REITs Look to Benefit as Federal Reserve to Keep Rates Low Even as Economy Rebounds

05 Octobre 2012 - 2:20PM

Marketwired

Mortgage REITs have garnered increased attention among investors in

recent weeks after the Federal Reserve announced stimulus measures

focused on the purchases of mortgage backed securities. The Market

Vectors Mortgage REIT Income ETF (MORT), which seeks to replicate

the price and yield performance of the Market Vectors Global

Mortgage REITs Index, has gained over 20 percent year-to-date. Five

Star Equities examines the outlook for diversified REITs and

provides equity research on American Capital Agency Corp. (NASDAQ:

AGNC) and Annaly Capital Management, Inc. (NYSE: NLY).

Access to the full company reports can be found at:

www.FiveStarEquities.com/AGNC www.FiveStarEquities.com/NLY

The Federal Open Market Committee last month announced the third

round of quantitative easing in which the Fed would purchase $40

billion of mortgage debt per month until the economy showed

"sustained improvement." The main interest rate is now forecasted

to remain near zero until at least mid-2015.

Federal Reserve Chairman Ben S. Bernanke has recently pledged to

sustain record stimulus even after the U.S. economy has

strengthened, but at the same time does not expect the "economy to

be weak through" 2015. "We expect that a highly accommodative

stance of monetary policy will remain appropriate for a

considerable time after the economy strengthens," Bernanke said in

a recent speech in Indianapolis.

Five Star Equities releases regular market updates on

Diversified REITs so investors can stay ahead of the crowd and make

the best investment decisions to maximize their returns. Take a few

minutes to register with us free at www.FiveStarEquities.com and

get exclusive access to our numerous stock reports and industry

newsletters.

American Capital Agency is a real estate investment trust that

invests in agency pass-through securities and collateralized

mortgage obligations for which the principal and interest payments

are guaranteed by a U.S. Government agency or a U.S.

Government-sponsored entity. The company currently offers investors

an annual dividend of $5.00 per share for a yield of roughly 14.2

percent.

Annaly manages assets on behalf of institutional and individual

investors worldwide. The Company's principal business objective is

to generate net income for distribution to investors from its

investment securities and from dividends it receives from its

subsidiaries. The company currently offers investors an annual

dividend of $2.00 per share for a yield of roughly 11.85

percent.

Five Star Equities provides Market Research focused on equities

hat offer growth opportunities, value, and strong potential return.

We strive to provide the most up-to-date market activities. We

constantly create research reports and newsletters for our members.

Five Star Equities has not been compensated by any of the

above-mentioned companies. We act as an independent research portal

and are aware that all investment entails inherent risks. Please

view the full disclaimer at:

www.FiveStarEquities.com/disclaimer

Add to Digg Bookmark with del.icio.us Add to Newsvine

Contact: Five Star Equities Email Contact

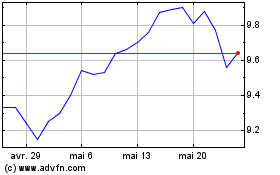

AGNC Investment (NASDAQ:AGNC)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

AGNC Investment (NASDAQ:AGNC)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024