TIDMWATR

RNS Number : 2244A

Water Intelligence PLC

22 September 2022

Water Intelligence plc (AIM: WATR.L)

Interim Results

Water Intelligence plc (AIM: WATR.L) (the "Group" or "Water

Intelligence" or the "Company"), a leading multinational provider

of precision, minimally-invasive leak detection and remediation

solutions for both potable and non-potable water is pleased to

provide its unaudited Interim Results for the period ending 30 June

2022.

Consistent with its historic trajectory, results are comfortably

in-line with market expectations as the Group continues to execute

on its long-run growth plan while navigating short-run market

volatility.

Financial Highlights*

-- Revenue increased by 44% to $35.6 million (1H 2021: $24.7 million)

o Network Sales (implied gross sales of franchisees from which

reported royalty is derived plus direct sales of corporate

locations) grew 12.5% to $85 million (1H 2021: $75.5 million)

-- EBITDA increased by 15% to $6.2 million (1H 2021: $5.4 million)

-- PBT Adjusted** increased by 10% to $4.6 million (1H 2021: $4.2 million)

-- Cash and equivalents increased to $21.9 million (1H 2021: $7.2 million)

o Net Cash at $5.3 million (cash minus bank borrowings)

o Bank borrowings amortized through 2027 at an average fixed

rate of 4.9%

* To make proper like-for-like comparisons, the above

comparisons of Statutory EBITDA and PBT Adjusted exclude the 1H

2021 one-time gain of $1.9 million

**PBT Adjusted (amortisation, share based payments and non-core

costs)

Corporate Development

-- Operations: Increase of 45 headcount, mostly technicians in training for growth plan

-- Financial:

o Expanded bank credit facilities by $17 million (with headroom

of approximately $7 million as of 30 June 2022)

-- Accretive acquisitions:

o 2 Franchises re-acquired: Fort Worth, Texas; Midland,

Texas

o Bolt-on acquisition: Connecticut Plumbing

-- New Locations:

o Greenfield territory launched as corporate location: Wichita

Falls, Texas

o Additional territory sold to Franchisee to be developed:

central North Carolina

o New Technician Training Center launched in Seattle

-- Technology:

o Field trials in US for proprietary new technologies:

residential sewer diagnostic tool and video e-commerce

o Salesforce.com implementation: on-boarding completed for all

corporate locations; franchise locations currently on-boarding

Dr. Patrick DeSouza, Executive Chairman of Water Intelligence,

commented:

We delivered strong results while navigating 1H market

volatility. We remain positive about the future and see

opportunities ahead even as we manage prudently in the short to

medium-run for both inflation and threats of future recession from

rising interest rates. We are pleased to have expanded our credit

facilities early in 1H and locked-in an attractive fixed rate

through 2027.

Ironically, now is a good time for us to capture more of the

market given our market leading position and competitive advantages

that we can exploit. Market demand for water and wastewater-related

infrastructure solutions remains strong whether we face Covid-19,

inflation or potentially recession. Long-run, climate change is

adversely affecting water infrastructure whether manifested by

droughts, floods or deterioration of pipe materials. In attacking

the market, which is characterized by fragmented, local service

providers, we have operating efficiencies to leverage: our

multinational sales footprint; business-to-business channels;

proprietary technology; Salesforce.com implementation; and

available financial resources for sustaining our long-run growth

plan. Moreover, in the short to medium-run, because most of our

operations are in the US, we are additionally assisted by the

strong US dollar and have the ability to be opportunistic

internationally."

This announcement contains inside information for the purposes

of Article 7 of the UK version of Regulation (EU) No 596/2014 which

is part of UK law by virtue of the European Union (Withdrawal) Act

2018, as amended ("MAR"). Upon the publication of this announcement

via a Regulatory Information Service, this inside information is

now considered to be in the public domain.

Enquiries:

Water Intelligence plc

Patrick DeSouza, Executive Chairman Tel: +1 203 654 5426

RBC Capital Markets - Joint Broker Tel: +44 (0)20 7653 4000

Jill Li

Daniel Saveski

WH Ireland Limited - NOMAD & Joint Tel: +44 (0)20 7220 1666

Broker

Chris Hardie

Ben Good

Tel: +44 (0)20 3903 7715

Dowgate Capital Ltd - Joint Broker

Stephen Norcross

Nicholas Chambers

Chairman's Statement

Overview

Once again, as has been the case consistently since 2016, our

operating fundamentals are strong. And market demand for our green

economy brand and water infrastructure solutions only looks to be

getting stronger given droughts, flooding and an inability of aging

infrastructure internationally to cope. We appreciate our

shareholders commitment to building a leading world-class growth

company over the long-run. Nonetheless, during 1H we implemented

important steps to get ahead of marketplace challenges threatening

various stakeholders - employees, customers, shareholders -

including rapid inflation and the threat of future recession from

rising interest rates geared to stem inflation. We expanded our

credit facilities by $17 million during 1H and locked-in an

attractive blended interest rate for all bank borrowings at 4.9%.

We have made prudent budget adjustments during 1H while staying

true to our long-run growth plan because it will create the highest

value for all stakeholders. For example, in putting capital to

work, we have continued to hire and train technicians to capture

market demand for solutions and at the same time we have managed

other expenses. Fortunately, our asset base gives Water

Intelligence a competitive advantage and management an ability to

navigate short-run, medium-run, and long-run operating windows.

Analysis

We remain on-track for another good year with respect to revenue

and profits. To present a comparable period-over-period analysis of

operations, we have excluded a one-time gain of $1.9 million in

2021 for the forgiveness of a PPP loan granted at the onset of

Covid in 2020. This loan forgiveness was treated in our 2021

audited accounts as profit before tax. In that report, we explained

the IFRS requirement and communicated that even excluding the

one-time gain for 2021, full year 2021 revenue grew by 44% to $54.5

million and adjusted EBITDA still grew 48% to $10.3 million. To

provide a meaningful comparison between operating performance for

1H 2022 and 1H 2021, we need to make the same adjustment. Revenue

grew in 1H by 44% to $35.6 million (1H 2021: $24.7 million), profit

before taxes adjusted for non-cash and non-core costs increased by

10% to $4.6 million (1H 2021: $4.2 million) and EBITDA grew by 15%

to $6.2 million (1H 2021: $5.4 million).

While strong, we note that our EBITDA growth percentage over

sequential periods from full year 2021 to 1H 2022 decreased. In

part, EBITDA margins declined somewhat to 17.5% from 21.9% because

of rapid inflation of direct costs from labor, gasoline for service

vehicles and supplies. However, it should also be noted that part

of increasing expenses was actually the timing of reinvestment due

to increased hiring and training of operating personnel including

45 technicians. Such execution personnel will become fully

productive in 2023 to capture increased market demand for water and

wastewater solutions and contribute revenue and profit over the

medium and long-run. As part of our growth plan, we raised equity

capital during 2H 2021, committing to institutional shareholders to

put capital to work to accelerate market capture given the global

market opportunity for providing water infrastructure

solutions.

Short-run Window. In the near-term, despite navigating market

volatility with care, we are continuing to grow organically both

the Water Intelligence (WI) brand and that of our core American

Leak Detection (ALD) business. In breaking down WI revenue growth,

each business line tracked well given our growth plan and key

performance indicators (KPIs) set forth in the Strategic Report as

part of our annual Accounts.

The core of our strategic plan focuses on growing the American

Leak Detection brand both organically by adding service

capabilities at each of our 150 locations across the United States

and by the reacquisition of franchises and converting such

locations to corporate operations. Converting franchises into

corporate operations unlocks significant shareholder value by

bringing underlying franchise revenue and profits directly onto

Water Intelligence accounts instead of as royalty income. We use

the concept of "Network Sales" to evaluate our growth plan because

it illuminates the growth of total sales to customers under our

American Leak Detection brand - both direct sales from corporate

operations and gross sales from franchisees from which royalty

income is reported. Both corporate and franchisee personnel execute

in the same branded vehicles and uniforms for customers. For 1H

2022, Network Sales grew 12.5% to $85 million (1H 2021: $75.5

million).

Each KPI tracks our growth plan well. Franchise royalties

declined by 3% to $3.6 million (1H: $3.7 million) as a result of

the franchise reacquisitions during 2021, which reduced the

available pool of royalty income for 2022. At the same time,

however, the franchise system still grew. Despite there being fewer

franchises, franchise-related revenues grew by 5% (1H 2022: $5.2

million vs. 1H 2021: $4.9 million). Our business-to-business

insurance channel component of franchise-related revenues grew by

7% to $4.8 million (1H 2021: $4.5 million). It is worth noting that

our business-to-business channel is growing faster than 7% because

we do not report insurance jobs executed by our corporate-operated

locations. Meanwhile, US corporate-operated locations grew 75% to

$23.3 million (1H 2021: $13.3 million) reflecting both organic

growth and growth through reacquisition of franchisees as discussed

above. With respect to organic growth, same store sales increased

by 30% to $17.1 million (1H 2021: $13.1 million). Finally,

international corporate operations (UK, Australia, Canada) grew 27%

to $3.6 million (1H 2021: $2.8 million).

Medium-run Window. We remain positive about market demand for

our water infrastructure solutions even in the medium-run scenario

of recession. For reference, during the first year of Covid-19,

when US GDP shrank, WI revenue still grew by 17%. We have made, and

are continuing to make, investments to capture a greater share of

the market over the medium term given strong demand for our

offerings. Firstly, we are adding more capacity - trained service

professionals - across all of our franchise and corporate

locations, especially in the US. At the beginning of 1H 2022, we

invested in creating a new training centre in Seattle. By the end

of 1H 2022, this centre has already trained several classes of new

technicians who are now deployed to different parts of the US and

gaining experience using our leak detection technology. These new

technicians will be contributing to revenue and profit in a

meaningful way during 2023. Secondly, to enable ALD to operate more

efficiently with more capacity, we have invested over the last two

years in Salesforce.com customer management technology and related

applications (together "Salesforce"). With the Salesforce suite of

applications, the entire American Leak Detection workflow across

its 150 locations will be automated from receipt of jobs from

customers to scheduling and delivery, report writing, payments and

follow-on sales. Importantly, all data will be secure with the

highest level of compliance; an attribute critical to our insurance

business-to-business channel. At the end of 1H 2022, all corporate

locations were successfully on-boarded to Salesforce. Prior to

year-end all franchise locations are scheduled to be on-boarded.

Thirdly, we have invested in proprietary technologies, such as a

new sewer diagnostic tool, that will increase our range of

offerings to meet market demand for wastewater services. A version

of this proprietary tool is currently being used commercially in

the UK for municipal customers such as Thames Water and a version

for residential users is currently being tested in the United

States for use by our American Leak Detection brand.

Outlook

Water Intelligence is well positioned for the future whether it

is characterized by persistent inflation or a shift to recession

from higher interest rates. Our balance sheet is strong with $21.9

million in cash as of 30 June 2022. Cash, net of bank borrowings,

is $5.3 million as at 30 June 2022. Credit availability under our

expanded facilities is $7 million as of 30 June 2022. The terms of

the bank debt are favorable with a fixed rate of approximately 4.9%

and amortization spread through 2027. Deferred consideration to

franchisees from reacquisitions at 30 June 2022 is $13.7 million

with payments spread through 2026. Given EBITDA growth and readily

available cash and credit, Water Intelligence has sufficient

capital to meet its obligations, reinvest in growth and even

consider selective acquisitions. With a strong US dollar forecast

through at least 2023 and since Water Intelligence generates cash

from operations largely in dollars, we are reviewing opportunities

internationally that have become relatively more attractive.

In evaluating any tactical changes, Water Intelligence does have

operating flexibility. If the medium-run is marked by inflation,

Water Intelligence has made significant investments in its

Salesforce.com infrastructure that is expected to deliver operating

efficiencies in 2023 and beyond. On the other hand, if the

medium-run is marked by recession due to rising US interest rates,

Water Intelligence also has the ability to navigate this given its

diverse matrix both in terms of solutions covering water and

wastewater and in terms of the variety of its customers from

homeowners to businesses like insurance to municipal. Both private

and public spending for water infrastructure solutions are expected

to increase irrespective of macroeconomic trends.

Long-run. We are mindful of macroeconomic variables. However, we

remain optimistic about the global opportunities in front of us and

management's ability to adjust as we move from short-run monitoring

to medium-run tactics. For our long-run outlook, global market

demand for water and wastewater infrastructure services continues

to increase. To a degree, we are acyclical because of the

importance of water and wastewater solutions especially as climate

change creates more anomalous conditions that puts stress on

infrastructure at all levels - residential, commercial,

municipal.

Importantly, as a competitive strategy matter, in a largely

fragmented market of local service providers, we are distinguished

from our competitors because we have: a well-recognized American

Leak Detection national brand; proprietary technology; established

US business-to-business channels; an installed base of operations

in over 150 locations across the US and in the UK, Canada and

Australia; and investments already made in the leading customer

relationship management system in the world that will come on line

fully during 2023. With these operating attributes and against a

landscape of smaller less-adaptable players, we should be prudent

as to tactics but confident in our growth plan and ability to

capture the market with a platform company as the market leader in

our category.

Patrick DeSouza

Executive Chairman

September 22, 2022

Interim Consolidated Statement of Comprehensive Income

For the six months ended 30 June 2022

Six months Six months Year ended

ended ended 31

30 June 30 June December

2022 2021 2021

------------------------------------ ------ ------------- ------------- -------------

Notes $ $ $

------------------------------------ ------ ------------- ------------- -------------

Unaudited Unaudited Audited

Revenue 4 35,583,457 24,698,724 54,543,408

Cost of sales (4,656,279) (4,504,060) (8,964,486)

------------------------------------ ------ ------------- ------------- -------------

Gross profit 30,927,178 20,194,664 45,578,922

Administrative expenses

* Other income 41,631 54,063 69,484

* Share-based payments (226,525) (187,719) (442,708)

* Amortisation of intangibles (429,440) (140,605) (470,226)

* Other administrative costs (26,074,124) (15,744,678) (38,131,195)

------------------------------------ ------ ------------- ------------- -------------

Total administrative

expenses (26,688,458) (16,018,939) (38,974,645)

------------------------------------ ------ ------------- ------------- -------------

Operating profit 4,238,720 4,175,725 6,604,277

PPP loan forgiveness - 1,869,800 1,869,800

Finance income 21,851 26,043 51,092

Finance expense (753,508) (341,612) (969,130)

------------------------------------ ------ ------------- ------------- -------------

Profit before tax 4 3,507,063 5,729,956 7,556,039

Taxation expense (1,106,026) (1,184,724) (1,641,350)

Profit for the period 2,401,037 4,545,232 5,914,689

Attributable to:

Equity holders of

the parent 2,407,239 4,452,586 5,764,952

Non-controlling interests (6,202) 92,646 149,737

------------------------------------ ------ ------------- ------------- -------------

2,401,037 4,545,232 5,914,689

Other comprehensive

income

Exchange differences

arising on translation

of foreign operations (370,207) (89,168) (221,281)

Fair value adjustment

on listed equity investment

(net of deferred tax) (475,794) 540,943 (300,049)

Total comprehensive

income for the period 1,555,036 4,997,007 5,393,359

------------------------------------ ------ ------------- ------------- -------------

Earnings per share Cents Cents Cents

------------------------------------ ------ ------------- ------------- -------------

Basic 5 13.9 28.8 36.1

------------------------------------ ------ ------------- ------------- -------------

Diluted 5 13.0 26.8 33.3

------------------------------------ ------ ------------- ------------- -------------

The gain on PPP loan forgiveness was a one-time extraordinary

item related to the Covid-19 pandemic. Under IFRS guidelines, we

were required to present this as a one-time gain in profit before

tax. However, this gain is not reflective of our underlying

operating results, and as such has been excluded from our period

over period analysis. See note 5 for adjusted EPS calculation.

Consolidated Statement of Financial Position as at 30 June

2022

At At At

30 June 30 June 31 December

2022 2021 2021

------------------------------ ------ ------------- ------------- -------------

Notes $ $ $

------------------------------ ------ ------------- ------------- -------------

Unaudited Unaudited Audited

ASSETS

Non-current assets

Goodwill 45,382,040 34,864,735 37,268,469

Listed equity investment 592,516 2,156,777 1,185,039

Other intangible assets 4,534,059 2,200,394 3,818,037

Property, plant and

equipment 9,655,046 7,255,295 7,807,227

Trade and other receivables 454,619 455,739 429,219

------------------------------ ------ ------------- ------------- -------------

60,618,280 46,932,940 50,507,991

------------------------------ ------ ------------- ------------- -------------

Current assets

Inventories 735,722 641,034 677,218

Trade and other receivables 12,461,108 8,981,051 8,379,894

Cash and cash equivalents 21,907,224 7,159,023 23,802,352

------------------------------ ------ ------------- ------------- -------------

35,104,054 16,781,108 32,859,464

------------------------------ ------ ------------- ------------- -------------

TOTAL ASSETS 4 95,722,334 63,714,048 83,367,455

------------------------------ ------ ------------- ------------- -------------

EQUITY AND LIABILITIES

Equity attributable

to holders of the parent

Share capital 6 142,260 116,606 142,260

Share premium 6 35,252,633 12,395,783 35,252,633

Shares held in treasury 6 (529,077) (284,611) (468,427)

Merger reserve 1,001,150 1,001,150 1,001,150

Share based payment

reserve 1,319,519 856,932 1,092,993

Other reserves (1,465,700) (963,380) (1,095,492)

Reverse acquisition

reserve 6 (27,758,089) (27,758,089) (27,758,088)

Equity investment reserve (429,123) 887,664 46,672

Retained profit 45,959,816 42,240,210 43,552,575

------------------------------ ------ ------------- ------------- -------------

53,493,389 28,492,265 51,766,276

------------------------------ ------ ------------- ------------- -------------

Equity attributable

to Non-Controlling interest

Non-controlling interest 568,513 555,436 612,528

------------------------------ ------ ------------- ------------- -------------

Non-current liabilities

Borrowings and lease

liabilities 15,369,104 8,447,368 8,176,893

Deferred consideration 7,929,371 9,981,713 8,220,613

Deferred tax liability 2,502,840 2,193,742 1,576,872

------------------------------ ------ ------------- ------------- -------------

25,801,315 20,622,823 17,974,378

------------------------------ ------ ------------- ------------- -------------

Current liabilities

Trade and other payables 4,730,349 3,888,937 4,194,031

Borrowings and lease

liabilities 5,365,027 3,010,759 3,325,579

Deferred consideration 5,763,741 7,143,828 5,494,663

15,859,117 14,043,524 13,014,273

------------------------------ ------ ------------- ------------- -------------

TOTAL EQUITY AND LIABILITIES 95,722,334 63,714,048 83,367,455

------------------------------ ------ ------------- ------------- -------------

Interim Consolidated Statement of Changes in Equity

For the six months ended 30 June 2022

Share Share Shares Reverse Merger Share Other Equity Retained Total Non-controlling Total

Capital Premium held Acquisition Reserve based Reserves investment Profit interest Equity

in Reserve payment reserve

treasury reserve

$ $ $ $ $ $ $ $ $ $ $ $

--------------- -------- ----------- ---------- ------------- ---------- ---------- ------------ ----------- ----------- ----------- ---------------- -----------

As at 1

January

2021 116,212 12,091,069 (340,327) (27,758,088) 1,001,150 650,284 (874,211) 346,721 37,787,623 23,020,434 346,124 23,366,558

--------------- -------- ----------- ---------- ------------- ---------- ---------- ------------ ----------- ----------- ----------- ---------------- -----------

Issue of

ordinary

shares 20 59,224 - - - - - - - 59,244 - 59,244

Options

purchase 374 38,553 - - - - - - - 38,928 - 38,928

Share based

payment

expense - - - - - 206,648 - - - 206,648 - 206,648

Share buyback - - (282,737) - - - - - (282,737) - (282,737)

Sale of

treasury

stock - 206,936 338,452 - - - - - - 545,388 - 545,388

Capital

Contribution

NCI - - - - - - - - - - 116,667 116,667

Profit for the

period - - - - - - - - 4,452,587 4,452,587 92,645 4,545,232

Other

comprehensive

income - - - - - - (89,169) 540,943 - 451,774 - 451,774

As at 30 June

2021

(unaudited) 116,606 12,395,783 (284,612) (27,758,088) 1,001,150 856,932 (963,380) 887,664 42,240,210 28,492,265 555,436 29,047,701

--------------- -------- ----------- ---------- ------------- ---------- ---------- ------------ ----------- ----------- ----------- ---------------- -----------

Issue of

ordinary

shares 21,271 22,126,416 - - - - - - - 22,147,687 - 22,147,687

Options

purchase 4,383 716,352 - - - - - - - 720,735 - 720,735

Share-based

payment

expense - - - - - 236,060 - - - 236,060 - 236,060

Share buyback - - (183,814) - - - - - (183,814) - (183,814)

Sale of

treasury

stock - 14,082 - - - - - - - 14,082 - 14,082

Profit for the

period - - - - - - - 1,312,365 1,312,365 57,092 1,369,457

Other

comprehensive

income - - - - - - (132,112) (840,992) - (973,104) - (973,104)

As at 31

December

2021

(audited) 142,260 35,252,633 (468,427) (27,758,088) 1,001,150 1,092,993 (1,095,492) 46,672 43,552,575 51,766,276 612,528 52,378,804

--------------- -------- ----------- ---------- ------------- ---------- ---------- ------------ ----------- ----------- ----------- ---------------- -----------

Share based

payment

expense - - - - - 226,525 - - - 226,525 - 226,525

Share buyback - - (60,650) - - - - - (60,650) - (60,650)

Dividend paid - - - - - - - - - - (37,813) (37,813)

Profit for the

period - - - - - - - - 2,407,239 2,407,239 (6,202) 2,401,037

Other

comprehensive

income - - - - - - (370,207) (475,794) - (846,001) - (846,001)

--------------- -------- ----------- ---------- ------------- ---------- ---------- ------------ ----------- ----------- ----------- ---------------- -----------

As at 30 June

2022

(unaudited) 142,260 35,252,633 (529,076) (27,758,088) 1,001,150 1,319,518 (1,465,699) (429,122) 45,959,814 53,493,389 568,513 54,061,902

--------------- -------- ----------- ---------- ------------- ---------- ---------- ------------ ----------- ----------- ----------- ---------------- -----------

Interim Consolidated Statement of Cash Flows

For the six months ended 30 June 2022

Six months Six months Year ended

ended ended 31 December

30 June 30 June 2021

2022 2021

----------------------------------------- -------------- ------------ -------------

$ $ $

----------------------------------------- -------------- ------------ -------------

Unaudited Unaudited Audited

Cash flows from operating activities

Profit before tax 3,507,063 5,729,956 7,556,039

Adjustments for non-cash/non-operating

items:

Depreciation of plant and equipment 1,559,464 1,086,086 2,475,069

Amortisation of intangible assets 429,440 140,605 470,225

Share based payments 226,525 187,719 442,708

PPP loan forgiveness - (1,869,800) (1,869,800)

Interest paid 466,225 341,612 969,130

Interest received (21,851) (26,043) (51,092)

----------------------------------------- -------------- ------------ -------------

Operating cash flows before movements

in working capital 6,166,866 5,590,134 9,992,279

----------------------------------------- -------------- ------------ -------------

Increase in inventories (58,504) (196,243) (232,427)

Increase in trade and other receivables (4,055,364) (2,806,532) (1,924,070)

Increase/(Decrease) in trade and

other payables 509,562 (226,127) (684,618)

Cash generated by operations 2,562,560 2,361,232 7,151,164

----------------------------------------- -------------- ------------ -------------

Income taxes (60,046) (4,724) (1,021,648)

----------------------------------------- -------------- ------------ -------------

Net cash generated from operating

activities 2,502,514 2,356,508 6,129,516

----------------------------------------- -------------- ------------ -------------

Cash flows from investing activities

Purchase of plant and equipment (649,120) (389,784) (517,707)

Purchase of intangibles (1,165,452) (142,890) (2,078,559)

Acquisition of subsidiaries (3,850,000) - (979,782)

Reacquisition of Franchises (1,400,000) (1,551,999) (5,239,558)

Interest received 21,851 26,043 51,092

----------------------------------------- -------------- ------------ -------------

Net cash used in investing activities (7,042,720) (2,058,631) (8,764,514)

----------------------------------------- -------------- ------------ -------------

Cash flows from financing activities

Issue of ordinary share capital - 20 21,291

Premium on issue of ordinary share

capital - 59,224 22,185,641

Share buy-back (60,652) (282,736) (466,551)

Sale of treasury shares - 545,389 559,469

Options exercised - 38,928 714,950

Dividend paid (37,812) - -

Interest paid (466,225) (341,612) (969,130)

Proceeds from borrowings 10,057,373 3,200,000 3,200,000

Repayment of borrowings (1,778,343) (879,733) (1,827,765)

Repayment of notes (4,309,447) (1,610,167) (2,350,676)

Repayment of lease liabilities (759,815) (686,881) (1,448,594)

Net cash generated by/(used in)

financing activities 2,645,079 42,431 19,618,635

----------------------------------------- -------------- ------------ -------------

Net (decrease)/increase in cash

and cash equivalents (1,895,128) 340,308 16,983,637

Cash and cash equivalents at the

beginning of period 23,802,352 6,818,715 6,818,715

Cash and cash equivalents at end

of period 21,907,224 7,159,023 23,802,352

----------------------------------------- -------------- ------------ -------------

Notes to the Interim Consolidated Financial Information

for the six months ended 30 June 2022

1 General information

The Group is a leading provider of minimally-invasive leak

detection and remediation services and products for water and

wastewater infrastructure. The Group's strategy is to be a provider

of "end-to-end" solutions - a "one-stop shop" for residential,

commercial and municipal customers.

Water Intelligence plc is a public limited company domiciled in

the United Kingdom and incorporated under registered number

03923150 in England and Wales. Its registered office is 27-28

Eastcastle Street, London, W1W 8DH.

2 Significant accounting policies

Basis of preparation and changes to the Group's accounting

policies

The accounting policies adopted in the preparation of the

interim consolidated financial information are consistent with

those of the preparation of the Group's annual consolidated

financial statements for the year ended 31 December 2021.

This interim consolidated financial information for the six

months ended 30 June 2022 has been prepared in accordance with IAS

34, "Interim financial reporting". This interim consolidated

financial information is not the Group's statutory financial

statements and should be read in conjunction with the annual

financial statements for the year ended 31 December 2021, which

have been prepared in accordance with International Financial

Reporting Standards (IFRS) and have been delivered to the Registrar

of Companies. The auditors have reported on those accounts; their

report was unqualified, did not include references to any matters

to which the auditors drew attention by way of emphasis of matter

without qualifying their report and did not contain statements

under section 498(2) or (3) of the Companies Act 2006.

The interim consolidated financial information for the six

months ended 30 June 2022 is unaudited. In the opinion of the

Directors, the interim consolidated financial information presents

fairly the financial position, and results from operations and cash

flows for the period. Comparative numbers for the six months ended

30 June 2021 are unaudited.

This interim consolidated financial information is presented in

US Dollars ($), rounded to the nearest dollar.

Foreign currencies

(i) Functional and presentational currency

Items included in this interim consolidated financial

information are measured using the currency of the primary economic

environment in which each entity operates ("the functional

currency") which is considered by the Directors to be the Pounds

Sterling (GBP) for the Parent Company and US Dollars ($) for

American Leak Detection Holding Corp. This interim consolidated

financial information has been presented in US Dollars which

represents the dominant economic environment in which the Group

operates and is considered to be the functional currency of the

Group. The effective exchange rate at 30 June 2022 was GBP1 = US$

1.2161 (30 June 2021: GBP1 = US$ 1.3851).

Critical accounting estimates and judgments

The preparation of interim consolidated financial information

requires management to make judgements, estimates and assumptions

that affect the application of accounting policies and the reported

amounts of assets and liabilities and the reported amounts of

income and expenses during the reporting period. Although these

estimates are based on management's best knowledge of current

events and actions, the resulting accounting estimates will, by

definition, seldom equal the related actual results.

In preparing this interim consolidated financial information,

the significant judgements made by management in applying the

Group's accounting policies and the key sources of estimation

uncertainty were the same as those that applied to the consolidated

financial statements for the year ended 31 December 2021.

3 Significant events and transactions

On 7 April 2022, the Group announced the expansion of its

acquisition line of credit to include an additional $15 million for

further acquisitions of its franchises and $2 million for a working

capital line of credit. As part of the facility, the Group entered

into swap arrangements that maintain a fixed interest rate of

approximately 5.5% on amounts drawn under the facility and are

amortised over a term of five years. The blended fixed interest

rate for our various credit facilities is approximately 4.9%. The

covenants and guarantee requirements for the new facility remain

the same all other credit facilities with People's Bank, now

operating post-acquisition as part of M&T Bank .

As detailed in Footnote 7 - "Reacquisition of franchisee

territories and other acquisitions" the Group reacquired the

following franchises and 3(rd) party companies: Franchises - Fort

Worth, Texas (1 January 2022); Central Texas (1 May 2022); Shanahan

Plumbing (1 May 2022). The Group also sold additional territory to

a franchisee.

4 Segmental information

In the opinion of the Directors, the operations of the Group

currently comprise four operating segments: (i) franchise royalty

income, (ii) franchise-related activities including sale of

franchise territory, business-to-business sales and product and

equipment sales, (iii) US corporate-operated locations led by the

Group's U.S.-based American Leak Detection subsidiary and (iv)

international corporate locations led by the Group's UK-based Water

Intelligence International subsidiary.

The Group mainly operates in the US, with operations in the UK,

Canada and Australia. In the six months to 30 June 2022, 89.8% (1H

2021: 88.6%) of its revenue came from the US-based operations; the

remaining 10.2% (1H 2021: 11.4%) of its revenue came from its

international corporate operated locations.

No single customer accounts for more than 10% of the Group's

total external revenue.

The Group adopted IFRS 8 Operating Segments with effect from 1

July 2008. IFRS 8 requires operating segments to be identified on

the basis of internal reports about components of the Group.

Information reported to the Group's Chief Operating Decision

Maker (being the Executive Chairman), for the purpose of resource

allocation and assessment of division performance is separated into

four income generating segments that serve as key performance

indicators (KPI's):

- Franchise royalty income;

- Franchise-related activities (including sale of franchise

territory, product and equipment sales and Business-to-Business

sales);

- US corporate operated locations; and

- International corporate operated locations.

Items that do not fall into the four segments have been

categorised as unallocated head office costs and non-core costs

which largely reflect transaction costs associated with the Group's

acquisition strategy.

The following is an analysis of the Group's revenues, results

from operations and assets:

Revenue Six months Six months Year ended

ended ended 31 December

30 June 2022 30 June 2021 2021

$ $ $

Unaudited Unaudited Audited

------------------------------ --------------- --------------- -------------

Franchise royalty income 3,574,855 3,679 450 6,803,489

Franchise related activities 5,154,080 4,926,435 9,769,657

US corporate operated

locations 23,267,410 13,272,353 31,861,087

International corporate

operated locations 3,587,113 2,820,487 6,109,175

------------------------------- --------------- --------------- -------------

Total 35,583,457 24,698,724 54,543,408

------------------------------- --------------- --------------- -------------

Profit before tax Six months Six months Year ended

ended ended 31 December

30 June 2022 30 June 2021 2021

$ $ $

Unaudited Unaudited Audited

------------------------------ --------------- --------------- -------------

Franchise royalty income 963,463 1,251,346 1,808,730

Franchise related activities 497,801 422,375 805,171

US corporate operated

locations 4,462,386 3,058,470 6,007,153

International corporate

operated locations 39,007 191,288 315,740

Unallocated head office

costs (2,035,594) (1,050,697) (2,927,132)

PPP loan forgiveness - 1,869,800 1,869,800

Non-core costs (420,000) (12,626) (323,423)

------------------------------- --------------- --------------- -------------

Total 3,507,063 5,729,956 7,556,039

------------------------------- --------------- --------------- -------------

As previously noted, the gain on PPP loan forgiveness was a

one-time extraordinary item related to the Covid pandemic. Under

IFRS guidelines, we were required to present this as a one-time

gain in profit before tax. However, this gain is not reflective of

our underlying operating results, and as such has been excluded

from our period over period analysis.

Assets Six months Six months Year ended

ended ended 31 December

30 June 2022 30 June 2021 2021

$ $ $

Unaudited Unaudited Audited

------------------------------ --------------- --------------- -------------

Franchise royalty income 28,132,461 12,896,040 27,869,663

Franchise related activities 2,725,813 2,476,084 2,452,933

US corporate operated

locations 48,408,920 40,492,132 43,050,953

International corporate

operated locations 16,455,139 7,849,792 9,993,906

------------------------------- --------------- --------------- -------------

Total 95,722,334 63,714,048 83,367,455

------------------------------- --------------- --------------- -------------

Geographic Information

The Group has two wholly-owned subsidiaries - American Leak

Detection (ALD) and Water Intelligence International (WII).

Operating activities are captured as both franchise-executed

operations and corporate-executed operations. ALD has both US

franchises and corporate-operated locations. It also has

international franchises, principally located in Australia and

Canada. Operations focus on residential and commercial water leak

detection and remediation with some municipal activities. By

comparison, WII has only corporate operations located outside the

United States. These WII international operations are principally

municipal activities with some residential leak detection and

remediation. As noted herein, the Group's vision is to become a

multinational growth company and a "One Stop Shop" for residential,

commercial and municipal solutions to water and wastewater

infrastructure problems.

Total Revenue

Six months ended 30 June Year ended 31 December

2022 2021

Unaudited Audited

US International Total US International Total

$ $ $ $ $ $

----------------------- ----------- -------------- ----------- ----------- -------------- -----------

Franchise royalty

income 3,525,982 48,872 3,574,855 6,698,729 104,760 6,803,489

Franchise related

activities 5,154,080 - 5,154,080 9,769,657 - 9,769,657

US corporate operated

locations 23,267,410 - 23,267,410 31,861,087 - 31,861,087

International

corporate operated

locations - 3,587,113 3,587,113 - 6,109,175 6,109,175

----------------------- ----------- -------------- ----------- ----------- -------------- -----------

Total 31,947,472 3,635,985 35,583,457 48,329,473 6,213,935 54,543,408

----------------------- ----------- -------------- ----------- ----------- -------------- -----------

5 Earnings per share

The earnings per share has been calculated using the profit for

the period and the weighted average number of Ordinary shares

outstanding during the period as follows:

Six months Six months Year ended

ended ended 31 December

30 June 2022 30 June 2021 2021

Unaudited Unaudited Audited

-------------------------- --------------- --------------- -------------

Earnings attributable

to shareholders ($) 2,407,239 4,452,586 5,764,952

Weighted average number

of ordinary shares 17,361,439 15,473,540 15,972,588

Diluted weighted average

number of ordinary

shares 18,463,573 16,587,603 17,286,616

--------------------------- --------------- --------------- -------------

Earnings per share

(cents) 13.9 28.8 36.1

--------------------------- --------------- --------------- -------------

Diluted earnings

per share (cents) 13.0 26.8 33.3

--------------------------- --------------- --------------- -------------

Adjusting for the exclusion of the one-time PPP loan forgiveness

has the following effect:

Earnings per share

(cents) - (12.1) (11.7)

Adjusted Earnings

per share (cents) 13.9 16.7 24.4

----------------------- ----- ------- -------

Diluted earnings per

share (cents) - (11.3) (10.8)

----------------------- ----- ------- -------

Adjusted Diluted

earnings per share

(cents) 13.0 15.6 22.5

----------------------- ----- ------- -------

Earnings per share are computed based on Ordinary shares. There

is a class of B Ordinary Shares that are not admitted to

trading.

6 Share capital

The issued share capital at the end of the period was as

follows:

Group & Company

Ordinary Shares held

Shares of 1p each in treasury

Number

Number Total Number

-------------------- ------------------- ------------- ------------

At 30 June 2022 17,366,688 56,500 17,423,188

At 30 June 2021 15,492,443 36,500 15,528,943

-------------------- ------------------- ------------- ------------

At 31 December 2021 17,366,688 51,000 17,417,688

-------------------- ------------------- ------------- ------------

On 1 May 2022 in connection with the acquisition of Shanahan

Plumbing, the vendor, was granted options to purchase 20,000 New

Ordinary Shares at a price of $8.95. These options have a four-year

vesting requirement.

On 30 June 2022, in connection with employee grants, certain

employees received options to purchase 152,000 New Ordinary Shares

at a price of $12.50 per share. These options have a four-year

vesting requirement.

The net number of options including the new grants and leavers

from the Group at 30 June 2022 is 2,375,000.

Group & Company Share Capital Share Premium Shares In

Treasury

$ $ $

-------------------- ------------- --------------- ---------

At 30 June 2022 142,260 35,252,633 (529,077)

At 30 June 2021 116,606 12,395,783 (284,611)

-------------------- ------------- --------------- ---------

At 31 December 2021 142,260 35,252,633 (468,427)

-------------------- ------------- --------------- ---------

Reverse acquisition reserve

The reverse acquisition reserve was created in accordance with

IFRS3 Business Combinations and relates to the reverse acquisition

of Qonnectis Plc by ALDHC in July 2010. Although these Consolidated

Financial Statements have been issued in the name of the legal

parent, Water Intelligence plc, it represents in substance is a

continuation of the financial information of the legal subsidiary

ALDHC. A reverse acquisition reserve was created in 2010 to enable

the presentation of a consolidated statement of financial position

which combines the equity structure of the legal parent with the

reserves of the legal subsidiary. Qonnectis Plc was renamed Water

Intelligence Plc on completion of the reverse acquisition on 29

July 2010.

7 Reacquisition of franchisee territories and other acquisitions in the period

On 19 January 2022, the Group announced the reacquisition of its

Fort Worth, Texas franchise territory within the Group's ALD

franchise business. The Fort Worth operation is fast-growing and

expected to accelerate further by adding new service locations in

north and west Texas during 2022. Moreover, this reacquisition

reinforces the Group's strategy of establishing regional corporate

hubs in the US that have scale to fuel growth in nearby corporate

and franchise locations. The purchase price of $7.7 million in cash

is to be paid over three years. The purchase price is based on 2021

pro forma of $3.6 million in revenue and $1.2 million in profit

before tax.

On 26 January 2022, the Group announced the sale of certain

territory in rural North Carolina to an existing, fast-growing

franchisee of American Leak Detection (ALD). The purchase price for

the territory is $90,000, all of which is recognised as revenue at

100% profit margin. It is also expected that the franchise owner

will be purchasing additional equipment from ALD to launch service

vehicles to develop the territory. Finally, the commercialization

of such "greenfield" territory will also add royalty income to the

Group's ALD business unit during 2022.

Effective 1 May 2022, the Group acquired Shanahan Plumbing LLC,

a plumbing company with operations in both Connecticut and New York

("Acquisition"). The Acquisition builds upon the Group's growing

American Leak Detection ("ALD") operations in Connecticut and New

York and enables customers to be offered a full range of leak

detection and repair solutions. The purchase price of $1 million is

based on Shanahan Plumbing's 2021 Statement of Income of $1.9

million in revenue and $0.2 million in adjusted profit before

tax.

On 12 May 2022, the Group announced the reacquisition of its

American Leak Detection Central Texas franchise. The franchise

includes the cities of Abilene, Lubbock and Midland which are west

of recently launched corporate-operated locations of Fort Worth

(via franchise acquisition) and Wichita Falls (greenfield). The

purchase price of $0.75 million in cash is based on the franchise's

2021 Statement of Income of $0.65 million in revenue and $0.21

million in profit before tax.

8 Publication of announcement and the Interim Results

A copy of this announcement will be available at Water

Intelligence plc's registered office ( 27-28 Eastcastle Street,

London, W1W 8DH ) from the date of this announcement and on its

website - www.waterintelligence.co.uk . This announcement is not

being sent to shareholders.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com .

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial

services.

END

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SEMFUFEESEEU

(END) Dow Jones Newswires

September 22, 2022 02:01 ET (06:01 GMT)

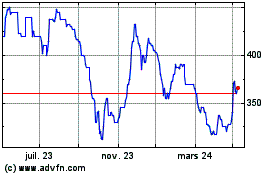

Water Intelligence (LSE:WATR)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

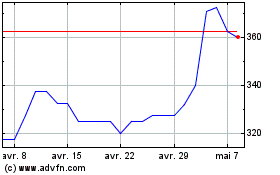

Water Intelligence (LSE:WATR)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024