The Group's policy with regard to liquidity ensures adequate

access to funds by maintaining an appropriate mix of short-term and

longer-term facilities, which are reviewed on a regular basis. The

maturity profile and details of debt outstanding at 31 March 2014

is set out in note 17.

The following are the contractual maturities of financial

liabilities, including estimated interest payments:

More

Nominal One year One to Two to than

interest Carrying Contractual or five five

rate amount Cash flows less two years years years

31 March 2014 Notes % GBP000 GBP000 GBP000 GBP000 GBP000

Non-derivative financial

liabilities

Secured bank loans

3.4 -

- Sterling 3.8 17,900 (18,833) (2,359) (3,898) (12,576) -

Secured bank loans

3.1 -

- US Dollar 3.6 9,372 (9,936) (1,908) (2,053) (5,975) -

Secured bank loans

- Euros 4.3 5,485 (7,023) (574) (574) (1,649) (4,226)

Total secured bank

loans 17 32,757 (35,792) (4,841) (6,525) (20,200) (4,226)

Finance leases 20

- Sterling leases 3.9 3,176 (3,616) (531) (529) (1,588) (968)

- Euro leases 4.8 1,505 (1,679) (258) (258) (1,163) -

- other leases 6.0 8 (8) (8) - - -

Other financial liabilities 9,325 (9,325) (9,210) (115) - -

Trade payables 21 25,031 (25,031) (25,031) - - -

Other payables 21 787 (787) (787) - - -

1.7 -

Asset backed loans 3.5 5,336 (5,336) (5,336) - - -

Revolving credit facilities 3.2 -

3.7 - - - - - -

1.5 -

Bank overdraft 5.1 2,529 (2,529) (2,529) - - -

Derivative financial

liabilities

Financial liabilities

at fair value through

the income statement

- Interest rate swaps

(a) 49 - - - - -

Financial liabilities

carried at

fair value through

the hedging reserve

- Interest rate swaps

(a) 399 - - - - -

Forward foreign exchange

contracts carried

at fair value through

the income statement 66 (150) (150) - - -

Forward foreign exchange

contracts carried

at fair value through

the hedging reserve 178 (21,374) (21,374) - - -

81,146 (105,627) (70,055) (7,427) (22,951) (5,194)

(a) The interest rate swaps with fair values of GBP49,000 and

GBP399,000 mature over a period ending January 2017.

Nominal One to

interest Carrying Contractual One year Two to More than

rate amount Cash flows or less two years five years five years

31 March 2013 Notes % GBP000 GBP000 GBP000 GBP000 GBP000

Non-derivative financial

liabilities

Secured bank loans

3.5 -

- Sterling 3.9 16,318 (17,709) (2,448) (2,396) (12,865) -

Secured bank loans

3.2 -

- US Dollar 3.6 12,264 (13,203) (2,001) (2,133) (9,069) -

Secured bank loans

- Euros 3.8 5,956 (7,739) (597) (583) (1,662) (4,897)

Total secured bank

loans 17 34,538 (38,651) (5,046) (5,112) (23,596) (4,897)

Finance leases 20

- Sterling leases 5.5 34 (35) (33) (2) - -

- Euro leases 4.8 1,719 (1,969) (262) (262) (1,445) -

- other leases 6.0 24 (27) (19) (7) (1) -

Other financial liabilities 8,475 (8,475) (8,212) (263) - -

Trade payables 21 28,291 (28,291) (28,291) - - -

Other payables 21 704 (704) (704) - - -

2.3 -

Asset backed loans 3.5 7,683 (7,683) (7,683) - - -

3.5

Revolving credit facilities - 3.7 658 (658) (658) - - -

1.5 -

Bank overdraft 4.5 336 (336) (336) - - -

Derivative financial

liabilities

Financial liabilities

at fair value through

the income statement

- interest rate swaps

(b) 54 - - - - -

Financial liabilities

carried at fair value

through the hedging

reserve - interest

rate swaps (b) 546 - - - - -

Forward foreign exchange

contracts carried

at fair value

through the hedging

reserve (95) (12,925) (12,925) - - -

82,967 (99,754) (64,169) (5,646) (25,042) (4,897)

(b) The interest rate swaps with fair values of GBP54,000 and

GBP546,000 mature over a period ending January 2017.

The following shows the facilities for bank loans, overdrafts,

asset backed loans and revolving credit facilities:

31 March 2014 31 March 2013

Facility used Facility used

Carrying contractual Facility Total Carrying contractual Facility Total

amount cash flows unused facility amount cash flows unused facility

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Secured bank loans (see

above) 32,757 (35,792) - (35,792) 34,538 (38,651) - (38,651)

Asset backed loans 5,336 (5,336) (9,283) (14,619) 7,683 (7,683) (4,900) (12,583)

Revolving credit

facilities - - (500) (500) 658 (658) (2,242) (2,900)

Bank overdraft 2,529 (2,529) (4,537) (7,066) 336 (336) (4,137) (4,473)

40,622 (43,657) (14,320) (57,977) 43,215 (47,328) (11,279) (58,607)

The asset backed loan facilities are dependent upon the levels

of the relevant inventory and receivables.

The major bank facilities vary in the year depending on forecast

debt requirements. The maximum limit across all facilities with the

major bank was GBP74 million (2013: GBP75 million). At 31 March

2014 the facility amounted to GBP42.9 million (2013: GBP35.8

million).

Additional facilities were available at other banks of GBP17.0

million (2013: GBP18.7 million), including asset backed loans

according to the level of receivables and inventory.

The short term overdraft, RCF and the asset backed loan elements

of those facilities was renewed on improved terms in May 2014,

which will slightly lower the blended rate in the forthcoming

year.

The asset backed loan facilities are to be renewed on:

-- UK - May 2016;

-- USA - August 2017; and

-- Europe - July 2017.

d) Cash flow hedges

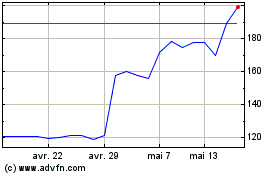

Ig Design (LSE:IGR)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Ig Design (LSE:IGR)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024