Europa Oil & Gas (Holdings) Plc Director Retirement and Corporate Update

20 Juillet 2020 - 8:00AM

UK Regulatory

TIDMEOG

Europa Oil & Gas (Holdings) plc / Index: AIM / Epic: EOG / Sector: Oil & Gas

Europa Oil & Gas (Holdings) plc ('Europa' or 'the Company')

Director Retirement and Corporate Update

Europa Oil & Gas (Holdings) plc, the UK, Ireland and Morocco focused oil and

gas exploration, development and production company, announces that Finance

Director Mr Phil Greenhalgh has informed the Board of his intention to retire.

Phil, who has been Finance Director of Europa since January 2008, has agreed to

remain on the Board until 14 October 2020 to ensure an orderly handover of his

duties and to complete the Group Annual Report and Accounts for the year to 31

July 2020.

The Company does not intend to appoint a replacement Finance Director at the

current time. Instead Phil's responsibilities will be divided and assigned to

existing members of the team at Europa. In line with this, Ms Alison Fuller

will become Financial Controller and Mr Murray Johnson will assume the position

of Company Secretary.

In addition, the Board has asked Executive Chairman Mr Simon Oddie to continue

as Interim CEO for at least a further six months.

Corporate Update

The Company is pleased to provide a corporate update in relation to activity

across its portfolio of multistage licences onshore UK, offshore Ireland and

offshore Morocco and its ongoing cost management programme as part of its

response to COVID-19 and volatile oil and gas markets.

Onshore UK - Wressle Field Development Project ('Wressle')

The development of the Wressle field in North Lincolnshire, in which Europa

holds a 30% working interest, continues according to plan with first oil on

track to commence in H2 2020. Under the development plan, Wressle is expected

to commence production at an initial gross rate of 500bopd, which would more

than double Europa's existing UK onshore production to over 200bopd. With an

estimated breakeven oil price of US$17.6 per barrel, production at Wressle is

expected to be very profitable at current oil prices of over US$40 per barrel.

Further updates on progress made towards bringing Wressle into production will

be provided to the market as and when it is appropriate to do so.

Offshore Ireland - Inishkea and Edge prospects in Slyne Basin

Europa recently announced the conditional acquisition of a 100% interest in

Frontier Exploration Licence ('FEL') 3/19, which holds the 1.2 tcf Edge

prospect. FEL 3/19 lies close to Europa's 100%-owned FEL 4/19, which holds the

1.5 tcf Inishkea prospect, and the 1tcf producing Corrib gas field. Both

licences therefore provide Europa with a key strategic position in the proven

gas play of the Slyne basin.

The acquisition of FEL 3/19 is subject to regulatory sign-off and once this has

been received the Company intends to undertake a comprehensive evaluation of

the technical data covering the licence. Following this, the forward plan is

to launch the farmout process for both licences in the Slyne Basin. Ahead of

the formal launch of the farmout, the Company is in discussions with several

interested parties.

The Company notes the cessation of gas production at the Kinsale Head gas

fields in the Celtic Sea earlier this month. Following this, the Corrib gas

field represents the only source of domestic gas production in Ireland.

Subject to regulatory sign-off for the transfer of FEL 3/19, Europa will hold

100% interests in what are currently the only large scale, drill-ready

prospects in a gas play that has been significantly de-risked by the producing

Corrib field and importantly lie close to existing processing facilities. As a

result, Europa classifies FELs 3/19 and 4/19 as lower risk "infrastructure-led"

exploration.

Offshore Morocco - Inezgane permit

Being largely desktop based, technical work has been able to continue on the

Inezgane permit despite COVID-19 and associated lockdowns. This work is

focused on reprocessing and interpreting 3D seismic data to de-risk large

prospects in the Lower Cretaceous play, a prolific producer in West Africa.

The Inezgane licence area is 11,228 square kilometres, i.e. equivalent to

about 50 UKCS North Sea blocks, or over half the size of Wales.

To date this work has resulted in the mapping of 14 prospects and 16 leads,

which the Company estimates have the potential to hold in aggregate close to 10

billion barrels of unrisked oil resources. The identified prospects each have

mean resources in excess of 150 mmboe which add up to total resources in

excess of 5 billion barrels of oil equivalent. The prospects have stacked

reservoir potential and include a wide range of structural styles including for

example 4-way dip closure in the case of the 827 mmboe Falcon and 204 mmboe

Turtle prospects. Europa has assigned a geological chance of success to these

prospects of 20-35%.

Ongoing work is focused on further de-risking these prospects and leads while

the forward plan is to build a robust prospect inventory and, subject to the

results, secure partner(s) to drill wells. In tandem with this workstream, the

Company has maintained dialogue with operators who have expressed an interest

in Inezgane.

Cost Management Programme

As previously announced, in response to volatile oil markets and the impact of

COVID-19 on the global economy, the Board, staff and consultants agreed to a

reduction in remuneration and fees (see announcement of 31 March 2020 for

further details). This had been set at 20% however the Board has now elected

to increase the reduction in their remuneration and fees to 50% from August

2020 until further notice. The Company is also considering an award of share

options to directors and staff and a further announcement will be made.

Elsewhere, appropriate cost savings and adjustments are continuing to be made

in the business whilst ensuring the integrity of the core strategy is

maintained. Existing cash reserves are expected to be sufficient to finance

current activity including the Wressle Field development. As mentioned

earlier, once on stream, Wressle will transform Europa's production and in turn

its revenue profile.

Simon Oddie, Interim CEO and Executive Chairman of Europa, said: "On behalf of

the Board, I would like to take this opportunity to thank Phil for the

considerable and invaluable contribution he has made to the Europa story over

the last decade or so. We wish him all the best for the future. In Alison and

Murray, we have two experienced employees who will be taking on Phil's finance

and corporate responsibilities and as a result I am confident the handover

process will prove to be seamless. We are confident that the next year promises

to be a highly active period for Europa, with Wressle due to come on stream

later this year, our unrivalled position in the Slyne Basin gas play set to be

bolstered further once the transfer of FEL 3/19 is completed, and with the

ongoing technical work offshore Morocco to date confirming Inezgane's exciting

potential."

* * ENDS * *

For further information please visit www.europaoil.com or contact:

Simon Oddie Europa + 44 (0) 20 7224

3770

Phil Greenhalgh Europa + 44 (0) 20 7224

3770

Christopher finnCap Ltd + 44 (0) 20 7220

Raggett 0500

Simon Hicks finnCap Ltd + 44 (0) 20 7220

0500

Frank Buhagiar St Brides Partners Ltd + 44 (0) 20 7236

1177

Megan Dennison St Brides Partners Ltd + 44 (0) 20 7236

1177

Notes

Europa Oil & Gas (Holdings) plc has a diversified portfolio of multi-stage

hydrocarbon assets which includes production, development and exploration

interests, in countries that are politically stable, have transparent licensing

processes, and offer attractive terms. In terms of production, in 2019 Europa

produced 91 boepd. Production is set to increase to over 200 boepd in H2 2020

once the Wressle field in the UK, which is currently under development, comes

on stream at a gross rate of 500 bopd.

The Company holds four exploration licences offshore Ireland which have the

potential to host gross mean un-risked prospective resources of 3.9 billion

barrels oil equivalent and 2.7* trillion cubic feet ('tcf') gas (*subject to

regulatory approval for the transfer of FEL 3/19). The Company's flagship

projects offshore Ireland are Inishkea and Edge, two near field gas prospects

in the Slyne Basin which the Company classifies as lower risk

infrastructure-led exploration due to their close proximity to the producing

Corrib gas field and associated gas processing infrastructure. In September

2019, Europa was awarded a 75% interest in the Inezgane permit offshore

Morocco. Initial results of technical work have identified 30 prospects and

leads that have the potential to hold close to 10 billion barrels of unrisked

resources.

END

(END) Dow Jones Newswires

July 20, 2020 02:00 ET (06:00 GMT)

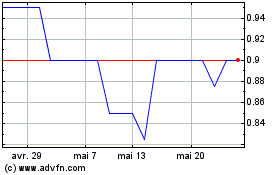

Europa Oil & Gas (holdin... (LSE:EOG)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Europa Oil & Gas (holdin... (LSE:EOG)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024