or stamp duty reserve tax forthwith and to indemnify on an

after-tax basis and to hold harmless the Company and Numis in the

event that any of the Company and/or Numis has incurred any such

liability to UK stamp duty or stamp duty reserve tax. If this is

the case, each Placee should seek its own advice and notify Numis

accordingly.

In addition, Placees should note that they will be liable for

any stamp duty and all other stamp, issue, securities, transfer,

registration, documentary or other duties or taxes (including any

interest, fines or penalties relating thereto) payable outside the

UK by them or any other person on the subscription by them of any

Placing Shares or the agreement by them to subscribe for any

Placing Shares.

Each Placee, and any person acting on behalf of the Placee,

acknowledges that Numis does not owe any fiduciary or other duties

to any Placee in respect of any representations, warranties,

undertakings or indemnities in the Placing Agreement.

Each Placee and any person acting on behalf of the Placee

acknowledges and agrees that Numis or any of its affiliates may, at

their absolute discretion, agree to become a Placee in respect of

some or all of the Placing Shares.

When a Placee or person acting on behalf of the Placee is

dealing with Numis, any money held in an account with Numis on

behalf of the Placee and/or any person acting on behalf of the

Placee will not be treated as client money within the meaning of

the rules and regulations of the FCA made under the FSMA. The

Placee acknowledges that the money will not be subject to the

protections conferred by the client money rules; as a consequence,

this money will not be segregated from Numis' money in accordance

with the client money rules and will be used by Numis in the course

of its own business and the Placee will rank only as a general

creditor of Numis.

All times and dates in this Announcement may be subject to

amendment. Numis shall notify the Placees and any person acting on

behalf of the Placees of any changes.

Past performance is no guide to future performance and persons

needing advice should consult an independent financial adviser.

Definitions

The following definitions apply throughout this Announcement,

unless the context requires otherwise.

"Act" the Companies Act 2006, as amended

"Admission" admission of the New Ordinary Shares to trading on

AIM becoming effective in accordance with the AIM Rules

"AIM" the market of that name operated by the London Stock

Exchange

"AIM Rules" the AIM Rules for Companies, which sets out the rules and

responsibilities for companies listed on AIM, as amended from

time to time

"Announcement" this announcement (including the appendix to this announcement)

"Board" or "Directors" the board of directors of the Company from time to time

"Circular" the circular of the Company dated 14 August 2014

giving (amongst other things) details of the Placing and

incorporating the Notice of General Meeting

"Company" or "Retroscreen" Retroscreen Virology Group plc, a public limited company

incorporated in England & Wales under registered number

08008725

"CREST" the relevant system (as defined in the Uncertificated

Regulations) which enables title to units of relevant securities

(as defined in the Regulations) to be evidenced and transferred

without a written instrument and in respect of which Euroclear UK

& Ireland Limited is the Operator (as defined in the

Uncertificated Regulations)

"Existing Ordinary Shares" the 54,723,821 Ordinary Shares in

issue at the date of this document

all of which are admitted to trading on AIM

"FCA" the Financial Conduct Authority of the United Kingdom

"FDA" the US Food and Drug Administration

"FSMA" the Financial Services and Markets Act 2000 (as amended)

"General Meeting" the general meeting of the Company to be held at 10.00 a.m. on

1 September 2014, notice of which is set out in the Circular

"Group" the Company, its subsidiaries and subsidiary

undertakings

"Invesco" Invesco Asset Management Limited, together with

Invesco Perpetual High Income Fund and Invesco Perpetual Income

Fund

"London Stock Exchange" London Stock Exchange plc

"New Ordinary Shares" 12,923,077 new Ordinary Shares which are to be conditionally placed

for cash with investors in accordance with the terms of the

Placing

Agreement and whose allotment and issue is conditional, inter

alia, on the passing of the Resolutions

"Notice of General Meeting" the notice of General Meeting, set out at the end of the Circular

"Numis" Numis Securities Limited, a private limited company

incorporated in

England & Wales under registered number 2285918 and having

its registered office at 10 Paternoster Square, London EC4M 7LT

"Ordinary Shares" ordinary shares of 5 pence each in the capital of the Company

"Placee" any person (including individuals, funds or otherwise)

by whom or on whose behalf a commitment to acquire Placing Shares

has been given

"Placing" the proposed conditional, non-pre-emptive placing by

Numis of the New Ordinary Shares (on behalf of the Company) at the

Placing Price

"Placing Agreement" the conditional agreement dated 14 August

2014 relating to the Placing in respect of the New Ordinary Shares,

between the Company and Numis

"Placing Price" 260 pence per New Ordinary Share

"Resolutions" the resolutions to be proposed at the General

Meeting as set out in

the Notice of General Meeting

"Shareholders" the holders of Ordinary Shares from time to time,

each individually a

"Shareholder"

"Uncertificated Regulations" the UK Uncertificated Securities

Regulations 2001 (SI 2001 No. 3755), as

amended

"UK" or "United Kingdom" the United Kingdom of Great Britain and Northern Ireland

"US" or "United States" the United States of America, its

territories and possessions, any state of the United States and the

District of Colombia

All references in this document to "GBP", "pence" or "p" are to

the lawful currency of the United Kingdom, all references to "US$"

or "$" are to the lawful currency of the United States.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IOEQKNDDNBKBOFD

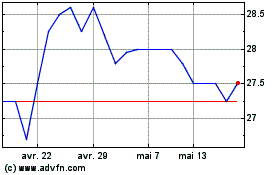

Hvivo (LSE:HVO)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Hvivo (LSE:HVO)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024