Arch Capital Acquires CMG Insurance - Analyst Blog

11 Février 2013 - 3:50PM

Zacks

Arch U.S. MI, the U.S. subsidiary

of Arch Capital Group Ltd. (ACGL) intends to foray

into the U.S. Mortgage Insurance market. It has announced that it

will acquire CMG Mortgage Insurance Company (CMG MI) from PMI

Mortgage Insurance Company for $300 million. PMI has been under

review of the Arizona Department of Insurance and CMFG Life

Insurance Company (CUNA Mutual). It had a 50% equity ownership in

CMG Mortgage Insurance Company and CMG Mortgage Assurance

Company.

The deal is expected to culminate within a year, pending regulatory

approval. Though the purchase consideration is estimated to be $300

million, additional amounts are payable depending on CMG MI’s

pre-closing portfolio over a pre-decided period. We believe the

strong cash position of the company to be sufficient to support the

transaction.

Per the transaction, Arch Capital will take over the entire capital

stock of CMG MI and its associates and also PMI’s mortgage

Insurance operating platform and related assets. Moreover, Arch

U.S. MI also expects to enter into a contract with CUNA Mutual,

under which the latter will continue serving the credit union

clients for the company. It is expected to strengthen its credit

union market operations.

Additionally, an Arch U.S. MI affiliate would be responsible for

reinsuring the run-off of in-force insurance on current,

non-delinquent loans within PMI’s primary mortgage insurance of

2009-2011 without any risk obligation. According to the deal, it

will also provide quota share reinsurance to CMG MI.

Thus the deal will not only entail Arch Capital to penetrate the

U.S. mortgage insurance market but also will help it obtain

mortgage insurance license throughout the nation, thereby

diversifying its business portfolio and providing a global

operating platform. The company also expects to employ the

competent senior management team of PMI to enhance its operating

efficiency.

Management expects the deal to complement its objective to expand

and capitalize on new specialty lines of business. The company is

optimistic about the incorporation of PMI’s staff strength as this

will entail it to serve more clients more efficiently.

Last month, another financial

services company, Fidelity National Financial

(FNF), acquired America’s leading employee benefits platform

Digital Insurance, Inc. (Digital) to expand its existing employee

benefits market rapidly.

Arch Capital group currently

carries a Zacks Rank #3 (Hold). Others from the industry, like

Cincinnati Financial (CINF), RLI

Corp. (RLI) as well as Fidelity National carry a favorable

Zacks Rank #1 (Strong Buy) and are worth noting.

ARCH CAP GP LTD (ACGL): Free Stock Analysis Report

CINCINNATI FINL (CINF): Free Stock Analysis Report

FIDELITY NAT FI (FNF): Free Stock Analysis Report

RLI CORP (RLI): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

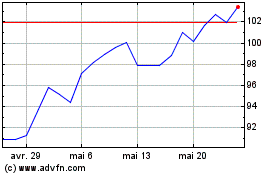

Arch Capital (NASDAQ:ACGL)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Arch Capital (NASDAQ:ACGL)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024