Progressive Posts Mixed Feb Results - Analyst Blog

14 Mars 2013 - 1:08PM

Zacks

Progressive Corp.’s (PGR) earnings per share

(EPS) for Feb 2013 were 17 cents, flat with the year-ago period.

Net income decreased 6% to $100.2 million in the reported

month.

The company recorded net premiums of $1.49 billion in the reported

month, up 8% from $1.39 billion in the year-ago period. Net

premiums earned were $1.29 billion, up 8% from $1.19 billion in the

year-ago period.

Net realized gains on securities in Feb 2013 were $19.5 million,

declining 34% from $29.4 million in the year-ago month. The

combined ratio − the percentage of premiums paid out as claims and

expenses − deteriorated 20 basis points (bps) from the prior-year

month to 91.4% in the reported month.

Numbers in February

Progressive publishes monthly financial reports. During February,

policies in force remained healthy, with the Personal Auto segment

increasing 1% year over year and sequentially. Special Lines also

increased 4% year over year, but remained flat with the preceding

month.

In Personal Auto, Direct Auto reported growth of 2% year over year

and 1.2% from the preceding month. Agency Auto was up 1% year over

year as well as sequentially. Progressive’s Commercial Auto segment

reported an increase of 1% year over year but declined 0.1%

sequentially.

Progressive's total expenses for the reported month increased 10.5%

to $1.21 billion from $1.10 billion in Feb 2012. The major

components contributing to the increase in total expenses were an

11.2% rise in losses and loss adjustment expenses and a 15% hike in

other underwriting expenses.

Progressive reported book value per share of $10.39 as of Feb 28,

2013, up from $10.06 as of Feb 29, 2012 and from $10.21 as of Jan

31, 2013.

Return on equity in Feb 2013 was 16.1%, down from 16.4% in Feb 2012

and 17.1% in Jan 2013. The debt-to-total-capital ratio was 24.8% as

of Feb 28, 2013, improving from 25.4% as of Feb 29, 2012 and from

25.1% as of Jan 31, 2013.

Progressive carries a Zacks Rank #2 (Buy). Other property and

casualty insurers, Cincinnati Financial Corp.

(CINF), Arch Capital Group Limited (ACGL) and XL

Group plc (XL), carry a Zacks Rank #1 (Strong Buy) and appear

impressive.

ARCH CAP GP LTD (ACGL): Free Stock Analysis Report

CINCINNATI FINL (CINF): Free Stock Analysis Report

PROGRESSIVE COR (PGR): Free Stock Analysis Report

XL GROUP PLC (XL): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

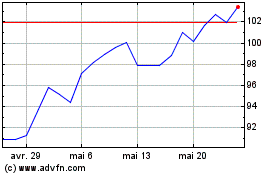

Arch Capital (NASDAQ:ACGL)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Arch Capital (NASDAQ:ACGL)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024