Arch Capital Group Ltd. Announces Launch of Public Offering of Preferred Shares

15 Mai 2006 - 3:44PM

Business Wire

Arch Capital Group Ltd. (NASDAQ: ACGL) announced today that it has

launched a public offering to sell a new series of its

Non-Cumulative Preferred Shares. The Company intends to use the net

proceeds of the offering for general corporate purposes, including

contributions to the capital of its wholly owned insurance and

reinsurance subsidiaries to support their underwriting activities.

The Company expects the preferred shares to be rated Baa3 by

Moody's Investors Service, BB+ by Standard & Poor's and BBB- by

Fitch Ratings. The Company intends to apply to have the preferred

shares listed on the NYSE. The offering will be led by Merrill

Lynch & Co., Citigroup, JPMorgan and Wachovia Securities, as

joint book-running managers. Credit Suisse and UBS Investment Bank

are senior co-managers for the offering. Arch Capital Group Ltd. is

a Bermuda public limited liability company with approximately $3.05

billion in capital at March 31, 2006 and, through operations in

Bermuda, the United States, Europe and Canada, writes insurance and

reinsurance on a worldwide basis. This press release shall not

constitute an offer to sell or the solicitation of an offer to buy,

nor shall there be any sale of these securities in any state in

which the offer, solicitation or sale would be unlawful prior to

the registration or qualification under the securities laws of any

such state. A registration statement relating to the preferred

shares has previously been filed with, and declared effective by,

the Securities and Exchange Commission. Any offer, if at all, will

be made only by means of a prospectus, including a prospectus

supplement, forming a part of the effective registration statement.

When available, copies of the prospectus supplement and base

prospectus relating to the offering may be obtained from Merrill

Lynch & Co., 4 World Financial Center, New York, NY 10080,

Citigroup Global Markets Inc., Brooklyn Army Terminal, 140 58th

Street, 8th Floor, Brooklyn, NY 11220, J. P. Morgan Securities

Inc., 270 Park Avenue, New York, NY 10017, Attention: High Grade

Syndicate Desk - 8th Floor, telephone: 212-834-4533, and Wachovia

Securities, 8739 Research Dr, Mail Code: NC0675, Attention: Hope

Karriker, Charlotte, NC 28262, telephone: 704-593-7212 Cautionary

Note Regarding Forward-Looking Statements The Private Securities

Litigation Reform Act of 1995 provides a "safe harbor" for

forward-looking statements. This release or any other written or

oral statements made by or on behalf of Arch Capital Group Ltd. and

its subsidiaries (collectively, the "Company") may include

forward-looking statements which reflect the Company's current

views with respect to future events and financial performance.

Forward-looking statements involve the Company's current assessment

of risks and uncertainties, which may cause actual events and

results and prospects to differ materially from those expressed or

implied in these statements. Certain information regarding such

risks and uncertainties is set forth in the Company's filings with

the Securities and Exchange Commission. The Company undertakes no

obligation to publicly update or revise any forward-looking

statement, whether as a result of new information, future events or

otherwise.

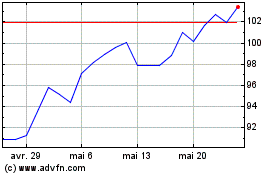

Arch Capital (NASDAQ:ACGL)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Arch Capital (NASDAQ:ACGL)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024