring 698 (967) (541)

Cash outflow from Directors' loan - (100) -

Loan repayment (500) - (600)

Capital repayments of lease liabilities (14) (15) (30)

Interest paid on lease liabilities (5) (6) (11)

Proceeds on issue of shares - - 5,844

Share issue costs - - (344)

-------------------------------------------------------------- -------------- -------------- --------------

Net cash from financing activities 112 (1,131) 4,693

============================================================== ============== ============== ==============

Net (decrease)/increase in cash and cash equivalents (3,122) (1,388) 1,710

Effects of exchange rate changes on cash and cash equivalents (3) 66 5

Cash and cash equivalents at beginning of period 4,070 2,355 2,355

============================================================== ============== ============== ==============

Cash and cash equivalents at end of period 945 1,033 4,070

============================================================== ============== ============== ==============

Notes to the Accounts

1. Basis of Preparation

The interim financial statements are for the six months ended 30

September 2023. They do not include all the information required

for full annual financial statements and should be read in

conjunction with the consolidated financial statements of the Group

for the year ended 31 March 2023, which have been filed at

Companies House. The Group's auditor issued a report on those

financial statements that was unqualified and did not contain a

statement under section 498(2) or section 498(3) of the Companies

Act 2006, however, the auditor's report emphasized the uncertainty

around the Group's ability to continue as a going concern.

These interim financial statements have been prepared in

accordance with UK-adopted International Accounting Standards.

These financial statements have been prepared under the historical

cost convention.

These interim financial statements have been prepared in

accordance with the accounting policies adopted in the last annual

financial statements for the year to 31 March 2023. The accounting

policies have been applied consistently throughout the group for

the purpose of preparation of these interim financial statements

and are expected to be followed throughout the year ending 31 March

2024.

2. Going Concern

To assess the ability of the Group to continue as a going

concern, the Directors have prepared a business plan and cash flow

forecast for the period to 31 March 2025 which, together, represent

the Directors' best estimate of the future development of the

Group. The forecast contains certain assumptions, the most

significant of which are the level and timing of sales and the

timing of customer payments. These detailed cashflow scenarios

include Letters of Credit which have been secured from the

customers against contracts recently won.

The Group's business activities, together with the factors

likely to affect its future development, performance and position,

have been considered in depth as part of the Directors' assessment

of the Group's ability to continue as a going concern. The

Directors have reviewed detailed trading forecasts for H2 of FY24.

An upturn in business activities and revenue is expected during

this period, which will ensure the Group's ability to meet market

expectations for the full financial year. At 30 September 2023 the

Group had cash reserves of GBP0.9 million (31 March 2023: GBP4.1

million) and completed a fundraise in November 2023, raising GBP2.7

million before expenses. In addition to the funds raised, warrants

were issued to each investor in the fundraise, which if exercised

in full during the exercise period of eighteen months, would raise

a further GBP4.1 million. Based on detailed cash flow provided to

the Board to 31 March 2025, there is sufficient cash for a period

of at least 12 months from the date of approval of this report,

with forecasts prepared in line with its standard operating model.

However, should the Company require additional cash to cover

working capital as a result of rapid growth, there could be a

requirement for additional funding for this purpose. The Company

continues to discuss working capital funding solutions with banks,

particularly in India. The Company has been approached with

alternative sources of finance, to support growth, such as secured

loans, which it could accept should such a requirement arise.

The Company received a R&D tax credit of GBP747,154 from

HMRC in August 2023. An advance loan of GBP500,000, received in

November 2022 was in place against this R&D tax credit, and was

repaid out of the proceeds of the tax credit received in August

2023. The Company intends to secure an advance against its R&D

tax credit for the current financial year, anticipated to be for a

minimum of GBP0.5 million, in the coming months.

Notwithstanding the material uncertainties described above,

which may cast significant doubt on the ability of the Group to

continue as a going concern, on the basis of sensitivities applied

to the cash flow forecast, the directors have a reasonable

expectation that the company can continue to meet its liabilities

as they fall due, for a period of at least 12 months from the date

of approval of this report.

Notes to the Accounts continued

3. Loss per Share

The calculation of the basic and diluted loss per share is based

on the following data:

Unaudited Unaudited Audited

6 months to 6 months to 12 months to

30 September 30 September 31 March

2023 2022 2023

====================================================================== ==============

Loss for the purposes of basic loss per share being net loss

attributable to equity holders

of the parent (GBP000) (1,874) (2,114) (2,406)

====================================================================== ============== ============== ==============

Weighted average number of ordinary shares for the purposes of basic

and diluted loss per

share 260,581,840 225,033,577 232,763,664

====================================================================== ============== ============== ==============

Loss per share (pence) (0.72) (0.94) (1.03)

====================================================================== ============== ============== ==============

The denominations used are the same as those detailed above for

both basic and diluted earnings per share from continuing

operations. However, in accordance with IAS 33 "Earnings Per

Share", potential ordinary shares are only considered dilutive when

their conversion would decrease the profit per share or increase

the loss per share from continuing operations attributable to the

equity shareholders.

4. Trade and Other Receivables

Unaudited Unaudited Audited

6 months to 6 months to 12 month 31 March 2023

30 September 30 September

2023 2022

============================ ============== -------------- ------------------------

Non-current

Contract assets 2,141 - 1,784

Other non-current assets 315 520 292

============================ ============== ============== ========================

Trade and other receivables 2,456 520 2,076

============================ ============== ============== ========================

Current

Trade receivables: amount receivable for the sale of goods and services [1] 8,056 3,708 7,224

Allowance for expected credit losses (275) (193) (274)

---------------------------------------------------------------------------- ----- ----- -----

7,781 3,515 6,950

Contract assets 374 648 24

Other debtors 274 253 52

Prepayments 84 170 156

============================================================================ ===== ===== =====

Trade and other receivables 8,513 4,586 7,182

============================================================================ ===== ===== =====

Notes to the Accounts continued

5. Reconciliation of Operating Loss to Operating Cash Flows

Unaudited Unaudited Audited

6 months to 6 months to 12 months to

30 September 30 September 31 March

2023 2022 2023

GBP000 GBP000 GBP000

========================================================= ============== ============== ==============

Operating loss for the period (2,177) (2,378) (3,347)

Adjustments for:

Depreciation of property, plant and equipment 22 15 32

Amortisation of intangible assets 133 214 426

Depreciation on right of use assets 14 14 31

Impairment of intangible assets - - 968

Interest received on contract assets - - 32

Foreign exchange (8) 334 8

Share issued in lieu of service/bonus - 14 24

Share-option payment expense 100 100 224

--------------------------------------------------------- -------------- -------------- --------------

Operating cash flows before movements in working capital (1,916) (1,687) (1,602)

Increase in inventories (747) (796) (634)

(Increase)/decrease in receivables (1,711) 2,410 (1,827)

(Decrease)/increase in payables 901 (2) 1,475

--------------------------------------------------------- -------------- -------------- --------------

Cash outflows from operating activities (3,473) (75) (2,588)

Income taxes received/(paid) 759 (68) 371

--------------------------------------------------------- -------------- -------------- --------------

Net cash outflow from operating activities (2,714) (143) (2,217)

========================================================= ============== ============== ==============

6. Post Balance Sheet Event

On 9 November 2023 CyanConnode Holdings plc raised GBP2.7

million (before expenses) through a placing of 19,188,500 ordinary

shares of 2.0 pence each and a subscription for 8,000,000 New

Ordinary Shares. In addition, each subscriber in the Placing and

the Subscription has been issued one Investor Warrant, as defined

in the placing announcement of 8 November 2023, for each new

Ordinary Share subscribed for by it in the Placing or the

Subscription. Each Investor Warrant has an exercise price of 15.0

pence per ordinary share. If exercised in full, the Investor

Warrants would result in the issue of a total of 27,188,500 further

new Ordinary Shares, raising a further GBP4.1 million.

7. Interim Results

The Group's Interim Results report is available for download on

the Group's website, www.cyanconnode.com. The report will not be

posted to shareholders.

[1] GBP1,124k of trade receivables has been collected via

invoice discounting and reflected as short-term borrowings in the

balance sheet as required by IFRS. The net value of trade

receivables in the current section of the balance sheet after

taking this into account is therefore GBP8,056k less GBP1,124k =

GBP6,932k (FY23 GBP7,224k less GBP426k = GBP6,798k)

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FVLLFXLLEFBE

(END) Dow Jones Newswires

December 19, 2023 02:00 ET (07:00 GMT)

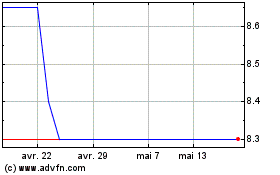

Cyanconnode (LSE:CYAN)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Cyanconnode (LSE:CYAN)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024