TIDMWBI

RNS Number : 0186D

Woodbois Limited

17 October 2022

17 October 2022

Woodbois Limited

("Woodbois", the "Group" or the "Company")

Q3 2022 Update and Board change

Woodbois Limited (AIM: WBI), the African focused forestry,

timber trading, reforestation and voluntary carbon credit company,

is pleased to announce its update for the third quarter to 30(th)

September 2022:

Substantial production increases maintained, gross margin

improved

-- Record quarterly revenue, up 29% to $5.8m in Q3 2022 vs Q3 2021 $4.5m.

-- Record nine months revenues of $17.1m in 2022 vs $12.7m for the same period in 2021, up 35%.

-- Group gross profit margin for first 9 months of 2022 further

improved to 24% from 20% in FY 2021 and 23% in H1 2022.

-- Cash balance of $1.4m as at 30 September 2022

-- Period end working capital(1) of $9.3m of which inventory was

$6.1m and excluding bank and other loans of $12.3m

-- Q3 Sawmill production 6,032m3, a 78% increase on the 2021 quarterly average

-- Q3 Veneer production 1,418m3, a 45% increase on the 2021 quarterly average

Total output from our factories increased again during Q3, with

new records for production set for sawn timber and consistent

output of veneer. The total quantity of goods shipped was

marginally above the strong previous quarter, making it a record

quarter for shipping of own production.

The veneer team will work on test orders from the bigger second

line, as its output is progressively ramped up during Q4.

Commissioning issues such as late receipt of parts delayed its

start-up but the benefits of its higher value-added products will

be increasingly seen as higher volumes of veneer are shipped in

2023.

Financial

Additional economies of scale continue to be realised as factory

output increases, and these economies combined with a careful focus

on cost control delivered further improvements in Group gross

profit margins to 24% for the first nine months of 2022 vs 23% in

H1 and 20% for FY 2020. Working capital marginally reduced to $9.3m

at 30 September 2022 owing to expected capex. Total borrowings

decreased marginally during the quarter from $12.4m to $12.3m

reflecting machinery lease repayments made during the period.

The Group has reduced senior management head-count and costs,

which will benefit Q4. The Group is also focused on higher margin

own-product sales and improving working capital and is therefore

planning a reduction in third party sales in Q4. The raw material

from our forestry concessions provides some protection from

inflation, whilst our revenue mix is largely USD based and many

costs are incurred in local currencies. Accordingly we expect some

further improvement in gross margin in Q4.

Operational

The investment into plant and machinery and the quality of the

personnel recruited and integrated over the last two years is

yielding both higher volumes and margins as quality continues to

improve. Maximising margin through identifying the optimal markets

to sell into has been a key focus for our revamped sales team who

have been highly visible and were successful in generating orders

from new customers at recent trade shows in Algeria and the

USA.

The Group will continue to broaden its distribution channels in

existing and selective new attractive markets. In the near-term

Woodbois will concentrate on making sales into geographies

experiencing high levels of economic growth, such as the Middle

East and North Africa, with strong representation at the final

trade show of the year in Egypt in December.

Availability of containers for shipping continued to improve

during Q3 and the sharply elevated prices for sea transport

experienced since 2020 continued their gradual downwards trend

towards pre-pandemic levels. The Group expects a higher

interest-rate, higher-inflation, lower-growth economic environment

worldwide to lead to some softening of demand. However, our

substantial recent investments in production facilities will

increasingly enable Woodbois to sell a greater proportion of higher

value-added products to a broader range of markets.

Completing FSC certification of our forestry concessions and

factories remains a top priority for the Group. Significant

progress has been made during 2022 and we are now 62% complete.

Certification will increase markets, margins and profitability.

It is an aim of the Group to become carbon neutral in the

medium-term and thence to becoming carbon negative through the

development of carbon projects.

Carbon

Planning for our initial large-scale afforestation project in

Gabon continues to be the focus for the carbon division and

discussions with the relevant government Ministers have continued

to progress. Because the timing of allocation of land for this

project is not within our control and to validate our

proof-of-concept we will commence a limited initial pilot project

on an area of low carbon stock land within our existing

concessions. Upon receiving any grant of land from the government

we will immediately look to scale the pilot scheme, preferably with

the financial support of one or more external funding partners.

COP27 will take place in Egypt shortly. As chair of the African

Group of Negotiators on climate change and noted as the most carbon

negative country on earth, Gabon is expected to continue to play a

prominent and leading role. Members of Woodbois' senior management

will attend and will be available to meet stakeholders throughout

the event.

Board

After approaching four years as a Non-Independent Non-Executive

Director and owing to his growing other work commitments at the

Company's second largest shareholder, Lombard Odier, Henry Turcan

is today standing down from the Board. His energy and guidance have

helped to transform the financial health of the Company, its

performance and its governance. The Board express their grateful

thanks to him on behalf of all stakeholders. The Company will

appoint a further Independent Non-Executive in due course.

Outlook

The investments made over recent periods are projected to enable

Woodbois to maintain its organic growth path with additional

higher-value-added capacity coming online, de-bottle-necking

benefits and utilisation of all of its concessions now the access

roads are completed. Incremental margin growth through the learning

and adoption of smarter working practices in all areas of

production and distribution is also an achievable target.

Recently, given the rising likelihood of some pricing pressure

however, its was felt prudent to reduce exposure to third party

trading for Q4 2022 and focus on own-products. The Group will

utilise its proprietary in-house technology to carefully monitor

risk, market pricing and demand to support further revenue and

margin expansion in Q4 and in 2023. Benefits are also expected from

our recently revamped and highly motivated trading and support

team, using our custom-built analytics.

CEO Paul Dolan commented : 'The business maintained its strong

momentum throughout Q3, delivering record quarterly revenues,

production and margins. Mindful of current worldwide uncertainties

we will continue to be resilient and adaptable. With further

high-value production increases underway we have a busy run-into

year-end. Almost regardless of market conditions we look forward

with confidence to further growth in 2023 and beyond.'

(1) Working Capital is a non-IFRS measure and consists of Cash,

plus Inventory, plus Receivables, less Payables.

Enquiries:

Woodbois Limited

Paul Dolan - CEO

Carnel Geddes- CFO + 44 (0)20 7099 1940

Canaccord Genuity, Nominated

Advisor

Henry Fitzgerald-O'Connor

Gordon Hamilton +44 (0)20 7523 8000

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) No 596/2014 which forms part of UK

law by virtue of the European Union (Withdrawal) Act 2018

("MAR").

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDGPGMPUUPPGMQ

(END) Dow Jones Newswires

October 17, 2022 02:00 ET (06:00 GMT)

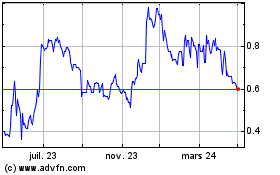

Woodbois (LSE:WBI)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

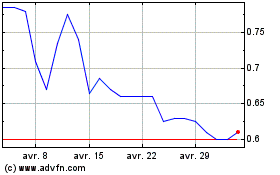

Woodbois (LSE:WBI)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024