Filed

Pursuant to Rule 424(b)(5)

Registration

No. 333-264234

PROSPECTUS

SUPPLEMENT

(To

Prospectus dated May 5, 2022)

1,500,000

Shares of Common Stock

Alset

Inc. (the “Company,” “Alset,” the “registrant,” “we,” “our” or “us”)

is offering 1,500,000 shares of common stock, par value $0.001, pursuant to this prospectus supplement and accompanying prospectus at

a public offering price of $1.00 per share.

Our

common stock is listed on The Nasdaq Capital Market under the symbol “AEI.” The last reported sale price of our common stock

on The Nasdaq Capital Market on January 2, 2025, was $1.38 per share.

We

have engaged Aegis Capital Corp. to act as our exclusive placement agent in connection with this offering. The placement agent has agreed

to use its best efforts to arrange for the sale of the shares offered by this prospectus. The placement agent is not purchasing or selling

any of the shares we are offering and the placement agent is not required to arrange the purchase or sale of any specific number or dollar

amount of shares. We have agreed to pay to the placement agent the placement agent fees set forth in the table below. We will bear all

costs associated with the offering. See “Plan of Distribution” on page S-7 of this prospectus supplement for more

information regarding these arrangements.

We

have entered into a securities purchase agreement with the purchasers for the sale of all of the shares being offered hereunder. We will

have one closing for all the shares purchased in this offering. The offering will terminate upon the completion of a single closing,

which is expected to occur on or about January 3, 2025.

We

intend to use the proceeds from this offering for working capital and other general corporate purposes. See “Use of Proceeds.”

The aggregate

market value of our outstanding common stock held by non-affiliates is $4,178,129, based on 9,235,119 shares of outstanding common stock,

of which 3,027,681 shares are held by non-affiliates, and a per share price of $1.38, which was the closing sale price of our common stock

on the Nasdaq Capital Market on November 6, 2024. During the 12 calendar month period that ends on, and includes, the date of this prospectus,

we have not offered and sold any of our securities pursuant to General Instruction I.B.6 of Form S-3.

Investing

in these securities involves a high degree of risk. See “Risk Factors” beginning on page S-4 of this prospectus

supplement and on page S-2 of the accompanying base prospectus, as well as the risk factors incorporated by reference into this

prospectus supplement and accompanying base prospectus, for a discussion of information that should be considered in connection with

an investment in our securities.

Neither

the Securities and Exchange Commission (“SEC”) nor any state securities commission has approved or disapproved of these securities

or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

We

are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012, and we have elected

to comply with certain reduced public company reporting requirements.

| | |

Per Share | | |

Total | |

| Public offering price | |

$ | 1.00 | | |

$ | 1,500,000 | |

| Placement agent fees(1) | |

$ | 0.07 | | |

$ | 105,000 | |

| Proceeds, before expenses, to us | |

$ | 0.93 | | |

$ | 1,395,000 | |

| (1) |

Represents

a cash fee equal to 7% of the aggregate purchase price paid by investors in this offering. We have also agreed to reimburse the placement

agent for the fees and disbursements of its legal counsel in an amount of $50,000 and pay to the placement agent a cash fee equal

to 1% of the aggregate purchase price paid by investors in this offering for non-accountable expenses. See “Plan of Distribution”

beginning on page S-7 of this prospectus supplement for a description of the compensation to be received by the placement agent. |

The

delivery to purchasers of shares in this offering is expected to be made on or about January 3, 2025, subject to satisfaction

of certain customary closing conditions.

Sole

Placement Agent

Aegis

Capital Corp.

The

date of this prospectus is January 2, 2025

TABLE

OF CONTENTS

PROSPECTUS

SUPPLEMENT

PROSPECTUS

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

prospectus supplement and the accompanying prospectus are part of a registration statement on Form S-3 (File No. 333-264234) that we

filed with the Securities and Exchange Commission, or SEC, on April 11, 2022, and was declared effective by the SEC on May 5, 2022, using

a “shelf” registration process. This document is in two parts. The first part is this prospectus supplement, which describes

the specific terms of this offering and also adds to and updates information contained in the accompanying prospectus and the documents

incorporated by reference herein. The second part, the accompanying prospectus, provides more general information, some of which may

not apply to this offering. Generally, when we refer to this prospectus, we are referring to both parts of this document combined. To

the extent there is a conflict between the information contained in this prospectus supplement and the information contained in the accompanying

prospectus or any document incorporated by reference therein filed prior to the date of this prospectus supplement, you should rely on

the information in this prospectus supplement. If any statement in one of these documents is inconsistent with a statement in another

document having a later date—for example, a document incorporated by reference in the accompanying prospectus—the statement

in the document having the later date modifies or supersedes the earlier statement.

We

further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document

that is incorporated by reference herein were made solely for the benefit of the parties to such agreement, including, in some cases,

for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or

covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such

representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

You

should rely only on the information contained in this prospectus supplement or the accompanying prospectus or incorporated by reference

herein. We have not authorized, and the placement agent has not authorized, anyone to provide you with information that is different.

The information contained in this prospectus supplement or the accompanying prospectus or incorporated by reference herein or therein

is accurate only as of the respective dates thereof, regardless of the time of delivery of this prospectus supplement and the accompanying

prospectus or of any sale of our common stock.

This

prospectus supplement and the accompanying prospectus contain summaries of certain provisions contained in some of the documents described

herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety

by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated herein

by reference as exhibits to the registration statement, and you may obtain copies of those documents as described below in the section

entitled “Where You Can Find More Information.”

It

is important for you to read and consider all information contained in this prospectus supplement and the accompanying prospectus, including

the documents incorporated by reference herein and therein, in making your investment decision. You should also read and consider the

information in the documents to which we have referred you in the sections entitled “Where You Can Find More Information”

and “Information Incorporated By Reference” in this prospectus supplement and in the accompanying prospectus, respectively.

This

prospectus supplement and the accompanying prospectus contain and incorporate by reference statistical data and estimates, including

those relating to market size and competitive position of the markets in which we participate, that we obtained from our own internal

estimates and research, as well as from industry and general publications and research, surveys and studies conducted by third parties.

Industry publications, studies and surveys generally state that they have been obtained from sources believed to be reliable. While we

believe our internal company research is reliable and the definitions of our market and industry are appropriate, neither this research

nor these definitions have been verified by any independent source.

We

further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document

that is incorporated by reference into this prospectus supplement and the accompanying prospectus were made solely for the benefit of

the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreement, and

should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were

accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately

representing the current state of our affairs.

We

are offering to sell, and seeking offers to buy, the shares offered by this prospectus supplement only in jurisdictions where offers

and sales are permitted. The distribution of this prospectus supplement and the accompanying prospectus and the offering of the shares

offered by this prospectus supplement in certain jurisdictions may be restricted by law. Persons outside the United States who come into

possession of this prospectus supplement and the accompanying prospectus must inform themselves about, and observe any restrictions relating

to, the offering of the common stock and the distribution of this prospectus supplement and the accompanying prospectus outside the United

States. This prospectus supplement and the accompanying prospectus do not constitute, and may not be used in connection with, an offer

to sell, or a solicitation of an offer to buy, any securities offered by this prospectus supplement and the accompanying prospectus by

any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

References

in this prospectus supplement to the terms “we,” “us,” the “Company” or other similar terms mean

Alset Inc. and its consolidated subsidiaries, unless we state otherwise or the context indicates otherwise.

PROSPECTUS

SUPPLEMENT SUMMARY

This

summary highlights selected information included elsewhere in or incorporated by reference in this prospectus supplement, in the accompanying

prospectus and in the documents incorporated by reference herein and therein, and does not contain all the information that you should

consider before investing in our securities pursuant to this prospectus supplement and the accompanying prospectus. You should read the

entire prospectus supplement and the accompanying prospectus carefully, especially “Risk Factors” and the financial statements

and related notes and other information incorporated by reference herein and therein, before deciding whether to participate in the offering

described in this prospectus supplement and the accompanying prospectus.

Overview

We

are a diversified holding company principally engaged through our subsidiaries in the development of EHome communities and other real

estate, financial services, digital transformation technologies, biohealth activities and consumer products with operations in the United

States, Singapore, Hong Kong, Australia, South Korea and the People’s Republic of China. We manage a significant portion of our

three principal businesses through our 85.7% owned subsidiary, Alset International, a public company traded on the Singapore Stock Exchange.

Through this subsidiary (and indirectly, through other public and private U.S. and Asian subsidiaries), we are actively developing real

estate projects near Houston, Texas in our real estate segment. In our digital transformation technology segment, we focus on serving

business-to-business (B2B) needs in e-commerce, collaboration and social networking functions. Our biohealth segment includes the sale

of consumer products. Alset Inc. and Alset International Limited collectively own 89.3% of HWH International Inc. (described in

further detail below). We also have certain wholly owned subsidiaries that collectively own 132 single family residential rental properties

in Montgomery and Harris Counties, Texas.

We

also have minority ownership interests, including a 36.9% equity interest in American Pacific Financial, Inc., formerly known as American

Pacific Bancorp Inc. (“APF”), a 48.9% equity interest in DSS Inc. (“DSS”), an indirect 48.7% equity interest

in Value Exchange International Inc. (“VEII”), a 0.5% equity interest in New Electric CV Corporation (“NECV”,

formerly known as “American Wealth Mining Inc.”) and a 29% equity interest in Sharing Services Global Corporation (“SHRG”).

APF is a financial network holding company. DSS is a multinational company operating businesses within nine divisions: product packaging,

biotechnology, direct marketing, commercial lending, securities and investment management, alternative trading, digital transformation,

secure living, and alternative energy. DSS is listed on the NYSE American (NYSE: DSS). VEII is a provider of information technology services

for businesses, and is traded on the OTCQB (OTCQB: VEII). NECV is a publicly traded consumer products company (OTCPK: HIPH). SHRG markets

and distributes health and wellness products, as well as member-based travel services, using a direct selling business model. SHRG is

traded on the OTCQB (OTCQB: SHRG).

We

generally acquire majority and/or control stakes in innovative and promising businesses that are expected to appreciate in value over

time. Our emphasis is on building businesses in industries where our management team has in-depth knowledge and experience, or where

our management can provide value by advising on new markets and expansion. We have at times provided a range of global capital and management

services to these companies in order to gain access to Asian markets. We have historically favored businesses that improve an individual’s

quality of life or that improve the efficiency of businesses through technology in various industries. We believe our capital and management

services provide us with a competitive advantage in the selection of strategic acquisitions, which creates and adds value for our Company

and our stockholders.

THE

OFFERING

| Common

stock offered by us |

|

1,500,000

shares of common stock. |

| |

|

|

| Common

stock outstanding prior to the offering(1) |

|

9,235,119

shares. |

| |

|

|

| Common

stock to be outstanding after the offering |

|

10,735,119

shares. |

| |

|

|

| Use

of Proceeds |

|

We

intend to use the net proceeds to us from this offering for working capital and other general corporate purposes. See “Use

of Proceeds” beginning on page S-5. |

| |

|

|

| Listing |

|

Our

common stock is listed on The Nasdaq Capital Market under the symbol “AEI”. |

| |

|

|

| Public

Offering Price |

|

$1.00

per share |

| |

|

|

| Risk

Factors |

|

Investing

in our common stock involves a high degree of risk. You should read the “Risk Factors” section beginning on page

S-4 of this prospectus supplement and page S-2 of the accompanying prospectus and in the documents incorporated by reference in

this prospectus supplement for a discussion of factors to consider before deciding to invest in our common stock. |

The

number of shares of our common stock that are and will be outstanding immediately before and after this offering as shown above is based

on 9,235,119 shares outstanding as of January 2, 2025. The number of shares outstanding as of January 2, 2025, as used throughout

this prospectus supplement, unless otherwise indicated, excludes, as of that date:

| |

● |

603,051

shares of common stock issuable upon exercise

of warrants to purchase common stock with a weighted-average exercise price of $80.46 per share. |

RISK

FACTORS

An

investment in our securities involves a high degree of risk. You should carefully consider the following risks and all of the other information

contained in this prospectus supplement, the accompanying prospectus, and the information and documents incorporated by reference before

deciding whether to invest in our securities, including the risks and uncertainties described below and under the caption “Risk

Factors” in our most recently filed Annual Report on Form 10-K and Quarterly Report on Form 10-Q filed with the SEC, in each case

as these risk factors are amended or supplemented by subsequent Annual Reports on Form 10-K or Quarterly Reports on Form 10-Q. Our business,

financial condition, results of operations and future prospects may be adversely affected as a result of such risks. In such an event,

the market price of our common stock could decline, and you could lose part or all of your investment.

Risks

Related to this Offering and the Ownership of Our Securities

Management

will have broad discretion as to the use of the proceeds from this offering, and may not use the proceeds effectively.

Our

management will have broad discretion in the application of the net proceeds from this offering and could spend the proceeds in ways

that may not improve our results of operations or enhance the value of our common stock. Our failure to apply these funds effectively

could have a material adverse effect on our business and cause the price of our common stock to decline.

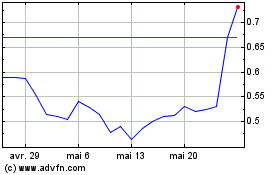

Our

common stock may be affected by limited trading volume and price fluctuations, which could adversely impact the value of the securities.

Although

our common stock is traded on The Nasdaq Capital Market, the volume of trading has historically been limited. Our average daily trading

volume of our shares from January 1, 2024 to December 31, 2024 was approximately 28,967 shares. Thinly traded stocks can

be more volatile than stock trading in a more active public market. We cannot predict whether and to what the extent to which an active

public market for our common stock will develop or be sustained. Therefore, a holder of our common stock who wishes to sell his or her

shares may not be able to do so immediately or at an acceptable price.

In

addition, our common stock has experienced, and is likely to experience, significant price and volume fluctuations in the future, which

could adversely affect the market prices of our common stock without regard to our operating performance. In addition, we believe that

factors such as quarterly fluctuations in our financial results and changes in the overall economy or the condition of the financial

markets could cause the market prices of our common stock to fluctuate substantially. These fluctuations may also cause short sellers

to periodically enter the market in the belief that we will have poor results in the future. We cannot predict the actions of market

participants and, therefore, can offer no assurances that the market for our common stock will be stable or appreciate over time.

An

investment in our common stock is speculative, and there can be no assurance of any return on any such investment.

Investors

are cautioned that an investment in the shares offered hereby is highly speculative and involves a significant degree of risk. The success

of our business and the ability to achieve our business goals and objectives, as outlined in this prospectus, are subject to numerous

uncertainties, contingencies and risks. As such, there is no assurance that investors will realize a return on their investment or that

they will not lose their entire investment. Potential investors should carefully consider whether such a speculative investment is suitable

for their financial situation and investment objectives before purchasing shares of our common stock.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

All

statements in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference that are not historical

facts should be considered “Forward Looking Statements” within the meaning of the “Safe Harbor” provisions of

the Private Securities Litigation Reform Act of 1995. Such statements involve known and unknown risks, uncertainties and other factors

that may cause actual results, performance or achievements of the Company to be materially different from any future results, performance

or achievements expressed or implied by the forward-looking statements. Some of the forward-looking statements can be identified by the

use words such as “believe,” “expect,” “may,” “estimates,” “should,” “seek,”

“approximately,” “intend,” “plan,” “estimate,” “project,” “continue”

or “anticipates” or similar expressions or words, or the negatives of those expressions or words. These statements may be

made directly in this prospectus supplement and the accompanying prospectus and they may also be incorporated by reference in this prospectus

supplement and accompanying prospectus from other documents filed with the SEC, and include, but are not limited to, statements about

future financial and operating results and performance, statements about our plans, objectives, expectations and intentions with respect

to future operations, products and services, and other statements that are not historical facts. These forward-looking statements are

based upon the current beliefs and expectations of our management and are inherently subject to significant business, economic and competitive

uncertainties and contingencies, many of which are difficult to predict and generally beyond our control. In addition, these forward-looking

statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. Actual results

may differ materially from the anticipated results discussed in these forward-looking statements.

We

undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments

or otherwise, except as may be required by applicable laws or regulations.

USE

OF PROCEEDS

We

estimate that the net proceeds to us from this offering will be approximately $1.2 million after deducting placement agent

fees and other estimated offering expenses payable by us for this offering.

We

intend to use the net proceeds from this offering for working capital and other general corporate purposes.

Investors

must rely on the judgment of our management, who will have broad discretion regarding the application of the net proceeds of this offering.

The amounts and timing of our actual expenditures will depend upon numerous factors, including market conditions, cash generated by our

operations (if any), business developments and the rate of our growth. We may find it necessary or advisable to use portions of the proceeds

of this offering for other purposes. Pending these uses, we intend to invest the net proceeds of this offering in a money market or other

interest-bearing account.

DIVIDEND

POLICY

Since

inception, we have not paid any dividends on our common stock. We currently do not anticipate paying any cash dividends in the foreseeable

future on our common stock. Although we intend to retain our earnings, if any, to finance the exploration and growth of our business,

our board of directors will have the discretion to declare and pay dividends in the future. Payment of dividends in the future will depend

upon our earnings, capital requirements, and other factors, which our board of directors may deem relevant.

DESCRIPTION

OF SECURITIES OFFERED

We

are offering 1,500,000 shares of our common stock.

General

Our

authorized capital stock consists of 250,000,000 shares of common stock, $0.001 par value per share, and 25,000,000 shares of blank check

preferred stock, $0.001 par value per share. As of January 2, 2025, there were 9,235,119 shares of common stock and 0 shares of

preferred stock outstanding.

This

description is intended as a summary and is qualified in its entirety by reference to our restated certificate of formation and by-laws,

which are filed, or incorporated by reference, as exhibits to our filings with the Securities and Exchange Commission.

Common

Stock

The

material terms and provisions of our common stock and each other class of our securities which qualifies or limits our common stock are

described in the section entitled “Description of Capital Stock” beginning on page 4 of the accompanying prospectus.

PLAN

OF DISTRIBUTION

We

have engaged Aegis Capital Corp., to act as our sole placement agent to solicit offers to purchase the shares offered by this prospectus

supplement on a best efforts basis. The placement agent is not purchasing or selling any such securities, nor is it required to arrange

for the purchase and sale of any specific number or dollar amount of such securities, other than to use its “best efforts”

to arrange for the sale of such securities by us. The terms of this offering were subject to market conditions and negotiations between

us, the placement agent and prospective investors. The placement agent may retain sub-agents and selected dealers in connection with

this offering. We will have one closing for all the shares purchased in this offering.

We

have entered into a securities purchase agreement directly with investors for the sale of all of the shares being offered hereunder.

Delivery

of the shares offered hereby is expected to occur on or about January 3, 2025 subject to satisfaction of certain customary closing conditions.

We

have agreed to pay the placement agent a fee equal to 7% of the gross proceeds received in the offering and pay to the placement agent

a cash fee equal to 1% of the aggregate purchase price paid by investors in this offering for non-accountable expenses. In addition,

we have agreed to reimburse the placement agent for its legal fees, and disbursements and expenses in connection with this offering in

an amount of $50,000.

| | |

Per Share | | |

Total | |

| Public offering price | |

$ | 1.00 | | |

$ | 1,500,000 | |

| Placement agent fees(1) | |

$ | 0.07 | | |

$ | 105,000 | |

| Proceeds, before expenses, to us | |

$ | 0.93 | | |

$ | 1,395,000 | |

| (1) |

Represents

a cash fee equal to 7% of the aggregate purchase price paid by investors in this offering. We have also agreed to reimburse the placement

agent for the fees and disbursements of its legal counsel in an amount of $50,000 and pay to the placement agent a cash fee equal

to 1% of the aggregate purchase price paid by investors in this offering for non-accountable expenses. See “Plan of Distribution”

beginning on page S-7 of this prospectus supplement for a description of the compensation to be received by the placement agent. |

We

will pay the placement agent’s legal expenses relating to the offering in the amount of $50,000. We estimate the total expenses

payable by us for this offering, excluding the placement agent fees and expenses, will be approximately $175,000.

We

anticipate payment to the placement agent of approximately $155,000, consisting of $105,000 for the placement agent

fee, and up to $50,000 for the reimbursement of legal expenses which are payable by us.

Company

Standstill

We have agreed

that without the prior written consent of the investors, the Company will not, for a period of thirty (30) days after the closing

of the placement, (a) offer, sell, issue, or otherwise transfer or dispose of, directly or indirectly, any equity of the Company

or any securities convertible into or exercisable or exchangeable for equity of the Company; (b) file or caused to be filed any registration

statement with the Commission relating to the offering of any equity of the Company or any securities convertible into or exercisable

or exchangeable for equity of the Company; or (c) enter into any agreement or announce the intention to effect any of the actions described

in subsections (a) or (b) hereof.

Right

of First Refusal

We have granted

Aegis a right of first refusal for a period of 12 months from the closing of this offering to act as (i) sole book-runner, sole manager,

sole placement agent or sole agent in the event we decide to finance or refinance any of our indebtedness and (ii) sole book-running

manager, sole underwriter or sole placement agent in the event we decided to raise funds by means of a public offering (including an

at-the-market offering) or a private placement or any other capital raising financing of equity, equity-linked or debt securities.

Regulation

M

The

placement agent may be deemed to be an underwriter within the meaning of Section 2(a)(11) of the Securities Act, and any commissions

received by it and any profit realized on the resale of the shares sold by it while acting as principal might be deemed to be underwriting

discounts or commissions under the Securities Act. As an underwriter, the placement Agent would be required to comply with the requirements

of the Securities Act and the Exchange Act, including, without limitation, Rule 415(a)(4) under the Securities Act and Rule 10b-5 and

Regulation M under the Exchange Act. These rules and regulations may limit the timing of purchases and sales of shares by the placement

agent acting as principal. Under these rules and regulations, the placement agent:

| |

● |

may

not engage in any stabilization activity in connection with our securities; and |

| |

● |

may

not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities, other than as permitted

under the Exchange Act, until it has completed its participation in the distribution. |

Listing

Our

common stock is listed on The Nasdaq Capital Market under the trading symbol “AEI.”

Other

Relationships

The

placement agent and its respective affiliates may in the future engage in investment banking and other commercial dealings in the ordinary

course of business with us or our affiliates. The placement agent may in the future receive customary fees and commissions for these

transactions.

In

the ordinary course of its various business activities, the placement agent and its affiliates may make or hold a broad array of investments

and actively trade debt and equity securities (or related derivative securities) and financial instruments (including bank loans) for

their own account and for the accounts of its customers, and such investment and securities activities may involve securities and/or

instruments of the issuer. The placement agent and its affiliates may also make investment recommendations and/or publish or express

independent research views in respect of such securities or instruments and may at any time hold, or recommend to clients that they acquire,

long and/or short positions in such securities and instruments.

Discretionary

Accounts

The

placement agent does not intend to confirm sales of the shares offered hereby to any accounts over which it has discretionary authority.

Indemnification

We

have agreed to indemnify the placement agent against certain liabilities, including certain liabilities arising under the Securities

Act, or to contribute to payments that the placement agent may be required to make for these liabilities.

Determination

of Offering Price

The

public offering price of the shares we are offering was negotiated between us and the investors, in consultation with the placement agent

based on the trading of our common stock prior to the offering, among other things. Other factors considered in determining the public

offering price of the shares we are offering include our history and prospects, the stage of development of our business, our business

plans for the future and the extent to which they have been implemented, an assessment of our management, general conditions of the securities

markets at the time of the offering and such other factors as were deemed relevant.

Electronic

Offer, Sale and Distribution

This

prospectus in electronic format may be made available on websites or through other online services maintained by the placement agent,

or by its affiliates. Other than this prospectus in electronic format, the information on the placement agent’s website and any

information contained in any other website maintained by the placement agent is not part of this prospectus or the registration statement

of which this prospectus forms a part, has not been approved and/or endorsed by us or the placement agent in its capacity as a placement

agent, and should not be relied upon by investors.

Offer

Restrictions Outside the United States

Other

than in the United States, no action has been taken by us or the placement agent that would permit a public offering of the shares offered

by this prospectus in any jurisdiction where action for that purpose is required. The shares offered by this prospectus may not be offered

or sold, directly or indirectly, nor may this prospectus or any other offering material or advertisements in connection with the offer

and sale of any such securities be distributed or published in any jurisdiction, except under circumstances that will result in compliance

with the applicable rules and regulations of that jurisdiction. Persons who come into possession of this prospectus are advised to inform

themselves about and to observe any restrictions relating to the offering and the distribution of this prospectus. This prospectus does

not constitute an offer to sell or a solicitation of an offer to buy any securities offered by this prospectus in any jurisdiction in

which such an offer or a solicitation is unlawful

Transfer

Agent and Registrar

The

transfer agent and registrar for our common stock is Direct Transfer, LLC, Raleigh, North Carolina.

EXPERTS

The

consolidated balance sheets of the Company as of December 31, 2023 and 2022, the related consolidated statements of operations, stockholders’

equity and cash flows for each of the two years in the period ended December 31, 2023 and the related notes, incorporated by reference

into this prospectus supplement, have been audited by Grassi & Co., CPAs, P.C., the independent registered public accounting firm

of the Company, as stated in their report thereon, which includes an explanatory paragraph as to the Company’s ability to continue

as a going concern, which is incorporated herein by reference. Such financial statements have been incorporated herein by reference in

reliance on the report of such firm given upon their authority as experts in accounting and auditing.

LEGAL

MATTERS

Certain

legal matters with respect to the validity of the shares being offered by this prospectus supplement and accompanying prospectus will

be passed upon by Travis Heuszel, Houston, Texas. The placement agent is being represented by

Kaufman & Canoles, P.C., Richmond, VA, in connection with this offering.

INFORMATION

INCORPORATED BY REFERENCE

The

SEC’s rules allow us to “incorporate by reference” information into this prospectus supplement and the accompanying

prospectus, which means that we can disclose important information to you by referring you to another document filed separately with

the SEC. The information incorporated by reference is deemed to be part of this prospectus supplement and the accompanying prospectus,

and subsequent information that we file with the SEC will automatically update and supersede that information. Any statement contained

in a previously filed document incorporated by reference will be deemed to be modified or superseded for purposes of this prospectus

supplement and the accompanying prospectus to the extent that a statement contained in this prospectus supplement or the accompanying

prospectus modifies or replaces that statement.

We

incorporate by reference our documents listed below and any future filings we may make with the SEC under Sections 13(a), 13(c), 14 or

15(d) of the Exchange Act in this prospectus supplement and the accompanying prospectus, on or after the date of this prospectus supplement

and prior to the termination of the offering of the shares described in this prospectus supplement. We are not, however, incorporating

by reference any documents or portions thereof, whether specifically listed below or filed in the future, that are not deemed “filed”

with the SEC, including the performance graph or any information furnished pursuant to Items 2.02 or 7.01 of Form 8-K or related exhibits

furnished pursuant to Item 9.01 of Form 8-K.

This

prospectus supplement and the accompanying prospectus incorporate by reference the documents set forth below that have previously been

filed with the SEC:

| |

● |

our

Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the SEC on April 1, 2024; |

| |

● |

our

Quarterly Reports on Form 10-Q for the quarterly period ended March 31, 2024, filed with the SEC on May 15, 2024, for the quarterly

period ended June 30, 2024, filed with the SEC on August 13, 2024, and for the quarterly period ended September 30, 2024, filed with

the SEC on November 14, 2024; |

| |

● |

our

Current Reports on Form 8-K filed with the SEC on January 16, 2024, March 14, 2024, April 18, 2024, May 22, 2024, September 27, 2024,

October 15, 2024, November 22, 2024, November 26, 2024, December 5, 2024, and December 16, 2024; |

| |

● |

the

description of our common stock in our Registration on Form 8-A (File No. 001-36057), filed with the SEC on November 23, 2020, as

updated by our proxy statement filed on April 25, 2022 and our Current Report on Form 8-K filed September 6, 2022. |

All

reports and other documents we subsequently file pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act prior to the termination

of this offering, but excluding any information furnished to, rather than filed with, the SEC, will also be incorporated by reference

into this prospectus supplement and the accompanying prospectus and deemed to be part of this prospectus supplement and the accompanying

prospectus from the date of the filing of such reports and documents.

Any

statement contained in this prospectus supplement or the accompanying prospectus or in a document incorporated or deemed to be incorporated

by reference into this prospectus supplement will be deemed to be modified or superseded for purposes hereof to the extent that a statement

contained in this prospectus supplement or the accompanying prospectus or any other subsequently filed document that is deemed to be

incorporated by reference into this prospectus supplement modifies or supersedes the statement. Any statement so modified or superseded

will not be deemed, except as so modified or superseded, to constitute a part of this prospectus supplement and accompanying prospectus.

You

may request a free copy of any of the documents incorporated by reference in this prospectus supplement (other than exhibits, unless

they are specifically incorporated by reference in the documents) by writing or telephoning us at the following address:

Alset

Inc.

4800

Montgomery Lane, Suite 210

Bethesda,

Maryland 20814

Telephone:

(301) 971-3940

WHERE

YOU CAN FIND MORE INFORMATION

We

have filed with the SEC a registration statement on Form S-3 under the Securities Act with respect to the shares offered hereby. This

prospectus supplement, which constitutes a part of the registration statement, does not contain all of the information set forth in the

registration statement or the exhibits and schedules filed therewith. For further information about us and our securities offered hereby,

we refer you to the registration statement and the exhibits and schedules filed therewith. Statements contained in this prospectus supplement

and the accompanying prospectus regarding the contents of any contract or any other document that is filed as an exhibit to the registration

statement are not necessarily complete, and each such statement is qualified in all respects by reference to the full text of such contract

or other document filed as an exhibit to the registration statement. The SEC maintains a website that contains reports, proxy and information

statements and other information regarding registrants that file electronically with the SEC. The address is http://www.sec.gov.

We

are subject to the reporting requirements of the Exchange Act, and file annual, quarterly and current reports, proxy statements and

other information with the SEC. You can read our SEC filings, including the registration statement, over the Internet at the

SEC’s website. We also maintain a website at https://www.alsetinc.com, at which you may access these materials

free of charge as soon as reasonably practicable after they are electronically filed with, or furnished to, the SEC. The information

contained in, or that can be accessed through, our website is not part of this prospectus. You may also request a copy of these

filings, at no cost, by writing or telephoning us at: 4800 Montgomery Lane, Suite 210, phone number (301) 971-3940.

PROSPECTUS

Alset

EHome International Inc.

$75,000,000

Common

Stock

Preferred

Stock

Warrants

Rights

Units

From

time to time, we may offer and sell up to $75,000,000 in aggregate of the securities described in this prospectus separately or together

in any combination, in one or more classes or series, in amounts, at prices and on terms that we will determine at the time of the offering.

This

prospectus provides a general description of the securities we may offer. We may provide specific terms of securities to be offered in

one or more supplements to this prospectus. We may also provide a specific plan of distribution for any securities to be offered in a

prospectus supplement. Prospectus supplements may also add, update or change information in this prospectus. You should carefully read

this prospectus and the applicable prospectus supplement, together with any documents incorporated by reference herein, before you invest

in our securities.

Our

common stock is listed on the Nasdaq Capital Market under the symbol “AEI.”

The

last reported sale price of our common stock on the Nasdaq Capital Market on April 8, 2022 was $0.74 per share. The aggregate market

value of our outstanding common stock held by non-affiliates is $51,191,658.58, based on 113,187,898 shares of outstanding common stock,

of which 69,177,917 shares are held by non-affiliates, and a per share price of $0.74, which was the closing sale price of our

common stock on the Nasdaq Capital Market on April 8, 2022. During the 12 calendar month period that ends on, and includes, the date

of this prospectus, we have not offered and sold any of our securities pursuant to General Instruction I.B.6 of Form S-3.

Investing

in any of our securities involves a high degree of risk. Please read carefully the section entitled “Risk Factors”

on page 4 of this prospectus, the “Risk Factors” section contained in the applicable prospectus supplement and the information

included and incorporated by reference in this prospectus.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is ,

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission, or the SEC, using

a “shelf” registration or continuous offering process. Under this shelf registration process, we may, from time to time,

sell any combination of the securities described in this prospectus in one or more offerings up to a total aggregate offering price of

$75,000,000.

This

prospectus provides a general description of the securities we may offer. We may provide specific terms of securities to be offered in

one or more supplements to this prospectus. We may also provide a specific plan of distribution for any securities to be offered in a

prospectus supplement. Prospectus supplements may also add, update or change information in this prospectus. If the information varies

between this prospectus and the accompanying prospectus supplement, you should rely on the information in the accompanying prospectus

supplement.

Before

purchasing any securities, you should carefully read both this prospectus and any prospectus supplement, together with the additional

information described under the heading “Information We Incorporate by Reference.” You should rely only on the information

contained or incorporated by reference in this prospectus, any prospectus supplement and any free writing prospectus prepared by or on

behalf of us or to which we have referred you. Neither we nor any underwriters have authorized any other person to provide you with different

information. If anyone provides you with different or inconsistent information, you should not rely on it. We take no responsibility

for, and can provide no assurance as to the reliability of, any other information that others may give you. You should assume that the

information contained in this prospectus, any prospectus supplement or any free writing prospectus is accurate only as of the date on

its respective cover, and that any information incorporated by reference is accurate only as of the date of the document incorporated

by reference, unless we indicate otherwise. Our business, financial condition, results of operations and prospects may have changed since

those dates. This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference

is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents.

Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to

the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under

the heading “Where You Can Find More Information.”

This

prospectus and any applicable prospectus supplement do not constitute an offer to sell or the solicitation of an offer to buy any securities

other than the registered securities to which they relate. We are not making offers to sell common stock or any other securities described

in this prospectus in any jurisdiction in which an offer or solicitation is not authorized or in which we are not qualified to do so

or to anyone to whom it is unlawful to make an offer or solicitation.

Unless

otherwise expressly indicated or the context otherwise requires, we use the terms “Alset,” the “Company,” “we,”

“us,” “our” or similar references to refer to Alset EHome International Inc. and its subsidiaries.

WHERE

YOU CAN FIND MORE INFORMATION

We

have filed our registration statement on Form S-3 with the SEC under the Securities Act of 1933, as amended, or the Securities Act. We

also file annual, quarterly and current reports, proxy statements and other information with the SEC. You may read and copy any document

that we file with the SEC, including the registration statement and the exhibits to the registration statement, at the SEC’s Public

Reference Room located at 100 F Street, N.E., Washington D.C. 20549. You may obtain further information on the operation of the Public

Reference Room by calling the SEC at 1-800-SEC-0330. Our SEC filings are also available to the public at the SEC’s web site at

www.sec.gov. These documents may also be accessed on our web site at www.alsetehomeintl.com. Information contained on our web site is

not incorporated by reference into this prospectus and you should not consider information contained on our web site to be part of this

prospectus.

This

prospectus and any prospectus supplement are part of a registration statement filed with the SEC and do not contain all of the information

in the registration statement. The full registration statement may be obtained from the SEC or us as indicated above. Other documents

establishing the terms of the offered securities are filed as exhibits to the registration statement or will be filed through an amendment

to our registration statement on Form S-3 or under cover of a Current Report on Form 8-K and incorporated into this prospectus by reference.

INFORMATION

WE INCORPORATE BY REFERENCE

The

SEC allows us to “incorporate by reference” into this prospectus the information we file with it, which means that we can

disclose important information to you by referring you to those documents. The information incorporated by reference is considered to

be part of this prospectus. Any statement contained herein or in a document incorporated or deemed to be incorporated by reference into

this document will be deemed to be modified or superseded for purposes of the document to the extent that a statement contained in this

document or any other subsequently filed document that is deemed to be incorporated by reference into this document modifies or supersedes

the statement. We incorporate by reference in this prospectus the following information (other than, in each case, documents or information

deemed to have been furnished and not filed in accordance with SEC rules):

| |

● |

our

Annual Report on Form 10-K for the year ended December 31, 2021 filed with the SEC on March 31, 2022; |

| |

|

|

| |

● |

our

Current Reports on Form 8-K filed with the SEC on January

20, 2022; January

21, 2022; January

25, 2022; January

25, 2022; January 27, 2022; February 1, 2022; February 8, 2022; February 17, 2022; February 25, 2022; and March 1, 2022. |

| |

|

|

| |

● |

the

description of our common stock, which is contained in the Registration Statement on Form 8-A, as filed with the SEC on November

23, 2020, as updated by the description of our common stock contained in Exhibit 4.9 to our Annual Report on Form 10-K

for the year ended December 31, 2021, filed with the SEC on March 31, 2022. |

We

also incorporate by reference each of the documents that we file with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Securities

Exchange Act of 1934, as amended, or the Exchange Act, (i) after the date of this prospectus and prior to effectiveness of this registration

statement on Form S-3 and (ii) on or after the date of this prospectus and prior to the termination of the offerings under this prospectus

and any prospectus supplement. These documents include periodic reports, such as Annual Reports on Form 10-K, Quarterly Reports on Form

10-Q and Current Reports on Form 8-K, as well as proxy statements. We will not, however, incorporate by reference in this prospectus

any documents or portions thereof that are not deemed “filed” with the SEC, including any information furnished pursuant

to Item 2.02 or Item 7.01 of our Current Reports on Form 8-K after the date of this prospectus unless, and except to the extent, specified

in such Current Reports.

We

will provide to each person, including any beneficial owner, to whom a prospectus (or a notice of registration in lieu thereof) is delivered

a copy of any of these filings (other than an exhibit to these filings, unless the exhibit is specifically incorporated by reference

as an exhibit to this prospectus) at no cost, upon a request to us by writing or telephoning us at the following address and telephone

number:

Alset

EHome International Inc.

4800

Montgomery Lane, Suite 210

Bethesda,

Maryland 20814

(301)

971-3940

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus, including the documents incorporated by reference herein, may contain or incorporate “forward-looking statements”

within the meaning of Section 21E of the Securities Exchange Act of 1934. In this context, forward-looking statements mean statements

related to future events, may address our expected future business and financial performance, and often contain words such as “expects”,

“anticipates”, “intends”, “plans”, “believes”, “will”, “should”,

“could”, “would” or “may” and other words of similar meaning. Forward-looking statements by their

nature address matters that are, to different degrees, uncertain. Various risks and uncertainties, including those discussed in this

and our other filings with the SEC, could cause our actual future results to differ materially from those expressed in our forward-looking

statements.

All

written and oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety

by the cautionary statements disclosed under “Item 1A. Risk Factors,” in our Annual Report on Form 10-K for the year ended

December 31, 2021, as such risk factors may be amended, supplemented or superseded from time to time by other reports we file with the

SEC, including subsequent Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q, and in any prospectus supplement. Accordingly,

forward-looking statements should be not be relied upon as a predictor of actual results. Readers are urged to carefully review and consider

the various disclosures made in this prospectus and in our other filings with the SEC that attempt to advise interested parties of the

risks and factors that may affect our business. We do not undertake to update our forward-looking statements to reflect events or circumstances

that may arise after the date of this prospectus, except as required by law.

Alset

EHome International Inc.

We

are a diversified holding company principally engaged through our subsidiaries in the development of EHome communities and other real

estate, financial services, digital transformation technologies, biohealth activities and consumer products with operations in the United

States, Singapore, Hong Kong, Australia and South Korea. We manage our three principal businesses primarily through our 77% owned subsidiary,

Alset International Limited (“Alset International”), a public company traded on the Singapore Stock Exchange. Through this

subsidiary (and indirectly, through other public and private U.S. and Asian subsidiaries), we are actively developing real estate projects

near Houston, Texas and in Frederick, Maryland in our real estate segment. We have designed applications for enterprise messaging and

e-commerce software platforms in the United States and Asia in our digital transformation technology business unit. Our biohealth segment

includes sale of consumer products. We identify global businesses for acquisition, incubation and corporate advisory services, primarily

related to our operating business segments.

We

also have ownership interests outside of Alset International, including a 41.3% equity interest in American Pacific Bancorp Inc., an

indirect 15.8% equity interest in Holista CollTech Limited, a 15.5% equity interest in True Partner Capital Holding Limited, a 28.5%

equity interest in DSS Inc. (“DSS”), an 18% equity interest in Value Exchange International, Inc., a 17.5% equity interest

in American Premium Water Corp., and an interest in Alset Capital Acquisition Corp. (“Alset Capital”). American Pacific Bancorp

Inc. is a financial network holding company. Holista CollTech Limited is a public Australian company that produces natural food ingredients

(ASX: HCT). True Partner Capital Holding Limited is a public Hong Kong company which operates as a fund management company in the U.S.

and Hong Kong. DSS is a multinational company operating businesses within nine divisions: product packaging, biotechnology, direct marketing,

commercial lending, securities and investment management, alternative trading, digital transformation, secure living, and alternative

energy. DSS Inc. is listed on the NYSE American (NYSE: DSS). Value Exchange International, Inc. is a provider of information technology

services for businesses, and is traded on the OTCQB (OTCQB: VEII). American Premium Water Corp. is a publicly traded consumer products

company (OTCPK: HIPH). Alset Capital is a newly organized blank check company formed for the purpose of effecting a merger, capital stock

exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses and is listed

on the Nasdaq (Nasdaq: ACAXU, ACAX, ACAXW and ACAXR).

Under

the guidance of Chan Heng Fai, our founder, Chairman and Chief Executive Officer, who is also our largest stockholder, we have positioned

ourselves as a participant in these key markets through a series of strategic transactions. Our growth strategy is both to pursue acquisition

opportunities that we can leverage on our global network using our capital and management resources and to accelerate the expansion of

our organic businesses.

We

generally acquire majority and/or control stakes in innovative and promising businesses that are expected to appreciate in value over

time. Our emphasis is on building businesses in industries where our management team has in-depth knowledge and experience, or where

our management can provide value by advising on new markets and expansion. We have at times provided a range of global capital and management

services to these companies in order to gain access to Asian markets. We have historically favored businesses that improve an individual’s

quality of life or that improve the efficiency of businesses through technology in various industries. We believe our capital and management

services provide us with a competitive advantage in the selection of strategic acquisitions, which creates and adds value for our company

and our stockholders.

We

intend at all times to operate our business in a manner as to not become inadvertently subject to the regulatory requirements under the

Investment Company Act by, among other things, (i) in the event of acquisitions, purchasing all or substantially all of an acquisition

target’s voting stock, and only in limited cases purchase less than 51% of the voting stock; (ii) monitoring our operations and

our assets on an ongoing basis in order to ensure that we own no less than a majority, or other control, of Alset International and that

Alset International, in turn, owns no less than a majority, or other control, of LiquidValue Development Inc. and other such subsidiaries

with significant assets and operations; and (iii) limiting additional equity investments into affiliated companies including our majority-owned

and/or controlled operating subsidiaries, except in special limited circumstances. Additionally, we will continue to hire in-house management

personnel and employees with industry background and experience, rather than retaining traditional investment portfolio managers to oversee

our group of companies.

We

were incorporated in the State of Delaware on March 7, 2018 as HF Enterprises Inc. Effective as of February 5, 2021, the Company changed

its name from “HF Enterprises Inc.” to “Alset EHome International Inc.” We effected such name change pursuant

to a merger entered into with a wholly owned subsidiary, Alset EHome International Inc. We are the surviving entity following this merger

and have adopted the name of our former subsidiary. In connection with our name change, our trading symbol on the Nasdaq Stock Market

was changed from “HFEN” to “AEI.”

The following chart illustrates

the current corporate structure of our key operating entities:

RISK

FACTORS

Investing

in our securities involves a high degree of risk. Before making an investment decision, you should carefully consider any risk factors

set forth in the applicable prospectus supplement and the documents incorporated by reference in this prospectus, including the factors

discussed under the heading “Risk Factors” in our most recent Annual Report on Form 10-K and each subsequently filed Quarterly

Report on Form 10-Q and any risk factors set forth in our other filings with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of

the Securities Exchange. See “Where You Can Find More Information” and “Information We Incorporate By Reference.”

Each of the risks described in these documents could materially and adversely affect our business, financial condition, results of operations

and prospects, and could result in a partial or complete loss of your investment. Additional risks and uncertainties not presently known

to us, or that we currently deem immaterial, may also adversely affect our business. In addition, past financial performance may not

be a reliable indicator of future performance and historical trends should not be used to anticipate results or trends in future periods.

USE

OF PROCEEDS

We

will retain broad discretion over the use of the net proceeds from the sale of the securities offered hereby. Unless otherwise specified

in any prospectus supplement, we currently intend to use the net proceeds from the sale of our securities offered under this prospectus

(i) to fund possible acquisitions of new companies and additional properties, (ii) to fund the further development of properties, including

services and infrastructure; (iii) to develop rental opportunities at properties; (iv) to exercise warrants of our subsidiaries to accomplish

the items in (i) – (iii) and (v) for working capital and general corporate purposes. Pending any specific application, we may initially

invest funds in short-term marketable securities or apply them to the reduction of indebtedness.

A

significant portion of the net proceeds from the sale of securities offered under this prospectus may be used to fund possible acquisitions

of new companies in the markets in which we operate, or may operate in the future, and to acquire additional real estate development

properties. We intend to acquire all or substantially all of an acquisition target’s voting stock and only in limited cases acquire

less than 51% of the voting stock. We have no such acquisition agreements or commitments in place at this time. Pending any specific

application, we may initially invest funds in short-term marketable securities or apply them to the reduction of indebtedness.

DESCRIPTION

OF CAPITAL STOCK

The

following description summarizes important terms of our common stock. For a complete description, you should refer to our certificate

of incorporation and bylaws, forms of which are incorporated by reference to the exhibits to the registration statement of which this

prospectus is a part, as well as the relevant portions of the Delaware law. References to our certificate of incorporation and bylaws

are to our certificate of incorporation and our bylaws, respectively, each of which will become effective upon completion of this offering.

General

Our

authorized capital stock consists of 250,000,000 shares of common stock with a $0.001 par value per share, and 25,000,000 shares of blank

check preferred stock with a $0.001 par value per share. Our board of directors may establish the rights and preferences of the preferred

stock from time to time. As of April 11, 2022, there were 113,187,898 shares of common stock issued and outstanding, and 0 shares of

preferred stock issued or outstanding.

Common

Stock

Each

holder of our common stock is entitled to one vote for each share on all matters to be voted upon by the stockholders and there are no

cumulative rights. Subject to any preferential rights of any outstanding preferred stock, holders of our common stock are entitled to

receive ratably the dividends, if any, as may be declared from time to time by the board of directors out of legally available funds.

If

there is a liquidation, dissolution or winding up of our company, holders of our common stock would be entitled to share in our assets

remaining after the payment of liabilities and any preferential rights of any outstanding preferred stock.

Holders

of our common stock have no preemptive or conversion rights or other subscription rights, and there are no redemption or sinking fund

provisions applicable to the common stock. All outstanding shares of our common stock will be fully paid and non-assessable. The rights,

preferences and privileges of the holders of our common stock are subject to, and may be adversely affected by, the rights of the holders

of shares of any series of preferred stock which we may designate and issue in the future.

Preferred

Stock

Under

the terms of our certificate of incorporation, our board of directors is authorized to issue shares of preferred stock in one or more

series without stockholder approval. Our board of directors has the discretion to determine the rights, preferences, privileges and restrictions,

including voting rights, dividend rights, conversion rights, redemption privileges and liquidation preferences, of each series of preferred

stock.

The

purpose of authorizing our board of directors to issue preferred stock and determine its rights and preferences is to eliminate delays

associated with a stockholder vote on specific issuances. The issuance of preferred stock, while providing flexibility in connection

with possible future acquisitions and other corporate purposes, will affect, and may adversely affect, the rights of holders of common

stock. It is not possible to state the actual effect of the issuance of any shares of preferred stock on the rights of holders of common

stock until the board of directors determines the specific rights attached to that preferred stock. The effects of issuing preferred

stock could include one or more of the following:

| ● | restricting

dividends on the common stock; |

| ● | diluting

the voting power of the common stock; |

| ● | impairing

the liquidation rights of the common stock; or |

| ● | delaying

or preventing changes in control or management of our company. |

We

have no present plans to issue any shares of preferred stock.

Effect

of Certain Provisions of our Charter and Bylaws and the Delaware Anti-Takeover Statute

Certain

provisions of Delaware law, our certificate of incorporation and our bylaws contain provisions that could have the effect of delaying,

deferring or discouraging another party from acquiring control of us. These provisions, which are summarized below, may have the effect

of discouraging coercive takeover practices and inadequate takeover bids. These provisions are also designed, in part, to encourage persons

seeking to acquire control of us to first negotiate with our board of directors. We believe that the benefits of increased protection

of our potential ability to negotiate with an unfriendly or unsolicited acquirer outweigh the disadvantages of discouraging a proposal

to acquire us because negotiation of these proposals could result in an improvement of their terms.

No

cumulative voting

The

Delaware General Corporation Law provides that stockholders are not entitled to the right to cumulate votes in the election of directors

unless our certificate of incorporation provides otherwise. Our certificate of incorporation and bylaws prohibit cumulative voting in

the election of directors.

Undesignated

preferred stock

The

ability to authorize undesignated preferred stock makes it possible for our board of directors to issue one or more series of preferred

stock with voting or other rights or preferences that could impede the success of any attempt to change control. These and other provisions

may have the effect of deferring hostile takeovers or delaying changes in control or management of our company.

Calling

of special meetings of stockholders

Our

charter documents provide that a special meeting of stockholders may be called only by resolution adopted by our board of directors,

chairman of the board of directors or chief executive officer or upon the written request of stockholders owning at least 33.3% of the

outstanding common stock. Stockholders owning less than such required amount may not call a special meeting, which may delay the ability

of our stockholders to force consideration of a proposal or for holders controlling a majority of our capital stock to take any action,

including the removal of directors.

Requirements

for advance notification of stockholder nominations and proposals

Our

bylaws establish advance notice procedures with respect to stockholder proposals and the nomination of candidates for election as directors,

other than nominations made by or at the direction of the board of directors or a committee of the board of directors. However, our bylaws

may have the effect of precluding the conduct of certain business at a meeting if the proper procedures are not followed. These provisions

may also discourage or deter a potential acquirer from conducting a solicitation of proxies to elect the acquirer’s own slate of

directors or otherwise attempting to obtain control of our company.

Section

203 of the Delaware General Corporation Law

We

are subject to the provisions of Section 203 of the Delaware General Corporation Law. In general, Section 203 prohibits a publicly-held

Delaware corporation from engaging in a “business combination” with an “interested stockholder” for a three-year

period following the time that this stockholder becomes an interested stockholder, unless the business combination is approved in a prescribed

manner. Under Section 203, a business combination between a corporation and an interested stockholder is prohibited unless it satisfies

one of the following conditions:

| ● | Before

the stockholder became interested, our board of directors approved either the business combination

or the transaction which resulted in the stockholder becoming an interested stockholder; |

| ● | Upon

consummation of the transaction which resulted in the stockholder becoming an interested

stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation

outstanding at the time the transaction commenced, excluding for purposes of determining

the voting stock outstanding, shares owned by persons who are directors and also officers,

and employee stock plans, in some instances, but not the outstanding voting stock owned by

the interested stockholder; or |

| ● | At

or after the time the stockholder became interested, the business combination was approved

by our board of directors and authorized at an annual or special meeting of the stockholders

by the affirmative vote of at least two-thirds of the outstanding voting stock which is not

owned by the interested stockholder. |

Section

203 defines a business combination to include:

| ● | Any

merger or consolidation involving the corporation and the interested stockholder; |

| ● | Any

sale, transfer, lease, pledge or other disposition involving the interested stockholder of

10% or more of the assets of the corporation; |

| ● | Subject

to exceptions, any transaction that results in the issuance or transfer by the corporation

of any stock of the corporation to the interested stockholder; |

| ● | subject

to exceptions, any transaction involving the corporation that has the effect of increasing

the proportionate share of the stock of any class or series of the corporation beneficially

owned by the interested stockholder; and |

| ● | the

receipt by the interested stockholder of the benefit of any loans, advances, guarantees,

pledges or other financial benefits provided by or through the corporation. |

In

general, Section 203 defines an interested stockholder as any entity or person beneficially owning 15% or more of the outstanding voting

stock of the corporation and any entity or person affiliated with or controlling or controlled by the entity or person.

Choice

of Forum

Our

certificate of incorporation provides that, unless we consent in writing to the selection of an alternative forum, the Court of Chancery

of the State of Delaware will be the sole and exclusive forum for (i) any derivative action or proceeding brought on our behalf, (ii)

any action asserting a claim of breach of a fiduciary duty owed by our directors, officers or other employees to us or to our stockholders,

(iii) any action asserting a claim against us or any director, officer or other employee arising pursuant to any provision of the Delaware

General Corporation Law, our certificate of incorporation or bylaws or (iv) any action asserting a claim governed by the internal affairs

doctrine, in all cases to the fullest extent permitted by law and subject to the court having personal jurisdiction over the indispensable

parties named as defendants; provided that these provisions of our certificate of incorporation will not apply to suits brought to enforce

a duty or liability created by the Exchange Act, or any other claim for which the federal courts have exclusive jurisdiction. Our certificate

of incorporation further provides that the federal district courts of the United States of America will be the exclusive forum for resolving

any complaint asserting a cause of action arising under the Securities Act, unless we consent in writing to the selection of an alternative

forum.

Limitations

of Liability and Indemnification

Section

145 of the Delaware General Corporation Law (the “DGCL”) provides for, under certain circumstances, the indemnification of

our officers, directors, employees and agents against liabilities that they may incur in such capacities. A summary of the circumstances

in which such indemnification provided for is contained herein.

In

general, the statute provides that any director, officer, employee or agent of a corporation may be indemnified against expenses (including

attorneys’ fees), judgments, fines and amounts paid in settlement, actually and reasonably incurred in a proceeding (including

any civil, criminal, administrative or investigative proceeding) to which the individual was a party by reason of such status. Such indemnity

may be provided if the indemnified person’s actions resulting in the liabilities: (i) were taken in good faith; (ii) were reasonably