A.M. Best Affirms Ratings of Arch Reinsurance Ltd. and Its Affiliates

15 Décembre 2009 - 4:12PM

Business Wire

A.M. Best Co. has affirmed the financial strength rating

(FSR) of A (Excellent) and issuer credit ratings (ICR) of “a+” of

Arch Reinsurance Ltd. (Arch) (Bermuda) and its reinsured

affiliates. A.M. Best also has affirmed the ICRs of “bbb” and

“bbb+” of Arch Capital Group (US) Inc. (New York, NY) and

Arch Capital Group Ltd (Bermuda) (NASDAQ: ACGL),

respectively. Concurrently, A.M. Best has affirmed all debt ratings

of Arch Capital Group Ltd. The outlook for all ratings is stable.

(See below for a detailed listing of the companies and

ratings.)

In addition, A.M. Best has withdrawn the FSR of A (Excellent)

and ICR of “a+” of Arch Indemnity Insurance Company (Omaha,

NE) and assigned an NR-5 (Not Formally Followed) to the FSR and an

“nr” to the ICR. These withdrawals are due to management’s decision

to postpone development of its business plans in this entity given

the current soft business conditions.

The affirmation of the ratings reflects Arch’s strong operating

performance, consistently excellent capitalization and demonstrated

risk management. Arch maintains a strong underwriting culture and

its overall underwriting performance continues to place it among

the leaders in the Bermuda market. Products are offered on a

worldwide basis in both primary and reinsurance markets for

property/casualty lines of business.

Arch places its operating emphasis on managing the underwriting

cycle and adapts its overall book of business to optimize profit

potential and limit exposure. Furthermore, Arch maintains a prudent

investment portfolio that does not place excessive risk on the

asset side of the balance sheet

Partially offsetting these positive rating attributes will be

Arch’s ability to maintain its underwriting discipline within its

chosen markets given the current soft market conditions. In

addition, as an underwriter of medium to long-tail casualty

businesses, Arch needs to be cognizant of exposure to potential

inflationary pressures.

The FSR of A (Excellent) and ICRs of “a+” has been affirmed for

Arch Reinsurance Ltd. and its following affiliates:

- Arch Reinsurance

Company

- Arch Insurance

Company

- Arch Specialty Insurance

Company

- Arch Excess & Surplus

Insurance Company

- Arch Insurance Company

(Europe) Ltd

The ICR of “bbb+” has been affirmed for Arch Capital Group

Ltd.

The ICR of “bbb” has been affirmed for Arch Capital Group

(US) Inc.

The following debt ratings have been affirmed:

Arch Capital Group Ltd—

-- “bbb+” on $300 million 7.35% senior unsecured notes, due 2034 --

“bbb-” on $200 million 8% non-cumulative preferred shares, Series

A, due 2011 -- “bbb-” on $125 million 7.875% non-cumulative

preferred shares, Series B

The following indicative shelf ratings have been affirmed for

debt securities available under the existing shelf

registration:

Arch Capital Group Ltd—

-- “bbb+” on senior debt -- “bbb” on subordinated debt -- “bbb-” on

preferred stock

Arch Capital Group (U.S.) Inc.

(guaranteed by Arch Capital Group Ltd)—

-- “bbb+” on senior debt -- “bbb” on subordinated debt -- “bbb-” on

preferred stock

For Best’s Credit Ratings, an overview of the rating process and

rating methodologies, please visit www.ambest.com/ratings.

The principal methodologies used in determining these ratings,

including any additional methodologies and factors, which may have

been considered, can be found at

www.ambest.com/ratings/methodology.

Founded in 1899, A.M. Best Company is a global full-service

credit rating organization dedicated to serving the financial and

health care service industries, including insurance companies,

banks, hospitals and health care system providers. For more

information, visit www.ambest.com.

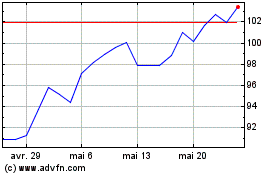

Arch Capital (NASDAQ:ACGL)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Arch Capital (NASDAQ:ACGL)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024