Arch Capital Group Ltd. (NASDAQ: ACGL) reports that net income

available to common shareholders for the 2010 third quarter was

$141.6 million, or $2.77 per share, compared to $274.4 million, or

$4.39 per share, for the 2009 third quarter. The Company also

reported after-tax operating income available to common

shareholders of $130.7 million, or $2.55 per share, for the 2010

third quarter, compared to $160.3 million, or $2.56 per share, for

the 2009 third quarter. All earnings per share amounts discussed in

this release are on a diluted basis.

The Company’s book value per common share was $89.24 at

September 30, 2010, an 8.7% increase from $82.07 per share at June

30, 2010 and a 22.2% increase from $73.01 per share at December 31,

2009. The Company’s after-tax operating income available to common

shareholders represented a 12.3% annualized return on average

common equity for the 2010 third quarter, compared to 16.4% for the

2009 third quarter. After-tax operating income available to common

shareholders, a non-GAAP measure, is defined as net income

available to common shareholders, excluding net realized gains or

losses, net impairment losses recognized in earnings, equity in net

income or loss of investment funds accounted for using the equity

method and net foreign exchange gains or losses, net of income

taxes. See page 7 for a further discussion of after-tax operating

income available to common shareholders and Regulation G.

The following table summarizes the Company’s underwriting

results:

Three Months Ended Nine Months Ended

September 30, September 30, (U.S. dollars in

thousands)

2010 2009 2010

2009 Gross premiums written $ 831,788 $ 937,328 $

2,602,575 $ 2,874,219 Net premiums written 636,117 727,308

2,028,129 2,244,025 Net premiums earned 627,409 734,385 1,920,337

2,134,207 Underwriting income 60,486 73,835 146,648 256,848

Combined ratio 90.4 % 90.0 % 92.4 % 88.0 %

The following table summarizes, on an after-tax basis, the

Company’s consolidated financial data, including a reconciliation

of after-tax operating income available to common shareholders to

net income available to common shareholders and related diluted per

share results:

Three Months Ended Nine Months

Ended September 30, September 30, (U.S. dollars

in thousands, except share data)

2010 2009

2010 2009

After-tax operating income available to

common shareholders

$ 130,672 $ 160,332 $ 361,585 $ 492,374 Net realized gains, net of

tax 68,611 69,190 175,233 48,836

Net impairment losses recognized in

earnings, net of tax

(2,075 ) (4,643 ) (8,091 ) (61,563 )

Equity in net income of investment funds

accounted for using the equity method, net of tax

9,708 69,119 38,410 135,428 Net foreign exchange gains (losses),

net of tax (65,346 ) (19,591 ) 21,956

(48,670 )

Net income available to common

shareholders

$ 141,570 $ 274,407 $ 589,093 $ 566,405

Diluted per common share results:

After-tax operating income available to

common shareholders

$ 2.55 $ 2.56 $ 6.78 $ 7.87 Net realized gains, net of tax 1.34

1.11 3.29 0.78

Net impairment losses recognized in

earnings, net of tax

(0.04 ) (0.08 ) (0.15 ) (0.98 )

Equity in net income of investment funds

accounted for using the equity method, net of tax

0.19 1.11 0.72 2.16 Net foreign exchange gains (losses), net of tax

(1.27 ) (0.31 ) 0.41 (0.78 )

Net income available to common

shareholders

$ 2.77 $ 4.39 $ 11.05 $ 9.05

Weighted average common shares and common

share equivalents outstanding – diluted

51,182,009 62,533,816 53,317,198

62,590,228

The combined ratio represents a measure of underwriting

profitability, excluding investment income, and is the sum of the

loss ratio and expense ratio. A combined ratio under 100%

represents an underwriting profit and a combined ratio over 100%

represents an underwriting loss. For the 2010 third quarter, the

combined ratio of the Company’s insurance and reinsurance

subsidiaries consisted of a loss ratio of 57.3% and an underwriting

expense ratio of 33.1%, compared to a loss ratio of 60.6% and an

underwriting expense ratio of 29.4% for the 2009 third quarter. For

the nine months ended September 30, 2010, the combined ratio of the

Company’s insurance and reinsurance subsidiaries consisted of a

loss ratio of 59.9% and an underwriting expense ratio of 32.5%,

compared to a loss ratio of 58.3% and an underwriting expense ratio

of 29.7% for the nine months ended September 30, 2009. The loss

ratio of 57.3% for the 2010 third quarter was comprised of 49.4

points of paid losses, 3.8 points related to reserves for reported

losses and 4.1 points related to incurred but not reported

reserves.

In establishing the reserves for losses and loss adjustment

expenses, the Company has made various assumptions relating to the

pricing of its reinsurance contracts and insurance policies and

also has considered available historical industry experience and

current industry conditions. Any estimates and assumptions made as

part of the reserving process could prove to be inaccurate due to

several factors, including the fact that relatively limited

historical information has been reported to the Company through

September 30, 2010. As actual loss information is reported to the

Company and it develops its own loss experience, the Company will

give more emphasis to other actuarial techniques. For a discussion

of underwriting activities and a review of the Company’s results by

operating segment, see “Segment Information” in the Supplemental

Financial Information section of this release.

The Company’s investment portfolio continues to be comprised

primarily of high quality fixed income securities with an average

credit quality of “AA+.” The average effective duration of the

portfolio was 3.11 years at September 30, 2010, compared to 2.87

years at December 31, 2009. During 2010, the Company has continued

to diversify its investment portfolio by increasing its holdings in

portfolios which include allocations to global natural resource

markets and other sectors and investment funds which invest in

global equities, fixed income securities, commodities, property and

emerging markets as part of total return objectives. Such amounts,

which are included in ‘Other investments’ on the Company’s balance

sheet, were approximately 3.5% of total investable assets at

September 30, 2010.

Including the effects of foreign exchange, total return on the

Company’s investment portfolio was approximately 3.61% for the 2010

third quarter, compared to 4.75% for the 2009 third quarter, and

7.08% for the nine months ended September 30, 2010, compared to

10.01% for the nine months ended September 30, 2009. Excluding the

effects of foreign exchange, total return was 2.94% for the 2010

third quarter, compared to 4.63% for the 2009 third quarter, and

7.31% for the nine months ended September 30, 2010, compared to

9.30% for the nine months ended September 30, 2009.

Net investment income for the 2010 third quarter was $90.8

million, or $1.77 per share, compared to $100.2 million, or $1.60

per share, for the 2009 third quarter. The comparability of net

investment income between the 2010 and 2009 periods was influenced

by the Company’s share repurchase program described below. The

pre-tax investment income yield was 3.33% for the 2010 third

quarter, compared to 3.76% for the 2009 third quarter, and 3.41%

for the nine months ended September 30, 2010, compared to 3.82% for

the nine months ended September 30, 2009. The lower yields in the

2010 periods primarily reflect lower prevailing interest rates

available in the market.

Consolidated cash flow provided by operating activities for the

2010 third quarter was $267.4 million, compared to $290.1 million

for the 2009 third quarter, and $657.6 million for the nine months

ended September 30, 2010, compared to $808.7 million for the nine

months ended September 30, 2009. The decline in operating cash

flows in the 2010 periods primarily reflect a lower premium

volume.

For the 2010 third quarter, the Company’s effective tax rates on

income before income taxes and pre-tax operating income were 2.1%

and 2.0%, respectively, compared to 0.8% and 0.5%, respectively,

for the 2009 third quarter. For the nine months ended September 30,

2010, the Company’s effective tax rates on income before income

taxes and pre-tax operating income were 1.8% and 2.0%,

respectively, compared to 3.4% and 2.9%, respectively, for the nine

months ended September 30, 2009. The Company’s effective tax rates

may fluctuate from period to period based on the relative mix of

income reported by jurisdiction primarily due to the varying tax

rates in each jurisdiction. The Company currently expects that its

annual effective tax rate on pre-tax operating income available to

common shareholders for the year ended December 31, 2010 will be in

the range of 1.0% to 3.0%. In addition, the Company’s Bermuda-based

reinsurer incurs federal excise taxes for premiums assumed on U.S.

risks. The Company incurred $8.7 million of federal excise taxes

for the nine months ended September 30, 2010, compared to $9.7

million for the nine months ended September 30, 2009. Such amounts

are reflected as acquisition expenses in the Company’s consolidated

statements of income.

Net foreign exchange losses for the 2010 third quarter were

$65.2 million (net unrealized losses of $66.1 million and net

realized gains of $0.9 million), compared to net foreign exchange

losses for the 2009 third quarter of $19.8 million (net unrealized

losses of $18.9 million and net realized losses of $0.9 million).

The 2010 third quarter net foreign exchange losses primarily

resulted from the weakening of the U.S. Dollar against the Euro,

British Pound and other currencies during the period, which

partially offset gains recorded through the first six months of

2010. Net foreign exchange gains for the nine months ended

September 30, 2010 were $22 million (net unrealized gains of $20.9

million and net realized gains of $1.1 million), compared to net

foreign exchange losses for the nine months ended September 30,

2009 of $48.2 million (net unrealized losses of $45.1 million and

net realized losses of $3.1 million).

Net unrealized foreign exchange gains or losses result from the

effects of revaluing the Company’s net insurance liabilities

required to be settled in foreign currencies at each balance sheet

date. Historically, the Company has held investments in foreign

currencies which are intended to mitigate its exposure to foreign

currency fluctuations in its net insurance liabilities. However,

changes in the value of such investments due to foreign currency

rate movements are reflected as a direct increase or decrease to

shareholders’ equity and are not included in the consolidated

statements of income. As a result of the current financial and

economic environment as well as the potential for additional

investment returns, the Company may not match a portion of its

projected liabilities in foreign currencies with investments in the

same currencies, which could increase the Company’s exposure to

foreign currency fluctuations and increase the volatility of the

Company’s shareholders’ equity.

During the 2010 third quarter, the Company repurchased 0.7

million common shares for an aggregate purchase price of $53.4

million under its share repurchase program. Since the inception of

the share repurchase program through September 30, 2010, ACGL has

repurchased 28.8 million common shares for an aggregate purchase

price of $2.01 billion. At September 30, 2010, $487.7 million of

repurchases were available under the share repurchase program.

At September 30, 2010, the Company’s capital of $5.14 billion

consisted of $300.0 million of senior notes, representing 5.8% of

the total, $125.0 million of revolving credit agreement borrowings

due in August 2011, representing 2.4% of the total, $325.0 million

of preferred shares, representing 6.3% of the total, and common

shareholders’ equity of $4.39 billion, representing the balance. At

December 31, 2009, the Company’s capital of $4.72 billion consisted

of $300.0 million of senior notes, representing 6.4% of the total,

$100.0 million of revolving credit agreement borrowings due in

August 2011, representing 2.1% of the total, $325.0 million of

preferred shares, representing 6.9% of the total, and common

shareholders’ equity of $4.00 billion, representing the

balance.

The Company will hold a conference call for investors and

analysts at 11:00 a.m. Eastern Time on Tuesday, October 26, 2010. A

live webcast of this call will be available via the Investor

Relations – Events & Presentations section of the Company's

website at http://www.archcapgroup.bm. A telephone replay of the

conference call also will be available beginning on October 26 at

2:00 p.m. Eastern Time until November 2, 2010 at midnight Eastern

Time. To access the replay, domestic callers should dial

888-286-8010 (passcode 50600078), and international callers should

dial 617-801-6888 (passcode 50600078).

Please refer to the Company’s Financial Supplement dated

September 30, 2010, which is posted on the Company’s website at

http://www.archcapgroup.bm/EarningsReleases.aspx. The Financial

Supplement provides additional detail regarding the financial

performance of the Company. From time to time, the Company posts

additional financial information and presentations to its website,

including information with respect to its subsidiaries. Investors

and other recipients of this information are encouraged to check

the Company’s website regularly, including the Investor Relations —

Events & Presentations section of the Company’s website at

http://www.archcapgroup.bm/presentations.aspx for additional

information regarding the Company.

Arch Capital Group Ltd., a Bermuda-based company with

approximately $5.14 billion in capital at September 30, 2010,

provides insurance and reinsurance on a worldwide basis through its

wholly owned subsidiaries.

Cautionary Note Regarding Forward-Looking Statements

The Private Securities Litigation Reform Act of 1995 (“PLSRA”)

provides a “safe harbor” for forward-looking statements. This

release or any other written or oral statements made by or on

behalf of the Company may include forward-looking statements, which

reflect the Company’s current views with respect to future events

and financial performance. All statements other than statements of

historical fact included in or incorporated by reference in this

release are forward-looking statements. Forward-looking statements,

for purposes of the PLSRA or otherwise, can generally be identified

by the use of forward-looking terminology such as “may,” “will,”

“expect,” “intend,” “estimate,” “anticipate,” “believe” or

“continue” and similar statements of a future or forward-looking

nature or their negative or variations or similar terminology.

Forward-looking statements involve the Company’s current

assessment of risks and uncertainties. Actual events and results

may differ materially from those expressed or implied in these

statements. Important factors that could cause actual events or

results to differ materially from those indicated in such

statements are discussed below and elsewhere in this release and in

the Company’s periodic reports filed with the Securities and

Exchange Commission (the “SEC”), and include:

- the Company’s ability to successfully

implement its business strategy during “soft” as well as “hard”

markets;

- acceptance of the Company’s business

strategy, security and financial condition by rating agencies and

regulators, as well as by brokers and its insureds and

reinsureds;

- the Company’s ability to maintain or

improve its ratings, which may be affected by its ability to raise

additional equity or debt financings, by ratings agencies’ existing

or new policies and practices, as well as other factors described

herein;

- general economic and market conditions

(including inflation, interest rates, foreign currency exchange

rates and prevailing credit terms) and conditions specific to the

reinsurance and insurance markets in which the Company

operates;

- competition, including increased

competition, on the basis of pricing, capacity, coverage terms or

other factors;

- developments in the world’s financial

and capital markets and the Company’s access to such markets;

- the Company’s ability to successfully

integrate, establish and maintain operating procedures (including

the implementation of improved computerized systems and programs to

replace and support manual systems) to effectively support its

underwriting initiatives and to develop accurate actuarial

data;

- the loss of key personnel;

- the integration of businesses the

Company has acquired or may acquire into its existing

operations;

- accuracy of those estimates and

judgments utilized in the preparation of the Company’s financial

statements, including those related to revenue recognition,

insurance and other reserves, reinsurance recoverables, investment

valuations, intangible assets, bad debts, income taxes,

contingencies and litigation, and any determination to use the

deposit method of accounting, which for a relatively new insurance

and reinsurance company, like the Company, are even more difficult

to make than those made in a mature company since relatively

limited historical information has been reported to the Company

through September 30, 2010;

- greater than expected loss ratios on

business written by the Company and adverse development on claim

and/or claim expense liabilities related to business written by its

insurance and reinsurance subsidiaries;

- severity and/or frequency of

losses;

- claims for natural or man-made

catastrophic events in the Company’s insurance or reinsurance

business could cause large losses and substantial volatility in its

results of operations;

- acts of terrorism, political unrest and

other hostilities or other unforecasted and unpredictable

events;

- losses relating to aviation business

and business produced by a certain managing underwriting agency for

which the Company may be liable to the purchaser of its prior

reinsurance business or to others in connection with the

May 5, 2000 asset sale described in the Company’s periodic

reports filed with the SEC;

- availability to the Company of

reinsurance to manage its gross and net exposures and the cost of

such reinsurance;

- the failure of reinsurers, managing

general agents, third party administrators or others to meet their

obligations to the Company;

- the timing of loss payments being

faster or the receipt of reinsurance recoverables being slower than

anticipated by the Company;

- the Company’s investment performance,

including legislative or regulatory developments that may adversely

affect the market value of the Company’s investments;

- material differences between actual and

expected assessments for guaranty funds and mandatory pooling

arrangements;

- changes in accounting principles or

policies or in the Company’s application of such accounting

principles or policies;

- changes in the political environment of

certain countries in which the Company operates or underwrites

business;

- statutory or regulatory developments,

including as to tax policy matters and insurance and other

regulatory matters such as the adoption of proposed legislation

that would affect Bermuda-headquartered companies and/or

Bermuda-based insurers or reinsurers and/or changes in regulations

or tax laws applicable to the Company, its subsidiaries, brokers or

customers; and

- the other matters set forth under Item

1A “Risk Factors”, Item 7 “Management’s Discussion and Analysis of

Financial Condition and Results of Operations” and other sections

of the Company’s Annual Report on Form 10-K, as well as the other

factors set forth in the Company’s other documents on file with the

SEC, and management’s response to any of the aforementioned

factors.

All subsequent written and oral forward-looking statements

attributable to the Company or persons acting on its behalf are

expressly qualified in their entirety by these cautionary

statements. The foregoing review of important factors should not be

construed as exhaustive and should be read in conjunction with

other cautionary statements that are included herein or elsewhere.

The Company undertakes no obligation to publicly update or revise

any forward-looking statement, whether as a result of new

information, future events or otherwise.

Comment on Regulation G

Throughout this release, the Company presents its operations in

the way it believes will be the most meaningful and useful to

investors, analysts, rating agencies and others who use the

Company’s financial information in evaluating the performance of

the Company. This presentation includes the use of after-tax

operating income available to common shareholders, which is defined

as net income available to common shareholders, excluding net

realized gains or losses, net impairment losses included in

earnings, equity in net income or loss of investment funds

accounted for using the equity method and net foreign exchange

gains or losses, net of income taxes. The presentation of after-tax

operating income available to common shareholders is a “non-GAAP

financial measure” as defined in Regulation G. The reconciliation

of such measure to net income available to common shareholders (the

most directly comparable GAAP financial measure) in accordance with

Regulation G is included on page 2 of this release.

The Company believes that net realized gains or losses, net

impairment losses included in earnings, equity in net income or

loss of investment funds accounted for using the equity method and

net foreign exchange gains or losses in any particular period are

not indicative of the performance of, or trends in, the Company’s

business performance. Although net realized gains or losses, net

impairment losses included in earnings, equity in net income or

loss of investment funds accounted for using the equity method and

net foreign exchange gains or losses are an integral part of the

Company’s operations, the decision to realize investment gains or

losses, the recognition of net impairment losses, the recognition

of equity in net income or loss of investment funds accounted for

using the equity method and the recognition of foreign exchange

gains or losses are independent of the insurance underwriting

process and result, in large part, from general economic and

financial market conditions. Furthermore, certain users of the

Company’s financial information believe that, for many companies,

the timing of the realization of investment gains or losses is

largely opportunistic. In addition, net impairment losses included

in earnings on the Company’s investments represent

other-than-temporary declines in expected recovery values on

securities without actual realization. The use of the equity method

on certain of the Company’s investments in certain funds that

invest in fixed maturity securities is driven by the ownership

structure of such funds (either limited partnerships or limited

liability companies). In applying the equity method, these

investments are initially recorded at cost and are subsequently

adjusted based on the Company’s proportionate share of the net

income or loss of the funds (which include changes in the market

value of the underlying securities in the funds). This method of

accounting is different from the way the Company accounts for its

other fixed maturity securities and the timing of the recognition

of equity in net income or loss of investment funds accounted for

using the equity method may differ from gains or losses in the

future upon sale or maturity of such investments. Due to these

reasons, the Company excludes net realized gains or losses, equity

in net income or loss of investment funds accounted for using the

equity method and net foreign exchange gains or losses from the

calculation of after-tax operating income available to common

shareholders.

The Company believes that showing net income available to common

shareholders exclusive of the items referred to above reflects the

underlying fundamentals of the Company’s business since the Company

evaluates the performance of and manages its business to produce an

underwriting profit. In addition to presenting net income available

to common shareholders, the Company believes that this presentation

enables investors and other users of the Company’s financial

information to analyze the Company’s performance in a manner

similar to how the Company’s management analyzes performance. The

Company also believes that this measure follows industry practice

and, therefore, allows the users of the Company’s financial

information to compare the Company’s performance with its industry

peer group. The Company believes that the equity analysts and

certain rating agencies which follow the Company and the insurance

industry as a whole generally exclude these items from their

analyses for the same reasons.

ARCH CAPITAL GROUP LTD. AND

SUBSIDIARIES

SUPPLEMENTAL FINANCIAL

INFORMATION

Book Value Per Common Share

September 30, December 31, (U.S. dollars in

thousands, except share data)

2010 2009

Calculation of book value per common share: Total shareholders’

equity $ 4,717,910 $ 4,323,349 Less preferred shareholders’ equity

(325,000 ) (325,000 ) Common shareholders’ equity $

4,392,910 $ 3,998,349 Common shares outstanding, net of treasury

shares (1) 49,225,371 54,761,678 Book

value per common share $ 89.24 $ 73.01

(1) Excludes the effects of 4,340,029 and 5,016,104 stock

options and 175,174 and 261,012 restricted stock units outstanding

at September 30, 2010 and December 31, 2009, respectively.

Share Repurchase Activity

Three Months Ended Nine Months Ended

Cumulative (U.S. dollars in thousands,

September 30,

September 30, September 30, except share data)

2010 2009 2010 2009 2010

Effect of share repurchases: Aggregate cost of shares repurchased $

53,398 $ 98,194 $ 503,724 $ 99,746 $ 2,012,321 Shares repurchased

681,065 1,533,247 6,855,205 1,566,552

28,826,317 Average price per share repurchased $ 78.40 $

64.04 $ 73.48 $ 63.67 $ 69.81

Estimated net accretive impact on diluted

earnings per share (1)

$ 0.70 $ 0.37 $ 1.65 $ 1.15

Estimated net accretive impact on ending

book value per common share (2)

$ 7.18

(1) The estimated impact on diluted earnings per share was

calculated comparing reported results versus (i) after-tax

operating income (loss) per share plus an estimate of lost net

investment income on the cumulative share repurchases divided by

(ii) weighted average diluted shares outstanding excluding the

weighted average impact of cumulative share repurchases. The impact

of cumulative share repurchases was accretive to diluted earnings

per share in the periods presented.

(2) As the cumulative average price per share of shares

repurchased through September 30, 2010 was lower than the ending

book value per common share, the repurchase of shares increased

ending book value per common share.

Investment Information

Three Months Ended Nine Months Ended September

30, September 30, (U.S. dollars in thousands, except

share data)

2010 2009 2010 2009

Components of net investment income: Fixed maturities and

short-term investments $ 94,682 $ 105,354 $ 287,009 $ 307,484

Securities lending transactions 60 487 166 2,189 Other 1,234

281 2,540 1,616

Gross investment income 95,976 106,122 289,715 311,289 Investment

expense (5,208 ) (5,909 ) (15,438 )

(14,709 ) Net investment income $ 90,768 $ 100,213 $

274,277 $ 296,580 Per share $ 1.77 $ 1.60 $

5.14 $ 4.74

Investment income yield, at amortized cost

(1): Pre-tax 3.33 % 3.76 % 3.41 % 3.82 % After-tax 3.22 % 3.64

% 3.30 % 3.70 % Cash flow from operations $ 267,424 $

290,119 $ 657,561 $ 808,664

(1) Investment income yield calculations exclude the impact of

investments for which returns are not included within investment

income, such as investments accounted for using the equity method

and certain equities.

September 30, December 31, (U.S.

dollars in thousands)

2010 2009 Investable

assets: Fixed maturities available for sale, at market value $

9,810,102 $ 9,391,926 Fixed maturities pledged under securities

lending agreements, at market value (1) 184,226

208,826 Total fixed maturities 9,994,328 9,600,752

Short-term investments available for sale, at market value 780,671

571,490

Short-term investments pledged under

securities lending agreements, at market value (1)

18,995 3,993 Cash 365,997 334,571 TALF investments, at market value

(2) 410,881 250,265 Other investments Credit funds 231,851 63,146

Equity securities and other 186,560 109,027 Investment funds

accounted for using the equity method (3) 432,418 391,869

Securities transactions entered into but not settled at the balance

sheet date (319,954 ) 50,790 Total investable

assets (1) $ 12,101,747 $ 11,375,903

Fixed

income portfolio (1): Average effective duration (in years)

3.11 2.87 Average credit quality AA+ AA+ Imbedded book yield on

fixed maturities (before investment expenses) 3.53 % 3.64 %

(1) This table excludes the collateral received and reinvested

and includes the fixed maturities and short-term investments

pledged under securities lending agreements, at market value.

(2) The Federal Reserve's Term Asset-Backed Securities Loan

Facility ("TALF") provides secured financing for certain

asset-backed securities and legacy commercial mortgage-backed

securities. TALF financing is non-recourse to the Company, is

collateralized by the purchased securities and provides financing

for the purchase price of the securities, less a 'haircut' that

varies based on the type of collateral. The Company can deliver the

collateralized securities to the Federal Reserve in full defeasance

of the loan.

(3) Changes in the carrying value of investments accounted for

using the equity method are recorded as ‘Equity in net income

(loss) of investment funds accounted for using the equity method’

rather than as an unrealized gain or loss component of accumulated

other comprehensive income in shareholders’ equity.

Selected Information on Losses and Loss Adjustment Expenses

Three Months Ended

Nine Months Ended September 30, September 30,

(U.S. dollars in thousands)

2010 2009 2010

2009

Components of losses and loss

adjustment expenses incurred

Paid losses and loss adjustment expenses $ 310,172 $ 365,423 $

938,231 $ 1,079,341 Increase in unpaid losses and loss adjustment

expenses 49,021 79,491 212,158

164,973 Total losses and loss adjustment

expenses $ 359,193 $ 444,914 $ 1,150,389 $

1,244,314

Estimated net (favorable) adverse

development in prior year loss reserves, net of related

adjustments

Net impact on underwriting results: Insurance $ (8,193 ) $ (17,939

) $ (5,375 ) $ (45,114 ) Reinsurance (29,059 )

(38,508 ) (94,242 ) (120,996 ) Total $ (37,252 ) $

(56,447 ) $ (99,617 ) $ (166,110 ) Impact on losses and loss

adjustment expenses: Insurance $ (9,251 ) $ (16,770 ) $ (13,307 ) $

(44,585 ) Reinsurance (29,327 ) (38,995 )

(94,884 ) (124,437 ) Total $ (38,578 ) $ (55,765 ) $

(108,191 ) $ (169,022 ) Impact on acquisition expenses:

Insurance $ 1,058 $ (1,169 ) $ 7,932 $ (529 ) Reinsurance

268 487 642 3,441

Total $ 1,326 $ (682 ) $ 8,574 $ 2,912

Impact on combined ratio: Insurance (2.0 %) (4.1 %) (0.4 %) (3.6 %)

Reinsurance (13.5 %) (13.2 %) (14.0 %) (13.9 %) Total (5.9 %) (7.7

%) (5.2 %) (7.8 %) Impact on loss ratio: Insurance (2.2 %)

(3.8 %) (1.1 %) (3.5 %) Reinsurance (13.6 %) (13.4 %) (14.1 %)

(14.3 %) Total (6.1 %) (7.6 %) (5.6 %) (7.9 %) Impact on

acquisition expense ratio: Insurance 0.2 % (0.3 %) 0.7 % (0.1 %)

Reinsurance 0.1 % 0.2 % 0.1 % 0.4 % Total 0.2 % (0.1 %) 0.4 % 0.1 %

Estimated net losses incurred from

current accident year catastrophic events (1)

Insurance $ 2,513 $ - $ 29,812 $ - Reinsurance 21,644

5,271 59,441 13,310 Total

$ 24,157 $ 5,271 $ 89,253 $ 13,310

Impact on loss ratio: Insurance 0.6 % 0.0 % 2.4 % 0.0 %

Reinsurance 10.0 % 1.8 % 8.8 % 1.5 % Total 3.9 % 0.7 % 4.6 % 0.6 %

(1) Equals estimated losses from catastrophic events occurring

in the current accident year, net of reinsurance and reinstatement

premiums. Amounts shown for the insurance segment are for named

catastrophic events only. Amounts shown for the reinsurance segment

include (i) named events with over $5 million of losses incurred by

its Bermuda and Europe operations and (ii) all catastrophe losses

incurred by its U.S. operations.

Segment Information – Discussion of 2010 Third Quarter

Performance

For additional details regarding the Company’s operating

segments, please refer to the Company’s Financial Supplement dated

September 30, 2010 on the Company’s website at

http://www.archcapgroup.bm/EarningsReleases.aspx.

Insurance Segment

Three Months Ended September

30, (U.S. dollars in thousands)

2010 2009

Gross premiums written $ 624,490 $ 673,986 Net premiums

written 431,361 473,676 Net premiums earned 411,881 443,319

Underwriting income 2,947 7,413 Loss ratio 64.4 % 68.4 %

Acquisition expense ratio 16.1 % 13.6 % Other operating expense

ratio 18.7 % 16.3 % Combined ratio 99.2 %

98.3 % Catastrophic activity and prior year

development: Current accident year catastrophic events 0.6 % 0.0 %

Net favorable development in prior year

loss reserves, net of related adjustments

(2.0 %) (4.1 %) Combined ratio excluding such items

100.6 % 102.4 %

Gross premiums written by the insurance segment in the 2010

third quarter were 7.3% lower than in the 2009 third quarter as

reductions in commercial aviation, property, executive assurance

and national accounts casualty lines of business were partially

offset by increases in collateral protection business and energy

casualty business. The reduction in commercial aviation business

primarily resulted from a strategic decision to exit the business

while the lower level of property and executive assurance business

was due in part to market conditions. The lower level of national

accounts casualty business resulted from the non-renewal of one

account and changes in ceded reinsurance structure. Growth in

collateral protection business and energy casualty business was

generated through new business opportunities.

Net premiums written were 8.9% lower than in the 2009 third

quarter and also reflect changes in the mix of business,

reinstatement premiums and the impact of changes in reinsurance

structure. Net premiums earned by the insurance segment in the 2010

third quarter were 7.1% lower than in the 2009 third quarter, and

reflect changes in net premiums written over the previous five

quarters.

The 2010 third quarter loss ratio included 0.6 points for

current year catastrophic event activity, primarily related to the

New Zealand earthquake event, while the 2009 third quarter did not

include any significant catastrophic activity. In addition, the

2010 third quarter loss ratio benefitted from a lower level of

large loss activity than the 2009 third quarter. Estimated net

favorable development, before related adjustments, reduced the loss

ratio by 2.2 points in the 2010 third quarter, compared to 3.8

points in the 2009 third quarter. The estimated net favorable

development in the 2010 third quarter primarily resulted from

better than expected claims emergence in property and other

short-tail lines, primarily from the 2005 to 2008 accident years,

and executive assurance business from the 2004 and 2007 accident

years.

The underwriting expense ratio was 34.8% in the 2010 third

quarter, compared to 29.9% in the 2009 third quarter. The

acquisition expense ratio was 16.1% in the 2010 third quarter,

compared to 13.6% in the 2009 third quarter. The 2010 third quarter

ratio included 0.8 points of contingent commissions, compared to

0.3 points in the 2009 third quarter, and reflects changes in the

form of reinsurance ceded and mix of business. The operating

expense ratio was 18.7% in the 2010 third quarter, compared to

16.3% in the 2009 third quarter, with the increase due in part to a

lower level of net premiums earned in the 2010 third quarter. In

addition, the 2010 third quarter operating expense ratio reflected

0.7 points related to costs incurred which are not expected to

impact the insurance segment’s results in the 2010 fourth

quarter.

Reinsurance Segment Three

Months Ended September 30, (U.S. dollars in thousands)

2010 2009 Gross premiums written $ 208,770 $

266,193 Net premiums written 204,756 253,632 Net premiums earned

215,528 291,066 Underwriting income 57,539 66,422 Loss ratio

43.5 % 48.7 % Acquisition expense ratio 20.4 % 21.2 % Other

operating expense ratio 9.4 % 7.3 % Combined ratio

73.3 % 77.2 % Catastrophic activity and prior

year development: Current accident year catastrophic events 10.0 %

1.8 %

Net favorable development in prior year

loss reserves, net of related adjustments

(13.5 %) (13.2 %) Combined ratio excluding such items

76.8 % 88.6 %

Gross premiums written by the reinsurance segment in the 2010

third quarter were 21.6% lower than in the 2009 third quarter,

primarily due to share decreases and non-renewals in property other

than property catastrophe, casualty and property catastrophe

business, partially offset by growth in the reinsurance segment’s

other specialty line. Net premiums written by the reinsurance

segment in the 2010 third quarter were 19.3% lower than in the 2009

third quarter, primarily due to the items noted above. Net premiums

earned in the 2010 third quarter were 26.0% lower than in the 2009

third quarter, and reflect changes in net premiums written over the

previous five quarters, including the mix and type of business

written.

The 2010 third quarter loss ratio included 10.0 points related

to current year catastrophic activity, primarily related to the New

Zealand earthquake event, compared to 1.8 points in the 2009 third

quarter. Estimated net favorable development, before related

adjustments, reduced the loss ratio by 13.6 points in the 2010

third quarter, compared to 13.4 points in the 2009 third quarter.

The estimated net favorable development in the 2010 third quarter

primarily resulted from better than expected claims emergence in

property and other short-tail lines, primarily from the 2006 to

2009 underwriting years, and casualty business from the 2003 to

2005 underwriting years. The balance of the change in the 2010

third quarter loss ratio reflected an increase in the underwriting

profit of the reinsurance segment’s property facultative

operations, a lower level of large loss activity than in the 2009

third quarter. In addition, the 2010 third quarter included a

higher level of shorter-tail premiums earned and an increase in the

percentage of premiums earned from excess of loss contracts than in

the 2009 third quarter, resulting in a lower loss ratio in the nine

months ended September 30, 2010 period.

The underwriting expense ratio was 29.8% in the 2010 third

quarter, compared to 28.5% in the 2009 third quarter. The

acquisition expense ratio for the 2010 third quarter was 20.4%,

compared to 21.2% for the 2009 third quarter. The comparison of the

2010 third quarter and 2009 third quarter acquisition expense

ratios is influenced by, among other things, the mix and type of

business written and earned and the level of ceding commission

income. The 2010 third quarter other operating expense ratio of

9.4% was higher than in the 2009 third quarter primarily due to the

lower level of net premiums earned and a higher contribution to net

premiums earned from the reinsurance segment’s property facultative

operations which operate primarily on a direct basis and,

accordingly, at a higher operating expense ratio.

ARCH CAPITAL GROUP LTD. AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

INCOME

(U.S. dollars in thousands, except

share data)

(Unaudited) (Unaudited) Three Months

Ended Nine Months Ended September 30,

September 30, 2010 2009 2010

2009 Revenues Net premiums written $ 636,117 $

727,308 $ 2,028,129 $ 2,244,025 Change in unearned premiums

(8,708 ) 7,077 (107,792 ) (109,818 )

Net premiums earned 627,409 734,385 1,920,337 2,134,207 Net

investment income 90,768 100,213 274,277 296,580 Net realized gains

68,828 70,638 178,724 53,681 Other-than-temporary impairment

losses (2,679 ) (7,860 ) (9,732 ) (142,663 )

Less investment impairments recognized in

other comprehensive income, before taxes

604 3,217 1,641

81,023 Net impairment losses recognized in earnings (2,075 )

(4,643 ) (8,091 ) (61,640 ) Fee income 874 826 2,551 2,568

Equity in net income of investment funds

accounted for using the equity method

9,708 69,119 38,410 135,428 Other income 1,840

5,687 12,346 14,588 Total

revenues 797,352 976,225

2,418,554 2,575,412

Expenses

Losses and loss adjustment expenses 359,193 444,914 1,150,389

1,244,314 Acquisition expenses 111,279 122,739 336,378 373,011

Other operating expenses 103,121 99,743 311,460 286,153 Interest

expense 7,371 6,001 22,547 17,425 Net foreign exchange (gains)

losses 65,157 19,755 (22,069 )

48,208 Total expenses 646,121

693,152 1,798,705 1,969,111

Income before income taxes 151,231 283,073 619,849 606,301

Income tax expense 3,200 2,205

11,373 20,513 Net Income 148,031

280,868 608,476 585,788 Preferred dividends 6,461

6,461 19,383 19,383

Net income available to common shareholders $ 141,570

$ 274,407 $ 589,093 $ 566,405

Net income per common share Basic $ 2.89 $ 4.56 $ 11.55 $

9.39 Diluted $ 2.77 $ 4.39 $ 11.05 $ 9.05

Weighted average common shares and

common share equivalents outstanding

Basic 48,997,791 60,156,219 50,993,316 60,295,144 Diluted

51,182,009 62,533,816 53,317,198 62,590,228

(Unaudited) September 30, December 31,

2010 2009 Assets Investments: Fixed maturities

available for sale, at market value (amortized cost: $9,411,927 and

$9,227,432) $ 9,810,102 $ 9,391,926 Short-term investments

available for sale, at market value (amortized cost: $777,989 and

$570,469) 780,671 571,489 Investment of funds received under

securities lending agreements, at market value (amortized cost:

$201,072 and $96,590) 200,020 91,160 TALF investments, at market

value (amortized cost: $393,377 and $247,192) 410,881 250,265 Other

investments (cost: $392,446 and $162,505) 418,411 172,172

Investment funds accounted for using the equity method

432,418 391,869 Total investments 12,052,503

10,868,881 Cash 365,997 334,571 Accrued investment income

79,180 70,673 Investment in joint venture (cost: $100,000) 104,347

102,855 Fixed maturities and short-term investments pledged under

securities lending agreements, at market value 203,221 212,820

Securities purchased under agreements to resell using funds

received under securities lending agreements - 115,839 Premiums

receivable 662,634 595,030 Unpaid losses and loss adjustment

expenses recoverable 1,654,900 1,659,500 Paid losses and loss

adjustment expenses recoverable 60,222 60,770 Prepaid reinsurance

premiums 267,240 277,985 Deferred acquisition costs, net 297,250

280,372 Receivable for securities sold 1,329,508 187,171 Other

assets 624,395 609,323 Total Assets $

17,701,397 $ 15,375,790

Liabilities Reserve

for losses and loss adjustment expenses $ 8,054,677 $ 7,873,412

Unearned premiums 1,524,100 1,433,331 Reinsurance balances payable

130,274 156,500 Senior notes 300,000 300,000 Revolving credit

agreement borrowings 125,000 100,000 TALF borrowings, at market

value (par: $332,291 and $218,740) 331,797 217,565 Securities

lending payable 209,411 219,116 Payable for securities purchased

1,649,462 136,381 Other liabilities 658,766

616,136 Total Liabilities 12,983,487

11,052,441

Commitments and Contingencies

Shareholders’ Equity Non-cumulative preferred shares -

Series A and B 325,000 325,000 Common shares ($0.01 par, shares

issued: 53,143,560 and 54,761,678) 531 548 Additional paid-in

capital 100,640 253,466 Retained earnings 4,194,902 3,605,809

Accumulated other comprehensive income, net of deferred income tax

388,370 138,526 Common shares held in treasury, at cost (shares:

3,918,189 and 0) (291,533 ) - Total Shareholders’

Equity 4,717,910 4,323,349 Total Liabilities

and Shareholders’ Equity $ 17,701,397 $ 15,375,790

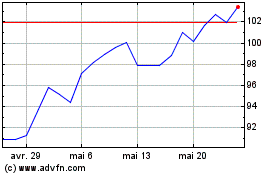

Arch Capital (NASDAQ:ACGL)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Arch Capital (NASDAQ:ACGL)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024