TIDMVDTK

RNS Number : 0764O

Verditek PLC

29 September 2023

Verditek plc

("Verditek" or the "Company" or the "Group")

Interim Report and Financial Statements for the six months to 30

June 2023

Verditek plc, (AIM:VDTK) the international green technology

company that develops, manufactures and sells lightweight solar

panels, is pleased to announce its interim results for the six

months to 30 June 2023.

This announcement contains inside information for the purposes

of Article 7 of the UK version of Regulation (EU) No 596/2014 which

is part of UK law by virtue of the European Union (Withdrawal) Act

2018, as amended ("MAR"). Upon the publication of this announcement

via a Regulatory Information Service, this inside information is

now considered to be in the public domain.

Enquiries:

Verditek plc Tel: +44 (0)20 7129 7903

RH Lord David Willetts FRS (Non-Executive enquiries@verditek.com

Chairman)

Rob Richards (Chief Executive Officer)

WH Ireland Limited (NOMAD and Broker) Tel: +44 (0)20 7220 1666

Chris Hardie

Hugh Morgan

Andrew de Andrade

Verditek plc

("Verditek" or the "Company" or the "Group")

Company Registration No. 10114644

Interim Report and Financial Statements

For the six month period to 30 June 2023

CEO Statement

Overview

Verditek has seen a growth in orders in connection with our

integrated panel roofing collaborations in the six-months to 30

June 2023. Around 120 projects have been delivered in the period, a

combination of commercial and trial projects. Verditek has

continued to work with strategic partners to develop innovative

integrated solar solutions.

Strategy

The Group's focus during 2023 continues to be on refining the

Group's solar offering and working to build and convert the sales

pipeline.

The Group's solar strategy is to manufacture high quality panels

with a focus on B2B sales through engaging distributors and sales

representatives in different regions. The Group also aims to

partner with solutions providers, who develop and bring to market

innovative solutions with integrated solar panels.

In light of the climate emergency, the world needs to evolve

from its dependency on hydrocarbon-based energy sources to cleaner,

more environmentally friendly energy; this need has been further

accentuated by the ongoing war which has had an impact on energy

prices across the board. We believe that the Verditek Solar product

is extremely well positioned to become a market leader in the

ultra-lightweight, flexible solar market. The Company's product has

numerous potential applications that are not available to the

traditional, heavy and fragile solar panel technology. We believe

major new market opportunities for our lightweight product will

open up in areas such as military, transportation, cellular

telecoms masts, new build homes (as part of an integrated roof tile

system), and warehousing (where roofing structures are less rigid).

Here the advantages of a highly durable, efficient ultralightweight

solar solution can now be embraced.

Operations

In May 2023, the Group's manufacturing operations were relocated

from Lainate to Tolmezzo in Udine, Italy. This move was made to

lower the cost base and take advantage of more flexible working

arrangements. From Tolmezzo a core staff, together with a further

flexible contract labour team, manufacture Verditek's flexible

lightweight solar panels using the latest components sourced from

around the world. The Tolmezzo facility is more automated and

allows a higher quality product while simultaneously reducing

costs.

Sales and Marketing

The Group has various routes to market, including

commission-only sales agents, employed sales consultants,

distributors and solutions partners.

The Group has highly promising partnerships with roofing

providers. Verditek has signed a long-term supply agreement in the

period with Lindab Profil AB, a Scandinavian supplier of roof

systems, and they have placed multiple orders for installations in

a number of countries.

Verditek is also collaborating with Metrotile, who are

incorporating the Verditek solar panel into their roof tile

products. Both these opportunities enhance the potential for

commercial growth in the lucrative roofing sector. Verditek

continue to work with two other large roofing companies elsewhere

in the world as we develop a similar offering for their respective

markets.

As a result of these collaborations, the value of order intake

in the first half of 2023 is approx. GBP395,000 versus GBP232,000

in the first half of 2022. The majority of the order intake is

expected to be recognized as revenue in the second half of

2023.

Other Opportunities

We are in discussions to license our manufacturing technology to

a larger scale, automated plant. In the period Verditek has agreed

a Memorandum of Understanding ("MOU") with Net Zero Valley, an

Italian fully owned investment holding of SerendipEquity Group, to

set up a framework for a 50:50 joint venture agreement to invest in

a 1GW ultra-lightweight solar panel manufacturing plant in Southern

Italy.

Finance

For the six-month period to 30 June 2023, the Group generated

revenues of GBP254,958 (H1 2022: GBP178,502 and recorded a loss

after tax of GBP970,989 (H1 2022: GBP636,798). The 2023 result

includes one-off costs of GBP142,556 relating to the relocation of

the Group's manufacturing operations to the new facility.

On 3 May 2023, the Company raised GBP500,000 before expenses by

issue of secured convertible loan notes. The Company used the

proceeds to repay outstanding Crowd for Angels bonds and to provide

additional working capital. Cash balances as at 30 June 2023 were

GBP135,357 (H1 2022: GBP1,492,380).

On 1 September 2023 June 2022, the Company announced a capital

raise of an additional GBP500,000 before expenses by way of a

subscription for ordinary shares to provide additional working

capital.

Overhead spend remains tightly controlled to conserve cash as

the conversion time for prospects to become customers has taken

longer than expected.

Outlook and conclusion

Despite recent challenges, we continue to see positive

opportunities develop for Verditek and believe the significant

investment into the development of our flexible, lightweight solar

panels will bring about meaningful financial reward.

I would like to thank all members of the Verditek team, advisers

and shareholders for their ongoing support.

Rob Richards

Chief Executive Officer

29 September 2023

Condensed Consolidated Statement of Comprehensive Income

For the six months ended 30 June 2023

H1 2023 H1 2022 FY 2022

Unaudited Unaudited Audited

Note GBP GBP GBP

Continuing operations

Revenue 3 254,958 178,502 417,457

Direct costs (319,233) (256,953) (670,547)

----------------------------------- ----- ---------- ---------- ------------

Gross loss (64,275) (78,451) (253,090)

Administrative expenses (881,218) (666,030) (1,661,935)

----------------------------------- ----- ---------- ---------- ------------

Operating loss (945,493) (744,481) (1,915,025)

Other income 5 - 144,551 91,933

Finance Income 2,895 587 2,084

Finance costs (28,390) (37,455) (73,604)

----------------------------------- ----- ---------- ---------- ------------

Loss before tax (970,989) (636,798) (1,894,612)

Income Tax - - 21,901

----------------------------------- ----- ---------- ---------- ------------

Loss for the period (970,989) (636,798) (1,872,711)

----------------------------------- ----- ---------- ---------- ------------

Loss for the period attributable

to: -

Owners of the Company (970,989) (636,798) (1,872,711)

Non-controlling interest - - -

----------------------------------- ----- ---------- ---------- ------------

(970,989) (636,798) (1,872,711)

----------------------------------- ----- ---------- ---------- ------------

Other comprehensive income

Items that will or may be

reclassified to profit or

loss:

Translation of foreign operations (20,454) 23,949 41,417

Total comprehensive loss

for the period from continuing

operations (991,443) (612,849) (1,831,294)

----------------------------------- ----- ---------- ---------- ------------

Total comprehensive loss

for the period attributable

to: -

Owners of the Company (991,443) (612,849) (1,831,294)

Non-controlling interest - - -

----------------------------------- -----

(991,443) (612,849) (1,831,294)

----------------------------------- ----- ---------- ---------- ------------

Loss per share

Basic and diluted (GBP) 6 (0.002) (0.002) (0.005)

----------------------------------- ----- ---------- ---------- ------------

Illustrative note to reflect H1 total

impact of one-off costs from including

factory move: H1 result H1 one-off relocation

excluding relocation costs for

one-off costs costs IFRS

Direct costs 4 (279,152) (40,081) (319,233)

------------------------------- --- --------------- ------------ ------------

Gross loss (24,194) (40,081) (64,275)

Administrative expenses 4 (778,744) (102,475) (881,219)

------------------------------- --- --------------- ------------ ------------

Operating loss (802,938) (142,556) (945,493)

------------------------------- --- --------------- ------------ ------------

Condensed Consolidated Statement of Financial Position

As at 30 June 2023

As at 30 June As at 30 June As at 31 December

2023 2022 2022

Note Unaudited Unaudited Audited

GBP GBP GBP

Assets

Non-current assets

Other receivables 7 556,783 773,556 556,783

Property, plant and

equipment 114,400 274,591 195,470

Right of use assets - 119,320 48,902

Non-current assets 671,183 1,167,467 801,155

------------------------------ ----- ---------------- ---------------- --------------------

Current assets

Inventories 696,452 638,021 534,959

Trade and other receivables 183,437 403,533 95,533

Cash and cash equivalents 135,357 1,492,380 842,632

Current assets 1,015,246 2,533,934 1,473,124

------------------------------ ----- ---------------- ---------------- --------------------

TOTAL ASSETS 1,686,429 3,701,401 2,274,279

------------------------------ ----- ---------------- ---------------- --------------------

Equity and liabilities

Non-current liabilities

Loans and borrowings 8 500,000 93,304 -

Lease liabilities - 64,071 -

------------------------------ ----- ---------------- ---------------- --------------------

Non-current liabilities 500,000 157,375 -

------------------------------ ----- ---------------- ---------------- --------------------

Current liabilities

Trade and other payables 483,191 469,864 289,995

Loans and borrowings 8 - 200,252 310,306

Lease liabilities - 73,749 29,682

------------------------------ ----- ---------------- ---------------- --------------------

Current liabilities 483,191 743,865 629,983

------------------------------ ----- ---------------- ---------------- --------------------

TOTAL LIABILITIES 983,191 901,240 629,983

------------------------------ ----- ---------------- ---------------- --------------------

Share capital 9 177,417 177,417 177,417

Share premium account 9 12,205,726 12,205,726 12,205,726

Share based payment

reserve 383,191 270,227 332,806

Accumulated losses (11,942,000) (9,735,098) (10,971,011)

Currency translation

reserve (14,209) (11,223) 6,245

Non-controlling interests (106,887) (106,887) (106,887)

Total shareholders'

equity 703,238 2,800,161 1,644,296

------------------------------ ----- ---------------- ---------------- --------------------

TOTAL EQUITY AND LIABILITIES 1,686,429 3,701,401 2,274,279

------------------------------ ----- ---------------- ---------------- --------------------

Condensed Statement of Changes in Equity

As at 30 June 2023

Issued Share Share Accumulated Currency Non-controlling Total

share capital Premium based losses translation interest

payment reserve

reserve

GBP GBP GBP GBP GBP GBP GBP

As at 1

January

2022 136,883 10,761,055 213,134 (9,098,300) (35,172) (106,887) 1,870,713

Loss for the

period - - - (636,798) - - (636,798)

Translation of

subsidiary - - - - 23,949 - 23,949

--------------- -------------- ----------- --------- -------------- ------------- ---------------- ------------

Total

comprehensive

loss for the

period - - - (636,798) 23,949 - (612,849)

Issue of

shares

net of

expenses 40,534 1,444,671 - - - - 1,485,205

Share based

payment - - 57,093 - - - 57,093

--------------- -------------- ----------- --------- -------------- ------------- ---------------- ------------

Shareholders'

equity at 30

June

2022 177,417 12,205,726 270,227 (9,735,098) (11,223) (106,887) 2,800,162

Loss for the

period - - - (1,235,913) - - (1,235,913)

Translation of

subsidiary - - - - 17,468 - 17,468

--------------- -------------- ----------- --------- -------------- ------------- ---------------- ------------

Total

comprehensive

profit/(loss)

for the

period - - - (1,235,913) 17,468 - (1,218,445)

Share based

payment - - 62,579 - - - 62,579

--------------- -------------- ----------- --------- -------------- ------------- ---------------- ------------

Shareholders'

equity at 31

December

2022 177,417 12,205,726 332,806 (10,971,011) 6,245 (106,887) 1,644,296

Loss for the

period - - - (970,989) - - (970,989)

Translation of

subsidiary - - - - (20,454) - (20,454)

--------------- -------------- ----------- --------- -------------- ------------- ---------------- ------------

Total

comprehensive

loss for the

period - - - (970,989) (20,454) - (991,443)

Share based

payment - - 50,385 - - - 50,385

--------------- -------------- ----------- --------- -------------- ------------- ---------------- ------------

Shareholders'

equity at 30

June

2023 177,417 12,205,726 383,191 (11,942,0001) (14,209) (106,887) 703,238

--------------- -------------- ----------- --------- -------------- ------------- ---------------- ------------

Condensed Statement of Cash Flows

For the 6 months ended 30 June 2023

Note

H1 2023 H1 2022 FY 2022

Unaudited Unaudited Audited

Operating activities GBP GBP GBP

Loss before tax from continuing

operations (970,989) (636,798) (1,894,612)

Adjustment for:

Depreciation 104,722 59,792 195,555

Finance costs 28,390 37,455 73,604

Financial income (2,895) (587) (2,084)

Fair value changes through

P&L - ICSI - (26,923) 125,486

Loss on disposal of assets 40,519 501 501

Share based payment expenses 50,384 57,093 119,672

Remeasurement of assets - - (78,323)

-------------------------------------------- ---------- ---------- ------------

(749,869) (509,467) (1,460,201)

Working capital adjustments

(Increase) / decrease in

inventory (161,493) 19,130 122,192

(Increase) / decrease in

trade and other receivables (85,130) (9,098) 211,395

Increase / (decrease) in

trade and other payables 153,454 (1,019) (97,847)

-------------------------------------------- ---------- ---------- ------------

Cash used in operations (843,038) (500,454) (1,224,461)

Taxation - - 145,142

-------------------------------------------- ---------- ---------- ------------

Net cash outflow from operating

activities (843,038) (500,454) (1,079,319)

-------------------------------------------- ---------- ---------- ------------

Investing activities

Sale of investment - 307,731 307,731

Purchase of fixed assets - (4,290) (19,540)

-------------------------------------------- ---------- ---------- ------------

Net cash outflow from investing

activities - 303,441 288,191

-------------------------------------------- ---------- ---------- ------------

Financing activities

Proceeds from issue of ordinary

share capital, net of transaction

costs - 1,485,205 1,485,205

Convertible loan notes issued 500,000 - -

Interest paid on loans (11,885) (11,011) (22,210)

Finance income 2,895 587 2,084

Repayments of corporate

green bonds (328,140) - -

Payment of lease liabilities (30,096) (35,372) (70,936)

---------- ---------- ------------

Net cash inflow from financing

activities 132,774 1,439,409 1,394,143

-------------------------------------------- ---------- ---------- ------------

Net (decrease)/increase

in cash and cash equivalents (710,264) 1,242,396 603,015

Cash and cash equivalents

at the beginning of the

period 842,632 237,613 237,613

-------------------------------------------- ---------- ---------- ------------

132,368 1,480,009 840,628

Exchange gains on cash

and cash equivalents 2,989 12,371 2,004

Cash and cash equivalents

at the end of the period 135,357 1,492,380 842,632

-------------------------------------------- ---------- ---------- ------------

Notes to the Condensed Financial Statements

1. General Information

The Interim Financial Statements are for the six months ended 30

June 2023 and are presented in British Pounds (GBP), which is the

functional currency of the parent company.

Verditek plc ("Verditek" or the "Company" or the "Group") is a

public limited company incorporated, registered and domiciled in

England Wales (registration number 10114644), whose shares are

quoted on the Alternative Investment Market on the London Stock

Exchange. Its registered office is located at Holborn Gate, 330

High Holborn, London, WC1V 7QH.

Verditek is the holding company of a group of companies engaged

in the clean technology sector.

The Interim Financial Statements have been approved for issue by

the Board of Directors on 29 September 2023.

2. Basis of Preparation of Half-year Report

The financial information presented in this condensed

consolidated interim report for the half-year has been prepared in

accordance with the recognition and measurement requirements of UK

adopted International Accounting Standards ("UK IAS"). The

principal accounting policies adopted in the preparation of the

financial information in this Interim Report are unchanged from

those used in the Company's financial statements for the year ended

31 December 2022.

They have been prepared in accordance with IAS 34 'Interim

Financial Reporting'. They do not include all of the information

required in annual financial statements in accordance with UK IAS

and should be read in conjunction with the consolidated financial

statements for the year ended 31 December 2022.

The financial information for the year ended 31 December 2022

presented in this Interim Report does not constitute the Company's

statutory accounts for that period but has been derived from them.

The Annual Report and Accounts for the year ended 31 December 2022

were audited and have been filed with the Registrar of Companies.

The Independent Auditors' Report on the Annual Report and Accounts

for the year ended 31 December 2022 was unqualified and did not

contain statements under s498(2) or (3) of the Companies Act 2006,

but did contain a material uncertainty in relation to going

concern. The financial information for the periods ended 30 June

2022 and 30 June 2023 is unaudited.

A copy of the audited consolidated financial statements for the

year ended 31 December 2022 is available on the Company's

website.

New Standards adopted as at 1 January 2023

Accounting pronouncements which have become effective from 1

January 2023 are:

-- IFRS 17 Insurance Contracts - the Group do not have any

contracts that meet the definition of insurance contracts as set

out in IFRS 17

-- Deferred Tax related to Assets and Liabilities arising from a

Single Transaction (Amendments to IAS 12)

-- Definition of Accounting Estimates (Amendments to IAS 8)

-- Disclosure of Accounting Policies (Amendments to IAS 1 and

Practice Statement 2)

These accounting pronouncements do not have a significant impact

on the Group's financial results or position and no changes to

existing accounting policies were required as a result of adopting

any amendments

Going concern

The interim financial information has been prepared under the

going concern basis as the Directors are satisfied that sufficient

funds are or will become available to the Group to meet its

on-going working capital requirements for at least the next 12

months. The Group's assessment takes account of current cash

resources, expected costs and expected revenues. The Group has a

pipeline of commercial opportunities and promising partnerships,

and is focussed on converting these into sales in the next year. On

1 September 2023 the Company announced a raise of an additional

GBP0.5m by way of a subscription for ordinary shares. In the event

that trading does not grow as envisaged, sufficient cost reductions

are not made, or if there are unforeseen costs, then it is possible

that the Company may need to seek additional funding in the next 12

months. Management has successfully raised money in the past, but

there is no guarantee that adequate funds will be available when

needed in the future. As there can be no guarantee that any

required future funding can be raised in the necessary timeframe, a

material uncertainty exists that may cast significant doubt on the

Company's future ability to continue as a going concern.

After considering the forecasts and the risks, the Directors

have a reasonable expectation that the Group has adequate resources

to continue in operational existence for the foreseeable future.

For these reasons, they continue to adopt the going concern basis

of accounting.

Dividends

The Directors do not propose an interim dividend.

Material changes in accounting estimates or judgments

The preparation of unaudited interim financial information

requires management to make judgements, estimates and assumptions

that affect the application of accounting policies and the reported

amounts of assets and liabilities, income and expenses for the

current and its corresponding financial period under review. Actual

results may differ from these estimates.

In preparing the unaudited interim financial information, the

significant judgements made by the management in applying the

Group's accounting policies and the sources of estimates

uncertainty were consistent with those applied to the audited

financial statements for the year ended 31 December 2022.

3. Segmental Information

The chief operating decision-maker is considered to be the Board

of Directors of Verditek. The chief operating decision-maker

allocates resources and assesses performance of the business and

other activities at the operating segment level.

The chief operating decision maker has determined that in the

period ended 30 June 2023, Verditek had one operating segment, the

development and commercialisation of clean technologies.

Revenue and segmental information

6 months 6 months For the year

ended 30 ended 30 ended 31 December

June 23 June 22 22

Unaudited Unaudited Audited

GBP GBP GBP

--------------- ---------- ---------- -------------------

Sale of Goods 254,958 178,502 417,457

Total 254,958 178,502 417,457

--------------- ---------- ---------- -------------------

The Group had two customers that exceeded 10% of revenue in H1

2023 (H1 2022: 2 customers exceeded 10%)

Geographical Segments

Apart from holding company activities in the UK, the Group had

operations in Italy, in the period. An analysis of revenue,

operating loss and non-current assets by geographical market is

given below:

6 months 6 months For the year

ended 30 ended 30 ended 31 December

June 23 June 22 22

Unaudited Unaudited Audited

GBP GBP GBP

--------------------------- ---------- ---------- -------------------

Revenue

UK - - 18,661

Rest of Europe 254,958 178,502 398,796

254,958 178,502 417,457

--------------------------- ---------- ---------- -------------------

Operating loss

UK (646,338) (449,376) (1,095,726)

Rest of Europe (299,155) (295,105) (819,299)

--------------------------- ---------- ---------- -------------------

(945,493) (744,481) (1,915,025)

--------------------------- ---------- ---------- -------------------

Non-current assets

UK 568,880 773,555 571,010

Rest of Europe 102,303 393,912 230,145

--------------------------- ---------- ---------- -------------------

671,183 1,167,467 801,155

--------------------------- ---------- ---------- -------------------

4. Relocation costs

During the interim period the Milan factory was closed, and the

operations moved to another premises in Tolmezzo, Italy. As a

result costs were incurred totalling GBP40,081 within direct costs

relating to staff and transport and GBP102,475 within

administrative expenses relating to logistics, legal fees, loss on

disposal of machinery and disposal costs. These are considered

non-recurring costs.

5. Other income

6 months 6 months For the year

ended 30 ended 30 ended 31 December

June 23 June 22 22

Unaudited Unaudited Audited

GBP GBP GBP

---------------------------- ----------- ---------- -------------------

Unwind of discount on ICSI

receivable - 26,922 (125,486)

Grant income - 117,629 217,419

Total other income - 144,551 91,933

---------------------------- ----------- ---------- -------------------

In prior period, grant income of GBP117,629 was recognised in

association with an Innovate UK grant awarded in 2021, in respect

of a project to design solar solutions for homes, schools and farms

in Zimbabwe.

During the prior period there was also an unwind of discount on

the receivable recognised upon disposal of the Group's investment

Industrial Climate Solutions Inc (ICSI) in February 2022,

GBP26,922.

6. Loss Per Share

The calculation of loss per share is based on the following loss

and number of shares:

6 months 6 months For the year

ended 30 June ended 30 June ended 31 December

23 22 22

Unaudited Unaudited Audited

GBP GBP GBP

------------------------------------- --------------- --------------- -------------------

Loss for the period from continuing

operations (GBP) (970,989) (636,798) (1,872,711)

------------------------------------- --------------- --------------- -------------------

Weighted average number of

shares: Basic 443,538,306 342,764,826 393,565,703

Loss per share (GBP) (0.002) (0.002) (0.005)

------------------------------------- --------------- --------------- -------------------

Basic loss per share is calculated by dividing the loss for the

period from continuing operations of the Group by the weighted

average number of ordinary shares in issue during the period. Due

to the loss in the periods and there are no potentially dilutive

ordinary shares, meaning the basic and diluted loss per share were

the same.

7. Non-current receivables

6 months 6 months For the year

ended 30 June ended 30 June ended 31 December

23 22 22

Unaudited Unaudited Audited

GBP GBP GBP

------------------------------- --------------- --------------- -------------------

Opening earn-out from ICSI

investment sale 556,783 682,268 682,268

FX gain - 64,365 29,339

Discount unwind - 26,923 73,437

Fair Value adjustment - - (228,261)

Total non-current receivables 556,783 773,556 556,783

------------------------------- --------------- --------------- -------------------

On 1 February 2022 the Company completed a sale of its stake in

the ICSI business. An initial payment of GBP307,731 was received

upon completion. Further payments are expected over a 5 year

earn-out period. The payments are linked to achievement of various

milestones in development of carbon capture technology, but have

been estimated based on management's assessment of the likelihood

of success, and discounted to present values. The valuation

methodology at 30 June 2023 is consistent with the fair valuation

methodology used at 31 December 2022 in measurement of the ICSI

investment. During the prior period there was an unwind of discount

of the earn-out receivable of GBP26,923 and an increase in

valuation of GBP64,332 as a result of foreign exchange movements.

During the current period it has been decided to retain the

existing valuation.

8. Loans and Borrowings

6 months 6 months For the year

ended 30 June ended 30 June ended 31 December

23 22 22

Unaudited Unaudited Audited

GBP GBP GBP

------------------------------------ --------------- --------------- -------------------

Current

Convertible bonds issued to

related party - 25,000 25,000

Convertible bonds - 175,252 285,306

------------------------------------ --------------- --------------- -------------------

Total current loans and borrowings - 200,252 310,306

Non-current

Convertible loan notes 500,000 - -

Convertible bonds issued to -

related party - -

Convertible bonds - 93,304 -

------------------------------------ --------------- --------------- -------------------

Total Non-current loans and

borrowings 500,000 93,304 -

Total loans and borrowing 500,000 293,556 310,306

------------------------------------ --------------- --------------- -------------------

During the year, on 9 May 2023, the Group raised GBP500,000 in

secured convertible loan notes and shortly thereafter repaid the

convertible green bonds. The convertible loan notes carry a coupon

of 7% per annum which is payable on the redemption date or earlier

if converted. The convertible loan notes are redeemable 2 years

from the date of issue and are convertible at the option of the

noteholder into ordinary shares at the lower of 1.0625 pence per

share, or the subscription price per ordinary share of any

fundraising over GBP250,000 in the 6 months from the issue of the

loan notes. As a result of the equity raise on 1 September 2023,

the conversion price for the secured convertible loan notes has

been adjusted to 0.45 pence per share.

9. Share capital and reserves

Number of shares Share capital Share premium

GBP GBP

-------------------------- ----------------- -------------- --------------

At 30 June 2022 443,538,306 177,417 12,205,726

-------------------------- ----------------- -------------- --------------

Issue of ordinary shares - - -

June 2022

-------------------------- ----------------- -------------- --------------

At 31 December 2022 443,538,306 177,417 12,205,726

-------------------------- ----------------- -------------- --------------

Issue of ordinary shares - - -

June 2023

-------------------------- ----------------- -------------- --------------

At 30 June 2023 443,538,306 177,417 12,205,726

-------------------------- ----------------- -------------- --------------

There have been no new options granted or exercised in the

period and options over 500,000 shares lapsed. The number of shares

outstanding on which options have been granted at 30 June 2023 is

19,500,000.

10. Events after the reporting date

On 1 September 2023 the Group raised GBP500,000 of funds by way

of a subscription for 111,111,111 ordinary shares at 0.45 pence per

share.

11. Copies of the interim report

Copies of this interim report will be made available on the

Company's website at www.verditek.plc.uk and from the Company's

registered office, Holborn Gate, 330 High Holborn, London, WC1V

7QH.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR GZGZLRRKGFZM

(END) Dow Jones Newswires

September 29, 2023 02:00 ET (06:00 GMT)

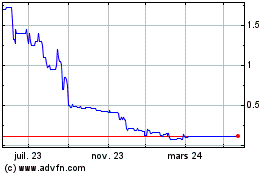

Verditek (LSE:VDTK)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

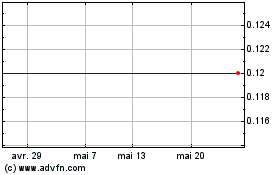

Verditek (LSE:VDTK)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024