Firering Strategic Minerals PLC Appointment of Joint Broker (1592T)

13 Novembre 2023 - 8:00AM

UK Regulatory

TIDMFRG

RNS Number : 1592T

Firering Strategic Minerals PLC

13 November 2023

Firering Strategic Minerals plc / EPIC: FRG / Market: AIM /

Sector: Mining

13 November 2023

Firering Strategic Minerals plc

("Firering" or "the Company" or "FSM")

Appointment of Joint Broker

Firering Strategic Minerals plc, an exploration company focusing

on critical minerals, is pleased to announce that it has appointed

Shard Capital Partners LLP to act as joint broker to the Company

with immediate effect.

- Ends -

For further information visit: www.fireringplc.com or contact

the following:

Firering Strategic Minerals Tel: +44 20 7236 1177

Yuval Cohen

SPARK Advisory Partners Limited (Nominated Tel: +44 20 3368 3550

Adviser)

Neil Baldwin / James Keeshan / Adam

Dawes

Optiva Securities Limited (Joint Tel: +44 20 3137 1903

Broker)

Christian Dennis / Daniel Ingram

S hard Capital Partners LLP (Joint Tel: 020 7186 9950

Broker)

Damon Heath / Erik Woolgar

St Brides Partners Limited (Financial T: +44 20 7236 1177

PR) E: firering @stbridespartners.co.uk

Ana Ribeiro / Susie Geliher / Isabelle

Morris

Notes to Editors:

Firering Strategic Mineral

www.fireringplc.com

Firering Strategic Minerals plc is an AIM-quoted mining company

focused on exploring and developing a portfolio of mines producing

strategic minerals in Côte d'Ivoire, specifically lithium and

tantalum, to support the global transition to net zero emissions.

It operates the Atex Lithium-Tantalum Project in northern Côte

d'Ivoire, which is prospective for both lithium and tantalum.

Firering's main focus is working together with Australian

diversified minerals company Ricca Resources to advance development

at Atex with a view to establishing a maiden lithium resource and

then progressing a Lithium project through to DFS. Firering is also

assessing pilot scale production of ethically sourced tantalum and

niobium to generate early revenues and support further exploration

work. Should pilot production be successful, a large-scale tantalum

production facility may be developed, which will be supported by a

debt facility of FCFA 5,057,000,000 (approximately EUR7,500,000)

currently under negotiation to fund the entire scale-up plan to

develop a portfolio of ethically sourced mineral projects in the

Côte d'Ivoire, supplying EV batteries, high tech electronics and

other fast-growing end markets. Firering also has an option to

acquire up to 28.33% of Limeco Resources Limited, the owner of a

Limestone project located 22km west of Lusaka in Zambia.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

APPZZMMMKZFGFZM

(END) Dow Jones Newswires

November 13, 2023 02:00 ET (07:00 GMT)

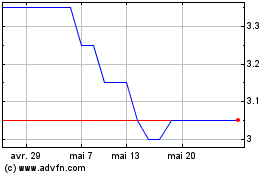

Firering Strategic Miner... (LSE:FRG)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Firering Strategic Miner... (LSE:FRG)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024