Fitch Affirms American Financial - Analyst Blog

28 Mars 2013 - 6:45PM

Zacks

Recently, Fitch Ratings affirmed the issuer default rating (IDR)

of American Financial Group Inc. (AFG) at “A-”

along with the debt rating on its senior unsecured notes at “BBB+”.

Additionally, the credit rating agency affirmed the insurer

financial strength (IFS) rating of American Financial’s principal

operating subsidiaries at “A+”. The outlook for all these ratings

is stable.

The rating affirmation was based on American Financial’s strong

capital and liquidity position, satisfactory financial leverage and

a history of outperforming peers in terms of profitability.

However, the company’s reducing underwriting profitability in the

property & casualty business and the weak interest rate

environment are causes of concern for the rating agency. Moreover,

the rapid growth in the annuity business amid the low interest rate

environment is also concerning, as it could adversely impact future

earnings.

Fitch may revise the ratings upward if American Financial’s

underwriting and investment results increase to the level of

companies with a higher credit rating, its property & casualty

reserve adequacy level improves or the company reduces the higher

end of the target range for long-term financial leverage to less

than 15%.

On the other hand, Fitch may downgrade the ratings of American

Financial if the property and casualty combined ratio stays above

100% over the long term or the property & casualty Prism score

falls to ‘adequate’. Other factors that could result in a downward

revision in ratings are a surge in the financial leverage beyond

30% and a rise in surrender rates or decline in operating results

of the annuity business. Further, the IFS rating of the

subsidiaries could be lowered if Fitch deems their strategic

importance to be reduced.

American Financial currently carries a Zacks Rank #3 (Hold).

Other property and casualty insurers worth considering are

Cincinnati Financial Corp. (CINF), Arch

Capital Group Ltd. (ACGL) and Navigators Group

Inc. (NAVG). All these companies carry a Zacks Rank #1

(Strong Buy).

ARCH CAP GP LTD (ACGL): Free Stock Analysis Report

AMER FINL GROUP (AFG): Free Stock Analysis Report

CINCINNATI FINL (CINF): Free Stock Analysis Report

NAVIGATORS GRP (NAVG): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

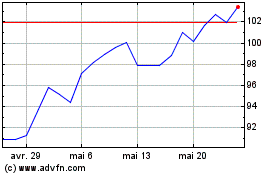

Arch Capital (NASDAQ:ACGL)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Arch Capital (NASDAQ:ACGL)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024