TIDMGLE

RNS Number : 0692Q

MJ Gleeson PLC

16 February 2023

16 February 2023

MJ GLEESON PLC

Results for the half-year ended 31 December 2022

-- Net reservations starting to recover | Demand for consented land remains strong

-- Expect to deliver between 1,650 and 1,850 homes in FY2023, subject to pace of recovery

-- Organisational restructuring under way to reinforce strong platform for sustainable growth

Graham Prothero, Chief Executive Officer, commented:

"I am delighted to have taken up my role as CEO and, as I

continue to embed myself in the business, am hugely impressed with

our talented and committed colleagues, our excellent product,

exciting land pipeline and, above all, our team's enthusiasm for

our ethos of "Building Homes. Changing Lives." We have an exciting

opportunity to take Gleeson to the next level by delivering

sustainable growth over the medium-term, across both our Homes and

Land divisions.

At the same time as managing through the lower levels of current

market demand, I want to ensure that the Group is in the best

possible shape to take advantage of the recovery which we are

beginning to see early signs of. Building on the strong platform I

have inherited, my focus is on optimising our organisational

structure and making us more operationally efficient and fit for

further growth. This will also result in significant annualised

savings of circa GBP4 million.

In terms of guidance: confidence, underpinned by improved

mortgage rates, is slowly returning to the market, evidenced by

improving net reservations. With full-year volumes dependent on the

pace of recovery, we now expect to deliver between 1,650 and 1,850

homes."

H1 22/23 H1 21/22 Change

Revenue

Gleeson Homes GBP166.7m GBP150.2m 11.0%

Gleeson Land GBP4.3m GBP23.3m (81.5%)

Total GBP171.0m GBP173.5m (1.4%)

Operating profit by division

Gleeson Homes GBP18.2m GBP22.5m (19.1%)

Gleeson Land GBP1.4m GBP5.5m (74.5%)

Profit before tax GBP16.1m GBP24.7m (34.8%)

Cash net of borrowings GBP13.5m GBP38.2m (64.7%)

ROCE(1) 20.0% 22.9% (290bp)

EPS (basic) 22.0p 34 .4p (36.0%)

Dividend per share 5.0p 6.0p (16.7%)

1 Return on capital employed is calculated based on earnings

before interest and tax and exceptional items (EBIT), expressed as

a percentage of the average of opening and closing net assets for

the prior 12 months after deducting deferred tax and cash and cash

equivalents net of borrowings.

Gleeson Homes:

-- 894 homes sold (H1 21/22: 932), reflecting the lower forward

order book at the start of the year and weaker sales following the

mini-budget

-- Average selling price up 15.6% to GBP186,400 (H1 21/22: GBP161,200)

o Underlying selling prices up 11.2%

-- Operating profit decreased 19.1% to GBP18.2m (H1 21/22: GBP22.5m)

-- Three new sites opened (H1 21/22: eight sites opened)

-- Land pipeline remains strong at 16,561 plots (June 2022: 16,814 plots)

-- Site acquisition, site starts and build activity being

carefully managed to maintain growth ambition as market demand

recovers

-- Restructuring operations to support future growth

Gleeson Land:

-- Senior leadership strengthened with appointment of Guy Gusterson to lead future growth

-- One land sale completed (H1 21/22: three land sales)

-- Three sites in an active sales process (H1 21/22: no sites in

a sales process) with strong levels of demand and pricing remaining

firm

-- A further two sites being marketed (H1 21/22: three sites)

-- Successfully secured planning permission on four sites (H1 21/22: none)

-- One new site added to the portfolio (H1 21/22: three sites added)

-- Portfolio of 71 sites (June 2022: 71 sites)

Current trading and outlook:

-- Net reservations in the last four weeks have doubled from the

low levels seen before Christmas but remain below the levels

typically seen this time of the year

-- The Company has narrowed its full year completions target to between 1,650 and 1,850 homes

A presentation by Graham Prothero, CEO and Stefan Allanson, CFO,

which will also be webcast, will be held at 9:00am today. To attend

virtually:

-- by webcast, access via the following link: https://stream.brrmedia.co.uk/broadcast/63cab7fb777efd4a8b51386d

-- by telephone, please dial-in using the below details:

o Number: +44 (0) 33 0551 0200

o Code: Gleeson Half Year Results

Enquiries:

MJ Gleeson plc Tel: +44 1142 612900

Graham Prothero Chief Executive Officer

Stefan Allanson Chief Financial Officer

Hudson Sandler Tel: +44 20 7796 4133

Mark Garraway Tel: +44 7771 860 938

Charlotte Cobb Tel: +44 7795 422 131

Singer Capital

Markets Tel: +44 20 7496 3000

Shaun Dobson

James Moat

Liberum Tel: +44 20 3100 2222

Richard Crawley

Kate Bannatyne

This announcement is released by MJ Gleeson plc and contains

inside information for the purposes of Article 7 of the Market

Abuse Regulation (EU) 596/2014 (MAR), and is disclosed in

accordance with the Company's obligations under Article 17 of MAR.

Upon the publication of this announcement, this information is

considered to be in the public domain.

For the purposes of MAR and Article 2 of Commission Implementing

Regulation (EU) 2016/1055, this announcement is being made on

behalf of the Company by Stefan Allanson, Chief Financial

Officer.

LEI: 21380064K7N2W7FD6434

About MJ Gleeson:

MJ Gleeson plc is the leading low-cost, affordable housebuilder

listed on the London Stock Exchange. Gleeson Homes' customers are

typically young, first-time buyers, with a median income of

GBP26,000. Its two-bedroom homes start from around GBP115,000.

Gleeson's vision is "Building Homes. Changing Lives", prioritising

areas where people need affordable housing the most.

Buying a Gleeson Home typically costs less than renting a

similar property. All Gleeson homes are traditional brick built

semi or detached homes which include a driveway and front and rear

gardens. Gleeson offers a wide mix of two, three and four bedroom

layouts.

Gleeson Land is the Group's land promotion division, which

identifies development opportunities and works with stakeholders to

promote land through the residential planning system.

As a high-quality, affordable housebuilder, Gleeson has strong

and inherent sustainability credentials. Its social purpose

underpins the Company's strategy, and Gleeson measures itself

closely against UN SDGs 5, 8, 11, 12, 13 and 15.

More details on the Company's sustainability approach can be

found at: mjgleesonplc.com/sustainability/

CHIEF EXECUTIVE'S STATEMENT

I was delighted to take up my role as Chief Executive Officer

and, as I continue to visit all our sites and offices, I am even

more impressed with our skilled and committed people, our excellent

product, our exciting land pipeline, and the enthusiasm of the

whole team for our ethos of "Building Homes. Changing Lives."

The Group's result for the first half of this financial year

reflects the challenges posed by the macro-economic environment in

the period, in particular during the second quarter.

Market volatility and the sharp increase in interest rates

following the disastrous mini-budget reduced affordability and

severely impacted buyer confidence, causing a significant slowdown

in demand. Meanwhile, supply chain and inflationary pressures

exacerbated by the war in Ukraine continue to put pressure on

costs, although we are seeing some welcome mitigation in

subcontract rates and certain material prices.

As well as tightly controlling recruitment and working capital

in the current environment, we are making some key changes to our

operating structure to ensure that we are well-positioned to grow

the business as the market recovers . I look forward to discussing

our medium and longer-term plans and targets in detail later this

year.

We are encouraged that signs of a recovery in buyer confidence

are evident, with reduced cancellations and increased gross

reservations in the last four weeks resulting in net reservations

doubling compared to the ten weeks before Christmas 2022. However,

sales rates remain below those typically seen at this time of

year.

Net reservations per site per week

Six weeks to Ten weeks to Four weeks to

mid-September Christmas 10 February

--------------- ------------- --------------

FY23 0.51 0.25 0.50

--------------- ------------- --------------

FY22 0.47 0.43 0.91

--------------- ------------- --------------

Whilst the pace and strength of recovery over the coming months

remains uncertain, having reviewed a number of scenarios, we are

narrowing the range of our full year expectation to between 1,650

and 1,850 homes.

Reviewing our operating structure

In response to the macroeconomic challenges and consequent

impact on sales volumes, the Group has taken a number of defensive

measures focused on managing its working capital and costs. These

include slowing build rates on certain sites in line with demand,

delaying the opening of new sites, maintaining our strong

discipline on land buying and freezing recruitment.

More importantly, we are reorganising the operating structure of

Gleeson Homes to ensure that it is strongly positioned to continue

its growth trajectory in a sustainable manner as market demand

recovers. Six management teams will operate nine operating regions

following the merging of a number of operating teams. The existing

three division structure will be merged into two divisions,

Northern and Central. Regional teams will be aligned onto a single

operating structure, supported by lean and focused central

services.

It is anticipated that these actions will incur a one-off cost

of GBP2 million in the second half and will result in annualised

cost savings of circa GBP4 million.

Affordability and quality

Whilst the sharp rise in interest rates during the period

significantly increased mortgage costs, a Gleeson home continues to

be affordable for a couple earning the National Living Wage (which

will increase by 9.7% on 1 April 2023), without requiring Help to

Buy support. Demand continues to be underpinned by the

affordability of our homes and the critically undersupplied nature

of our segment of the market. We are also increasingly selling to

customers who would have previously bought a home from a more

expensive developer, but who are attracted by Gleeson's affordable

price points and high quality.

The cost of owning a Gleeson home remains lower than the cost of

renting an equivalent property, and the advantages of home

ownership - both economically and socially - remain clear. Gleeson

homes are also highly energy efficient, requiring around half the

energy to heat and power than existing housing and our customers

therefore benefit from both the financial savings and the health

and wellbeing benefits of living in a modern, well insulated

home.

We continue to work with lenders and Homes England to offer

affordable products to our customers, including through First Homes

under the Government's early delivery programme and Deposit Unlock,

an industry-led scheme guaranteeing the top slice of higher

loan-to-value mortgages. These products will be important in

continuing to help first time buyers onto the property ladder and

will sit alongside other products, including shared ownership, to

support our customers.

Meanwhile, we continue to support the delivery of a high-quality

service to our customers through the digitisation of quality

control on each plot and bringing enhanced visibility to each stage

of the customer journey. In addition, during the period we invested

significantly in our Customer Care team, moving to a regional model

and recruiting 15 new Customer Relations Advisors and Regional

Maintenance Technicians. Delivering a high-quality product at

affordable price points remains a key priority for the

business.

Planning

The recently announced consultation on planning reforms by the

Department for Levelling Up, Housing and Communities (DLUHC) has

led to further uncertainty within the planning system. Whilst the

potential changes continue to be debated, the system remains

chronically slow and frequently requires an "appeal led" approach

to decision making. The proposed changes to the National Planning

Policy Framework (NPPF) pose serious risks to the effective

operation of the planning system in England and could adversely

impact the delivery of new homes both now and for future

generations.

Whilst the planning environment grows ever more challenging, our

land teams, both in Gleeson Homes and Gleeson Land, have an

excellent track record of successfully navigating sites through the

process, including via appeal, and both businesses boast strong

pipelines.

Build costs and availability

There have been further supply chain related challenges

resulting from macroeconomic pressures, including those as a result

of the war in Ukraine. We have managed the impact of these through

the strong relationships that we have with our suppliers and

subcontractors and through selective procurement. Nevertheless,

build cost inflation over the last 12 months has been high at

10.3%, albeit largely offset in the first half by selling price

increases.

Encouragingly, we are now starting to see subcontractor and some

material costs beginning to reduce, as market activity slows down,

and this will help to protect margins.

Building safety

Gleeson strongly agrees with the principle that leaseholders

should not bear the costs or anxiety arising from the national

cladding and fire safety crisis. In April 2022 the Group signed the

building safety Pledge to the Department for Levelling Up, Housing

and Communities (DLUHC). In doing so, the Group gave its commitment

to remediate any life-critical fire-safety issues on buildings over

11 metres which it had any involvement in developing over the last

30 years. DLUHC published the agreed Self-remediation terms on 30

January 2023. The Company has informed DLUHC that it intends to

enter into this agreement ahead of the deadline of 13 March

2023.

An exceptional provision of GBP12.9m was established by the

Group in the prior year. As part of this, as previously announced,

we are moving quickly to execute a programme of intrusive

inspections and fire risk assessments. No further exceptional

provisions are expected. The costs of the inspections incurred to

date were included in the provision, of which GBP0.1m has been

utilised, reducing the balance to GBP12.8m at 31 December 2022. For

those buildings where intrusive inspections and fire risk

assessments have been completed, we are commencing remediation

works, with around half of the provision expected to be utilised

over the next year. We conduct regular reviews of the provision,

taking into account the most recent inspections and any other

relevant information.

Along with all housebuilders, we have been subject to the

additional 4% residential property developer tax (RPDT) from April

2022, which was designed to raise at least GBP2bn over a 10-year

period towards the cost of dealing with defective cladding

installed by other developers. We believe that through the Pledge

and RPDT, housebuilders are contributing very strongly to the

resolution of the cladding and fire-safety crises, and further

taxes or levies on the industry would serve only to be detrimental

to housing delivery.

Sustainability

Our mission to build affordable, quality homes where they are

most needed and for the people that need them most continues to

create social and economic value in deprived areas across the North

of England and the Midlands. Our business model fundamentally

supports the United Nation's Sustainable Development Goal (UNSDG)

11 through providing access to safe and affordable housing, and in

January 2023 we became the second UK housebuilder to join the

United Nations Global Compact (UNGC), aligning our business to the

10 principles of the UNGC across human rights, labour, environment

and anti-corruption.

As outlined in our 2021 Annual Report, we increased our scope 1

and 2 CO(2) e reduction plans to 30% and set a target of no more

than 1.75 tonnes per home sold by 2023. Our actions from the past

few years had put us on track to achieve this intensity target but,

as a result of the lower sales volume expected, we are unlikely to

achieve the 1.75 tonnes target this year.

We do, however, continue to make significant progress in

reducing total carbon emissions, including scope 3 in-use emissions

for our homes:

-- We are installing Air Source Heat Pumps (ASHP's) in all new

homes we commence building from July 2023 which, combined with

modern insulation, are expected to achieve a significant reduction

in carbon emissions when occupied.

-- 6% of the homes we built in the period used concrete bricks

or reconstituted concrete stone - which contains half the embedded

CO(2) e of clay bricks and reduces the embedded CO(2) e in each

home built by 4% - and we aim to build a quarter of our homes with

concrete bricks next year.

-- EV charging points were installed in 8% of the homes we sold

in the period - and we aim to install these in 14% of the homes we

sell over the next six months.

Combined with our high build quality and increased standards of

insulation we expect our homes will, within the next few years,

achieve a 69% improvement above the current standards for energy

performance. This reflects our commitment to longer term

sustainability goals, and we are targeting this without

compromising quality or affordability.

We continue to make good progress with our biodiversity

strategy, which is focused on improving the local wildlife and

ecosystems on and around our developments. Despite the often highly

biodiverse nature of brownfield sites compared to greenfield, we

embrace the spirit of prospective legislation, in particular the

Environment Act 2021, and are examining a range of potential

solutions.

As an inherently sustainable business, we remain committed to

upholding the highest possible environmental standards. During the

period, we appointed an experienced Senior Ecologist to provide

ecological advice and guidance on our land purchases and planning

applications. We also partnered with the Supply Chain

Sustainability School, enabling us to upskill colleagues and work

collaboratively with other housebuilders, contractors and suppliers

to achieve common goals on areas such as climate action, resource

use and biodiversity.

Finally, we are proud to have retained accreditation from the

Fair Tax Foundation. We remain the only listed housebuilder to be

accredited with the Fair Tax Mark, which certifies we pay our fair

share of tax in the right place, at the right time and are honest

and transparent in our disclosures.

Financial Performance

Group results

Revenue decreased 1.4% to GBP171.0m (H1 21/22: GBP173.5m) with

gross profit decreasing 3.3% to GBP49.2m (H1 21/22: GBP50.9m). The

Group's operating profit decreased 33.3% to GBP16.8m (H1 21/22:

GBP25.2m). Following a net interest charge of GBP0.7m (H1 21/22:

GBP0.5m), profit before tax decreased 34.8% to GBP16.1m (H1 21/22:

GBP24.7m).

The tax charge for the period was GBP3.3m (H1 21/22: GBP4.7m)

reflecting an effective rate of 20.4% (H1 21/22: 19.0%). The profit

after tax for the period was GBP12.8m (H1 21/22: GBP20.0m).

Total shareholders' equity was GBP278.0m at 31 December 2022

compared to GBP259.9m at 31 December 2021. This equates to net

assets per share of 476.5 pence (31 December 2021: 445.8

pence).

The Group's net cash balance at 31 December 2022 decreased by

GBP20.3m to GBP13.5m (30 June 2022: GBP33.8m), primarily driven by

lower house sales and higher levels of build inventory.

The Group's GBP105m borrowing facility was undrawn at the period

end.

Gleeson Homes

Revenue increased 11.0% to GBP166.7m (H1 21/22: GBP150.2m), with

increased selling prices outweighing a fall in the number of homes

sold.

The average selling price for homes sold in the period increased

15.6% to GBP186,400 (H1 21/22: GBP161,200), reflecting underlying

selling price increases of 11.2%, a higher proportion of larger

4-bedroom homes sold, and good levels of customer extras, which are

typically higher margin.

The division entered the year with a significantly lower forward

order book than in prior years, reflecting our intentional

management of sales releases to optimise both prices and the

customer journey. Therefore, the slowdown in demand resulting from

the mini-budget in September 2022 had a more pronounced impact on

total homes sold. As a result, 4.1% fewer homes were sold in the

period, at 894 homes (H1 21/22: 932 homes sold).

Of the 894 homes sold during the half-year, 47% were purchased

using the Government's Help to Buy scheme (FY22: 53%, H1 21/22:

55%). Help to Buy closed for new applications in October 2022, with

the final completions to be made in March 2023 for homes built by

31 January 2023. However, our homes remain affordable to low income

buyers without the use of Help to Buy.

Gross profit on homes sold increased 5.0% to GBP46.1m (H1 21/22:

GBP43.9m), driven by the increased revenue from higher selling

prices. The gross margin on homes sold in the period was 27.7% (H1

21/22: 29.2%) reflecting build cost inflation of 10.3% and

increased fixed site costs as site durations extended due to the

slowdown. These costs were largely, albeit not entirely, offset by

selling price increases.

Administrative expenses increased 29.5% to GBP28.1m (H1 21/22:

GBP21.7m), reflecting investment in the business' operating

structure, headcount and pay inflation which took place ahead of

the market slowdown, including opening a ninth regional office in

West Yorkshire. This office was fully operational from 1 July

2022.

Operating margin on homes sold decreased 410 basis points to

10.9% (H1 21/22: 15.0%), with operating profit falling 19.1% to

GBP18.2m (H1 21/22: GBP22.5m) in line with the increased

administrative expenses.

The division purchased three sites during the period (H1 21/22:

seven sites). The pipeline of owned plots decreased during the

period by a net 161 plots to 8,317. The total pipeline of owned and

conditionally purchased plots was 16,561 plots on 168 sites at 31

December 2022 (30 June 2022: 16,814 plots on 160 sites). During the

period, 19 new sites were added to the pipeline. Our land pipeline

represents over eight years of home sales.

Gleeson Homes opened three new sites during the first half,

meaning it was building on 87 sites at 31 December 2022 (31

December 2021: 83 sites) and selling from 68 active sites (31

December 2021: 60 sites).

The slowdown in demand during the period means that we enter the

second half with a forward order book of 319 plots (30 June 2022:

618 plots, 31 December 2021: 616), of which 296 are expected to

complete in the second half. In addition, as a result of the market

slowdown and to preserve working capital we are pausing new site

openings and do not currently anticipate opening any new build

sites until the pace of recovery in demand is clearer.

By the end of the financial year, the division expects to be

building on approximately 77 sites (June 2022: 87) and actively

selling on approximately 65 sites (June 2022: 61).

Gleeson Land

The division completed one land sale in the first half (H1

21/22: three). As a result, operating profit for the first half was

GBP1.4m (H1 21/22: GBP5.5m).

Three sites were being actively progressed for sale at 31

December 2022, which have the potential to deliver 1,342 plots (31

December 2021: no sites being progressed for sale). A further two

sites were being marketed with the potential to deliver 305 plots

(31 December 2021: three sites being marketed, 1,384 plots).

At 31 December 2022, there were six sites in the portfolio with

either planning permission or a resolution to grant permission for

a total of 1,525 plots (30 June 2022: three sites, 1,206

plots).

There are a further 16 sites where the division is currently

awaiting a decision on planning applications or appeals (30 June

2022: 16 sites). The challenges in the planning system continue to

mean there are a number of applications that are delayed or

progressed via appeal. However, the team is experienced in

navigating these challenges and has an excellent track record at

appeal.

We continue to invest in the Gleeson Land portfolio. One

high-quality new site was secured in the period, with the potential

to deliver 450 plots. Agreements on a number of other well-located

sites are currently being progressed.

At 31 December 2022, the portfolio, in which the Group has a

beneficial interest of 83%, comprised 71 sites with the potential

to deliver 18,775 plots (30 June 2022: 71 sites, 20,241 plots).

Dividends

Considering these results and the immediate outlook, the Board

is declaring an interim dividend of 5.0 pence per share (H1 21/22:

6.0 pence per share). The Company's policy of covering total full

year dividends with earnings between three and five times remains

in place.

The interim dividend will be paid on 3 April 2023 to

shareholders on the register at close of business on 3 March

2023.

Board changes

On 31 December 2022, Dermot Gleeson stepped down after 47 years

on the Board and 28 years as Chairman. James Thomson, former CEO,

was appointed as non-executive Chairman and Chair of the Nomination

Committee with effect from 1 January 2023.

On behalf of the Board, I would like to express our sincere

thanks to Dermot for his extraordinary contribution to the Company.

He leaves the business with a robust and clear vision, and a highly

successful model to drive future growth.

Summary & Outlook

I could not be more excited to have joined Gleeson. Everything I

have seen and everyone I have met confirms that it is a business

with a strong platform and a great opportunity ahead of it.

We are beginning to see a tentative return of confidence to the

market and expect demand for new homes to slowly recover through

the year. Selling prices remain stable and net reservation rates

have continued to improve from 0.25 per site per week for the ten

weeks before Christmas to 0.50 per site per week in the last four

weeks.

Whilst full year volumes will depend on the pace of the market's

recovery, we currently expect to deliver between 1,650 and 1,850

homes.

We are implementing a reorganisation to optimise our structure,

preparing the business for the next phase of growth. We are also

controlling working capital and making operational savings to

respond to the challenges posed by the current macroeconomic

environment, and are ready to ramp up activity when required.

Looking beyond the current uncertainty in the market, the

prospects for the Group are exciting and I look forward to

discussing our medium and longer-term plans and targets in detail

later this year.

Graham Prothero

Chief Executive

Condensed Consolidated Income Statement

for the six months to 31 December 2022

Audited

Unaudited Unaudited Year

Six months Six months to

to 31 December to 31 December 30 June

Note 2022 2021 2022

GBP000 GBP000 GBP000

Revenue 170,999 173,543 373,409

Cost of sales (121,832) (122,659) (275,620)

----------------- ----------------- ----------

Gross profit 49,167 50,884 97,789

Administrative expenses (32,578) (25,982) (54,543)

Other operating income 232 310 684

----------------- ----------------- ----------

Operating profit 16,821 25,212 43,930

Analysed as:

Underlying operating profit 16,821 25,212 56,797

Exceptional items - - (12,867)

--------------------------------- ----- ----------------- ----------------- ----------

Finance income 99 47 172

Finance expenses (846) (527) (1,482)

----------------- ----------------- ----------

Profit before tax 16,074 24,732 42,620

Analysed as:

Underlying profit before tax 16,074 24,732 55,487

Exceptional items - - (12,867)

--------------------------------- ----- ----------------- ----------------- ----------

Profit before tax 16,074 24,732 42,620

Tax 3 (3,281) (4,690) (7,531)

Profit for the period 12,793 20,042 35,089

================= ================= ==========

Earnings per share

Basic 5 21.97 p 34.38 p 60.23 p

Diluted 5 21.95 p 34.38 p 60.08 p

Basic - pre-exceptional items 5 21.97 p 34.38 p 78.12 p

Diluted - pre-exceptional items 5 21.95 p 34.38 p 77.92 p

======== ======== ========

Condensed Consolidated Statement of Comprehensive Income

for the six months to 31 December 2022

Audited

Unaudited Unaudited Year

Six months Six months to

to 31 December to 31 December 30 June

2022 2021 2022

GBP000 GBP000 GBP000

Profit for the period 12,793 20,042 35,089

Other comprehensive (expense)/income

Items that may be subsequently

reclassified to profit or loss

Change in value of shared equity

receivables at fair value (267) 32 120

Movement in tax on share-based

payments taken directly to equity - 49 -

----------------- ----------------- ---------

Other comprehensive (expense)/income

for the period, net of tax (267) 81 120

----------------- ----------------- ---------

Total comprehensive income for

the period 12,526 20,123 35,209

================= ================= =========

Condensed Consolidated Statement of Financial Position

at 31 December 2022

Unaudited Unaudited Audited

31 December 31 December 30 June

Note 2022 2021 2022

GBP000 GBP000 GBP000

Non-current assets

Property, plant and

equipment 9,537 7,750 8,112

Trade and other receivables 141 8,261 5,051

Deferred tax assets 1,183 1,363 941

10,861 17,374 14,104

============== ============== =========

Current assets

Inventories 6 326,793 244,724 286,882

Trade and other receivables 22,033 19,808 29,243

UK corporation tax 512 4,941 3,565

Cash and cash equivalents 7 13,485 38,160 33,764

362,823 307,633 353,454

============== ============== =========

Total assets 373,684 325,007 367,558

============== ============== =========

Non-current liabilities

Trade and other payables 9 (10,934) (4,248) (9,703)

Provisions 8 (7,328) (264) (12,049)

-------------- -------------- ---------

(18,262) (4,512) (21,752)

============== ============== =========

Current liabilities

Trade and other payables 9 (71,481) (60,539) (72,291)

Provisions 8 (5,960) (15) (1,339)

(77,441) (60,554) (73,630)

============== ============== =========

Total liabilities (95,703) (65,066) (95,382)

============== ============== =========

Net assets 277,981 259,941 272,176

============== ============== =========

Equity

Share capital 1,166 1,166 1,166

Share premium 15,843 15,843 15,843

Own shares (751) - (471)

Retained earnings 261,723 242,932 255,638

Total equity 277,981 259,941 272,176

============== ============== =========

Condensed Consolidated Statement of Changes in Equity

for the six months to 31 December 2022

Share Share Own Retained Total

Note capital premium shares earnings equity

GBP000 GBP000 GBP000 GBP000 GBP000

At 1 July 2021 (audited) 1,165 15,843 - 227,923 244,931

Profit for the period - - - 20,042 20,042

Other comprehensive income - - - 81 81

Total comprehensive income

for the period - - - 20,123 20,123

=============== ========== ========= ===================== ===============

Share issue 1 - - - 1

Purchase of own share - - - (30) (30)

Share-based payments - - - 746 746

Dividends - - - (5,830) (5,830)

Transactions with owners,

recorded directly in equity 1 - - (5,114) (5,113)

=============== ========== ========= ===================== ===============

At 31 December 2021 (unaudited) 1,166 15,843 - 242,932 259,941

=============== ========== ========= ===================== ===============

Profit for the period - - - 15,047 15,047

Other comprehensive income - - - 39 39

--------------- ---------- --------- --------------------- ---------------

Total comprehensive income

for the period - - - 15,086 15,086

=============== ========== ========= ===================== ===============

Opening adjustment to own

shares - - (136) 136 -

(Purchase)/sale of own shares - - (403) 30 (373)

Utilisation of own shares - - 68 268 336

Share-based payments - - - 822 822

Movement in tax on share-based

payments taken directly to

equity - - - (128) (128)

Dividends - - - (3,508) (3,508)

Transactions with owners,

recorded directly in equity - - (471) (2,380) (2,851)

=============== ========== ========= ===================== ===============

At 30 June 2022 (audited) 1,166 15,843 (471) 255,638 272,176

=============== ========== ========= ===================== ===============

Profit for the period - - - 12,793 12,793

Other comprehensive expense - - - (267) (267)

--------------- ---------- --------- --------------------- ---------------

Total comprehensive income

for the period - - - 12,526 12,526

=============== ========== ========= ===================== ===============

Purchase of own shares - - (295) - (295)

Utilisation of own shares - - 15 (15) -

Share-based payments - - - 652 652

Movement in tax on share-based

payments taken directly to

equity - - - (82) (82)

Dividends - - - (6,996) (6,996)

Transactions with owners,

recorded directly in equity - - (280) (6,441) (6,721)

=============== ========== ========= ===================== ===============

At 31 December 2022 (unaudited) 1,166 15,843 (751) 261,723 277,981

=============== ========== ========= ===================== ===============

Condensed Consolidated Statement of Cash Flow

for the six months to 31 December 2022

Audited

Unaudited Unaudited Year

Six months Six months to

to 31 December to 31 December 30 June

2022 2021 2022

GBP000 GBP000 GBP000

Operating activities

Profit before tax 16,074 24,732 42,620

Depreciation of property, plant and

equipment 1,819 1,571 3,124

Share-based payments 652 746 1,568

Profit on redemption of shared equity

receivables (172) (246) (375)

(Decrease)/increase in provisions including

exceptional items (100) - 13,129

Loss on disposal of property, plant

and equipment 13 101 403

Finance income (99) (47) (172)

Finance expenses 853 527 1,482

----------------- ----------------- ---------

Operating cash flows before movements

in working capital 19,040 27,384 61,779

Increase in inventories (39,911) (4,763) (46,921)

Decrease/(increase) in receivables 11,537 (1,555) (8,165)

(Decrease)/increase in payables (750) (3,907) 13,244

----------------- ----------------- ---------

Cash (used in)/generated from operating

activities (10,084) 17,159 19,937

Tax paid (552) (5,836) (7,059)

Finance costs paid (782) (505) (1,043)

----------------- ----------------- ---------

Net cash flow (deficit)/surplus from

operating activities (11,418) 10,818 11,835

================= ================= =========

Investing activities

Proceeds from disposal of shared equity

receivables 582 852 1,566

Interest received 4 3 20

Purchase of property, plant and equipment (1,832) (1,677) (3,684)

----------------- ----------------- ---------

Net cash flow deficit from investing

activities (1,246) (822) (2,098)

================= ================= =========

Financing activities

Net proceeds from issue of shares - 1 1

Purchase of own shares (295) (30) (403)

Dividends paid (6,996) (5,830) (9,338)

Principle element of lease payments (324) (308) (564)

Net cash flow deficit from financing

activities (7,615) (6,167) (10,304)

================= ================= =========

Net (decrease)/increase in cash and

cash equivalents (20,279) 3,829 (567)

Cash and cash equivalents at beginning

of period 33,764 34,331 34,331

Cash and cash equivalents at end of

period 13,485 38,160 33,764

================= ================= =========

Notes to the Condensed Consolidated Financial Statements

for the six months to 31 December 2022

1. Basis of preparation and accounting policies

This condensed consolidated interim financial report ("the

Interim Report") for the six months ended 31 December 2022 has been

prepared in accordance with UK-adopted International Accounting

Standards in conformity with the requirements of the Companies Act

2006. The Interim Report has been prepared on the basis of the

policies set out in the Annual Report and Accounts for the year

ended 30 June 2022 and in accordance with Accounting Standard IAS

34 "Interim Financial Reporting" and the Disclosure Guidance and

Transparency Rules sourcebook of the UK's Financial Conduct

Authority. The Interim Report does not constitute financial

statements as defined in Section 434 of the Companies Act 2006 and

is neither audited nor reviewed.

The interim financial statements need to be read in conjunction

with the consolidated financial statements for the year ended 30

June 2022, which were prepared in accordance with UK-adopted

International Financial Reporting Standards. A copy of the Annual

Report and Accounts for the year ended 30 June 2022 is available

either on request from the Group's registered office, 6 Europa

Court, Sheffield Business Park, Sheffield, S9 1XE, or can be

downloaded from the corporate website, www.mjgleesonplc.com.

The comparative figures for the financial year ended 30 June

2022 are not the Group's statutory accounts for that financial

year. Those accounts have been reported on by the auditors of the

Company and the Group and delivered to the Registrar of Companies.

The report of the auditors was (i) unqualified, (ii) did not

include a reference to any matters which the auditor drew attention

to by way of emphasis without qualifying their report and (iii) did

not contain statements under Section 498 (2) or (3) of the

Companies Act 2006.

During the period, the Group has adopted the following new and

revised standards and interpretations that have had no material

impact on these condensed consolidated financial statements:

-- Amendments to IAS 16, IAS 37 and IFRS 3, and the annual

improvements to IFRS Standards 2019 to 2020.

The preparation of condensed consolidated interim financial

statements requires management to make judgements, estimates and

assumptions that affect the application of accounting policies and

the reported amounts of assets and liabilities, income and expense.

Actual results may subsequently differ from these estimates. In

preparing these condensed consolidated interim financial

statements, the significant judgements made by management in

applying the Group's accounting policies and the key sources of

estimation uncertainty were the same as those that applied to the

consolidated financial statements for the year ended 30 June

2022.

The accounting policies, method of computation, and presentation

adopted are consistent with those of the Annual Report and Accounts

for the year ended 30 June 2022.

Going concern

The Group has maintained its strong financial position and ended

the period with cash balances of GBP13.5m (30 June 2022: GBP33.8m).

The Group's committed club facility of GBP105m was undrawn. The

Group's financial forecasts reflect current trading and outlook,

including the impact of the last three months.

These forecasts have been subjected to a range of sensitivities

including a severe but plausible scenario together with the likely

effectiveness of mitigating actions. The assessment considered the

impact of a number of realistically possible, but severe and

prolonged changes to principal assumptions from a downturn in the

housing and land markets including:

-- a reduction in Gleeson Homes volumes of approximately 15%,

reflecting a fall in net reservations from the current trading

position;

-- a sustained reduction in Gleeson Homes selling prices of 5%;

-- a delay on the timing of Gleeson Land transactions and a reduction in land selling values.

1. Basis of preparation and accounting policies (cont.)

Under these sensitivities, after taking mitigating actions, the

Group continues to have a sufficient level of liquidity, operate

within its financial covenants and meet its liabilities as they

fall due.

Based on the results of the analysis undertaken, the Directors

have a reasonable expectation that the Group has adequate resources

available to continue in operation for the foreseeable future and

operate in compliance with the Group's bank facilities and

financial covenants. As such, the Interim Report for the Group has

been prepared on a going concern basis.

2. Segmental analysis

The Group is organised into the following two operating

divisions under the control of the Executive Board, which is

identified as the Chief Operating Decision Maker as defined under

IFRS 8 "Operating segments":

-- Gleeson Homes

-- Gleeson Land

The revenue in the Gleeson Homes segment relates to the sale of

residential properties and ad hoc land sales. All revenue for the

Gleeson Land segment relates to the sale of land interests. All of

the Group's operations are carried out entirely within the United

Kingdom. Segment information about the Group's operations is

presented below:

Audited

Unaudited Unaudited Year

Six months Six months to

to 31 December to 31 December 30 June

2022 2021 2021

Note GBP000 GBP000 GBP000

Revenue

Gleeson Homes 166,662 150,251 334,571

Gleeson Land 4,337 23,292 38,838

----------------- ----------------- ---------

Total revenue 170,999 173,543 373,409

================= ================= =========

Divisional operating profit

Gleeson Homes 18,185 22,504 51,227

Gleeson Land 1,429 5,524 11,061

Exceptional items* - - (12,867)

----------------- ----------------- ---------

19,614 28,028 49,421

Group administrative expenses (2,793) (2,816) (5,491)

Finance income 99 47 172

Finance expenses (846) (527) (1,482)

----------------- ----------------- ---------

Profit before tax 16,074 24,732 42,620

Tax 3 (3,281) (4,690) (7,531)

Profit for the period 12,793 20,042 35,089

================= ================= =========

* Gleeson Homes - Building safety provision.

2. Segmental analysis (cont.)

Balance sheet analysis of business segments:

Unaudited 31 December 2022

Assets Liabilities Net assets

GBP000 GBP000 GBP000

Gleeson Homes 309,127 (87,827) 221,300

Gleeson Land 49,334 (3,651) 45,683

Group activities 1,738 (4,225) (2,487)

Cash and cash equivalents 13,485 - 13,485

---------- -------------- -------------

373,684 (95,703) 277,981

========== ============== =============

Unaudited 31 December 2021

Assets Liabilities Net assets

GBP000 GBP000 GBP000

Gleeson Homes 232,823 (54,747) 178,076

Gleeson Land 51,995 (6,858) 45,137

Group activities 2,029 (3,461) (1,432)

Cash and cash equivalents 38,160 - 38,160

---------- -------------- -------------

325,007 (65,066) 259,941

========== ============== =============

Audited 30 June 2022

Assets Liabilities Net assets

GBP000 GBP000 GBP000

Gleeson Homes 280,481 (85,170) 195,311

Gleeson Land 49,230 (5,869) 43,361

Group activities 4,083 (4,343) (260)

Cash and cash equivalents 33,764 - 33,764

-------- ------------ -----------

367,558 (95,382) 272,176

======== ============ ===========

3. Tax

The results for the six months to 31 December 2022 include a tax

charge of 20.4% of profit before tax (31 December 2021: 19.0%, 30

June 2022: 17.7%), representing the best estimate of the average

annual effective tax rate expected for the full year, applied to

the pre-tax income of the six month period.

4. Dividends

Unaudited Unaudited Audited

Six months Six months Year to

to 31 December to 31 December 30 June

2022 2021 2022

GBP000 GBP000 GBP000

Amounts recognised as distributions

to equity holders:

Final dividend for the year ended 30

June 2021 of 10.0p - 5,830 5,831

Interim dividend for the year ended

30 June 2022 of 6.0p - - 3,507

Final dividend for the year ended 30

June 2022 of 12.0p 6,996 - -

6,996 5,830 9,338

================ ================= =========

On 15 February 2023 the Board approved an interim dividend of

5.0 pence per share at an estimated total cost of GBP2,911,000. The

dividend has not been included as a liability as at 31 December

2022 .

5. Earnings per share

The calculation of the basic and diluted earnings per share is

based on the following data:

Earnings Unaudited Unaudited Audited

Six months Six months Year to

to 31 December to 31 December 30 June

2022 2021 2022

GBP000 GBP000 GBP000

Profit for the period 12,793 20,042 35,089

Exceptional items - - 12,867

Tax on exceptional items - - (2,445)

----------------- ----------------- ----------

Profit for the year - pre-exceptional

items 12,793 20,042 45,511

================= ================= ==========

Number of shares Unaudited Unaudited Audited

31 December 31 December 30 June

2022 2021 2022

No. 000 No. 000 No. 000

Weighted average number of ordinary

shares for the purposes of

basic earnings per share 58,230 58,290 58,259

Effect of dilutive potential ordinary

shares:

Share-based payments 58 2 145

Weighted average number of ordinary

shares for the purposes of

diluted earnings per share 58,288 58,292 58,404

================= ================= ==========

Unaudited Unaudited Audited

Six months Six months Year to

to 31 December to 31 December 30 June

2022 2021 2022

pence pence pence

Basic earnings per share 21.97 34.38 60.23

Diluted earnings per share 21.95 34.38 60.08

Basic earnings per share - pre-exceptional

items 21.97 34.38 78.12

Diluted earnings per share - pre-exceptional

items 21.95 34.38 77.92

================= ================= ==========

6. Inventories

Unaudited Unaudited Audited

31 December 31 December 30 June

2022 2021 2022

GBP000 GBP000 GBP000

Land held for development 116,720 100,482 113,745

Work in progress 210,073 144,242 173,137

------------- ------------- ---------

326,793 244,724 286,882

============= ============= =========

Net realisable value provisions held against inventories at 31

December 2022 were GBP6,462,000

(31 December 2021: GBP7,690,000, 30 June 2022: GBP5,933,000).

The amount of inventory write-down recognised as an expense in the

period was GBP955,000 (31 December 2021: GBP2,553,000, 30 June

2022: GBP3,341,000) and the amount of reversal of previously

recognised inventory write-down was GBP41,000 (31 December 2021:

GBP143,000, 30 June 2022: GBP2,211,000). The cost of inventories

recognised as an expense in cost of sales was GBP120,673,000 (31

December 2021: GBP121,933,000, 30 June 2022: GBP261,293,000).

7. Net cash/(debt)

Unaudited Unaudited Audited

31 December 31 December 30 June

2022 2021 2022

GBP000 GBP000 GBP000

Cash and cash equivalents 13,485 38,160 33,764

Lease liabilities (4,109) (3,076) (3,009)

------------- ------------- ---------

Net cash/(debt) 9,376 35,084 30,755

============= ============= =========

At 31 December 2022, monies held by solicitors on behalf of the

Group and included within cash and cash equivalents were GBP872,000

(31 December 2021: GBP3,033,000, 30 June 2022: GBP15,417,000).

Unaudited 31 December 2022

Cash and

cash equivalents Lease liabilities Total

GBP000 GBP000 GBP000

Net cash/(debt) at 1 July 2022 33,764 (3,009) 30,755

Cash flows (20,279) 394 (19,885)

New leases - (1,425) (1,425)

Finance expense - (69) (69)

------------------ ------------------ ---------

Net cash/(debt) at 31 December 2022 13,485 (4,109) 9,376

================== ================== =========

8. Provisions

Unaudited 31 December 2022

Building

Dilapidations safety Total

GBP000 GBP000 GBP000

As at 1 July 2022 521 12,867 13,388

Provisions made during the period - - -

Provisions utilised during the period - (100) (100)

As at 31 December 2022 521 12,767 13,288

========================== ============= =========

Unaudited Unaudited Audited

31 December 31 December 30 June

2022 2021 2022

GBP000 GBP000 GBP000

Current provisions 5,960 15 1,339

Non-current provisions 7,328 264 12,049

-------------------------- ------------- ---------

13,288 279 13,388

========================== ============= =========

Dilapidations

The dilapidations provision covers the Group's leased property

estate. The expected provision needed at the end of each lease is

recognised on a straight-line basis over the term of the lease.

There is no material uncertainty in either the timing or

amount.

Building safety

The building safety provision includes estimated costs to

remediate life-critical fire-safety issues on buildings over 11

metres which the Group had some involvement in developing over the

last 30 years. By signing the Department for Levelling Up, Housing

and Communities' (DLUHC) Pledge, the Group has committed to put

right life-critical fire-safety issues in relation to these

buildings. DLUHC published the agreed Self-remediation terms on 30

January 2023. The Company has informed DLUHC that it intends to

enter into this agreement ahead of the deadline of 13 March

2023.

8. Provisions (cont.)

In the prior year, an exceptional provision of GBP12,867,000 was

established for remediation works. The Group is in the process of

working with building owners to complete a programme of intrusive

inspections and fire risk assessments and no further exceptional

costs have been identified to date.

Further surveys have been carried out in the six months to 31

December 2022 and, as a result, GBP100,000 of the provision in

relation to professional fees has been utilised, reducing the

provision to GBP12,767,000 at 31 December 2022. For those buildings

where intrusive inspections and fire risk assessments have been

completed, we expect to commence remediation works in the next six

months with around half of the provision expected to be utilised

over the next year.

9. Trade and other payables

Trade and other payables includes GBP13,353,000 of deferred

payables on the purchase of land by the Gleeson Homes division (31

December 2021: GBP9,678,000), of which GBP7,895,000 is due in more

than one year (31 December 2021: GBP3,296,000).

10. Related party transactions

There have been no material changes to the related party

arrangements as reported in note 27 of the Annual Report and

Accounts for the year ended 30 June 2022.

11. Seasonality

Reservations in Gleeson Homes are largely unaffected by seasonal

variations and tend to be driven more by the timing of site

openings than by seasonality. There is no seasonality in the

Gleeson Land division.

12. Group risks and uncertainties

The Directors consider that the principal risks and

uncertainties which could have a material impact on the Group's

performance remain consistent with those set out in the Strategic

Report on pages 34 to 39 of the Annual Report and Accounts for the

year ended 30 June 2022.

13. Subsequent events

Subsequent to 31 December 2022, changes are being made to the

operating structure of the business and the Company has commenced

consultation on that restructuring, which if implemented, is

expected to cost around GBP2 million and generate annualised

savings of circa GBP4 million.

Statement of Directors' Responsibility

for the six months to 31 December 2022

The Directors confirm that, to the best of our knowledge, these

condensed interim financial statements have been prepared in

accordance with UK adopted IAS 34 "Interim financial reporting" and

that the interim management report includes a fair review of

information required by DTR 4.2.7 and DTR 4.28, namely:

a) an indication of important events that have occurred during

the first six months and their impact on the condensed set of

financial statements, and a description of the principal risks and

uncertainties for the remaining six months of the financial year;

and

b) material related party transactions in the first six months

and any material changes in the related party transactions

described in the last annual report.

The Board

The Board of Directors of MJ Gleeson plc at 30 June 2022 and

their respective responsibilities can be found on pages 86 to 91 of

the MJ Gleeson plc Annual Report and Accounts for the year ended 30

June 2022. Subsequent to the publication of the Annual Report and

Accounts, the following Board changes have taken place:

-- Dermot Gleeson, non-executive Chairman, retired from the Board on 31 December 2022;

-- James Thomson succeeded Dermot Gleeson as non-executive

Chairman with effect from 1 January 2023; and

-- Graham Prothero joined the Board as Chief Executive Officer

with effect from 1 January 2023.

By order of the Board

Stefan Allanson

Chief Financial Officer

15 February 2023

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR NKPBBFBKDABD

(END) Dow Jones Newswires

February 16, 2023 02:00 ET (07:00 GMT)

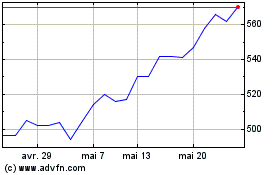

Mj Gleeson (LSE:GLE)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

Mj Gleeson (LSE:GLE)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024