IFRS 9: the first phase of IFRS 9, which addressed

classification and measurement of financial assets was published in

November 2009, and was subsequently amended in October 2010 and

November 2013, to include classification and measurement

requirements for financial liabilities and hedge accounting

requirements. IFRS 9 does not currently have a mandatory effective

date. A mandatory effective date will be set when the IASB

completes the impairment phase of the project. However, the IASB

has tentatively decided that the mandatory effective date of IFRS 9

will be for annual periods beginning on or after 1 January 2018.

The Group will quantify the impact of IFRS 9 when the final

standard, including all phases, is issued.

IFRS 10: IFRS 10 replaces the portion of IAS 27 that addresses

the accounting for consolidated financial statements. IFRS 10 does

not change consolidation procedures (i.e. how to consolidate an

entity). Rather, IFRS 10 changes whether an entity is consolidated

by revising the definition of control. IFRS 10 also provides a

number of clarifications on applying the new definition of

control.

IFRS 12: IFRS 12 includes all the disclosure requirements for

subsidiaries, joint ventures, associates and "structured

entities".

IFRS 15: IFRS 15 replaces existing IFRS revenue recognition

requirements in IAS 18 Revenue. The standard applies to all revenue

contracts and provides a model for the recognition and measurement

of sales of some non-financial assets (e.g. disposals of property,

plant and equipment). The core principle of IFRS 15 is that revenue

is recognised to depict the transfer of promised goods or services

to customers in an amount that reflects the consideration to which

the entity expects to be entitled in exchange for those goods or

services. Application is required for annual periods beginning on

or after 1 January 2017. The Group are currently assessing the

impact of IFRS 15.

2 Critical accounting judgements and key sources of estimation

uncertainty

In the application of the Group's accounting policies, which are

described in note 1, the Directors are required to make judgements,

estimates and assumptions about the carrying amounts of assets and

liabilities that are not readily apparent from other sources. The

estimates and associated assumptions are based on historical

experience and other factors, including expectations of future

events that are believed to be reasonable under the circumstances.

Actual results may differ from these estimates.

The estimates and underlying assumptions are reviewed on an

ongoing basis. Revisions to accounting estimates are recognised in

the period in which the estimate is revised if the revision only

affects that period or in the period of revision and future periods

if the revision affects both current and future periods.

In addition to the forward operating profit and cash flow

projections, the estimates and assumptions that have had a

significant bearing on the financial statements in the current year

or could have a significant risk of causing a material adjustment

to the carrying amounts of assets and liabilities within the next

financial year are discussed below:

Critical judgements in applying the Group's accounting

policies

The following are the critical judgements, apart from those

involving estimations (which are dealt with separately below), that

the Directors have made in the process of applying the Group's

accounting policies and that have the most significant effect on

the amounts recognised in the financial statements.

Exceptional items

The Directors have chosen to separate certain items of financial

performance which they believe, because of size or incidence,

require separate disclosure to enable underlying performance to be

assessed. These items are fully described in note 10.

Key sources of estimation uncertainty

The key assumptions concerning the future, and other key sources

of estimation uncertainty at the balance sheet date, that have

significant risk of causing a material adjustment to the carrying

amount of assets and liabilities within the next financial year,

are discussed in the strategic report and below.

Impairment of goodwill and property, plant and equipment

Determining whether goodwill and property, plant and equipment

are impaired requires an estimation of the value in use of the cash

generating units to which goodwill has been allocated or to which

property, plant and equipment belong. The value in use calculation

requires the entity to estimate the future cash flows expected to

arise from the cash-generating unit and a suitable discount rate in

order to calculate present value. The carrying amount of goodwill

at the balance sheet date was GBP31.2 million (2013: GBP31.5

million). No impairment (2013: GBPnil) was required. The carrying

amount of property, plant and equipment was GBP32.0 million (2013:

GBP30.0 million). No impairment loss (2013: GBPnil) was

required.

Provision for slow moving inventory

The Group has guidelines for providing for inventory which may

be sold below cost due to its age or condition. Directors assess

the inventory at each location and in some cases decide that there

are specific reasons to provide more than the guideline levels, or

less if there are specific action plans in place which mean the

guideline provision level is not required. Determining the level of

inventory provision requires an estimation of likely future

realisable value of the inventory in various time frames and

comparing with the cost of holding stock for those time frames.

Regular monitoring of stock levels, the ageing of stock and the

level of the provision is carried out by the Directors. Details of

inventory carrying values are provided in note 14. At the year end,

stock purchased more than 15 months previously had increased from

GBP5.1 million to GBP5.8 million (at March 2014 exchange rates) and

the Group has provisions of GBP3.3 million (2013: GBP3.7 million)

over the total inventory value.

Share-based payments

The Directors are required to estimate the fair value of

services received in return for share options granted to employees

that are measured by reference to the fair value of share options

granted. For the share options scheme the estimate of the fair

value of the services received is based on a Black Scholes model

(with the contractual life of the option and expectations of early

exercise incorporated into the model). For the long term incentive

plan the estimate of the fair value is based on the share price on

the date the scheme was approved and the proportion of shares

expected to vest. Details of the key assumptions made in the

measurement of share-based payments are provided in note 25.

Taxation

There are many transactions and calculations for which the

ultimate tax determination is uncertain. Significant judgement is

required in determining the Group's tax assets and liabilities.

Deferred tax assets have been recognised to the extent they are

recoverable based on profit projections for future years. Income

tax liabilities for anticipated issues have been recognised based

on estimates of whether additional tax will be due. Notwithstanding

the above, the Group believes that it will recover tax assets and

has adequate provision to cover all risks across all business

operations. See note 13 for more details.

3 Financial risk management

Risk management is discussed in the strategic report and a

discussion of risks and uncertainties can be found further on in

the report, along with the Group's key risks. See note 26 for

additional information about the Group's exposure to each of these

risks and the ways in which they are managed. Below are key

financial risk management areas:

* currency risk is mitigated by a mixture of forward

contracts, spot currency purchases and natural

hedges;

* liquidity risk is managed by monitoring daily cash

balances, weekly cash flow forecasts, regular

reforecasting of monthly working capital and regular

dialogue with the Group's banks; and

* credit risk is managed by constant review of key

debtors and banking with reputable banks.

4 Segmental information

The Group has one material business activity being the design,

manufacture and distribution of gift packaging and greetings,

stationery and creative play products.

For management purposes the Group is organised into four

geographic business units.

The results below are allocated based on the region in which the

businesses are located; this reflects the Group's management and

internal reporting structure. The decision was made during 2011 to

focus Asia as a service provider of manufacturing and procurement

operations, whose main customers are our UK businesses. Both the

China factory and the majority of the Hong Kong procurement

operations are now overseen by our UK operational management team

and we therefore continue to include Asia within the internal

reporting of the UK operations, such that UK and Asia comprise an

operating segment. The Chief Operating Decision Maker is the

Board.

Intra-segment pricing is determined on an arm's length basis.

Segment results include items directly attributable to a segment as

well as those that can be allocated on a reasonable basis.

Financial performance of each segment is measured on operating

profit. Interest expense or revenue and tax are managed on a Group

basis and not split between reportable segments.

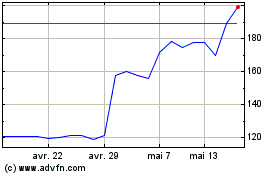

Ig Design (LSE:IGR)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Ig Design (LSE:IGR)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024