false

0001750106

0001750106

2024-12-10

2024-12-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): December 10, 2024

ALSET

INC.

(Exact

name of registrant as specified in its charter)

| Texas |

|

001-39732 |

|

83-1079861 |

(State

or other

jurisdiction

of incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

| 4800

Montgomery Lane |

|

|

| Suite

210 |

|

|

| Bethesda,

Maryland |

|

20814 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (301) 971-3940

Not

Applicable

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.001 par value per share |

|

AEI |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01 Entry into a Material Definitive Agreement

On

December 10, 2024, Alset Inc. (the “Company”) entered into a stock purchase agreement (the “Stock Purchase Agreement”)

with DSS, Inc. (“DSS”), pursuant to which the Company agreed to purchase 820,597 newly issued shares of DSS’s common

stock (the “DSS Shares”) for a total purchase price of $800,000 (representing a price of $0.9749 per share of DSS common

stock).

The

Company and its various subsidiaries are collectively the largest shareholder of DSS. The Company’s Chairman, Chief Executive Officer

and majority stockholder, Heng Fai Chan, is also the Executive Chairman of DSS and a significant stockholder of DSS.

The

foregoing summary of the Stock Purchase Agreement is qualified in its entirety by reference to the Stock Purchase Agreement attached

hereto as Exhibit 10.1 and which is incorporated herein by reference.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

ALSET

INC. |

| |

|

|

| Dated:

December 16, 2024 |

By: |

/s/

Rongguo Wei |

| |

Name: |

Rongguo

Wei |

| |

Title: |

Co-Chief

Financial Officer |

Exhibit

10.1

STOCK

PURCHASE AGREEMENT

This

STOCK PURCHASE AGREEMENT (this “Agreement”) is made as of December 10, 2024 by and among DSS, Inc.,

a New York corporation (the “Seller”), and Alset Inc., a Texas corporation (the “Buyer”).

RECITALS

WHEREAS,

Seller and Buyer are executing and delivering this Agreement in reliance upon the exemption from securities registration afforded by

Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”), and Rule 506(b) of Regulation

D (“Regulation D”) as promulgated under the Securities Act;

WHEREAS,

the Seller wishes to sell 820,597 shares of its common stock (the “DSS Shares”), par value $0.02 per share,

at a purchase price equal to $0.9749 per share, upon the terms and conditions set forth in this Agreement.

WHEREAS,

the Buyer wishes to purchase the DSS Shares upon the terms and conditions set forth in this Agreement.

NOW,

THEREFORE, in consideration of the mutual covenants contained in this Agreement, and for other good and valuable consideration,

the receipt and adequacy of which are hereby acknowledged, Seller and Buyer hereby agree as follows:

| 1. | SALE

AND PURHCASE OF SHARES. |

1.1

SALE. On the terms and subject to the conditions set forth in this Agreement, at the Closing Seller will sell, convey, transfer

and assign to Buyer, free and clear of all liens, pledges, encumbrances, changes, restrictions or known claims of any kind, nature

or description, and Buyer will purchase and accept from Seller, the DSS Shares

1.2

PURCHASE. In consideration therefor, Buyer will convey, transfer and assign to Seller, and Seller will accept from Buyer,

$800,000.00 (such purchase and sale referred to as the “Purchase”).

| 2. | REPRESENTATIONS

AND WARRANTIES. |

2.1

REPRESENTATIONS AND WARRANTIES BY THE SELLER. The Seller represents and warrants to Buyer as follows as of the date

hereof:

(a)

Organization and Good Standing. Seller is duly organized, validly existing and in good standing under the laws of its jurisdiction

of incorporation or organization, as the case may be.

(b)

Requisite Power and Authority. Seller has all necessary power and authority to execute and deliver this Agreement and the other

agreements and instruments entered into or delivered by any of the parties hereto in connection with the transactions contemplated hereby

and thereby (the “Transaction Documents”) and to carry out their provisions. All action on Seller’s part

required for the execution and delivery of this Agreement and the other Transaction Documents has been taken. Upon its execution and

delivery, this Agreement and the other Transaction Documents will be valid and binding obligations of Seller, enforceable in accordance

with their respective terms, except (a) as limited by applicable bankruptcy, insolvency, reorganization, moratorium or other laws of

general application affecting enforcement of creditors’ rights, and (b) as limited by general principles of equity that restrict

the availability of equitable remedies.

(c)

No Violations. The execution and delivery of the Transaction Documents, and the consummation by the Seller of the transactions

contemplated thereby, does not (i) result in a violation of either the Certificate of Incorporation or By-laws of the Seller, or (ii)

constitute a default under (or an event which with notice or lapse of time or both could become a default) or give to others any rights

of termination, amendment or cancellation of, any material agreement, indenture or instrument to which the Seller is a party unless the

same shall have been waived or consented to by the other party, or result in a violation of any law, rule, regulation, order, judgment

or decree (foreign or domestic and including federal and state securities laws and regulations) applicable to the Company or by which

any material property or asset of the Seller is bound or affected other than any of the foregoing which would not have a Material Adverse

Effect.

(d)

Good Title. The DSS Shares issued by Seller shall be free and clear of any lien, encumbrance, adverse claim, restriction on sale,

transfer or voting (other than restrictions imposed by applicable securities laws), preemptive right, option or other right to purchase,

and upon the consummation of the sale of such DSS Shares as contemplated hereby, Buyer will have good title to such DSS Shares, free

and clear of any lien, encumbrance, adverse claim, restriction on sale, transfer or voting (other than restrictions imposed by applicable

securities laws), preemptive right, option or other right to purchase.

(e)

Issuance of the Securities. The Securities are duly authorized and, when issued and paid for in accordance with the applicable

Transaction Documents, will be duly and validly issued, fully paid and nonassessable, free and clear of all Liens imposed by the Company

other than restriction. Seller has reserved from its duly authorized capital stock the maximum number of shares of common stock issuable

pursuant to this Agreement.

2.2

REPRESENTATIONS AND WARRANTIES BY BUYER. Buyer represents and warrants to the Seller, as of the date hereof, as follows:

(a)

Organization and Good Standing. Buyer is duly organized, validly existing and in good standing under the laws of its jurisdiction

of incorporation or organization, as the case may be.

(b)

Requisite Power and Authority. Buyer has all necessary power and authority to execute and deliver this Agreement and the other

Transaction Documents and to carry out their provisions. All action on Buyer’s part required for the execution and delivery of

this Agreement and the other Transaction Documents has been taken. Upon its execution and delivery, this Agreement and the other Transaction

Documents will be valid and binding obligations of Buyer, enforceable in accordance with their respective terms, except (a) as limited

by applicable bankruptcy, insolvency, reorganization, moratorium or other laws of general application affecting enforcement of creditors’

rights, and (b) as limited by general principles of equity that restrict the availability of equitable remedies.

(c)

Issuance of DSS Shares. The DSS Shares have been duly authorized and, upon issuance in accordance with the terms hereof, shall

be validly issued and free from all taxes, liens and charges with respect to the issue thereof, and the DSS Shares shall be fully paid

and non- assessable with the holder being entitled to all rights accorded to a holder of DSS common stock.

(d)

No Reliance. Buyer has not relied on and is not relying on any representations, warranties or other assurances regarding The Company

and other than the representations and warranties expressly set forth in this Agreement.

2.3

SURVIVAL OF REPRESENTATIONS AND WARRANTIES. The representations and warranties shall survive the Closing for a period of 12 months

and shall be fully enforceable at law or in equity against the parties and each party’s successors and assigns.

3.1

Conditions to Seller’s Obligations. The obligations of Seller under this Agreement, shall be subject to satisfaction of the

following conditions, unless waived by Seller: (i) Buyer shall have performed in all material respects all agreements, and satisfied

in all material respects all conditions on its part to be performed or satisfied hereunder, at or prior to the Closing; (ii) all of the

representations and warranties of Buyer herein shall have been true and correct in all respects when made, shall have continued to have

been true and correct in all respects at all times subsequent thereto, and shall be true and correct in all material respects on and

as of the Closing as though made on, as of, and with reference to such Closing; (iii) Buyer shall have executed and delivered to Seller

all documents necessary to issue the DSS Shares to Buyer, as contemplated by this Agreement; (iv) Buyer shall have obtained or made,

as applicable, all consents, authorizations and approvals from, and all declarations, filings and registrations required to consummate

the transactions contemplated by this Agreement, including all items required under the incorporation document and bylaws of Buyer; and

(v) Seller shall have received authorization from the New York Stock Exchange (the “NYSE”) for the issuance of the DSS Shares,

if required by the rules of the NYSE.

3.2

Conditions to Buyer’s Obligations. The obligations of Buyer under this Agreement, shall be subject to satisfaction of the following

conditions, unless waived by Buyer: (i) Seller shall have performed in all respects all agreements, and satisfied in all respects all

conditions on their part to be performed or satisfied hereunder, at or prior to the Closing; (ii) all of the representations and warranties

of Seller herein shall have been true and correct in all material respects when made, shall have continued to have been true and correct

in all material respects at all times subsequent thereto, and shall be true and correct in all material respects on and as of the Closing

as though made on, as of, and with reference to such Closing; (iii) Seller shall have executed and delivered to Buyer all documents necessary

issue the DSS Shares to Buyer, as contemplated by this Agreement; (iv) Seller shall have obtained or made, as applicable, all consents,

authorizations and approvals from, and all declarations, filings and registrations required to consummate the transactions contemplated

by this Agreement, including all items required under the incorporation document and bylaws of Seller; and (v) Seller shall have received

authorization from the NYSE for the issuance of the DSS Shares, if required by the rules of the NYSE.

| 3.3 | Closing

Documents. At the Closing |

(a)

Seller shall deliver to Buyer, in form and substance reasonably satisfactory to Buyer (i) a duly executed copy of this Agreement, together

with any other Transaction Documents (ii) certificates evidencing the DSS Shares, together with stock powers duly for such certificates

to allow such certificates to be registered in the name of Buyer, or evidence of such book-entry transfer of the DSS Shares to Buyer;

(iii) copies of resolutions adopted by the board of directors of Seller and certified by the Secretary of Seller authorizing the execution

and delivery of, and performance of Seller’s obligations under, this Agreement.

(b)

Buyer shall deliver to Seller, in form and substance reasonably satisfactory to Seller (i) a duly executed copy of this Agreement, together

with any other Transaction Documents (ii) the Purchase price; (ii) copies of resolutions adopted by the board of directors of Buyer and

certified by the Secretary of Buyer authorizing the execution and delivery of, and performance of Buyer’s obligations under, this

Agreement

4.1

ADDRESSES AND NOTICES. Any and all notices or other communications or deliveries required or permitted to be provided hereunder shall

be in writing and shall be deemed given and effective on the earliest of (a) the date of transmission, if such notice or communication

is delivered via e-mail transmission prior to 5:00 P.M., New York City time, on a trading day, (b) the next trading day after the date

of transmission, if such notice or communication is delivered via e-mail transmission on a day that is not a trading day or later than

5:00 P.M., New York City time, on any trading day, (c) the trading day following the date of mailing, if sent by U.S. nationally recognized

overnight courier service with next day delivery specified, or (d) upon actual receipt by the party to whom such notice is required to

be given. The address and e-mail address for such notices and communications shall be as follows:

| |

If to Seller to: |

DSS, Inc. |

| |

|

275

Wiregrass Pkwy |

| |

|

West

Henrietta, NY 14586 |

| |

|

Attention:

Todd D. Macko |

| |

|

Telephone: |

| |

|

Email: |

| |

If to Buyer: |

Alset Inc. |

| |

|

4800

Montgomery Lane, Suite 210 |

| |

|

Bethesda,

Maryland 20814 |

| |

|

Attention: Ronald Wei |

| |

|

Telephone: |

| |

|

Email: |

Any

such person may by notice given in accordance with this Section to the other parties hereto designate another address or person for receipt

by such person of notices hereunder.

4.2

TITLES AND CAPTIONS. TITLES AND CAPTIONS. All Article and Section titles or captions in this Agreement are for convenience only.

They shall not be deemed part of this Agreement and do not in any way define, limit, extend or describe the scope or intent of any provisions

hereof.

4.3 ASSIGNABILITY. This Agreement is not transferable or assignable by the undersigned.

4.4

PRONOUNS AND PLURALS. Whenever the context may require, any pronoun used herein shall include the corresponding masculine, feminine

or neuter forms. The singular form of nouns, pronouns and verbs shall include the plural and vice versa.

4.5

FURTHER ACTION. The parties shall execute and deliver all documents, provide all information and take or forbear from taking all

such action as may be necessary or appropriate to achieve the purposes of this Agreement. Each party shall bear its own expenses in connection

therewith.

4.6

APPLICABLE LAW. This Agreement shall be construed in accordance with and governed by the laws of the State of New York without regard

to its conflict of law rules.

4.7

BINDING EFFECT. This Agreement shall be binding upon and inure to the benefit of the parties hereto and their respective heirs, administrators,

successors, legal representatives, personal representatives, permitted transferees and permitted assigns. If the undersigned is more

than one person, the obligation of the undersigned shall be joint and several and the agreements, representations, warranties and acknowledgments

herein contained shall be deemed to be made by and be binding upon each such person and such person’s heirs, executors, administrators

and successors.

4.8

INTEGRATION. This Agreement constitutes the entire agreement among the parties pertaining to the subject matter hereof and supersedes

and replaces all prior and contemporaneous agreements and understandings, whether written or oral, pertaining thereto, including without

limitation, the Prior Agreement. No covenant, representation or condition not expressed in this Agreement shall affect or be deemed to

interpret, change or restrict the express provisions hereof.

4.9

AMENDMENT. Neither this Agreement nor any term or provision hereof may be amended, modified, waived or supplemented orally, but only

by a written consent executed by the parties hereto.

4.10

CREDITORS. None of the provisions of this Agreement shall be for the benefit of or enforceable by creditors of any

party.

4.11

WAIVER. No failure by any party to insist upon the strict performance of any covenant, agreement, term or condition of this Agreement

or to exercise any right or remedy available upon a breach thereof shall constitute a waiver of any such breach or of such or any other

covenant, agreement, term or condition.

4.12

RIGHTS AND REMEDIES. The rights and remedies of each of the parties hereunder shall be mutually exclusive, and the implementation

of one or more of the provisions of this Agreement shall not preclude the implementation of any other provision.

4.13

COUNTERPARTS. This Agreement may be executed in one or more counterparts, each of which will be deemed to be an original copy of

this Agreement and all of which, when taken together, will be deemed to constitute one and the same agreement. In the event that any

signature is delivered by facsimile transmission or by e-mail delivery of a “.pdf” format data file, such signature shall

create a valid and binding obligation of the party executing(or on whose behalf such signature is executed) with the same force and effect

as if such facsimile or “.pdf” signature page were an original thereof.

SIGNATURES

ON THE FOLLOWING PAGES

IN

WITNESS WHEREOF, the parties have caused this Agreement to be duly executed by their respective representatives hereunto authorized as

of the day and year first above written.

| |

By Buyer: |

| |

|

| |

ALSET INC. |

| |

|

| |

By: |

/s/ Rongguo Wei |

| |

Name: |

Rongguo Wei |

| |

Title: |

Co-CFO |

| |

By Seller: |

| |

|

| |

DSS, INC. |

| |

|

| |

By: |

/s/ Jason Grady |

| |

Name: |

Jason Grady |

| |

Title: |

Interim CEO |

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

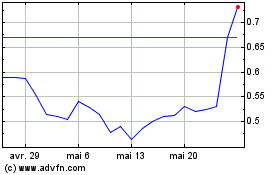

Alset (NASDAQ:AEI)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Alset (NASDAQ:AEI)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025