TIDMWBI

RNS Number : 4580M

Woodbois Limited

12 January 2023

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) No 596/2014 which forms part of UK

law by virtue of the European Union (Withdrawal) Act 2018

("MAR").

12 January 2023

Woodbois Limited

("Woodbois", the "Group" or the "Company")

Q4 Update

Financial (preliminary and unaudited)

-- $23.1m total revenue FY 2022 vs $17.5m FY 2021, a 32% increase.

-- FY 2022 gross profit up 69% to $5.9m vs FY 2021 of $3.5m.

-- FY 2022 gross profit margin increased to 25% vs 20% in FY 2021.

-- FY 2022 EBITDAS [i] of >$3m was >3x the $1.0m in FY 2021.

-- Finance charge of $1m for FY 2022 vs $0.6m for FY 2021.

-- Q4 2022 revenue rose 25% to $6m vs $4.8m in Q4 2021.

-- Cash balance of $2.3m as at 31(st) December 2022.

-- Period end working capital [ii] of $10.1m, of which inventory

was $4.6m and excluding bank and other loans of $14.3m.

Operational

-- 2022 sawn timber production of approximately 18,600m3, a 42% increase year-on-year ("YOY").

-- 2022 veneer production of approximately 5,200m3, a 38% increase YOY.

-- Installation of second veneer line completed during H2 2022,

with further volume increase expected in 2023.

-- First afforestation application: decision awaited.

-- In Mozambique, conditions remain challenging and the Group

continues to review its strategic options.

-- The search for a further independent non-executive director is in progress.

Reflections on 2022 and outlook for 2023

2022 marked another solid year of progress for the Group with

increased levels of production at both factories in Gabon resulting

in an unaudited revenue increase of 32% to $23.1m and a 69% rise in

Gross Profit to $5.9m. EBITDAS increased by more than 3x.

Sawn timber provided the largest contribution to the growth of

revenues with the investment made in plant and machinery in our

sawmill over the last three years reflected in consistently higher

levels of production. The contribution from sales of veneer was

more muted owing to logistical delays in the commissioning of the

second production line, completed in H2 2022. The shortfall in

expected veneer revenue was partially made up by log sales to other

veneer producers in Gabon.

Our focus on higher value-add products and markets, in

combination with the gradual decline in shipping costs throughout

the year, allowed an improvement in gross profit margins to 25%, up

from 20% in 2021.

We dealt with a number of challenges during 2022, including an

increase in the cost and, at times, limited supplies of diesel, as

well as a later and heavier than usual rainy season severely

affecting forestry operations and transportation of raw material.

The latter led to us shutting our factories two weeks earlier than

planned at the beginning of December. Normal operations have

resumed on time in January.

In 2023 our overriding priority is to generate consistent,

positive cash flow from our substantial forestry assets to ensure

that we continue to grow the business and meet any debt repayments.

The scale at which we are able to grow and generate net cash in the

immediate future will be partially subject to external economic

conditions, which we continue to monitor closely and respond

to.

We will continue to invest in delivering further operational

productivity improvements, development of our in-house systems to

optimise sales of our own products and working towards our FSC

certification, which will continue to be a high priority and for

which we are currently more than 60% complete. The investment and

work that has been undertaken to this point provide grounds for

optimism that the Company will deliver further improvements in

profitability.

Carbon division

Having attended COP27 as part of Gabon's delegation, the Company

remains in close contact with the relevant ministries in Gabon

regarding our application for our first large-scale afforestation

project. An initial, limited pilot planting project will commence

during 2023 either in our concession area or in an area under

discussion with the relevant ministry. This will be scaled up once

any grant of land has been confirmed and the pilot has been proven

successful.

Financing

We are grateful to our largest shareholder, Lombard Odier, for

agreeing to extend the duration of our $1.0m working capital

finance facility. The loan remains fully drawn and is repayable as

receivables are settled, with further re-draw requests remaining at

their discretion . The interest rate remains at 8.5% per annum and

the loan is expected to be amortised and repaid during 2023. We

were also pleased to have been able to expand our working capital

loan with our bank partners by $1m, which was drawn in Q4 2022.

Share capital

Following a final adjustment in relation to the 2017 purchase of

Woodbois Aps, the Company has received 19,138,147 ordinary voting

shares. Following this , the Company's total number of Ordinary

Shares in issue will remain 2,489,988,873 and this will consist of

2,235,850,726 Voting Ordinary Shares, 19,138,147 Treasury Shares

and 235,000,000 Non-Voting Ordinary Shares. The aforementioned

figure of 2,235,850,726 Voting Ordinary Shares may be used by

shareholders in the Company as the denominator for the calculations

by which they will determine if they are required to notify their

interest in, or a change to their interest in the Company under the

Financial Conduct Authority's Disclosure Guidance and Transparency

Rules.

Commenting on today's announcement, CEO Paul Dolan said:

Our team feels justifiably proud of what it has delivered in

2022. We are prepared for the challenges and optimistic for the

outcomes that await us in the year ahead. Plans to continue the

operational and financial growth are in place. Our ambition is to

continue strive for a position of leadership within a fragmented

industry, whilst moving further up the value chain. The headwinds

facing the global economy as we enter 2023 reinforce our management

team's primary focus on becoming cash flow generative on a

consistent and sustainable basis and thence to become dividend

paying .

(i) EBITDAS is a non-IFRS measure and refers to Earnings Before

Interest, Tax, Depreciation, Amortisation and Share based

payments.

(ii) Working Capital is a non-IFRS measure and consists of Cash,

plus Inventory, plus Receivables, less Payables.

Enquiries:

Woodbois Limited +44 (0)20 7099 1940

Paul Dolan - Chief Executive Officer

Carnel Geddes - Chief Financial Officer

Canaccord Genuity, Nominated Advisor +44 (0)20 7523 8000

Henry Fitzgerald-O'Connor

Harry Pardoe

Gordon Hamilton

Background on Woodbois

Woodbois Limited (AIM:WBI) is an African-focused forestry

company, divided into three distinct, but highly complementary

divisions comprising the production and supply of sustainable

African hardwood products, the trading of hardwood and hardwood

products, and a reforestation and carbon credit division.

Woodbois' forestry division has production facilities in Gabon

and Mozambique, managing a total of c470,000 hectares of natural

forest concessions. The trading division comprises a highly

experienced team of timber specialists, who source and supply

sustainable timber to a global customer base. Its proprietary

technology developed in-house, captures, stores and presents data,

providing a matching engine to build scale and optimise trading

opportunities with its global customer base.

The Company's carbon sequestration and trading division was

formed in March 2021 and aims to generate voluntary carbon credits

for corporate partners through the delivery of large-scale

reforestation projects.

The Company's focus on the transparency and sustainability of

its timber operations has been recognised by The Zoological Society

of London, which ranked Woodbois joint sixth in its Sustainability

Policy Transparency Toolkit ('SPOTT") ESG policy transparency

assessments for the worldwide timber and pulp industries for

2021.

Please follow the Company on Twitter: @WoodboisLtd

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDUAVKROAUAAAR

(END) Dow Jones Newswires

January 12, 2023 02:00 ET (07:00 GMT)

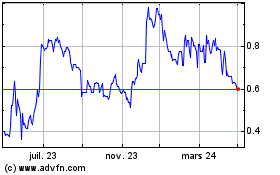

Woodbois (LSE:WBI)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

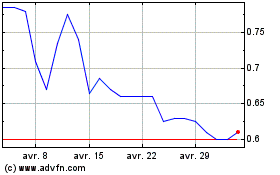

Woodbois (LSE:WBI)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024