Cincinnati Shares Hit 52-Week High - Analyst Blog

04 Avril 2013 - 4:40PM

Zacks

On Apr 3, 2013, shares of

Cincinnati Financial Corp. (CINF) hit a 52-week

high of $47.69. The company reported a positive earnings surprise

of 122% in the fourth quarter. Cincinnati Financial witnessed

positive earnings surprises in all the 4 quarters of 2012, with an

average beat of 64.01%.

Cincinnati’s Excess and Surplus line is performing well. Despite a

soft market environment, the segment has been able to achieve rate

increases consistently. We expect the trend to continue, given the

improving excess and surplus lines market.

Moreover, the company engages in appointing agencies to augment its

performance in the long-term. During 2013 it plans to appoint

around 65 agencies. These new agencies are expected to plough in $5

billion of direct written premium by 2015.

Its long-term strategy also includes geographical diversification

of operations which makes Cincinnati a national insurer, a step up

from being a regional insurer.

Cincinnati has a strong capital position which allows it to indulge

in share repurchases and dividend payouts to create shareholder

value. The company also focuses on maintaining lower debt levels.

Moreover, its consistent cash flow and prudent cash balances

continue to create strong liquidity.

Significant share repurchases and long-term growth strategies are

expected to bolster earnings of Cincinnati going forward.

Cincinnati is scheduled to report its first quarter, 2013 results

on Apr 25, 2013. The Zacks Consensus Estimate for the first quarter

of 2013 is pegged at 52 cents representing a year over year

improvement of 7.64%.

Valuation looks attractive for Cincinnati. The shares are trading

at a discount to the peer group average, both on a price-to-book

basis and forward price-to-earnings basis, with return on equity

remaining 1.4% above the peer group average of 7.3%. The 1-year

return from the stock is 37.43%, much above NASDAQ’s return of

4.11%.

Cincinnati currently carries a Zacks Rank #2 (Buy). Other stocks in

this industry such as AXIS Capital Holdings

Limited (AXS), EMC Insurance Group Inc.

(EMCI) and Arch Capital Group Ltd. (ACGL) carry a

favorable Zacks Rank #1 (Strong Buy) and appear impressive.

ARCH CAP GP LTD (ACGL): Free Stock Analysis Report

AXIS CAP HLDGS (AXS): Free Stock Analysis Report

CINCINNATI FINL (CINF): Free Stock Analysis Report

EMC INSURANCE (EMCI): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

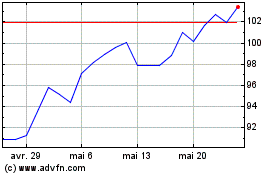

Arch Capital (NASDAQ:ACGL)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Arch Capital (NASDAQ:ACGL)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024