Affirm and Adyen Expand Partnership to Bring Flexible Payment Options to More Merchants and Platforms

18 Décembre 2024 - 3:00PM

Business Wire

Affirm will be the first BNPL provider to

support Adyen for Platforms

Expanded partnership also brings Affirm’s

monthly installments to Adyen merchants in Canada

Affirm Holdings, Inc. (NASDAQ: AFRM), the payment network that

empowers consumers and helps merchants drive growth, today

announced that it has expanded its partnership with Adyen, the

global financial technology platform of choice for leading

businesses. The expanded partnership makes Affirm the first Buy

Now, Pay Later (BNPL) provider to support Adyen for Platforms, an

end-to-end payment solution for platform businesses, and brings

more payment options to Adyen merchants in Canada.

Launched in November 2020, the partnership between Affirm and

Adyen began by making Affirm available to eligible Adyen merchants

in the U.S., online as well as in-store through Adyen’s physical

payment terminals. With the expanded agreement, Affirm will be

available to customers of Adyen for Platforms, which include

peer-to-peer marketplaces, on-demand services, crowdfunding

platforms and more. Additionally, Adyen merchants in Canada will

access a wider range of Affirm’s offerings, delivering monthly

installments alongside the existing biweekly payment option. With

Affirm, approved consumers can choose from a range of customized

payment plans – from six weeks to 36 months, and for as low as 0%

APR – and will never owe a penny in late or hidden fees.

This milestone in Affirm and Adyen’s relationship follows the

significant growth the partnership has experienced since launch

with average annual volume increasing by more than seven times from

2021 to 2023.

“Adyen is committed to delivering best-in-class payment

experiences that help our global merchants drive growth and better

serve their customers. That is why we’re excited to expand our

partnership with Affirm, enabling Adyen for Platforms customers to

offer this payment method,” said Davi Strazza, president of Adyen

North America. “The opportunity for platforms to embed payments and

financial services is incredible — a game-changing $185 billion

market opportunity for SaaS platforms, according to our research

with Boston Consulting Group. Together with Affirm, we’re unlocking

greater flexibility for consumers across the U.S. and Canada.”

Merchants and their customers are reaping the benefits of Affirm

and Adyen’s partnership. Since integrating with Affirm, AffiniPay,

an Adyen partner that is a leading provider of practice management

software, integrated payments and embedded fintech for

professionals, has processed over $125 million in payments with Pay

Later. Pay Later is AffiniPay’s legal fee financing solution

powered by Affirm and exclusively available through their leading

legal payments software, LawPay.

“At AffiniPay, we are relentlessly committed to providing the

latest innovative technology to drive outstanding outcomes for our

customers,” said Dru Armstrong, Chief Executive Officer of

AffiniPay. “By partnering with market leaders like Adyen and

Affirm, we are able to continuously exceed expectations for our

customers.”

"Adyen has built a powerful platform to help businesses drive

growth all around the world," said Wayne Pommen, Chief Revenue

Officer of Affirm. "Deepening our partnership with Adyen — and

continuing to build out an unparalleled network of payment partners

– will further expand Affirm’s reach so that more consumers,

merchants and platforms can benefit from our honest financial

products.”

Offering Affirm at checkout can help businesses drive overall

sales, increase average order value, and reach new customers. Adyen

merchants and platforms can go here to learn more.

About Affirm

Affirm’s mission is to deliver honest financial products that

improve lives. By building a new kind of payment network – one

based on trust, transparency and putting people first – we empower

millions of consumers to spend and save responsibly, and give

thousands of businesses the tools to fuel growth. Unlike most

credit cards and other pay-over-time options, we never charge any

late or hidden fees. Follow Affirm on social media: LinkedIn |

Instagram | Facebook | X .

About Adyen

Adyen (AMS: ADYEN) is the financial technology platform of

choice for leading companies. By providing end-to-end payments

capabilities, data-driven insights, and financial products in a

single global solution, Adyen helps businesses achieve their

ambitions faster. With offices around the world, Adyen works with

the likes of Meta, Uber, H&M, and eBay. The cooperation with

Affirm as described in this update underlines Adyen’s continuous

expansion of supported payment methods over the years.

Payment options through Affirm are subject to eligibility, and

are provided by these lending partners: affirm.com/lenders. CA

residents: Loans by Affirm Loan Services, LLC are made or arranged

pursuant to California Finance Law License 60DBO-111681. Canada

residents: Payment options through Affirm Canada Holdings Ltd. are

subject to an eligibility check, depend on purchase amount, vary by

merchant, and may not be available in all

provinces/territories.

AFRM-F

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241218480257/en/

Media press@affirm.com

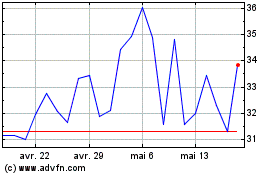

Affirm (NASDAQ:AFRM)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Affirm (NASDAQ:AFRM)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024