UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM SD

Specialized Disclosure Report

Amkor Technology, Inc.

(Exact name of the registrant as specified in its charter)

| | | | | |

Delaware | 000-29472 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) |

| | | | | |

2045 East Innovation Circle, Tempe, AZ | 85284 |

(Address of principal executive offices) | (Zip Code) |

| | | | | |

Mark N. Rogers | (480) 821-5000 |

(Name and telephone number, including area code, of the person to contact in connection with this report) |

Check the appropriate box to indicate the rule pursuant to which this form is being filed:

[X] Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, 2023.

☐ Rule 13q-1 under the Securities Exchange Act (17 CFR 240.13q-1) for the fiscal year ended____________ .

Section 1 - Conflict Minerals Disclosure

Item 1.01 Conflict Minerals Disclosure and Report

Conflict Minerals Disclosure

This Specialized Disclosure Report on Securities and Exchange Commission (“SEC”) Form SD (this “Form SD”) is filed pursuant to Section 13(p) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and Rule 13p-1 thereunder, which implements Section 1502 of the Dodd-Frank Wall Street Reform and Consumer Protection Act (Section 13(p) of the Exchange Act, Rule 13p-1 thereunder, and Section 1502 of the Dodd-Frank Wall Street Reform and Consumer Protection Act collectively, the “Conflict Minerals Regulations”). Pursuant to the Conflict Minerals Regulations, Amkor Technology, Inc. (the “Company”) conducted a good faith Reasonable Country of Origin Inquiry in 2023 (the “RCOI”) on the sources of its Conflict Minerals (as defined in the Conflict Minerals Regulations) to determine whether the Conflict Minerals used when performing the Company’s semiconductor packaging services originated from the Democratic Republic of the Congo or an adjoining country (the “Covered Countries”) or are from recycled or scrap sources.

The Company conducted the RCOI with its direct suppliers using the Conflict Minerals Reporting Template (“CMRT”), a supply chain survey tool provided by the Responsible Minerals Initiative (“RMI”), an industry group that works to address Conflict Minerals issues within supply chains. The CMRT requests direct suppliers to identify the smelters, refiners, and countries of origin of the Conflict Minerals in their products. The Company relied primarily on responses received from its direct suppliers and information provided by the RMI to identify sources of the Conflict Minerals used by the Company.

Based on the responses to the Company’s RCOI, the Company knows or has reason to believe that a portion of the Conflict Minerals used by the Company originated or may have originated from the Covered Countries or may not be solely from recycled or scrap sources.

In accordance with the Conflict Minerals Regulations, the Company’s Conflict Minerals Report for the year ended December 31, 2023 (the “CMR”) is attached to this Form SD as Exhibit 1.01 and is incorporated into this Form SD by reference. Both reports are available on the Company’s website under the heading “Financial Information > SEC Filings” at https://ir.amkor.com. This Form SD and Exhibit 1.01 contain references to the Company’s website. The information on the Company’s website is not incorporated by reference into this Form SD or the CMR, nor are they deemed “filed” with the SEC pursuant to the Exchange Act or the Securities Act of 1933, as amended.

Item 1.02 Exhibit

Information concerning Conflict Minerals required by the Conflict Minerals Regulations is included in Exhibit 1.01 to this Form SD.

Section 2 - Resource Extraction Issuer Disclosure

Item 2.01 Resource Extraction Issuer Disclosure and Report

Not applicable.

Section 3 - Exhibits

Item 3.01 Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the duly authorized undersigned.

(Registrant)

| | | | | | | | |

/s/ Mark N. Rogers | | May 28, 2024 |

Mark N. Rogers, Executive Vice President, General Counsel, and Corporate Secretary |

| Date |

Exhibit 1.01

Conflict Minerals Report of Amkor Technology, Inc.

This Conflict Minerals Report for the year ended December 31, 2023 (this “Report”) of Amkor Technology, Inc. (the “Company,” “Amkor,” “we,” or “us”) contains forward-looking statements within the meaning of the federal securities laws. You are cautioned not to place undue reliance on forward-looking statements, which are often characterized by terminology such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue,” or “intend,” by the negative of these terms or other comparable terminology, or by discussions of strategy, plans, or intentions. All forward-looking statements in this Report are made based on our current expectations, forecasts, estimates, and assumptions. Because such statements include risks, uncertainties, assumptions, and other factors, actual results may differ materially from those anticipated in such forward-looking statements, including, but not limited to, our customers’ requirements to use certain suppliers, our suppliers’ responsiveness and cooperation with our due diligence efforts, our ability to implement improvements in our conflict minerals program, changes to the sourcing status of smelters and refiners in our supply chain, our ability to identify and mitigate related risks in our supply chain, and other important risk factors discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 (the “Form 10-K”) and from time to time in the Company’s other reports filed with or furnished to the Securities and Exchange Commission (“SEC”). You should carefully consider the trends, risks, and uncertainties described in this Report, the Form 10-K, and other reports filed with or furnished to the SEC before making any investment decision with respect to our securities. If any of these trends, risks, or uncertainties continues or occurs, our business, financial condition, or operating results could be materially adversely affected, the trading prices of our securities could decline, and you could lose part or all of your investment. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by this cautionary statement. We undertake no obligation to review or update any forward-looking statements to reflect events or circumstances occurring after the date of this Report except as may be required by applicable law.

This Report was prepared in accordance with Section 13(p) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and Rule 13p-1 thereunder, which implements Section 1502 of the Dodd-Frank Wall Street Reform and Consumer Protection Act (Section 13(p) of the Exchange Act, Rule 13p-1 thereunder, and Section 1502 of the Dodd-Frank Wall Street Reform and Consumer Protection Act collectively, the “Conflict Minerals Regulations”).

Business Overview

Amkor Technology, Inc. is the world's largest US-headquartered OSAT (outsourced semiconductor assembly and test) service provider. Our packaging and test services are designed to meet application and chip-specific requirements including: the required type of interconnect technology; size; thickness; and electrical, mechanical, and thermal performance. Some of the materials we use when providing packaging services contain tantalum, tin, tungsten, or gold (collectively, “Conflict Minerals”). Test services involve checking that a packaged die meets its design and performance specifications and do not involve the use of Conflict Minerals.

The supply chain that provides us with Conflict Minerals is divided into “upstream” and “downstream” entities. An upstream entity is an entity in our supply chain located between the mine of origin and the smelter or refiner and includes miners, local traders, exporters from the country of mineral origin, international concentrate traders, mineral processors, smelters, and refiners. A downstream entity is an entity in our supply chain located between the smelter or refiner and the retailer and includes metal traders and exchanges, component manufacturers, product manufacturers, original equipment manufacturers, and retailers.

Amkor is a downstream entity and is typically several tiers removed from the smelter or refiner and mineral origin. We have limited visibility beyond our direct suppliers to entities within our supply chain. Therefore, we rely principally on our direct suppliers to provide us with sourcing information.

Due Diligence Overview

We undertook due diligence on the source and chain of custody of the Conflict Minerals we use when providing packaging services using tools and relying on information provided by the Responsible Minerals Initiative (the “RMI”), an industry group that works to address Conflict Minerals issues within supply chains. One RMI tool we used as part of our due diligence was the Conflict Minerals Reporting Template (“CMRT”), which facilitates the collection of information on the source of Conflict Minerals. We also relied on information from the Responsible Minerals Assurance Process (“RMAP”), a voluntary initiative managed by the RMI, in which an independent third party validates the Conflict Minerals management procedures of a smelter or refiner to determine, with reasonable confidence, that the minerals it processes were sourced responsibly. If a smelter or refiner has committed to undergo an RMAP assessment, completed the relevant documents, and scheduled the RMAP assessment, they are designated by the RMI as “Active.” Upon completion of a successful audit, the smelter or refiner is designated by the RMI as “Conformant.”

Due Diligence Design

We designed our due diligence to conform to an internationally recognized due diligence framework, the Organisation for Economic Co-operation and Development (OECD), Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas, Third Edition, and related supplements on Tin, Tantalum and Tungsten and on Gold (collectively, the “OECD Framework”).

The OECD Framework provides a five-step outline for risk-based due diligence in the mineral supply chain. Our due diligence framework, which was designed to align with and incorporate the five-step outline from the OECD Framework, is summarized below.

Step 1 - Establish Strong Management Systems

•Adopt and revise, as needed, our Responsible Minerals Sourcing Policy, which states our goal to source Conflict Minerals responsibly and is located on the “About Us” tab of www.amkor.com, under “ESG.”

•Maintain an internal team to implement our Responsible Minerals Sourcing Policy, which includes members from the Procurement, Legal, and Quality Assurance teams, and reported program activities to Executive Management.

•Update processes and procedures, as appropriate, to meet the requirements of our Responsible Minerals Sourcing Policy.

•Enforce the requirement that our direct suppliers undertake due diligence to achieve a conformant supply chain.

•Maintain our record retention practice for records related to the sourcing of Conflict Minerals.

•Continue our existing grievance system where suppliers can submit questions or reports on ethical or legal issues, including issues relating to Conflict Minerals.

Step 2 - Identify and Assess Risks in the Supply Chain

•Conduct a survey of direct suppliers of Conflict Minerals in our supply chain using the CMRT to identify the smelters, refiners, and/or mines of origin of Conflict Minerals.

•Compare smelters, refiners, and/or mines of origin identified by our direct suppliers against the list of smelters, refiners, and mineral sourcing information that have received a “Conformant” designation by the RMAP.

•Perform reviews of select suppliers to evaluate the reasonableness of responses received and alignment with the OECD Framework.

Step 3 - Design and Implement a Strategy to Respond to Identified Risks

•Devise and adopt a risk management plan designed to mitigate the risk that our direct suppliers do not meet our expectations to achieve a conformant supply chain.

•Monitor risk management plan periodically by, among other methods, engaging directly with impacted suppliers, smelters, and refiners.

•Contact a portion of smelters and refiners within our supply chain to encourage them to maintain their participation in the RMAP or industry equivalent. Our outreach efforts include in-person training and meetings with select smelters and industry associations.

•Report information on the source and chain of custody of Conflict Minerals in our supply chain to Executive Management and the Audit Committee of the Company’s Board of Directors.

Step 4 - Carry Out Independent Third-party Audits of Smelter’s/Refiner’s Due Diligence Practices

•Maintain our membership in the RMI, an industry group that has implemented the RMAP to carry out independent third-party audits of a smelter’s or refiner’s Conflict Minerals management practices. As an RMI member, we rely on the results of the RMAP to provide smelter, refiner, and mineral sourcing information on the Conflict Minerals we used when providing packaging services.

Step 5 - Report Annually on Supply Chain Due Diligence

•Annually publish the results of our supply chain due diligence in a Specialized Report on Form SD and related Conflict Minerals Report, which are available on our website under the heading “Financial Information > SEC Filings” at https://ir.amkor.com.

Due Diligence Performed

In addition to the measures described above in the “Due Diligence Design” section of this Report, we undertook the following steps during the prior year to source Conflict Minerals responsibly:

•Conducted a supply chain survey of our direct suppliers of Conflict Minerals using the CMRT to identify the smelters, refiners, and/or mines of origin of Conflict Minerals.

•Continued engaging with our direct suppliers through periodic communications and evaluation of the smelter and refiner data provided to us.

•Followed established procedures designed to identify the smelters and refiners within our supply chain, including by evaluating the information received from our direct suppliers and comparing it with updated information published by the RMI.

•Contacted a portion of our smelters and refiners directly to encourage them to maintain their participation in the RMAP or industry equivalent.

•Continued our active involvement in the RMI and supported industry efforts to improve the monitoring and reporting of supply chain activities.

Due Diligence Results

The results of our due diligence indicate that the sources of Conflict Minerals are: (1) from recycled or scrap materials; (2) from within the Democratic Republic of the Congo or adjoining countries (the “Covered Countries”); or (3) from outside the Covered Countries. We received responses from all our direct suppliers subject to our supply chain survey for 2023. Collectively, their responses identified 218 smelters and refiners within their supply chains for the reporting year. 216 smelters and refiners had been designated as Conformant and 2 refiners had been designated as Active as of April 4, 2024.

The following tables list the population of smelters, refiners, and origin of Conflict Minerals within our supply chain for 2023. Our efforts to determine this population are described above under the caption “Due Diligence Performed.” The information presented is derived from information provided by our direct suppliers and the RMI.

| | | | | | | | |

| Smelters and Refiners Processing Conflict Minerals |

| Mineral | Smelter and Refiner Name | Country Location |

| Gold | Abington Reldan Metals, LLC | United States of America |

| Gold | Advanced Chemical Company* | United States of America |

| Gold | Agosi AG | Germany |

| Gold | Aida Chemical Industries Co., Ltd. | Japan |

| Gold | Almalyk Mining and Metallurgical Complex (AMMC) | Uzbekistan |

| Gold | AngloGold Ashanti Corrego do Sitio Mineracao | Brazil |

| Gold | Argor-Heraeus S.A. | Switzerland |

| Gold | Asahi Pretec Corp. | Japan |

| Gold | Asahi Refining Canada Ltd. | Canada |

| Gold | Asahi Refining USA Inc. | United States of America |

| Gold | Asaka Riken Co., Ltd. | Japan |

| Gold | Aurubis AG | Germany |

| Gold | Bangalore Refinery* | India |

| Gold | Bangko Sentral ng Pilipinas (Central Bank of the Philippines) | Philippines |

| Gold | Boliden Ronnskar | Sweden |

| Gold | C. Hafner GmbH + Co. KG | Germany |

| Gold | CCR Refinery - Glencore Canada Corporation | Canada |

| | | | | | | | |

| Gold | Chimet S.p.A. | Italy |

| Gold | Chugai Mining | Japan |

| Gold | Dowa | Japan |

| Gold | DSC (Do Sung Corporation) | Korea, Republic of |

| Gold | Eco-System Recycling Co., Ltd. East Plant | Japan |

| Gold | Eco-System Recycling Co., Ltd. North Plant | Japan |

| Gold | Eco-System Recycling Co., Ltd. West Plant | Japan |

| Gold | Gold by Gold Colombia | Colombia |

| Gold | Gold Refinery of Zijin Mining Group Co., Ltd. | China |

| Gold | Heimerle + Meule GmbH | Germany |

| Gold | Heraeus Germany GmbH Co. KG | Germany |

| Gold | Heraeus Metals Hong Kong Ltd. | China |

| Gold | Inner Mongolia Qiankun Gold and Silver Refinery Share Co., Ltd. | China |

| Gold | Ishifuku Metal Industry Co., Ltd. | Japan |

| Gold | Istanbul Gold Refinery | Turkey |

| Gold | Italpreziosi | Italy |

| Gold | Japan Mint | Japan |

| Gold | Jiangxi Copper Co., Ltd. | China |

| Gold | JX Nippon Mining & Metals Co., Ltd. | Japan |

| Gold | Kazzinc | Kazakhstan |

| Gold | Kennecott Utah Copper LLC | United States of America |

| Gold | KGHM Polska Miedz Spolka Akcyjna | Poland |

| Gold | Kojima Chemicals Co., Ltd. | Japan |

| Gold | Korea Zinc Co., Ltd. | Korea, Republic of |

| Gold | L'Orfebre S.A. | Andorra |

| Gold | LS MnM Inc. | Korea, Republic of |

| Gold | LT Metal Ltd. | Korea, Republic of |

| Gold | Materion | United States of America |

| Gold | Matsuda Sangyo Co., Ltd. | Japan |

| Gold | Metal Concentrators SA (Pty) Ltd. | South Africa |

| Gold | Metalor Technologies (Hong Kong) Ltd. | China |

| Gold | Metalor Technologies (Singapore) Pte., Ltd. | Singapore |

| Gold | Metalor Technologies (Suzhou) Ltd. | China |

| Gold | Metalor Technologies S.A. | Switzerland |

| Gold | Metalor USA Refining Corporation | United States of America |

| Gold | Metalurgica Met-Mex Penoles S.A. De C.V. | Mexico |

| Gold | Mitsubishi Materials Corporation | Japan |

| Gold | Mitsui Mining and Smelting Co., Ltd. | Japan |

| | | | | | | | |

| Gold | MKS PAMP SA | Switzerland |

| Gold | MMTC-PAMP India Pvt., Ltd. | India |

| Gold | Nadir Metal Rafineri San. Ve Tic. A.S. | Turkey |

| Gold | Navoi Mining and Metallurgical Combinat | Uzbekistan |

| Gold | NH Recytech Company | Korea, Republic of |

| Gold | Nihon Material Co., Ltd. | Japan |

| Gold | Ogussa Osterreichische Gold- und Silber-Scheideanstalt GmbH | Austria |

| Gold | Ohura Precious Metal Industry Co., Ltd. | Japan |

| Gold | Planta Recuperadora de Metales SpA | Chile |

| Gold | PT Aneka Tambang (Persero) Tbk | Indonesia |

| Gold | PX Precinox S.A. | Switzerland |

| Gold | Rand Refinery (Pty) Ltd. | South Africa |

| Gold | REMONDIS PMR B.V. | Netherlands |

| Gold | Royal Canadian Mint | Canada |

| Gold | SAFINA A.S. | Czechia |

| Gold | SEMPSA Joyeria Plateria S.A. | Spain |

| Gold | Shandong Gold Smelting Co., Ltd. | China |

| Gold | Shandong Zhaojin Gold & Silver Refinery Co., Ltd. | China |

| Gold | Sichuan Tianze Precious Metals Co., Ltd. | China |

| Gold | Solar Applied Materials Technology Corp. | Taiwan, Province of China |

| Gold | Sumitomo Metal Mining Co., Ltd. | Japan |

| Gold | SungEel HiMetal Co., Ltd. | Korea, Republic of |

| Gold | T.C.A S.p.A | Italy |

| Gold | Tanaka Kikinzoku Kogyo K.K. | Japan |

| Gold | Tokuriki Honten Co., Ltd. | Japan |

| Gold | TOO Tau-Ken-Altyn | Kazakhstan |

| Gold | Torecom | Korea, Republic of |

| Gold | Umicore S.A. Business Unit Precious Metals Refining | Belgium |

| Gold | United Precious Metal Refining, Inc. | United States of America |

| Gold | Valcambi S.A. | Switzerland |

| Gold | Western Australian Mint (T/a The Perth Mint) | Australia |

| Gold | WIELAND Edelmetalle GmbH | Germany |

| Gold | Yamakin Co., Ltd. | Japan |

| Gold | Yokohama Metal Co., Ltd. | Japan |

| Gold | Zhongyuan Gold Smelter of Zhongjin Gold Corporation | China |

| Tantalum | AMG Brasil | Brazil |

| Tantalum | D Block Metals, LLC | United States of America |

| Tantalum | FIR Metals & Resource Ltd. | China |

| | | | | | | | |

| Tantalum | F&X Electro-Materials Ltd. | China |

| Tantalum | Global Advanced Metals Aizu | Japan |

| Tantalum | Global Advanced Metals Boyertown | United States of America |

| Tantalum | Hengyang King Xing Lifeng New Materials Co., Ltd. | China |

| Tantalum | Jiangxi Dinghai Tantalum & Niobium Co., Ltd. | China |

| Tantalum | Jiangxi Tuohong New Raw Material | China |

| Tantalum | JiuJiang JinXin Nonferrous Metals Co., Ltd. | China |

| Tantalum | Jiujiang Tanbre Co., Ltd. | China |

| Tantalum | Jiujiang Zhongao Tantalum & Niobium Co., Ltd. | China |

| Tantalum | KEMET de Mexico | Mexico |

| Tantalum | Materion Newton Inc. | United States of America |

| Tantalum | Metallurgical Products India Pvt., Ltd. | India |

| Tantalum | Mineracao Taboca S.A. | Brazil |

| Tantalum | Mitsui Mining and Smelting Co., Ltd. | Japan |

| Tantalum | Ningxia Orient Tantalum Industry Co., Ltd. | China |

| Tantalum | NPM Silmet AS | Estonia |

| Tantalum | QuantumClean | United States of America |

| Tantalum | Resind Industria e Comercio Ltda. | Brazil |

| Tantalum | RFH Yancheng Jinye New Material Technology Co., Ltd. | China |

| Tantalum | Taki Chemical Co., Ltd. | Japan |

| Tantalum | TANIOBIS Co., Ltd. | Thailand |

| Tantalum | TANIOBIS GmbH | Germany |

| Tantalum | TANIOBIS Japan Co., Ltd. | Japan |

| Tantalum | TANIOBIS Smelting GmbH & Co. KG | Germany |

| Tantalum | Telex Metals | United States of America |

| Tantalum | Ulba Metallurgical Plant JSC | Kazakhstan |

| Tantalum | XIMEI RESOURCES (GUANGDONG) LIMITED | China |

| Tantalum | XinXing HaoRong Electronic Material Co., Ltd. | China |

| Tantalum | Yanling Jincheng Tantalum & Niobium Co., Ltd. | China |

| Tin | Alpha | United States of America |

| Tin | Aurubis Beerse | Belgium |

| Tin | Aurubis Berango | Spain |

| Tin | Chenzhou Yunxiang Mining and Metallurgy Co., Ltd. | China |

| Tin | Chifeng Dajingzi Tin Industry Co., Ltd. | China |

| Tin | China Tin Group Co., Ltd. | China |

| Tin | CRM Fundicao De Metais E Comercio De Equipamentos Eletronicos Do Brasil Ltda | Brazil |

| Tin | CRM Synergies | Spain |

| | | | | | | | |

| Tin | CV Ayi Jaya | Indonesia |

| Tin | CV Venus Inti Perkasa | Indonesia |

| Tin | Dowa | Japan |

| Tin | DS Myanmar | Myanmar |

| Tin | EM Vinto | Bolivia (Plurinational State of) |

| Tin | Estanho de Rondonia S.A. | Brazil |

| Tin | Fabrica Auricchio Industria e Comercio Ltda. | Brazil |

| Tin | Fenix Metals | Poland |

| Tin | Gejiu Non-Ferrous Metal Processing Co., Ltd. | China |

| Tin | Guangdong Hanhe Non-Ferrous Metal Co., Ltd. | China |

| Tin | HuiChang Hill Tin Industry Co., Ltd. | China |

| Tin | Jiangxi New Nanshan Technology Ltd. | China |

| Tin | Luna Smelter, Ltd. | Rwanda |

| Tin | Magnu's Minerais Metais e Ligas Ltda. | Brazil |

| Tin | Malaysia Smelting Corporation (MSC) | Malaysia |

| Tin | Metallic Resources, Inc. | United States of America |

| Tin | Mineracao Taboca S.A. | Brazil |

| Tin | Mining Minerals Resources SARL | Congo, Democratic Republic of the |

| Tin | Minsur | Peru |

| Tin | Mitsubishi Materials Corporation | Japan |

| Tin | O.M. Manufacturing (Thailand) Co., Ltd. | Thailand |

| Tin | O.M. Manufacturing Philippines, Inc. | Philippines |

| Tin | Operaciones Metalurgicas S.A. | Bolivia (Plurinational State of) |

| Tin | PT Aries Kencana Sejahtera | Indonesia |

| Tin | PT Artha Cipta Langgeng | Indonesia |

| Tin | PT ATD Makmur Mandiri Jaya | Indonesia |

| Tin | PT Babel Inti Perkasa | Indonesia |

| Tin | PT Babel Surya Alam Lestari | Indonesia |

| Tin | PT Bangka Prima Tin | Indonesia |

| Tin | PT Bangka Serumpun | Indonesia |

| Tin | PT Belitung Industri Sejahtera | Indonesia |

| Tin | PT Bukit Timah | Indonesia |

| Tin | PT Cipta Persada Mulia | Indonesia |

| Tin | PT Menara Cipta Mulia | Indonesia |

| Tin | PT Mitra Stania Prima | Indonesia |

| Tin | PT Mitra Sukses Globalindo | Indonesia |

| Tin | PT Premium Tin Indonesia | Indonesia |

| Tin | PT Prima Timah Utama | Indonesia |

| | | | | | | | |

| Tin | PT Putera Sarana Shakti (PT PSS) | Indonesia |

| Tin | PT Rajawali Rimba Perkasa | Indonesia |

| Tin | PT Rajehan Ariq | Indonesia |

| Tin | PT Refined Bangka Tin | Indonesia |

| Tin | PT Sariwiguna Binasentosa | Indonesia |

| Tin | PT Stanindo Inti Perkasa | Indonesia |

| Tin | PT Sukses Inti Makmur (SIM) | Indonesia |

| Tin | PT Timah Tbk Kundur | Indonesia |

| Tin | PT Timah Tbk Mentok | Indonesia |

| Tin | PT Tinindo Inter Nusa | Indonesia |

| Tin | PT Tommy Utama | Indonesia |

| Tin | Resind Industria e Comercio Ltda. | Brazil |

| Tin | Rui Da Hung | Taiwan, Province of China |

| Tin | Super Ligas | Brazil |

| Tin | Thaisarco | Thailand |

| Tin | Tin Smelting Branch of Yunnan Tin Co., Ltd. | China |

| Tin | Tin Technology & Refining | United States of America |

| Tin | White Solder Metalurgia e Mineracao Ltda. | Brazil |

| Tin | Yunnan Chengfeng Non-ferrous Metals Co., Ltd. | China |

| Tungsten | A.L.M.T. Corp. | Japan |

| Tungsten | Asia Tungsten Products Vietnam Ltd. | Vietnam |

| Tungsten | China Molybdenum Tungsten Co., Ltd. | China |

| Tungsten | Chongyi Zhangyuan Tungsten Co., Ltd. | China |

| Tungsten | Cronimet Brasil Ltda | Brazil |

| Tungsten | Fujian Xinlu Tungsten Co., Ltd. | China |

| Tungsten | Ganzhou Jiangwu Ferrotungsten Co., Ltd. | China |

| Tungsten | Ganzhou Seadragon W & Mo Co., Ltd. | China |

| Tungsten | Global Tungsten & Powders LLC | United States of America |

| Tungsten | Guangdong Xianglu Tungsten Co., Ltd. | China |

| Tungsten | H.C. Starck Tungsten GmbH | Germany |

| Tungsten | Hubei Green Tungsten Co., Ltd. | China |

| Tungsten | Hunan Chenzhou Mining Co., Ltd. | China |

| Tungsten | Hunan Shizhuyuan Nonferrous Metals Co., Ltd. Chenzhou Tungsten Products Branch | China |

| Tungsten | Japan New Metals Co., Ltd. | Japan |

| Tungsten | Jiangwu H.C. Starck Tungsten Products Co., Ltd. | China |

| Tungsten | Jiangxi Gan Bei Tungsten Co., Ltd. | China |

| Tungsten | Jiangxi Tonggu Non-ferrous Metallurgical & Chemical Co., Ltd. | China |

| | | | | | | | |

| Tungsten | Jiangxi Xinsheng Tungsten Industry Co., Ltd. | China |

| Tungsten | Jiangxi Yaosheng Tungsten Co., Ltd. | China |

| Tungsten | Kennametal Fallon | United States of America |

| Tungsten | Kennametal Huntsville | United States of America |

| Tungsten | Lianyou Metals Co., Ltd. | Taiwan, Province of China |

| Tungsten | Malipo Haiyu Tungsten Co., Ltd. | China |

| Tungsten | Masan High-Tech Materials | Vietnam |

| Tungsten | Niagara Refining LLC | United States of America |

| Tungsten | Philippine Chuangxin Industrial Co., Inc. | Philippines |

| Tungsten | TANIOBIS Smelting GmbH & Co. KG | Germany |

| Tungsten | Wolfram Bergbau und Hutten AG | Austria |

| Tungsten | Xiamen Tungsten (H.C.) Co., Ltd. | China |

| Tungsten | Xiamen Tungsten Co., Ltd. | China |

* Smelters and refiners that have been designated by the RMAP as “Active” as of April 4, 2024

| | | | | | | | |

| Countries of Origin for Conflict Minerals, to the Extent Known |

| Australia | Guinea | Peru |

| Benin** | Guyana | Philippines |

| Bolivia | Indonesia | Russia |

| Bolivia (Plurinational State of) | Korea, Republic of | Rwanda** |

| Brazil | Laos | Sierra Leone |

| Burundi | Madagascar | South Africa |

| Canada | Malaysia | Spain |

| Chile | Mongolia | Sweden |

| China | Mozambique | Tanzania** |

| Colombia | Myanmar | Thailand |

| Congo, Democratic Republic of the** | Nicaragua | United Kingdom |

| Ethiopia | Niger | Uzbekistan |

| France | Nigeria | Vietnam |

| Ghana | Papua New Guinea | Zimbabwe |

**The DRC or one or more of the Covered Countries were identified in the aggregated list of potential countries of origin reported by RMI for the conformant smelters and refiners listed above. As Amkor’s direct suppliers generally provide smelter and refiner information at the company level, the aggregated information reported by RMI does not necessarily imply that minerals originating from the DRC or a Covered Country are incorporated in the materials purchased by Amkor.

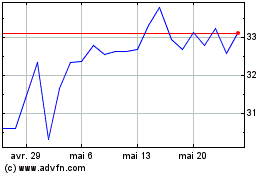

Amkor Technology (NASDAQ:AMKR)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

Amkor Technology (NASDAQ:AMKR)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024