Affirm and PGIM Fixed Income Expand Partnership with Completion of Private Purchase of $500 Million in Loans

03 Décembre 2024 - 2:00PM

Business Wire

Affirm Holdings, Inc. (NASDAQ: AFRM), the payment network that

empowers consumers and helps merchants drive growth, and PGIM Fixed

Income, a Prudential Financial (NYSE: PRU) company and one of the

largest global fixed income managers with $859 billion in assets

under management, today announced that PGIM Fixed Income has

completed an inaugural private purchase of $500 million in Affirm

loans.

The transaction deepens Affirm’s partnership with PGIM Fixed

Income, which manages a leading asset-based finance (“ABF”)

platform and more than $120 billion in assets under management

across public and private securitized credit*. Previously, PGIM

Fixed Income invested in Affirm’s assets via the company’s public

asset-backed securitizations. As a scaled and programmatic issuer,

Affirm has issued 21 asset-backed securitizations totaling nearly

$10 billion with participation from over 130 unique capital

partners across institution types, including: alternative asset

managers, insurance companies, pension funds, sovereign wealth

funds, hedge funds, and banks.

"We are pleased to further invest in our partnership with Affirm

as we selectively expand our origination relationships and identify

investments that provide compelling risk-adjusted returns for our

clients from partners that put the needs of their clients first,”

said Edwin Wilches, Managing Director and Co-Head of Securitized

Products at PGIM Fixed Income. “As we see the pay-over-time

industry growing, we believe that Affirm’s assets represent an

attractive investment opportunity. We are excited to build a

mutually beneficial long-term partnership that combines Affirm’s

differentiated approach to managing credit with PGIM’s deep

experience and established platform as an asset-based finance

lender.”

“Our differentiated approach to underwriting every transaction

has enabled us to deliver consistently strong credit outcomes and

attract some of the top investors in the world,” said Brooke

Major-Reid, Chief Capital Officer at Affirm. “We are thrilled to

deepen our partnership with PGIM as we strengthen our funding

platform and capitalize on our significant momentum. As one of the

largest global asset managers with a meaningful third-party

investor base, we believe that PGIM is an ideal partner to help

Affirm advance our mission of delivering honest financial products

that improve lives.”

Affirm empowers more than 19 million active consumers with a

transparent and flexible way to pay over time without late or

hidden fees. The company generated over $28 billion in gross

merchandise volume (GMV) for the last twelve months ending

September 30, 2024. With a diverse and durable funding model across

multiple channels, Affirm has grown its total funding capacity by

over 50% over the last two years to $16.8 billion as of September

30, 2024.

About Affirm

Affirm’s mission is to deliver honest financial products that

improve lives. By building a new kind of payment network – one

based on trust, transparency and putting people first – we empower

millions of consumers to spend and save responsibly, and give

thousands of businesses the tools to fuel growth. Unlike most

credit cards and other pay-over-time options, we never charge any

late or hidden fees. Follow Affirm on social media: LinkedIn |

Instagram | Facebook | X.

About PGIM FIXED INCOME

PGIM Fixed Income, with $859 billion in assets under management

as of September 30, 2024, is a global asset manager offering active

solutions across all fixed income markets. The company has offices

in Newark, N.J., London, Amsterdam, Zurich, Munich, Paris,

Singapore, Sydney, Hong Kong, and Tokyo. For more information,

visit pgimfixedincome.com.

About PGIM

PGIM is the global asset management business of Prudential

Financial, Inc. (NYSE: PRU). In 42 offices across 19 countries and

jurisdictions, our more than 1,400 investment professionals serve

both retail and institutional clients around the world.

As a leading global asset manager with $1.4 trillion in assets

under management,* PGIM is built on a foundation of strength,

stability, and disciplined risk management. Our multi-affiliate

model allows us to deliver specialized expertise across key asset

classes with a focused investment approach. This gives our clients

a diversified suite of investment strategies and solutions with

global depth and scale across public and private asset classes,

including fixed income, equities, real estate, private credit, and

other alternatives. For more information visit pgim.com.

*As of Sept. 30, 2024.

AFRM-F

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241203806661/en/

Affirm Contacts

Investor Relations ir@affirm.com

Media press@affirm.com

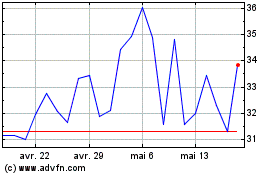

Affirm (NASDAQ:AFRM)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Affirm (NASDAQ:AFRM)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024