A.M. Best Affirms Ratings of Arch Reinsurance Ltd.

02 Août 2007 - 8:07PM

Business Wire

A.M. Best Co. has affirmed the financial strength rating (FSR) of A

(Excellent) and the issuer credit ratings (ICR) of �a� of Arch

Reinsurance Ltd. (Arch) (Bermuda) and its reinsured affiliates.

A.M. Best also has affirmed the ICR of �bbb-� of Arch Capital Group

(US) Inc. (Greenwich, CT), and the ICR of �bbb� and all debt

ratings of Arch Capital Group Limited (Bermuda) (NASDAQ: ACGL). The

outlook for all ratings is stable. (See below for a detailed list

of the companies and ratings.) These ratings reflect Arch�s

excellent capitalization, strong operating performance since its

inception and robust risk management system. Arch�s proven risk

management capabilities have created a recent and historical

operating performance, enabling the company to be among the leaders

in the Bermuda market. Arch, along with its affiliated companies,

offers primary and reinsurance coverage for both property/casualty

lines on a worldwide basis. The combination of Arch�s risk

management characteristics, operational controls and diversified

business profile have created an organization capable of

effectively responding to changes in the market cycle. Furthermore,

the company�s solid financial flexibility provides strong access to

both debt and equity markets. Arch�s financial leverage measures

remain low as compared to the industry. A.M. Best expects the

company to maintain financial leverage as measured by debt and

preferred-to-total capital below 20%, while fixed charge coverage

is expected to remain in the upper single digit range. Arch�s

reinsurance and insurance casualty loss reserves for earlier

accident years have been maturing and proven to be within

conservative ranges. The absence of adverse development in these

reserves has provided A.M. Best with comfort concerning Arch�s

initial loss ratio assumptions. Partially offsetting these

strengths will be Arch�s ability to maintain its underwriting

discipline and competitive position within its chosen markets given

the additional capital that has entered the industry through new

company formations, sidecars and strong 2006 earnings. The FSR of A

(Excellent) and ICRs of �a� have been affirmed for Arch Reinsurance

Ltd. and its following reinsured affiliates: Arch Reinsurance

Company Arch Insurance Company Arch Specialty Insurance Company

Arch Excess & Surplus Insurance Company Arch Insurance Company

(Europe) Ltd The ICR of �bbb� has been affirmed for Arch Capital

Group Limited. The ICR of �bbb-� has been affirmed for Arch Capital

Group (US) Inc. The following debt ratings have been affirmed: Arch

Capital Group Limited� -- �bbb� on $300 million 7.35% senior

unsecured notes, due 2034 -- �bb+� on $200 million 8%

non-cumulative preferred shares, Series A, due 2011 -- �bb+� on

$125 million 7.875% non-cumulative preferred shares, Series B The

following indicative shelf ratings have been affirmed for debt

securities available under the existing shelf registrations: Arch

Capital Group Limited� -- �bbb� on senior debt -- �bbb-� on

subordinated debt -- �bb+� on preferred stock Arch Capital Group

(U.S.) Inc. (guaranteed by Arch Capital Group Limited)� -- �bbb� on

senior debt Founded in 1899, A.M. Best Company is a full-service

credit rating organization dedicated to serving the financial

services industries, including the banking and insurance sectors.

For more information, visit www.ambest.com.

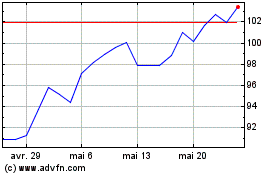

Arch Capital (NASDAQ:ACGL)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Arch Capital (NASDAQ:ACGL)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024