TIDMRVG

RNS Number : 9296O

Retroscreen Virology Group PLC

26 September 2013

For immediate release 07.00: 26 September 2013

RETROSCREEN VIROLOGY GROUP PLC

("Retroscreen" or the "Company" or the "Group")

HALF-YEAR FINANCIAL REPORT

FOR THE SIX MONTHS ENDED 30 JUNE 2013

Retroscreen Virology Group plc (AIM: RVG), the viral challenge

and "virometrics" specialist, is pleased to announce its half-year

financial report for the six months ended 30 June 2013.

Financial Highlights

-- Continued growth in revenue to GBP12.01 million (H1'12 -

GBP5.07 million; 2012 - GBP14.40 million);

-- Gross profit was GBP3.40 million and gross margin 28.3%

(H1'12 - GBP1.19 million and 23.5%; 2012 - GBP3.70 million and

25.7%);

-- Administrative expenses as a percentage of revenue was 24.4%

(H1'12 - 26.7%; 2012 - 26.9%);

-- Profit before taxation was GBP0.03 million (H1'12 - loss of

GBP0.26 million; 2012 - loss of GBP0.43 million);

-- Profit for the year was GBP0.57 million (H1'12 - loss of

GBP0.26 million; 2012 - profit of GBP0.53 million);

-- Strong balance sheet with cash and cash equivalents at 30

June 2013 of GBP13.19 million (H1'12 - GBP16.93 million; 2012 -

GBP16.34 million) and net assets of GBP16.92 million (H1'12 -

GBP15.53 million; 2012 - 16.34 million);

-- GBP25.5 million fundraising completed just after the

half-year end on 3 July 2013.

Operational Highlights

-- Completed the largest RSV challenge study ever performed with

an investigational drug, which was also Retroscreen's largest VCM

study to-date;

-- Conducted the largest ever investigation into influenza

transmission, in collaboration with the University of Nottingham

and funded by the United States Centers for Disease Control and

Prevention (CDC);

-- Continued focus on building solid foundations for significant

revenue growth and improvement in margins:

- opened a new FluCamp screening centre in Manchester

- in March 2013 moved our support functions to our newly

developed open-plan office facilities on the 3rd floor of the QMB

Innovation Centre in Whitechapel, London

- ongoing investment in infrastructure, IT and equipment

-- Investment in challenge virus inventory:

- Characterised our new HRV-16, which we developed for use in

our upcoming AD-VCM, and we are using in our core VCM for a global

pharmaceutical client in H2'13

- On track with our new flu challenge virus, which we are soon

to characterise and anticipate to be available for commercial use

in Q2 '14

-- Solidifying our plans for an AD-VCM and on track to begin the

AD-VCM validation studies in Q1'14;

-- Made significant strides forward in defining Retroscreen's

plans to leverage the VCM as human models of disease and initiated

the all-important IT infrastructure development;

-- Momentum established in 2013 is set to continue and

Retroscreen remains well placed to meet its growth plans over the

next year.

Kym Denny, Chief Executive Officer, said:

"I am pleased to report Retroscreen's half-year financial

results for the six months ended 30 June 2013, which reflect our

commitment to growing client engagements and VCM adoption, while

realising the operational efficiencies and utilisation, reflected

in our improved margins. In this period we have solidified our

plans to add new Airways Disease challenge models (AD-VCM) and have

defined the VCM as human models of disease, which together with the

pioneering of our virometrics database will create powerful tools

in mapping human response to infection. To support our expansion

plans we successfully raised GBP25.5m (gross) just after the

half-year end on 3 July 2013.

I am delighted that we are on track to meet the objectives we

set out for 2013, including starting our first AD-VCM validation

studies, implementing the IT infrastructure pivotal in building the

virometrics database, and continuing to build solid foundations for

expansion and revenue growth."

For further information please contact:

Retroscreen Virology Group plc +44 207 756 1300

Kym Denny (CEO)

Graham Yeatman (FD)

Numis Securities Limited +44 207 260 1000

Michael Meade / Freddie Barnfield (Nominated Adviser)

James Black / Michael Burke (Corporate Broking)

Retroscreen Virology Group plc

Statement from the Chief Executive Officer

Introduction

I am very pleased to present Retroscreen's half-year financial

report for the six months ended 30 June 2013, which highlight our

continuing revenue growth and improving margin as the organisation

begins to reap the benefits of investment in staff and

infrastructure from the past 18 months. We successfully raised an

additional GBP25.5m (gross) on 3 July 2013 from existing and new

shareholders, in order that we continue our trajectory towards

further core business expansion alongside the development of a new

challenge model in Airways Disease, and the pioneering of our

virometrics database; which turns our VCM into a very powerful,

species-specific research and development tool.

Background

Retroscreen is a virology healthcare business that provides

clinical research services, focused on the Viral Challenge Model

("VCM"), and pre-clinical analytical services to global

pharmaceutical companies, biotechnology organisations, academic and

government institutions. Retroscreen has grown and developed the

VCM for evidencing the efficacy of antiviral and viral therapeutics

in Influenza, RSV and HRV (common cold). In addition to our

established viral clinical research service platform, Retroscreen

aims to develop human challenge models for research into Asthma and

Chronic Obstructive Pulmonary Disease (COPD), leading ultimately to

a translational medicine platform that isolates patterns in the

human response to major disease causing viruses and translates

these patterns into revolutionary new treatments and

diagnostics.

Overview

The first half of 2013 saw Retroscreen running VCM engagements

at two different quarantine facilities: at our flagship London unit

and at our new Cambridgeshire facility. During this time, we

initiated trial design and study start-up for a multitude of new

customers, in addition to completing the largest RSV challenge

study ever performed with an investigational drug. Not only was

this the largest RSV challenge study, but it was also Retroscreen's

largest VCM full-stop - eclipsing last year's record holder, and

yet another example of how far Retroscreen is pushing the

boundaries of early phase research. In the first half of 2013 we

also had the honour of conducting the largest and most definitive

investigation into how flu is transmitted, in collaboration with

Nottingham University and via funding from the United States

Centers for Disease Control and Prevention ("CDC"). We also ran our

VCM validation study for our newly manufactured HRV-16 cold virus,

which we developed for use in our upcoming new Airways Disease

Viral Exacerbation challenge model (AD-VCM), and which we are using

in our standard VCM with a global pharmaceutical client in the

second half of this year. We will shortly begin our VCM validation

study for a new flu virus, anticipated to be available for

commercial use in Q2 2014, and over the summer we opened our newest

screening centre in Manchester, joining our existing centres in

London and Cambridgeshire in screening volunteers for our VCM

studies.

Our VCM sales pipeline continues to expand in line with our

expectations surrounding revenue growth, with 31% more leads in our

longer term sales pipeline than this time last year. Currently we

are working on five fully qualified VCM study opportunities with an

estimated value of GBP30 million, while leads under conversion

include two opportunities under Start-up Agreement and three in

final contract negotiation.

In addition to the expansion activities associated with our core

VCM business, the first half of 2013 saw Retroscreen solidifying

our plans to add a new challenge model to its VCM repertoire, and

to unlock the additional value inherent in these VCMs. In order to

validate our thinking in both of these areas, we undertook a

scientific road show in late Q2 2013, presenting our plans to world

leading experts in flu, RSV, common cold and airways diseases, as

well as the global thought leaders in immunology, genomics, and

bioinformatics. The overwhelmingly positive response we received

from these sources - and the healthy progress we had made on our

AD-VCM development plan - gave us the assurance that the timing was

right to raise the additional funds we would need to fully validate

the AD-VCM, and to build our viro-database and initially populate

it with the outputs from our biological samples. As a result, we

commenced a fund raising road show in June 2013, raising GBP25.5m

(gross) via a cash placing from new and existing shareholders and

which completed on 3 July 2013. The support we have received

financially and strategically from our investor base has been

invaluable, and I am immensely grateful to each and every one of

them for enabling us to proceed with our next phase of growth

without losing momentum.

The immediate beneficiary of the fundraise is our first new

challenge model in many, many years: the AD-VCM, which is an

airways disease viral exacerbation challenge model. We are on track

to begin the AD-VCM validation studies in Q1 2014. The key disease

areas for the AD-VCM are Asthma and COPD, two prevalent conditions

with significant unmet medical needs which are very specific to us

as a species. Asthmatics at risk of having asthma attacks when they

have a viral infection will be the first patient population to

enter the AD-VCM, with concept design for infection-induced COPD

attacks commencing by Q3 2014. In consultation with many of our

clients, we see the addition of the AD-VCM to Retroscreen's

capabilities as being pivotal to accessing sizable adjacent markets

and encouraging additional significant growth potential for us as a

company.

We also presented to investors Retroscreen's plans to unlock

additional value from all our VCMs by using them in a novel way, as

human models of disease ("HMD"). By conducting VCMs without

investigational drug, Retroscreen aims to study the mechanics of

viral disease in both healthy subjects and in patients suffering

from respiratory disease in a way that will pioneer a better

understanding of the disease pathways and biomarkers that could

eventually lead to novel treatments and diagnostics. To facilitate

this goal, we will create a multidimensional map within our

viro-database of the human response to infection, allowing us to

identify common correlates of protection across viruses and healthy

and vulnerable patient populations alike. We are currently in the

throes of setting up the IT infrastructure needed for this

proprietary database, and plans are in development for the conduct

of HMDs in RSV, flu, cold and virally exacerbated asthma over the

next 12 to 18 months.

Financial Review

Statement of Comprehensive Income

Revenue for the six months ended 30 June 2013 was GBP12.01

million (H1'12 - GBP5.07 million; 2012 - GBP14.40 million). Revenue

was principally from Retroscreen operating concurrent VCM

engagements in two quarantine units for the first time, together

with the study set-up for new VCM engagements with quarantines

commencing in the next twelve months.

Gross profit was GBP3.40 million and gross margin 28.3% (H1'12 -

GBP1.19 million and 23.5%; 2012 - GBP3.70 million and 25.7%).

Profit before taxation was GBP32,000 (H1'12 - Loss before

taxation of GBP0.26 million; 2012 - Loss before taxation of GBP0.43

million).

Balance Sheet and Cash Flow

As at 30 June 2013 net assets amounted to GBP16.92m (H1'12

GBP15.53 million; 2012 GBP16.34 million), including cash and cash

equivalents of GBP13.19 million (H1'12 - GBP16.93 million; 2012 -

GBP16.34 million). Retroscreen raised GBP25.50 million (before

expenses) by way of a placing on 3 July 2013, immediately after the

period end.

Net cash used in operating activities over the six months was

GBP1.07 million (H1'12 - Net cash generated of GBP1.98 million;

2012 Net cash generated of GBP2.10 million).

Outlook

As Retroscreen settles into its second year as an AIM-listed

organisation, we remain focused on developing our operational

infrastructure to meet market demand and to accommodate exciting

new challenge models for asthma and COPD. At the same time, we have

initiated the all-important IT infrastructure development that will

allow us to leverage the VCM as a human model of disease.

I am confident that the momentum we established in the first

half of 2013 is set to continue, and that Retroscreen remains well

placed to meet its growth plans over the next year.

Kym Denny

Chief Executive Officer

25 September 2013

Retroscreen Virology Group plc

Consolidated Statement of Comprehensive Income

For the six months ended 30 June 2013

Note 6 Months 6 Months Year

ended ended ended

30 Jun 30 Jun 31 Dec

13 12 Unaudited 12

Unaudited GBP'000 Audited

GBP'000 GBP'000

Revenue 12,009 5,066 14,395

Cost of sales (8,611) (3,875) (10,694)

--------------- ------------------ -------------

Gross profit 3,398 1,191 3,701

Research and development (496) (87) (307)

Administration expenses (2,928) (1,354) (3,873)

Share-based payment charge (11) (24) (48)

--------------- ------------------ -------------

Loss from operations (37) (274) (527)

Finance income 74 27 111

Finance costs (5) (9) (12)

--------------- ------------------ -------------

Profit/ (loss) before taxation 32 (256) (428)

Taxation 4 540 - 957

--------------- ------------------ -------------

Profit/ (loss) for the period 572 (256) 529

Other comprehensive income, - - -

net of tax

--------------- ------------------ -------------

Total comprehensive loss

for the period/ year attributable

to shareholders 572 (256) 529

=============== ================== =============

Profit/ (loss) per share

- basic (pence) 5 1.4p (0.9)p 1.5p

Profit/ (loss per share -

diluted (pence) 5 1.3p (0.9)p 1.4p

All results derive from continuing operations.

Retroscreen Virology Group plc

Consolidated Statement of Financial Position

As at 30 June 2013

30 Jun 30 Jun 31 Dec

13 12 Unaudited 12

Unaudited GBP'000 Audited

GBP'000 GBP'000

Assets

Property, plant and equipment 3,226 726 1,377

--------------- ------------------ -------------

Non-current assets 3,226 726 1,377

Inventories 3,036 1,808 1,613

Trade and other receivables 4,211 1,244 2,695

R&D tax credit receivable 1,615 500 1,075

Cash and cash equivalents 13,194 16,934 16,338

--------------- ------------------ -------------

Current assets 22,056 20,486 21,721

--------------- ------------------ -------------

Total assets 25,282 21,212 23,098

--------------- ------------------ -------------

Liabilities

Trade and other payables (7,625) (5,685) (6,762)

Current liabilities (7,625) (5,685) (6,762)

--------------- ------------------ -------------

Net current assets 14,431 14,801 14,959

--------------- ------------------ -------------

Financial liabilities (738) - -

--------------- ------------------ -------------

Non-current liabilities (738) - -

--------------- ------------------ -------------

Net assets 16,919 15,527 16,336

=============== ================== =============

Equity

Share capital 2,049 2,049 2,049

Share premium account 13,013 13,013 13,013

Share-based payment reserve 228 193 217

Merger reserve 4,199 4,199 4,199

Retained earnings (2,570) (3,927) (3,142)

--------------- ------------------ -------------

Equity attributable to shareholders 16,919 15,527 16,336

=============== ================== =============

The interim consolidated financial statements of Retroscreen

Virology Group plc (registered company number 08008725) were

approved by the Board of Directors and authorised for issue on 26

September 2013 and signed on its behalf by:

Graham E Yeatman

Finance Director

Retroscreen Virology Group plc

Consolidated Statement of Changes in Equity

As at 30 June 2013

Ordinary Share Share-Based Merger Retained Total

Share Premium Payment Reserve Earnings

Capital Account Reserve

GBP

GBP GBP GBP GBP GBP GBP

At 1 January 2012 1,096 - 5 4,196 (3,671) 1,626

Issued equity share

capital:

Issued in subsidiary

undertakings 6 - - 3 - 9

Placing on admission

to AIM 947 13,177 - - - 14,124

------------- ------------- ---------------- ------------- -------------- -----------

Total transactions

with owners in their

capacity as owners 953 13,177 - 3 - 14,133

Total comprehensive

loss for the period - - - - (256) (256)

Share-based payment

expense - - 24 - - 24

Warrants issued - (164) 164 - - -

------------- ------------- ---------------- ------------- -------------- -----------

Balance at 30 June

2012 2,049 13,013 193 4,199 (3,927) 15,527

Total comprehensive

profit for the period - - - - 785 785

Share-based payment

expense - - 24 - - 24

---------- ------ -------- ---------- ------- -----------

Balance at 31 December

2012 2,049 13,013 217 4,199 (3,142) 16,336

Total comprehensive

profit for the period - - - - 572 572

Share-based payment

expense - - 11 - - 11

---------- ------ -------- ---------- ------- -----------

Balance at 30 June

2013 2,049 13,013 228 4,199 (2,570) 16,919

========== ====== ======== ========== ======= ===========

Retroscreen Virology Group plc

Consolidated Statement of Cash Flows

For the six months ended 30 June 2013

6 Months 6 Months Year

ended ended ended

30 Jun 30 Jun 31 Dec

13 12 Unaudited 12

Unaudited GBP'000 Audited

GBP'000 GBP'000

Cash flow from continuing operating

activities

Profit/ (loss) before taxation 32 (256) (428)

Adjustments for:

Depreciation of plant, property

and equipment 292 80 230

Loss on disposal of plant, property

and - - 2

Share-based compensation 11 24 48

Increase in inventories (1,423) (363) (168)

(Increase)/ decrease in trade

and other receivables (1,516) 1,643 192

Increase in trade and other

payables 1,601 865 1,941

Finance costs 5 9 12

Finance income (74) (27) (111)

--------------- ------------------ -------------

Cash (used in)/ from operations (1,072) 1,975 1,718

Corporation tax refund - - 383

--------------- ------------------ -------------

Net cash (used in)/ generated

by operating activities (1,072) 1,975 2,101

Investing activities

Acquisition of plant, property

and equipment (2,141) (411) (1,214)

Finance income 74 27 111

--------------- ------------------ -------------

Net cash used in investing activities (2,067) (384) (1,103)

Financing activities

Net proceeds from issue of shares - 14,133 14,133

Loans repaid - (374) (374)

Finance costs (5) (9) (12)

--------------- ------------------ -------------

Cash (used in)/ generated from

financing activities (5) 13,750 13,747

Net (decrease)/ increase in cash

and cash equivalents (3,144) 15,341 14,745

Cash and cash equivalents at

beginning of financial period 16,338 1,593 1,593

Cash and cash equivalents at

end of financial period 13,194 16,934 16,338

=============== ================== =============

Retroscreen Virology Group plc

Notes to the accounts

1. Basis of preparation and accounting policies

The interim financial statements have been prepared in

accordance with the AIM rules and the basis of accounting policies

set out in the accounts of the Group for the year ended 31 December

2012 and on the basis of all International Financial Reporting

Standards as endorsed by the EU ("IFRS") that are expected to be

applicable to the Group's statutory accounts for the year ended 31

December 2013. The interim financial statements are unaudited and

were approved by the Board of Directors for issue on 26 September

2013. The information set out herein is abbreviated and does not

constitute statutory accounts within the meaning of Section 434 of

the Companies Act 2006. The results for the year ended 31 December

2012 are in abbreviated form and have been extracted from the

published financial statements of the Group. These were audited and

reported upon without qualification by Baker Tilly UK Audit LLP and

did not contain a statement under Section 498(2) or (3) of the

Companies Act 2006.

The Group has not applied IAS 34 "Interim Financial Reporting"

(which is not mandatory for UK Groups) in the preparation of these

interim financial statements.

The Company is a limited liability company incorporated and

domiciled in England & Wales and whose shares are quoted on

AIM, a market operated by The London Stock Exchange. The Group

financial statements are presented in pounds Sterling, which is the

Group's presentational currency, and all values are rounded to the

nearest thousand (GBP'000) except where indicated otherwise.

2. Basis of consolidation

The consolidated financial statements incorporate the financial

statements of the Company and its subsidiary undertakings. The

results of subsidiaries acquired or disposed of during the year are

included in the consolidated statement of comprehensive income from

the date of their acquisition.

The purchase method of accounting is used for the acquisition of

subsidiaries. The cost of acquisition is measured at the aggregate

fair values of assets given, equity instruments issued and

liabilities incurred or assumed by the Group to obtain control and

any directly attributable acquisition costs.

Intra-group balances, and any unrealised income and expenses

arising from intra-group transactions, are eliminated in preparing

the consolidated financial statements.

Retroscreen Virology Group plc acquired Retroscreen Virology

Limited on 20 April 2012 through a share for share exchange that

does not meet the definition of a business combination. It is noted

that such transactions are outside the scope of IFRS 3 and there is

no other guidance elsewhere in IFRS covering such transactions.

IAS 8 Accounting Policies, Changes in Accounting Estimates and

Errors, requires that where IFRS does not include guidance for a

particular issue, the Directors may also consider the most recent

pronouncements of other standard setting bodies that use a similar

conceptual framework to develop accounting standards when

developing an appropriate accounting policy.

In this regard, it is noted that the UK Accounting Standards

Board has, in issue, an accounting standard covering business

combinations (FRS 6) that permits the use of the merger accounting

principles for such transactions. The Directors have therefore

chosen to adopt these principles and the accounts have been

prepared as if Retroscreen Virology Limited had been owned and

controlled by the Company throughout the 6 months ended 30 June

2012 and the year ended 31 December 2012. Accordingly, the assets

and liabilities of Retroscreen Virology Limited have been

recognised at their historical carrying amounts, the results for

the periods prior to the date the Company legally obtained control

have been recognised and the financial information and cash flows

reflect those of Retroscreen Virology Limited.

3. Segmental information

The Directors consider that there are no identifiable business

segments that are engaged in providing individual products or

services or a group of related products and services that are

subject to risks and returns that are different to the core

business. The information reported to the Group's Chief Executive

Officer, who is considered the chief operating decision maker, for

the purposes of resource allocation and assessment of performance

is based wholly on the overall activities of the Group. The Group

has therefore determined that it has only one reportable segment

under IFRS8, which is 'medical and scientific research services'.

The Group's revenue and results and assets for this one reportable

segment can be determined by reference to the Group's consolidated

statement of comprehensive income and consolidated statement of

financial position.

The Group carries out all its activities from the UK and as such

only has a single geographic segment.

4. Taxation on ordinary activities

6 Months 6 Months Year

ended ended ended

30 Jun 30 Jun 31 Dec

13 12 Unaudited 12

Unaudited GBP'000 Audited

GBP'000 GBP'000

Current tax:

R&D tax credit (250) - (947)

Adjustments in respect

of prior periods (290) - (10)

--------------- ------------------ -------------

(540) - (957)

=============== ================== =============

5. Earnings/ (loss) per share

The calculation of the basic and dilutes EPS/ (LPS) is based on

the following data:

6 Months 6 Months Year

ended ended ended

30 Jun 30 Jun 31 Dec

13 12 Unaudited 12

Unaudited GBP'000 Audited

GBP'000 GBP'000

Earnings:

Earnings/ (loss) for the

purposes of basic and diluted

EPS/ (LPS) being net profit/

(loss) attributable to

owners of the Company 572 (256) 529

=============== ================== ===============

Number of shares:

Weighted average number

of ordinary shares for

the purpose of basic EPS/

(LPS) 40,976,920 28,077,963 34,580,451

Effect of dilutive potential

ordinary shares:

* share options 3,851,268 - 3,582,103

* warrants - - 56,596

--------------- ------------------ ---------------

44,828,188 28,077,963 38,219,150

=============== ================== ===============

In the 6 months ended 30 June 2012, the potential ordinary

shares were not treated as dilutive as the Group was loss making,

therefore the weighted average number of ordinary shares for the

purposes of the basic and dilutive loss per share were the

same.

6. Post balance sheet events

On 3 July 2013, the Company raised GBP25.5 million (before

expenses) by way of a placing of 12,750,000 new ordinary shares

with both new and existing institutional shareholders at a price of

200 pence per ordinary share. Following admission of the new

ordinary shares to trading on AIM, the total number of ordinary

shares in issue became 53,726,920.

7. Interim announcement

The interim report was approved by the Board of Directors for

issue on 26 September 2013. A copy will be posted on the Company's

website at www.Retroscreen.com.

Retroscreen Virology Group plc

Independent review report to Retroscreen Virology Group plc

Introduction

We have been engaged by the Company to review the condensed set

of financial statements in the half-year financial report for the

six months ended 30 June 2013 which comprises Consolidated

Statement of Comprehensive Income, Consolidated Statement of

Financial Position, Consolidated Statement of Changes in Equity,

Consolidated Statement of Cash Flows and the related explanatory

notes. We have read the other information contained in the

half-year financial report and considered whether it contains any

apparent misstatements or material inconsistencies with the

information in the condensed set of financial statements.

This report is made solely to the Company in accordance with

International Standard on Review Engagements (UK and Ireland) 2410

"'Review of Interim Financial Information performed by the

Independent Auditor of the Entity" issued by the Auditing Practices

Board. Our review work has been undertaken so that we might state

to the Company those matters we are required to state to them in an

independent review report and for no other purpose. To the fullest

extent permitted by law, we do not accept or assume responsibility

to anyone other than the Company, for our review work, for this

report, or for the conclusions we have formed.

Directors' Responsibilities

The half-year financial report, is the responsibility of, and

has been approved by the Directors. The Directors are responsible

for preparing and presenting the half-year financial report in

accordance with the AIM Rules of the London Stock Exchange.

As disclosed in note 1, the annual financial statements of the

Group are prepared in accordance with International Financial

Reporting Standards and International Financial Reporting

Interpretations Committee pronouncements as adopted by the European

Union. The condensed set of financial statements included in this

half-year financial report has been prepared in accordance with the

presentation, recognition and measurement criteria of International

Financial Reporting Standards and International Financial Reporting

Interpretations Committee pronouncements, as adopted by the

European Union.

Our Responsibility

Our responsibility is to express to the Company a conclusion on

the condensed set of financial statements in the half-yearly

financial report based on our review.

Scope of Review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410, "Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity" issued by the Auditing Practices Board for use in

the United Kingdom. A review of interim financial information

consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures. A review is substantially less in scope than an

audit conducted in accordance with International Standards on

Auditing (UK and Ireland) and consequently does not enable us to

obtain assurance that we would become aware of all significant

matters that might be identified in an audit. Accordingly, we do

not express an audit opinion.

Basis for Qualified Conclusion

The Group has made an accrual in Administrative Expenses for

2013 employee performance-based bonus, amounting to GBP0.56m in

respect of the six months ended 30 June 2013. We consider that in

accordance with IAS 37 Provisions, Contingent Liabilities and

Contingent Assets there is no constructive obligation arising as at

30 June 2013.

Qualified Conclusion

Based on our review, with the exception of the matter described

in the preceding paragraph, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-year financial report for the six months ended 30 June

2013 is not prepared, in all material respects, in accordance with

the presentation, recognition and measurement criteria of

International Financial Reporting Standards and International

Financial Reporting Interpretations Committee pronouncements as

adopted by the European Union, and the AIM Rules of the London

Stock Exchange.

Baker Tilly UK Audit LLP

Chartered Accountants

3 Hardman Street

Manchester

M3 3HF

25 September 2013

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR PGUQABUPWGMA

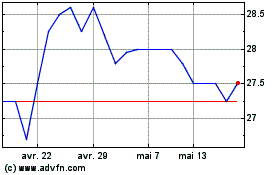

Hvivo (LSE:HVO)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Hvivo (LSE:HVO)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024