TIDMPYX

RNS Number : 2916M

PYX Resources Limited

13 September 2023

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES, CANADA,

JAPAN OR THE REPUBLIC OF SOUTH AFRICA OR ANY OTHER JURISDICTION IN

WHICH THE RELEASE, PUBLICATION OR DISTRIBUTION OF THIS ANNOUNCEMENT

WOULD BE UNLAWFUL. THE COMMUNICATION OF THIS ANNOUNCEMENT IS NOT

BEING MADE, AND HAS NOT BEEN APPROVED, BY AN AUTHORISED PERSON FOR

THE PURPOSES OF SECTION 21 OF THE UK FINANCIAL SERVICES AND MARKETS

ACT 2000.

PYX Resources Limited / EPIC: LSE/NSX: PYX / Market: Standard /

Sector: Mining

13 September 2023

PYX Resources Limited

("PYX" or "the Company")

Half Year 2023 Results

Positive Underlying EBITDA, Cash Neutral Status, No Debt and

Significant Growth in Zircon Sales

FINANCIAL AND OPERATIONAL HIGHLIGHTS

-- Premium Zircon production increased by 33% to 5.7kt

-- Premium Zircon sales up 34% to 5.2kt

-- 8% reduction in cash cost of production per tonne of Premium Zircon

-- EBITDA of negative US$9.8 million mainly due to the non-cash

share-based payment provision of US$7.6m and the non-cash loss on

fair value change of financial instrument of US$1.2m

-- Underlying EBITDA improved by 46% to US$131k

-- US$7.2 million cash on balance sheet with no debt

-- Successful renewal of a 10-year exploration and mining

license (maximum term) for the Tisma Mineral Sands project

-- New Indonesian regulation allows export of titanium dioxide

with minimum grades of TiO(2) >= 45% for Ilmenite and TiO(2)

>= 90% for Rutile

-- Received the licence to export Rutile and Ilmenite, PYX has

accumulated a stockpile of 8.0kt of Titanium Dioxide

-- Sustainability (PYX Cares programme): partnered with the

Indonesian Red Cross Society in its annual Blood Donor Day for a

third year

-- Awarded with the COVID-19 Prevention and Management and Zero

Accident Award 2023, both from the Government authorities in

Kalimantan

PYX Resources Ltd (NSX: PYX | LSE: PYX), the world's third

largest publicly listed Premium Zircon producer by Zircon resources

([1]) , is pleased to announce its results for the six months ended

30 June 2023 ("HY 2023").

Financial and Operations Summary

Commenting on the half year results, Chairman and Chief

Executive of PYX said:

"In the six months to June 2023, PYX has made significant

headways in establishing itself as a leading player in the Premium

Zircon market. Since its listing in February 2020, the Company has

focused on delivering its strategy and creating shareholder value.

Today, I am delighted to report several milestones achieved during

the period, but I am particularly proud of our operational

achievements which resulted in a positive underlying EBITDA in just

under two years since our London listing and three years since our

Australian listing.

"Looking ahead, PYX remains well positioned for growth with the

award of the exploration and mining licence for Tisma and Mandiri's

export licence for Rutile and Ilmenite, of which we have 8.5kt

stockpiled and are ready to ship at the end of August 2023."

PYX has achieved significant milestones in its third year as a

public company following its Australian IPO in 2020 and two years

since its London Stock Exchange listing. The Company reported

positive underlying EBITDA and finished with the same cash on the

balance sheet as 31 December 2022, with no debt, since its initial

public offering in February 2020. The Company's strategy of

producing and selling Premium Zircon has resulted in a 33% increase

in production, from 4.3kt to 5.7kt, and a 34% increase in Premium

Zircon sales, from 3.9kt to 5.2kt, compared to the same period last

year, which helped to reduce the cash cost of production in US$ per

tonne by 8% compared to the same period last year.

This is a significant achievement for PYX Resources. The

increase in production and sales of Premium Zircon is a testament

to the Company's commitment to providing high-quality products to

its customers. PYX Resources' Premium Zircon is highly sought-after

in the market due to its superior quality, and the increase in

demand for the product is a clear indication of the market's trust

in the company's products.

The negative EBITDA and the resulting Net Loss are the result of

the non-cash loss on fair value change of financial instrument of

US$1.2m and the cancellation of 20,332,494 performance rights

convertible into a maximum of 23,532,494 shares. According to

Australian Accounting Standards Board 2, share-based payments

should be settled or cancelled as an acceleration of vesting. All

this with no effect on cash.

The cash on our balance sheet at the end of the first half of

this year was slightly higher than at the end of last fiscal year

with US$7,232k . This is a result of an increase of Operating

Working capital of US$1.4m required for the increase of production,

US$1.3m investment in capex and a positive US$2.8m of financial

activities, mainly showing the strong support of our

shareholders.

Moreover, PYX Resources has successfully renewed its exploration

and mining licence for the Tisma Mineral Sands project, with a

maximum term of 10 years. The Tisma project is focused on exploring

mineral sands and producing and exporting premium grade Zircon. The

project has significant inferred resources, including approximately

4.5Mt of zircon, along with gold and Titanium minerals (Rutile and

Ilmenite).

The renewal of the exploration and mining licence for Tisma

Mineral Sands, our second project, is a significant milestone for

PYX Resources. The licence renewal provides the Company with

long-term stability and growth opportunities.

Post Period

On 17 August 2023, PYX announced the receipt of the licence for

the export of Ilmenite and Rutile ores from the Indonesian

government, allowing it to extract, produce, and export 24kt of

Zircon, 20kt of Rutile and 50kt of Ilmenite, as well as extract and

produce other by-products such as SiO(2) . This followed the

introduction of the new Indonesian regulation which allows the

export of Titanium Dioxide with minimum grades of TiO(2) >= 45%

for Ilmenite and TiO(2) >= 90% for Rutile.

The Company has already stockpiled 8.3kt of Titanium Dioxide

feedstock and, with the new export licence, PYX Resources can

expand its export opportunities and contribute to the global

Ilmenite and Rutile market. The Titanium Dioxide feedstock

production industry is valued at around US$4.5 billion annually .

([2])

Moreover, PYX received approval for its Tisma Work Plan and

Budget for 2023 from the Energy and Resource Service Department of

the Government of the Province of Central Kalimantan. This approval

allows the Company to extract and process 24kt of zircon from its

Tisma asset, which was acquired in January 2021.

The Work Plan and Budget costs cover various areas, including

mining operations, processing, marketing, environment, safety,

training, and community development.

Sustainability

PYX remains committed to its PYX Cares program in 2023 and

submitted its Second Communication on Progress Report to the United

Nations Global Compact Organization which focuses on five key

pillars: People, Planet, Prosperity, Peace, and Partnership.

PYX Resources emphasises community engagement and environmental

stewardship, implementing projects that empower local communities

and protect wildlife and the natural environment. These initiatives

aim to create sustainable opportunities and improve the quality of

life for the community.

The Company partnered with the Indonesian Red Cross Society in

its annual Indonesian National Blood Donor Day, received the Award

for Prevention and Management of COVID-19 in the Workplace in 2023,

and the Zero Accident Award 2023 from the government authorities in

Kalimantan.

These recent developments are expected to contribute

significantly to the company's long-term stability and growth

opportunities, expand its export capabilities, and contribute to

the global business community. PYX Resources is well positioned to

continue its growth trajectory and establish itself as a leading

player in the zircon market.

2023 Half Year Results Conference Call and Investor Meet Company

Presentation

A conference call for equity market participants will take place

on Monday 18 September 2023 at 4pm AWST / 6pm AEST / 9am BST. All

participants wishing to listen in to the call must pre-register

here before they can receive the dial-in number.

The Company is also providing a live presentation via the

Investor Meet Company platform on 20 September 2023 at 11am BST /

6pm AWST / 8pm AEST. Current and potential investors can sign up

and submit questions here (

https://www.investormeetcompany.com/pyx-resources-limited/register-investor

).

***S ***

For more information:

PYX Resources Limited T: +61 2 8823 3132

E: ir@pyxresources.com

WH Ireland Limited (Broker) T: +44 (0)20 7220 1666

Harry Ansell / Katy Mitchell / Darshan

Patel

------------------------------

St Brides Partners Ltd (Financial E: pyx@stbridespartners.co.uk

PR)

Ana Ribeiro / Isabel de Salis /

Isabelle Morris

------------------------------

About PYX Resources

PYX Resources Limited (NSX: PYX | LSE: PYX) is a producer of

premium zircon dual listed on the National Stock Exchange of

Australia and on the Main Market of the London Stock Exchange.

PYX's key deposits, Mandiri and Tisma, are large-scale,

near-surface open pit deposits both located in the alluvium-rich

region of Central Kalimantan, Indonesia. PYX, whose Mandiri deposit

has been in production since 2015, is the 3(rd) largest publicly

traded producing mineral sands company by zircon resources

globally. Determined to mine responsibly and invest in the wider

communities where we operate, PYX is committed to fully developing

its Mandiri and Tisma deposits, with the vision to consolidate the

mineral sands resources in Kalimantan and explore and acquire

mineral sands assets in Asia and beyond.

CONSOLIDATED STATEMENT of Profit or Loss and Other comprehensive

Income

FOR THE HALF-YEARED 30 JUNE 2023

Note Half-year Half-year Ended

Ended 30 June 2022

30 June 2023

US$ US$

Revenue 2 9,971,528 10,645,890

Other income 2 100,169 -

Cost of sales 3 (9,067,092) (7,403,682)

Selling and distribution expenses (459,926) (970,335)

Corporate and administrative expenses (1,631,674) (2,865,411)

Foreign exchange loss (58,700) (319,902)

Share-based payment 3 (7,588,787) (1,889,090,)

Loss on FV change of financial instrument 3 (1,239,273) (795,990)

Finance costs (8,950) (15,124)

Loss before income tax (9,982,705) (3,613,644)

Income tax benefit 148,189 (10,107)

Net loss for the period (9,834,516) (3,623,751)

============= ===============

Other comprehensive income

Items that will be reclassified

subsequently to profit or loss

when specific conditions are met

Exchange differences on translating

foreign operations, net

of tax 292,836 (55,457)

------------- ---------------

Total comprehensive income for the

period (9,541,680) (3,679,208)

============= ===============

Net loss attributable to:

- owners of the Parent Entity (9,295,815) (3,729,389)

- non-controlling interest (538,701) 105,638

------------- ---------------

(9,834,516) (3,623,751)

============= ===============

Total comprehensive income attributable

to:

- owners of the Parent Entity 910 51,170

- non-controlling interest 291,926 (106,627)

------------- ---------------

292,836 (55,457)

============= ===============

Loss per share

Basic loss per share (US$ cents

per share) (2.22) (0.84)

Diluted loss per share (US$ cents

per share) (2.18) (0.81)

The accompanying notes form part of these financial statements.

CONSOLIDATED Statement of Financial Position

AS AT 30 JUNE 2023

Note As at As at

30 June 2023 31 December

2022

US$ US$

ASSETS

CURRENT ASSETS

Cash and cash equivalents 7,232,727 7,221,085

Trade and other receivables 987,683 1,396,300

Advance to suppliers 371,690 619,782

Other assets 544,981 517,847

Prepayments and deposits 60,029 102,457

Prepaid tax 757,175 661,130

Inventories 2,058,412 705,776

-------------- -------------

TOTAL CURRENT ASSETS 12,012,697 11,224,377

-------------- -------------

NON-CURRENT ASSETS

Right of use assets 5,642 11,332

Property, plant and equipment 8 5,014,757 4,051,196

Deferred tax assets 691,039 523,421

Intangible assets 9 73,522,137 73,314,239

-------------- -------------

TOTAL NON-CURRENT ASSETS 79,233,575 77,900,188

-------------- -------------

TOTAL ASSETS 91,246,272 89,124,565

============== =============

LIABILITIES

CURRENT LIABILITIES

Trade and other payables 872,945 1,505,996

Amount due to shareholder 2,975,550 -

Other liabilities 3,246,224 4,064,122

TOTAL CURRENT LIABILITIES 7,094,719 5,570,118

-------------- -------------

TOTAL LIABILITIES 7,094,719 5,570,118

============== =============

NET ASSETS 84,151,553 83,554,447

============== =============

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2023

Note As at As at

30 June 2023 31 December

2022

US$ US$

EQUITY

Issued capital 5 104,776,925 102,226,925

Reserves 6 637,902 8,905,334

Accumulated losses (19,465,808) (26,027,122)

------------------ -------------

Equity attributable to owners

of the Parent Entity 85,949,019 85,105,137

Non-controlling interest (1,797,466) (1,550,690)

------------------ -------------

TOTAL EQUITY 84,151,553 83,554,447

================== =============

The accompanying notes form part of these financial statements.

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

for the half-year ended 30 JUNE 2023

Foreign Options

Ordinary Share-based currency reserve

Share payment Accumulated translation Non-controlling

Note Capital reserve losses reserve Subtotal Interests Total

US$ US$ US$ US$ US$ US$ US$ US$

Balance at

1 January 2022 96,651,080 3,906,968 (16,555,930) (24,207) - 83,977,911 (941,260) 83,036,651

------------ ------------- ------------- ------------ ---------- ------------ ---------------- ------------

Comprehensive

income

Loss for the

period - - (3,729,389) - - (3,729,389) 105,638 (3,623,751)

Other comprehensive

income for

the period - - - 51,170 - 51,170 (106,627) (55,457)

------------ ------------- ------------- ------------ ---------- ------------ ---------------- ------------

Total comprehensive

income for

the period - - (3,729,389) 51,170 - (3,678,219) (989) (3,679,208)

------------ ------------- ------------- ------------ ---------- ------------ ---------------- ------------

Transactions

with owners,

in their

capacity

as owners,

and other

transfers

Shares issued

during the

period 3,387,320 - - - - 3,387,320 - 3,387,320

Share based

payments - 1,889,090 - - - 1,889,090 - 1,889,090

Issue of shares

to employees - (1,123,386) - - - (1,123,386) - (1,123,386)

------------ ------------- ------------- ------------ ---------- ------------ ---------------- ------------

Total transactions

with owners

and

other transfers 3,387,320 765,704 - - 411,732 4,564,756 - 4,564,756

------------ ------------- ------------- ------------ ---------- ------------ ---------------- ------------

Balance at

30 June 2022 100,038,400 4,672,672 (20,285,319) 26,963 411,732 84,864,448 (942,249) 83,922,199

============ ============= ============= ============ ========== ============ ================ ============

Balance at

1 January 2023 102,226,925 8,350,453 (26,027,122) 942 553,939 85,105,137 (1,550,690) 83,554,447

------------ ------------- ------------- ------------ ---------- ------------ ---------------- ------------

Comprehensive

income

Loss for the

period - - (9,295,815) - - (9,295,815) (538,701) (9,834,516)

Other comprehensive

income for

the period - - - 910 - 910 291,925 292,835

------------ ------------- ------------- ------------ ---------- ------------ ---------------- ------------

Total comprehensive

income for

the period - - (9,295,815) 910 - (9,294,905) (246,776) (9,541,681)

------------ ------------- ------------- ------------ ---------- ------------ ---------------- ------------

Transactions

with owners,

in their

capacity

as owners,

and other

transfers

Shares issued

during the

period 2,550,000 - - - - 2,550,000 - 2,550,000

Share based

payments - 7,588,787 - - - 7,588,787 - 7,588,787

Share based

payments cancelled - (15,857,129) 15,857,129 - - - - -

------------ ------------- ------------- ------------ ---------- ------------ ---------------- ------------

Total transactions

with owners

and

other transfers 2,550,000 (8,268,342) 15,857,129 - - 10,138,787 - 10,138,787

------------ ------------- ------------- ------------ ---------- ------------ ---------------- ------------

Balance at

30 June 2023 104,776,925 82,111 (19,465,808) 1,852 553,939 85,949,019 (1,797,466) 84,151,553

============ ============= ============= ============ ========== ============ ================ ============

CONSOLIDATED STATEMENT of Cash Flows

FOR THE HALF-YEARED 30 JUNE 2023

Half-year Half-year

Ended Ended

30 June 2023 30 June 2022

US$ US$

CASH FLOWS FROM OPERATING ACTIVITIES

Receipts from customers 10,313,889 11,050,784

Payments to suppliers and employees (11,729,505) (12,954,223)

Other income 100,169 -

Interest received 1,075 148

Finance costs (10,025) (15,272)

Income tax es refunded/(paid) (120,272) 9,674

------------- -------------

Net cash used in operating activities (1,444,669) (1,908,889)

------------- -------------

CASH FLOWS FROM INVESTING ACTIVITIES

Purchase of property, plant and equipment (1,331,906) (943,247)

Net cash used in investing activities (1,331,906) (943,247)

------------- -------------

CASH FLOWS FROM FINANCING ACTIVITIES

Net proceeds from placement funds - 4,383,822

Deposits from shareholder 2,800,000 -

Costs associated with option issues - (250,037)

Receipts/(Advances) of employee loans (3,335) 4,092

Repayment of lease liabilities (830) (15,631)

Net cash generated by financing activities 2,795,835 4,122,246

------------- -------------

Net increase in cash held 19,260 1,270,110

Cash and cash equivalents at beginning

of period 7,221,085 6,624,364

Effect of foreign exchange rate changes (7,618) (241,404)

------------- -------------

Cash and cash equivalents at end of period 7,232,727 7,653,070

============= =============

The accompanying notes form part of these financial statements

.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE HALF-YEARED 30 JUNE 2023

Note 1: Summary of Significant accounting policies

a. Basis of Preparation

These general purpose interim financial statements for half-year

reporting period ended 30 June 2023 have been prepared in

accordance with requirements of the Corporations act 2001 and

Australian Accounting Standard AASB 134: Interim Financial

Reporting. The Group is a for-profit entity for financial reporting

purposes under Australian Accounting Standards.

This interim financial report is intended to provide users with

an update on the latest annual financial statements of Pyx

Resources Limited and its controlled entities (referred to as the

"Consolidated Group" or "Group"). As such, it does not contain

information that represents relatively insignificant changes

occurring during the half-year within the Group. It is therefore

recommended that this financial report be read in conjunction with

the annual financial statements of the group for the year ended 31

December 2022 , together with any public announcements made during

the following half-year.

These interim financial statements were authorised for issue on

12 September 2023 .

b. Accounting Policies

The same accounting policies and methods of computation have

been followed in this interim financial report as were applied in

the most recent annual financial statements .

The group has considered the implications of new or amended

Accounting Standards, but determined that their application to the

financial statements is either not relevant or not material.

Note 2: Revenue and Other Income

The group has recognised the following amounts relating to

revenue in the statement of profit or loss.

Half-year Half-year

Ended Ended

30 June 30 June

2023 2022

US$ US$

Revenue from contracts with customers 9,971,528 10,645,890

========= ==========

Other income 100,169 -

========= ==========

Revenue from contracts with customers

Revenue from contracts with customers represents the amounts

received and receivable for production and distribution of premium

Zircon.

NOTE 3: LOSS FOR THE PERIOD

Half-year Half-year

Ended Ended

30 June 30 June 2022

2023

US$ US$

Loss before income tax from continuing operations

includes

the following specific expenses:

Expenses

Cost of sales 9,067,092 7,403,682

--------- -------------

Interest expense on financial liabilities

not classified as at

fair value through profit or loss:

* unrelated parties 10,025 15,233

Finance charges - 39

Less: Interest income (1,075) (148)

--------- -------------

Net interest expense 8,950 15,124

--------- -------------

Employee benefits expense:

* Staff salaries and benefits 173,878 183,163

* Share based payments (non-cash) 7,588,787 1,889,090

Rental expense on operating leases

* short- term lease expense 997 2,574

Depreciation 166,967 111,698

Note 4: Contingent Liabilities

There has been no change in contingent liabilities since the

last reporting period.

Note 5: ISSUED CAPITAL

Half-year Ended Year Ended

30 June 2023 31 December

US$ 2022

US$

452,976,142 (2022: 441,349,100) fully

paid ordinary shares 104,776,925 102,226,925

----------------- ---------------

2023 2022

No. of Contributed No. of Contributed

shares equity Shares equity

US$ US$

a. Ordinary Shares

At the beginning of the reporting

period 441,349,100 102,226,925 429,520,222 96,651,080

Movement :

Year 2022 - - 11,828,878 5,575,845

5 January 2023 2,436,438 850,000 - -

23 February 2023 2,976,191 500,000 - -

30 March 2023 2,732,241 500,000 - -

16 June 2023 3,482,172 700,000 - -

At the end of the reporting

period 452,976,142 104,776,925 441,349,100 102,226,925

------------- ------------- ------------- -------------

On 5 January 2023, 2,436,438 shares valued at US$850,000 were

issued to L1 Capital Global Opportunities Master Fund ("L1").

On 23 February 2023, 2,976,191 shares valued at US$500,000 were

issued to L1 Capital Global Opportunities Master Fund ("L1").

On 30 March 2023, 2,732,241 shares valued at US$500,000 were

issued to L1 Capital Global Opportunities Master Fund ("L1").

On 16 June 2023, 3,482,172 shares valued at US$700,000 were

issued to L1 Capital Global Opportunities Master Fund ("L1").

These shares were issued in connection with the funds of

US$4,383,822 received from L1 as a prepayment for US$5 million

worth of PYX shares in financial year 2022.

At the shareholders' meetings each ordinary share is entitled to

one vote when a poll is called; otherwise, each shareholder has one

vote on a show of hands.

30 June 2023 31 December

2022

No. No.

b. Unlisted options

At the beginning of the reporting period 4,944,576 537,500

Year 2022 - 4,407,076

Expired during the period (537,500) -

------------ -----------

4,407,076 4,944,576

------------ -----------

During the period, 537,500 unlisted options held by Tamarind

Classic resources Limited were expired.

c. Capital Management

Management controls the capital of the Group in order to

maintain a sustainable debt to equity ratio, generate long-term

shareholder value and ensure that the Group can fund its operations

and continue as a going concern.

Management effectively manages the Group's capital by assessing

the Group's financial risks and adjusting its capital structure in

response to changes in these risks and in the market. These

responses include the management of debt levels, distributions to

shareholders and share issues.

Half-year Ended Year Ended

30 June 2023 31 December

2022

US$ US$

Total borrowings - -

Less cash and cash equivalents 7,232,727 7,221,085

--------------- -----------

Net cash/(debt) 7,232,727 7,221,085

Total equity 84,151,553 83,554,447

--------------- -----------

Total capital 84,151,553 83,554,447

Gearing ratio 0.00% 0.00%

NOTE 6: RESERVES

a. Share-based Payment Reserve

The share-based payment reserve records items recognized as

expenses on valuation of share-based payments.

b. Options Reserve

The options reserve records costs associated with the option

issue.

c. Foreign Currency Translation Reserve

The foreign currency translation reserve records exchange

differences arising on translation of the foreign controlled

subsidiaries.

d. Analysis of Reserves

Half-year Ended Year Ended

30 June 2023 31 December

2022

US$ US$

Share-Based Payment Reserve

At the beginning of the reporting

period 8,350,453 3,906,968

Share-based payments expense 7,588,787 5,566,871

Share-based payments cancelled (15,857,129) -

Issue of shares to employees - (1,123,386)

-----------

Closing balance in share-based payment

reserve 82,111 8,350,453

--------------- -----------

Options Reserve

At the beginning of the reporting

period 553,939 -

Options reserve - 553,939

--------------- -----------

Closing balance in options reserve 553,939 553,939

--------------- -----------

Foreign Currency Translation Reserve

At the beginning of the reporting

period 942 (24,207)

Exchange differences on translation

of foreign operations 910 25,149

--------------- -----------

Closing balance in foreign currency

translation reserve 1,852 942

--------------- -----------

Total 637,902 8,905,334

=============== ===========

NOTE 7: SHARE-BASED PAYMENT PLANS

Performance Rights

The following performance rights were granted to staff during

the period.

Number Grant date Expiry date Share price

at grant date

20,000 01/04/2023 30/9/2026 A$0.33

20,000 01/04/2023 30/9/2026 A$0.33

20,000 01/04/2023 30/9/2027 A$0.33

20,000 01/04/2023 30/9/2027 A$0.33

During the half year, 16,900,000 performance rights were

cancelled.

NOTE 8: PROPERTY, PLANT, AND EQUIPMENT

Half-year Ended Year Ended

30 June 2023 31 December

2022

US$ US$

Land and Buildings

Freehold land at cost 211,603 211,603

Translation (1,888) (11,286)

Total land 209,715 200,317

--------------- -----------

Buildings at cost 1,208,238 1,231,651

Accumulated depreciation (255,060) (248,221)

Translation (9,087) (53,375)

--------------- -----------

Total buildings 944,091 930,055

--------------- -----------

Total land and buildings 1,153,806 1,130,372

--------------- -----------

Construction in Progress

Construction in progress at cost 3,144,223 2,258,130

Translation (34,134) (132,079)

--------------- -----------

Total Construction in Progress 3,110,089 2,126,051

--------------- -----------

Plant and Equipment

Plant and equipment at cost 1,046,390 1,073,904

Accumulated depreciation (373,498) (333,363)

Translation (20,395) (53,678)

--------------- -----------

Total plant and equipment 652,497 686,863

--------------- -----------

Motor Vehicles

Motor vehicles at cost 138,707 138,707

Accumulated depreciation (59,970) (42,618)

Translation (1,646) (6,254)

--------------- -----------

Total motor vehicles 77,091 89,835

--------------- -----------

Furniture and Fittings

Furniture and fittings at cost 36,192 31,806

Accumulated depreciation (16,214) (13,145)

Translation 1,296 (586)

--------- ---------

Total furniture and fittings 21,274 18,075

--------- ---------

Total property, plant and equipment 5,014,757 4,051,196

========= =========

NOTE 9: INTANGIBLE ASSETS

Half-year Ended Year Ended

30 June 2023 31 December

2022

US$ US$

Goodwill:

Cost 7,774 7,774

Accumulated impairment losses - -

--------------- -------------

Net carrying amount 7,774 7,774

--------------- -------------

Mining License Renewal:

Cost 332,346 88,984

Accumulated amortization (81,823) (40,041)

Translation 3,787 (2,531)

---------- ----------

Net carrying amount 254,310 46,412

---------- ----------

Exploration asset

Cost 73,260,053 73,260,053

Net carrying amount 73,260,053 73,260,053

---------- ----------

Total intangible assets 73,522,137 73,314,239

========== ==========

Goodwill Mining Exploration Total

License asset

US$ US$ US$ US$

Half-year ended 30 June 2023

Balance at the beginning of

the year 7,774 46,412 73,260,053 73,314,239

Addition - 243,362 - 243,362

Amortisation - (41,782) - (41,782)

Translation - 6,318 - 6,318

---------- ---------------- ----------- ----------

Closing value at 30 June 2023 7,774 254,310 73,260,053 73,522,137

========== ================ =========== ==========

Note 10: INTERESTS IN SUBSIDIARIES

Name of Entity Equity Interest Proportion Contribution

of Non-Controlling to Net Profit/(Loss)

Interest before taxation

2023 2022 2023 2022 2023 2022

% % % % US$ US$

Takmur Pte Ltd. 100 100 - - (17,038) (11,702)

PT Andary Usaha Makmur 99.5 99.5 0.5 0.5 (68,552) (142,681)

PT Investasi Mandiri* - - 100 100 (667,870) 128,139

Tisma Development (HK)

Ltd. 100 100 - - (9,017) 8,214

PT Tisma Investasi Abadi 99 99 1 1 (1,667) (1,719)

PT Tisma Global Nusantara** - - 100 100 (15,039) (11,663)

* This entity is accounted for as a controlled entity on the

basis that control was obtained through the execution of an

exclusive operations and management agreement between PT Andary

Usaha Makmur and PT Investasi Mandiri and was for nil purchase

consideration.

** This entity is accounted for as a controlled entity on the

basis that control was obtained through the execution of an

exclusive operations and management agreement between PT Tisma

Investasi Abadi and PT Tisma Global Nusantara and was for nil

purchase consideration.

The non-controlling interests in PT Andary Usaha Makmur and PT

Tisma Global Nusantara are not material to the Group.

Subsidiary financial statements used in the preparation of these

consolidated financial statements have also been prepared as at the

same reporting date as the Group's financial statements.

DIRECTORS' DECLARATION

In accordance with a resolution of the directors of Pyx

resources Limited, the directors of the Entity declare that:

1. The financial statements and notes, as set out on pages 8 to

20, are in accordance with the Corporations Act 2001,

including:

a. complying with Accounting Standard AASB 134: Interim Financial Reporting; and

b. giving a true and fair view of the Consolidated Group's

financial position as at 30 June 2023 and of its performance for

the half-year ended on that date.

2. In the directors' opinion there are reasonable grounds to

believe that the Entity will be able to pay its debts as and when

they become due and payable.

Oliver B. Hasler

Chairman and Chief Executive Officer

Hong Kong

Date: 12 September 2023

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

This Announcement contains forward-looking statements and

forward-looking information within the meaning of applicable

Australian and UK securities laws, which are based on expectations,

estimates and projections as of the date of this Announcement.

This forward-looking information includes, or may be based upon,

without limitation, estimates, forecasts and statements as to

management's expectations with respect to, among other things, the

timing and amount of funding required to execute the Company's

exploration, development and business plans, capital and

exploration expenditures, the effect on the Company of any changes

to existing legislation or policy, government regulation of mining

operations, the length of time required to obtain permits,

certifications and approvals, the success of exploration,

development and mining activities, the geology of the Company's

properties, environmental risks, the availability of labour, the

focus of the Company in the future, demand and market outlook for

precious metals and the prices thereof, progress in development of

mineral properties, the Company's ability to raise funding

privately or on a public market in the future, the Company's future

growth, results of operations, performance, and business prospects

and opportunities. Wherever possible, words such as "anticipate",

"believe", "expect", "intend", "may" and similar expressions have

been used to identify such forward-looking information.

Forward-looking information is based on the opinions and

estimates of management at the date the information is given, and

on information available to management at such time. Forward

looking information involves significant risks, uncertainties,

assumptions, and other factors that could cause actual results,

performance, or achievements to differ materially from the results

discussed or implied in the forward-looking information. These

factors, including, but not limited to, fluctuations in currency

markets, fluctuations in commodity prices, the ability of the

Company to access sufficient capital on favourable terms or at all,

changes in national and local government legislation, taxation,

controls, regulations, political or economic developments in

Indonesia and Australia or other countries in which the Company

does business or may carry on business in the future, operational

or technical difficulties in connection with exploration or

development activities, employee relations, the speculative nature

of mineral exploration and development, obtaining necessary

licenses and permits, diminishing quantities and grades of mineral

reserves, contests over title to properties, especially title to

undeveloped properties, the inherent risks involved in the

exploration and development of mineral properties, the

uncertainties involved in interpreting drill results and other

geological data, environmental hazards, industrial accidents,

unusual or unexpected formations, pressures, cave-ins and flooding,

limitations of insurance coverage and the possibility of project

cost overruns or unanticipated costs and expenses, and should be

considered carefully. Many of these uncertainties and contingencies

can affect the Company's actual results and could cause actual

results to differ materially from those expressed or implied in any

forward-looking statements made by, or on behalf of, the Company.

Prospective investors should not place undue reliance on any

forward-looking information.

Although the forward-looking information contained in this

Announcement is based upon what management believes, or believed at

the time, to be reasonable assumptions, the Company cannot assure

prospective purchasers that actual results will be consistent with

such forward-looking information, as there may be other factors

that cause results not to be as anticipated, estimated or intended,

and neither the Company nor any other person assumes responsibility

for the accuracy and completeness of any such forward-looking

information. The Company does not undertake, and assumes no

obligation, to update or revise any such forward-looking statements

or forward-looking information contained herein to reflect new

events or circumstances, except as may be required by law.

No stock exchange, regulation services provider, securities

commission or other regulatory authority has approved or

disapproved the information contained in this Announcement.

Compliance Statement

The Mandiri mineral sands deposit hosts a 6Mt Inferred JORC

Resource of zircon. The Company originally announced this resource

in its Prospectus released on 20 February 2020 and confirms that it

is not aware of any new information or data that materially affects

the information included in the Prospectus. All material

assumptions and technical parameters disclosed in the Prospectus

that underpin the estimates continue to apply and have not

materially changed.

The Tisma mineral sands deposit hosts a 4.5 Mt Inferred JORC

Resource of zircon. The Company originally announced this resource

in its Announcement "PYX Resources Limited Agrees to Acquire Tisma

Development (HK) Limited, a World-Class, Fully Licensed Mineral

Sands Deposit" on NSX on 13 January 2021 and confirms that it is

not aware of any new information or data that materially affects

the information included in the Announcement. All material

assumptions and technical parameters disclosed in the Announcement

that underpin the estimates continue to apply and have not

materially changed.

Together the Mandiri and Tisma mineral sand deposits total 10.5

Mt of contained zircon within a total of 263.5 Mt of heavy mineral

sands.

[1] according to publicly available information as of 30 June

2023

[2]

https://www.kenmareresources.com/en/our-products/titanium-feedstocks

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR UOVVROKUKARR

(END) Dow Jones Newswires

September 13, 2023 02:01 ET (06:01 GMT)

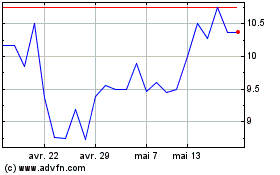

Pyx Resources (LSE:PYX)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Pyx Resources (LSE:PYX)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024