The current geographical profile of Group profits before

exceptional items at current local rates of tax would result in an

underlying blended tax rate of just under 29%. However, there are

still tax losses in the USA with a current tax value of GBP2.2

million and in the UK with a current tax value of GBP0.3 million,

not yet recognised in the balance sheet. The opportunity to

recognise and utilise these as profitability is sustained and

improves, will suppress the actual tax rate for some time to

come.

Profit for the year

Net profit for the year was down 8.5% to GBP3.7 million (2013:

GBP4.1 million). However, this was after charging GBP1.9 million

(2013: GBP1.3 million) in respect of exceptional items, with the

current year element all relating to the investment and consequent

restructuring in our manufacturing facilities in Wales and GBP0.1

million in respect of the new LTIP scheme (2013: nil).

Earnings per share and dividends

Basic earnings per share were 5.2p (2013: 6.0p). After removing

the effect of exceptional items, the adjusted earnings per share

increased to 8.5p (2013: 8.1p) representing an increase of

4.9%.

Employee share options of 1.8 million had vested but not yet

been exercised as at 31 March 2014. As these are exercised,

earnings per share will trend towards the fully diluted level and

the Company targets growth in this fully diluted metric (before

exceptional items) as a primary goal. In addition the Company

introduced a new long term incentive plan during the year and this

approach of targeting fully diluted earnings per share (before

exceptional items) will accommodate that scheme as and when any of

the new "performance shares" vest. Details of share plans can be

found in note 25 to the financial statements. Fully diluted

earnings per share (stated before exceptional items) were 8.3p, up

6.4% on the prior year (2013: 7.8p), and ahead of plan.

No dividend was paid during the year (2013: GBPnil) and the

Board does not propose a final dividend for the year. The other

primary focus remains the reduction of leverage from the current

level of 2.4 times EBITDA (2013: 2.8 times) to below 2.0 times

EBITDA. At this point, the Board will consider whether it is

appropriate to resume dividends.

Balance sheet and cash flow

Net debt at 31 March 2014 was much improved at GBP36.9 million

(2013: GBP42.1 million) and leverage fell accordingly to 2.4 times

from 2.8 times in the prior year. Weaker exchange rates helped in

this regard and net debt at like for like rates would have been

GBP1.4 million higher. Nonetheless this is a very strong

performance and well ahead of our plan in a year in which capital

expenditure of GBP8.3 million (2013: GBP1.9 million) exceeded

depreciation by GBP3.3 million. Notes 17 and 26 to the financial

statements provide further information.

Year-end net debt included amounts denominated in US Dollars of

$25.5 million (2013: $22.6 million) and in Euros of EUR5.8 million

(2013: EUR12.4 million). The year-end exchange rates were $1.67

(2013: $1.52) and EUR1.21 (2012: EUR1.19). Allowing for this, debt

stated at constant exchange rates would have been GBP1.4 million

higher.

Working capital management continues to be a priority.

Outstanding debtors are monitored closely, both to maximise cash

but also to reduce our credit risk. Trade debtors reduced to

GBP16.1 million (2013: GBP18.8 million) at the year end, more than

reversing last year's increase, which related to specific customer

circumstances but in the 2013/14 year also reflecting lower Q4

sales in the USA following the extraordinarily adverse weather

conditions.

The charge for bad and doubtful debts in the year was GBP0.1

million or less than 0.1% of turnover.

Net stock levels after provisioning for older stock reduced by

3.3% from GBP50.1 million to GBP48.5 million. Stock levels only

increased in the USA, again related to lower sales as a result of

the poor weather conditions in Q4.

Older stock (measured as over 15 months since last purchase)

increased slightly from GBP5.1 million to GBP5.8 million (at March

2014 exchange rates) but provisioning remains adequate and our

businesses consistently achieve in excess of 100% recovery against

written down values of old stock.

Group cash generated from operations was more than double that

of the prior year at GBP15.2 million (2013: GBP7.5 million),

reflecting full conversion of operating profits into cash flow and

assisted by a small net reduction in working capital of GBP0.7

million (2013: increase of GBP5.7 million).

As noted above, investment in capital expenditure was very

substantial at GBP8.3 million (2013: GBP1.9 million), well above

depreciation and the prior year. This reflects the investment in

two new state-of-the-art printing presses and associated facilities

at our gift wrap manufacturing operation in Wales, matching the

equivalent capability installed in Europe in 2012 that is now

yielding such strong results. During the year we also invested in

further automation at our manufacturing facilities in China and the

USA, which mitigates against the twin challenges of availability

and cost of labour.

The investment in Wales is consolidating our operations, and we

anticipate one of our three current sites will then become

available for sale later in the 2014/15 year. The net book value of

this site is GBP1.25 million. In addition the Company is in the

second of a five-year period by which a company has the option to

purchase part of another under utilised site (net book value GBP0.8

million) for a price of GBP2.4 million. This is also generating

premium income of GBP0.1 million p.a. over the option period,

recognised within other operating income.

Equity attributable to shareholders has increased to GBP53.5

million from GBP51.9 million predominantly reflecting profits

generated in the year.

Risks and key performance indicators

Our areas of primary focus are:

* improved earnings attributable to shareholders, which

we aim to achieve through top line growth and mix

management in selected markets and channels together

with strong cost and gross margin management; and

* lower leverage measured as the ratio of net debt to

pre-exceptional EBITDA, which we aim to achieve

through improved profitability together with close

management of our working capital.

Operationally this means a focus on:

* nurturing valuable relationships: monitoring the

profitability, product mix and service delivered in

respect of our customer base; growing those

relationships in existing and new territories and

product categories;

* creating a toolbox of expertise: ensuring that we

have market leading design and product capability in

our categories, sharing knowledge through common

platforms;

* providing best quality, value and service: monitoring

and benchmarking the key elements of our cost bases,

buying or manufacturing as efficiently and

effectively as possible from a total cost perspective

across the whole season so that we can deliver great

value to customers and strong returns to

shareholders;

* balancing our business: we monitor the mix and

profitability in each of our businesses across season,

brand and product categories, seeking out those

opportunities that yield the best returns on our

scarce capital while rooting out those activities

that consume resources for little or no gain; and

* providing differentiated product offerings: across

the value, mass and upscale markets.

Foreign Exchange Impact to Profit and Earnings

Our diverse geographical revenue and profit streams continue to

provide us with market resilience but naturally this carries with

it the volatility of currency. As noted above in the context of net

debt, foreign exchange rates impacted significantly in the year on

the translation of our overseas figures relative to prior years

with the US dollar rate moving 10% from 1.52 to 1.67 during the

year and the Australian dollar rate moving 23% from 1.46 to 1.80.

The movement in the Euro rate was more muted at 1.19 to 1.21. This

change in rates placed some pressure on profit against planned

outcomes although this was manageable within 2013/14. However, if

we assume that the significantly weaker rates at the end of the

year continue through calendar 2014, the impact will be more

material in next year's results through the translation of overseas

earnings.

Treasury operations

The Group operates with four supportive bankers, each addressing

one of our geographic segments. The Group's principal bank has

recently extended additional facilities to support the capital

programme in Wales, now almost complete. Current global facilities

comprise:

* term facilities at Group level in Sterling and USD,

repayable in tranches with bullets in May 2016;

* leasing facilities for seven and five years

respectively in the UK and Netherlands for key plant

and machinery;

* asset backed facilities secured on the stock and

debtors of the relevant operating businesses in each

segment, all of which have at least one more year to

run and are usually renewed for two to three years at

a time; and

* a revolving multi-currency credit facility and

overdraft to manage peak working capital

requirements; these are renewed in May annually.

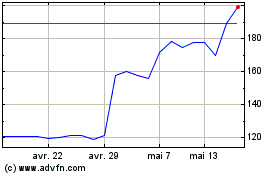

Ig Design (LSE:IGR)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Ig Design (LSE:IGR)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024