UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement

Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

| Filed by the Registrant |

x |

| Filed by a Party other than the Registrant |

¨ |

Check the appropriate box:

| x | Preliminary Proxy Statement |

| ¨ | Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Applied

DNA Sciences, Inc.

(Name of Registrant as Specified

In Its Charter)

(Name of Person(s) Filing

Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that

apply):

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

APPLIED DNA SCIENCES, INC.

50 HEALTH SCIENCES DRIVE

STONY BROOK, NEW YORK 11790

(631) 240-8800

June [●],

2024

Dear Fellow Stockholder:

You are cordially

invited to attend a Special Meeting of Stockholders (the “Special Meeting”) of Applied DNA Sciences, Inc. (“Applied

DNA Sciences,” the “Company,” “we” or “us”) to be held at 10:00

a.m., Eastern Time, on Friday, August 2, 2024.

We

are very pleased that the Special Meeting will be a completely virtual meeting of stockholders, which will be conducted via live webcast.

The Special Meeting will be held in a virtual format only, via the Internet, with no physical in-person meeting. You will be able to

attend the Special Meeting online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/APDN2024SM.

You will also be able to vote your shares electronically at the Special Meeting.

We

are pleased to use the latest technology to increase access, to improve communication and to obtain cost savings for our stockholders

and the Company. Use of a virtual meeting will enable increased stockholder attendance and participation as stockholders can participate

from any location.

At the meeting,

you will be asked to approve, in accordance with Nasdaq Listing Rule 5635(d), the issuance of certain common stock purchase warrants in

connection with an offering of securities of the Company that occurred on May 28, 2024. Detailed information with respect to this matter

is set forth in the accompanying Proxy Statement, which we encourage you to carefully read in its entirety.

We look forward

to greeting personally those stockholders who are able to attend the meeting online. However, whether or not you plan to join us at the

meeting, it is important that your shares be represented. Stockholders of record at the close of business on June 3, 2024 are entitled

to notice of and to vote at the meeting. Such stockholders are urged to promptly submit the enclosed proxy card, even if their shares

were sold after the record date.

You may vote

over the Internet, as well as by telephone or by mail pursuant to instructions provided on the proxy card. Please review the instructions

for each of your voting options described in the Proxy Statement.

Thank you for your ongoing support of Applied

DNA Sciences.

| |

Very

truly yours, |

| |

|

| |

/s/

James A. Hayward |

| |

James

A. Hayward |

| |

Chairman,

President and Chief Executive Officer |

APPLIED DNA SCIENCES,

INC.

NOTICE OF SPECIAL

MEETING OF STOCKHOLDERS

Notice is hereby given that

a Special Meeting of Stockholders (the “Special Meeting”) of Applied DNA Sciences, Inc. (“Applied DNA

Sciences” or the “ Company”), will be held online at 10:00 a.m., Eastern Time, on Friday,

August 2, 2024, for the following purposes:

| • | to approve, in accordance with Nasdaq Listing Rule 5635(d), the issuance of certain common stock purchase

warrants in connection with an offering of securities of the Company that occurred on May 28, 2024 (the “Warrant Issuance Proposal”);

and |

| • | to consider and act upon such other matters as may properly come before the meeting or any postponement

or adjournment of the meeting. |

These matters are more fully described

in the accompanying Proxy Statement.

Only

stockholders of record at the close of business on June 3, 2024 are entitled to notice of and to vote at the Special Meeting and any adjournment

or postponement thereof. The Special Meeting will be held in a virtual format only, via the Internet, with no physical in-person meeting.

Stockholders will have the ability to attend, vote and submit questions before and during the virtual meeting from any location via the

Internet at www.virtualshareholdermeeting.com/APDN2024SM.

A complete list

of these stockholders will be available in electronic form at the Special Meeting and will be accessible for ten days prior to the Special

Meeting. All stockholders are cordially invited to virtually attend the Special Meeting.

Your

vote is very important. Whether or not you plan to attend the Special Meeting, we encourage you to read the Proxy Statement and submit

your proxy or voting instructions as soon as possible by Internet, telephone or mail. For specific instructions on how to vote your shares,

please refer to the instructions in the section entitled “About the Special Meeting” beginning on page 1 of the Proxy Statement

or your enclosed proxy card. Please note that shares held beneficially in street name may be voted by you in person at the Special Meeting

only if you obtain a legal proxy from the broker, bank, trustee, or other nominee that holds your shares giving you the right to vote

the shares.

| |

Very

truly yours, |

| |

|

| |

/s/

James A. Hayward |

| |

James

A. Hayward |

| |

Chairman,

President and Chief Executive Officer |

Stony Brook, New York

June [●], 2024

This Notice

of Special Meeting and the enclosed Proxy Statement and proxy card are first being mailed on or about June 21, 2024 to stockholders

entitled to notice of and to vote at the Special Meeting.

Important

Notice Regarding the Availability of Proxy Materials

for the Special Meeting of Stockholders

To Be Held on August 2, 2024

The

Proxy Statement, along with our 2023 Annual Report, as amended, is available free of charge at the following website: www.proxyvote.com

Table of Contents

APPLIED DNA SCIENCES,

INC.

50

HEALTH SCIENCES DRIVE

STONY

BROOK, NEW YORK 11790

PROXY STATEMENT

The

Company’s board of directors (the “Board of Directors”) has made this Proxy Statement and related materials available

to you on the Internet, or, upon your request, has delivered printed proxy materials to you by mail, in connection with the Board of Directors’

solicitation of proxies for use at a Special Meeting of Stockholders (the “Special Meeting”) of Applied DNA Sciences,

Inc. to be held online on Friday, August 2, 2024, beginning at 10:00 a.m., Eastern Time, and at any postponements or adjournments of the

Special Meeting. As a stockholder, you are invited to attend the Special Meeting and are requested to vote on the items of business described

in this proxy statement (this “Proxy Statement”).

ABOUT THE SPECIAL

MEETING

Why did I receive a notice

in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials?

In

accordance with rules adopted by the Securities and Exchange Commission (“SEC”), we are providing access to our proxy

materials over the Internet. Accordingly, we are sending a Notice Regarding Availability of Proxy Materials (the “Notice”)

to our stockholders of record and beneficial owners as of the record date (for more information on the record date, see “–

Who is entitled to vote at the Special Meeting?”). The mailing of the Notice to our stockholders is scheduled to begin on

or about June 21, 2024. All stockholders will have the ability to access the proxy materials and our Annual Report on Form 10-K

for the fiscal year ended September 30, 2023 (the “Annual Report”) on a website referred to in the Notice or to request

to receive a printed set of the proxy materials and the Annual Report. Instructions on how to access the proxy materials over the Internet

or to request a printed copy may be found in the Notice. Stockholders may also request to receive proxy materials and our Annual Report

in printed form by mail or electronically by email on an ongoing basis.

How do I get electronic access

to the proxy materials?

The

Notice will provide you with instructions regarding how you can:

| · | View our proxy materials for the Special Meeting

and our Annual Report on the Internet; and |

| · | Instruct us to send our future proxy materials

to you electronically by email. |

Choosing

to receive your future proxy materials by email will save us the cost of printing and mailing documents to you, and will reduce the impact

of printing and mailing these materials on the environment. Stockholders may also request to receive proxy materials and our Annual Report

in printed form by mail or electronically by email on an ongoing basis. If you choose to receive future proxy materials by email, you

will receive an email prior to our next stockholder meeting with instructions containing a link to those materials and a link to the proxy

voting website. Your election to receive proxy materials by email will remain in effect until you terminate it.

What is the purpose of the Special

Meeting?

At

the Special Meeting, stockholders will act upon the matters outlined in the notice of meeting accompanying this Proxy Statement, consisting

of (i) the approval, in accordance with Nasdaq Listing Rule 5635(d), of the issuance of certain common stock purchase warrants in connection

with an offering of securities of the Company that occurred on May 28, 2024 (the “Warrant Issuance Proposal”) and (ii)

such other business that may properly come before the meeting or any postponement or adjournment thereof. Our Board of Directors is not

currently aware of any other matters which will come before the meeting.

How do proxies work and how

are votes counted?

The

Board of Directors is asking for your proxy. Giving us your proxy means that you authorize us to vote your shares at the Special Meeting

in the manner you direct. You may vote to approve the Warrant Issuance Proposal. If a stockholder of record does not indicate instructions

with respect to one or more matters on his, her or its proxy, the shares represented by that proxy will be voted as recommended by the

Board of Directors (for more information, see “— How does the Board of Directors’ recommend that I vote?”).

If a beneficial owner of shares held in street name does not provide instructions to the bank, broker, or other nominee holding those

shares, please see the information below under the caption “— What if I am a beneficial owner and do not give voting instructions

to my broker or other nominee?”

Who is entitled to vote at the

Special Meeting?

Only

stockholders of record at the close of business on June 3, 2024, the record date for the meeting (the “Record Date”),

are entitled to receive notice of and to participate in the Special Meeting, or any postponements and adjournments of the meeting. If

you were a stockholder of record on that date, you will be entitled to vote all of the shares you held on that date at the meeting, or

any postponements or adjournments of the meeting.

On

the Record Date, there were 9,011,857 shares of our common stock, par value $0.001 per share (“Common Stock”)

outstanding. Each outstanding share of Common Stock is entitled to one vote on each of the matters presented at the Special Meeting

or postponements and adjournments of the meeting.

What constitutes a quorum?

The

presence at the meeting, in person or by proxy, of the holders of a majority of the outstanding shares of Common Stock as of the

Record Date will constitute a quorum, permitting the Special Meeting to conduct its business. As of the Record Date, 9,011,857

shares of Common Stock, representing the same number of votes, were outstanding. Thus, the presence of holders representing at least

4,505,930 shares will be required to establish a quorum.

If

a stockholder abstains from voting as to any matter or matters, the shares held by such stockholder shall be deemed present at the Special

Meeting for purposes of determining a quorum. If a bank, broker, or other nominee returns a “broker non-vote” proxy, indicating

a lack of voting instructions by the beneficial holder of the shares and a lack of discretionary authority on the part of the bank, broker,

or other nominee to vote on a particular matter but has discretionary authority as to at least one matter, then the shares covered by

such broker non-vote proxy shall be deemed present at the Special Meeting for purposes of determining a quorum. For more information on

discretionary and non-discretionary matters, see “— What if I am a beneficial owner and do not give voting instructions

to my broker or other nominee?”

What vote is required to approve

each matter and how are votes counted?

Proposal

No. 1: Approval, in Accordance with Nasdaq Listing Rule 5635(d), of the issuance of certain Common Stock Purchase Warrants in connection

with an Offering of Securities of the Company that occurred on May 28, 2024.

The

affirmative vote of a majority of the outstanding shares of our Common Stock present in person or represented by proxy at the Special

Meeting and entitled to vote on this proposal is required for the approval of the Warrant Issuance Proposal. An abstention from voting

by a stockholder present in person or represented by proxy at the meeting has the same legal effect as a vote “against” the

matter. A broker non-vote for which the broker does not have voting discretion will be excluded entirely from the vote and will therefore

have no effect on the outcome of the vote for this matter.

How can you attend the Special

Meeting?

We

will be hosting the Special Meeting live via audio webcast. Any stockholder can attend the Special Meeting live online at www.virtualshareholdermeeting.com/APDN2024SM.

If you were a stockholder as of the Record Date, or you hold a valid proxy for the Special Meeting, you can

vote at the Special Meeting. A summary of the information you need to attend the Special Meeting online is provided below:

| • | Instructions on how to attend and participate via the Internet, including how

to demonstrate proof of stock ownership, are posted at

www.virtualshareholdermeeting.com/APDN2024SM. |

| • | Assistance with questions regarding how to attend

and participate via the Internet will be provided at www.virtualshareholdermeeting.com/APDN2024SM on

the day of the Special Meeting. |

| • | Webcast will start on August 2, 2024, at 10:00 a.m., Eastern Time. |

| • | You will need your 11-digit control number to enter the Special Meeting. |

| • | Stockholders may submit questions while attending the Special Meeting via the Internet. |

| • | Webcast replay of the Special Meeting will be available until August 2, 2025. |

To

attend and participate in the Special Meeting, you will need the 11-digit control number included on your proxy card, or on the instructions

that accompanied your proxy materials. If your shares are held in “street name,” you should contact your bank or broker to

obtain your 11-digit control number or otherwise vote through the bank or broker. If you lose your 11-digit control number, you may join

the Special Meeting as a “Guest”, but you will not be able to vote, ask questions or access the list of stockholders as of

the Record Date.

Why hold a virtual meeting?

We

are excited to use the latest technology to provide expanded access, improved communication and cost savings for our stockholders and

the Company while providing stockholders the same rights and opportunities to participate as they would have at an in-person meeting.

We believe the virtual meeting format enables increased stockholder attendance and participation because stockholders can participate

from any location around the world.

How do I ask questions at the

virtual Special Meeting?

During

the virtual Special Meeting, you may only submit questions in the question box provided at www.virtualshareholdermeeting.com/APDN2024SM.

We will respond to as many inquiries at the virtual Special Meeting as time allows.

What if during the check-in

time or during the virtual Special Meeting I have technical difficulties or trouble accessing the virtual meeting website?

We

will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting website. If you encounter

any difficulties accessing the virtual Special Meeting during the check-in or meeting time, please call the technical support number that

will be posted on the Special Meeting website log-in page.

How can I vote my shares?

Record Owners and Beneficial Owners

Who Have Been Provided With an 11-Digit Control Number

If you

are a record holder, meaning your shares are registered in your name and not in the name of a broker, trustee, or other nominee, or a

beneficial owner who has been provided by your broker with an 11-digit control number, you may vote:

| 1. | Over the Internet — If you have Internet access,

you may authorize the voting of your shares by accessing www.proxyvote.com and following the instructions set forth in the proxy materials.

You must specify how you want your shares voted or your vote will not be completed, and you will receive an error message. Your shares

will be voted according to your instructions. You can also vote during the meeting by visiting www.virtualshareholdermeeting.com/APDN2024SM

and having available the control number included on your proxy card or on the instructions that accompanied

your proxy materials. |

| 2. | By Telephone — If you are a registered stockholder or a beneficial owner

who has been provided with a control number on the voting instruction form that accompanied your proxy materials, you may call 1-800-690-6903

in the United States (toll-free) or from foreign countries (tolls may apply) to vote by telephone. Your shares will be voted according

to your instructions. |

| 3. | By Mail — Complete and sign the attached WHITE proxy card and mail it in

the enclosed postage prepaid envelope. Your shares

will be voted according to your instructions. If you sign your WHITE proxy card but do not specify how you want your shares voted, they

will be voted as recommended by our Board of Directors. Unsigned proxy cards will not be voted. |

If your shares

are held in a brokerage account or by a bank or other nominee, your ability to vote by telephone or the Internet depends on your broker’s

voting process. Please follow the directions provided to you by your broker, bank or nominee.

Beneficial Owners

As the

beneficial owner, you have the right to direct your broker, trustee, or other nominee on how to vote your shares. In most cases, when

your broker provides you with proxy materials, they will also provide you with an 11-digit control number, which will allow you to vote

as described above or at the Special Meeting. If your broker has not provided you with an 11-digit control number, please contact your

broker for instructions on how to vote your shares.

Stockholders

who submit a proxy by Internet or telephone need not return a proxy card or any form forwarded by your broker, bank, trust or nominee.

Stockholders who submit a proxy through the Internet or telephone should be aware that they may incur costs to access the Internet or

telephone, such as usage charges from telephone companies or Internet service providers, and that these costs must be borne by the stockholder.

What am I voting on at the Special

Meeting?

The following proposal is scheduled for

a vote at the Special Meeting:

| • | Proposal No. 1: to

approve, in accordance with Nasdaq Listing Rule 5635(d), the issuance of certain

Common Stock Purchase

Warrants in connection with an Offering of Securities

of the Company that occurred on May 28, 2024. |

The proposal is described in further detail

below.

What happens if additional matters

are presented at the Special Meeting?

Other

than the items of business described in this Proxy Statement, we are not currently aware of any other business to be acted upon at the

Special Meeting. If you grant a proxy, the persons named as proxy holders, Ms. Beth Jantzen and Ms. Judith Murrah,

will have the discretion to vote your shares on any additional matters properly presented for a vote at the meeting.

How does the Board of Directors’

recommend that I vote?

As

to the proposal to be voted on at the Special Meeting, the Board of Directors unanimously recommends that you vote FOR the

Warrant Issuance Proposal, to approve, in accordance with Nasdaq Listing Rule 5635(d), the issuance

of certain common stock purchase warrants in connection with an offering of securities of the Company that occurred on May 28, 2024.

What if I am a stockholder of

record and do not indicate voting instructions on my proxy?

If

you are a stockholder of record and provide specific instructions on your proxy with regard to certain items, your shares will be voted

as you instruct on such items. If no instructions are indicated on your proxy for the proposal to be voted on, the shares will be voted

as recommended by the Board of Directors for the approval of the Warrant Issuance Proposal, to approve, in accordance with Nasdaq

Listing Rule 5635(d), the issuance of certain common stock purchase warrants in connection with an offering

of securities of the Company that occurred on May 28, 2024. If any other matters are properly presented for consideration at the meeting,

the individuals named as proxy holders, Ms. Beth Jantzen and Ms. Judith Murrah, will vote

the shares that they represent on those matters as recommended by the Board of Directors. If the Board of Directors does not make a recommendation,

then they will vote in accordance with their best judgment.

What if I am a beneficial owner

and do not give voting instructions to my broker or other nominee?

As a

beneficial owner, in order to ensure your shares are voted in the way you would like, you must provide voting instructions to your

bank, broker, or other nominee by the deadline provided in the materials you receive from your bank, broker, or other nominee or

vote by mail, telephone or Internet according to instructions provided by your bank, broker, or other nominee. If you do not provide

voting instructions to your bank, broker, or other nominee, whether your shares can be voted by such person or entity depends on the

type of item being considered for vote.

The

Warrant Issuance Proposal is a non-discretionary item and may not be voted on by brokers, banks or other nominees who have not received

specific voting instructions from beneficial owners. A broker non-vote occurs when a broker holding shares for a beneficial owner does

not vote on a particular proposal because the broker does not have discretionary voting authority and has not received voting instructions

from the beneficial owner.

We encourage

you to provide instructions to your broker regarding the voting of your shares.

Can I change my vote or revoke

my proxy?

Yes.

(1)

If you are a stockholder of record, you may revoke your proxy by (i) entering a new vote by telephone or over the Internet up until 11:59

P.M. Eastern Time on August 1, 2024; (ii) attending the Special Meeting and voting in person (although attendance at the Special Meeting

will not in and of itself revoke a proxy); or (iii) entering a new vote by mail. Any written notice of revocation or subsequent proxy

card must be received by the Secretary of the Company prior to the holding of the vote at the Special Meeting at 10:00 a.m., Eastern Time,

on August 2, 2024. Such written notice of revocation or subsequent proxy card should be hand delivered to the Secretary of the Company

or sent to the Company’s principal executive offices at 50 Health Sciences Drive, Stony Brook, New York 11790, Attention:

Corporate Secretary. (2) If a broker, bank, or other nominee holds your shares, you must contact them in

order to find out how to change your vote.

The last proxy or vote that we receive

from you will be the vote that is counted.

Who will bear the cost of soliciting

votes for the Special Meeting?

We

will pay the entire cost of preparing, assembling, printing, mailing, and distributing these proxy materials and soliciting votes. If

you choose to access the proxy materials and/or vote over the Internet, you are responsible for Internet access charges you may incur.

If you choose to vote by telephone, you are responsible for telephone charges you may incur. In addition to the mailing of these proxy

materials, the solicitation of proxies or votes may be made in person, by telephone, or by electronic communication by our directors,

officers, and employees, who will not receive any additional compensation for such solicitation activities. We have engaged Kingsdale

Shareholder Services US LLC (“Kingsdale Advisors”) to assist in soliciting proxies on

our behalf. Kingsdale Advisors may solicit proxies personally, electronically or by telephone. We have agreed to pay Kingsdale Advisors

a fee of $10,000 plus reimburse them for certain out-of-pocket disbursements and expenses. We have also agreed to indemnify Kingsdale Advisors

and its employees against certain liabilities arising from or in connection with the engagement.

What is “householding”

and where can I get additional copies of proxy materials?

For information

about householding and how to request additional copies of proxy materials, please see the section captioned “Householding of

Proxy Materials.”

Whom may I contact if I have

other questions about the Special Meeting or voting?

You

may contact the Company at 50 Health Sciences Drive, Stony Brook, New York 11790, Attention: Beth Jantzen, or by telephone at

631-240-8800, or you may contact Kingsdale Advisors by telephone at 1-800-497-3946 (toll free) or

1-917-936-5214 (call or text outside North America) or by email at contactus@kingsdaleadvisors.com.

Where can I find the voting

results of the Special Meeting?

We

will announce preliminary voting results at the Special Meeting. Final voting results will be disclosed on a Form 8-K filed with the SEC

within four business days after the Special Meeting, which will also be available on our website.

We

encourage you to vote by proxy over the Internet, by mail or telephone pursuant to instructions provided on the proxy card or the

instructions that accompanied your proxy materials.

PROPOSAL NO. 1

APPROVAL, IN

ACCORDANCE WITH NASDAQ LISTING RULE 5635(D), OF THE ISSUANCE OF CERTAIN COMMON STOCK PURCHASE WARRANTS IN CONNECTION WITH AN OFFERING

OF SECURITIES OF THE COMPANY THAT OCCURRED ON MAY 28, 2024

We

are seeking stockholder approval, for purposes of complying with Nasdaq Listing Rule 5635(d), for the issuance of (i) 9,230,769 Series

A warrants, each to purchase one share of the Company’s Common Stock (the “Series A Warrants”) and (ii) 9,230,769

Series B warrants, each to purchase one share of the Company’s Common Stock (the “Series B Warrants” and, together

with the Series A Warrants, the “Series Warrants”) in connection with an offering of securities of the Company that

occurred on May 28, 2024 (the “Offering”).

The

information set forth in this Proposal No. 1 is qualified in its entirety by reference to the full text of the Placement Agreement (as

defined below), form of Series A Warrant and form of Series B Warrant, attached as exhibits 10.1, 4.2 and 4.3, respectively, to our Current

Report on Form 8-K filed with the SEC on May 29, 2024.

Stockholders

are urged to carefully read these documents.

Background

On

May 28, 2024, the Company entered into a placement agency agreement (the “Placement Agreement”) with Craig-Hallum Capital

Group LLC and Laidlaw & Company (UK) Ltd. (collectively, the “Placement Agents”) pursuant to which the Placement Agents

agreed to serve as the co-placement agents, on a “reasonable best efforts” basis, in connection with the Offering, which

consisted of 9,230,769 units (the “Units”), with each Unit consisting of either (A) one share of the Company’s Common

Stock (collectively, the “Shares”), one Series A Warrant and one Series B Warrant or (B) one pre-funded warrant (each, a “Pre-Funded

Warrant”) to purchase one share of Common Stock and one Series A Warrant and one Series B Warrant. The

Offering closed on May 29, 2024. The purchase price of each Unit was $1.30, except for Units which include Pre-Funded Warrants, which

had a purchase price of $1.2999. The Units had no stand-alone rights and were certificated or issued as stand-alone securities.

The

Company received gross proceeds from the Offering, before deducting placement agent fees and other estimated offering expenses payable

by the Company, of approximately $12 million.

The

exercisability of the Series Warrants will be available only upon the first trading day following the Company’s notice to warrantholders

of receipt of such stockholder approval as may be required by the applicable rules and regulations of the Nasdaq Capital Market (the “Warrant

Stockholder Approval”). Each Series A Warrant offered will become exercisable beginning on the date of the Warrant Stockholder Approval

at an exercise price of $1.99 per share of Common Stock, and will expire five years from the Stockholder Approval Date (as defined in

the Series A Warrant). Each Series B Warrant offered will become exercisable beginning on the date of the Warrant Stockholder Approval

at an exercise price of $1.99 per share of Common Stock, and will expire one year from the date of the Stockholder Approval Date (as defined

in the Series B Warrant).

Under

the alternate cashless exercise option of the Series B Warrants, the holder of the Series B Warrant has the right to receive

an aggregate number of shares equal to the product of (x) the aggregate number of shares of Common Stock that would be issuable upon

a cash exercise of the Series B Warrant and (y) 3.0. In addition, the Series A Warrants and Series B Warrants include a

provision that resets their respective exercise price in the event of a reverse split of the Company’s Common Stock, to a price

equal to the lesser of (i) the then exercise price and (ii) the lowest volume weighted average price (VWAP) during the period

commencing five trading days immediately preceding and the five trading days commencing on the date the Company effects a reverse stock

split in the future with a proportionate adjustment to the number of shares underlying the Series A Warrants and Series B Warrants.

In

addition, and subject to certain exemptions, if the Company sells, enters into an agreement to sell, or grants any option to

purchase, or sells, enters into an agreement to sell, or grants any right to reprice (excluding Exempt Issuances, as defined in the

Placement Agency Agreement), or otherwise dispose of or issue (or announce any offer, sale, grant or any option to purchase or other

disposition) any shares of common stock, at an effective price per share less than the exercise price of the Series A Warrants then

in effect, the exercise price of the Series A Warrants will be reduced to the lower of

such price or the lowest volume weighted average price (VWAP) during the five consecutive trading days immediately following such

dilutive issuance or announcement thereof, and the number of shares issuable upon exercise will be proportionately adjusted

such that the aggregate exercise price will remain unchanged.

In the case of certain fundamental transactions affecting the

Company, a holder of Series Warrants, upon exercise of such Series Warrants after such fundamental transaction, will have the right to

receive, in lieu of shares of the Company’s common stock, the same amount and kind of securities, cash or property that such holder

would have been entitled to receive upon the occurrence of the fundamental transaction, had the Series Warrants been exercised immediately

prior to such fundamental transaction. In lieu of such consideration, a holder of Series Warrants may instead elect to receive a cash

payment based upon the Black-Scholes value of their Series Warrants.

We

are seeking approval for Proposal No. 1 because, pursuant to the Placement Agreement and the Series Warrants, we agreed to issue the

Series Warrants in the Offering, and the Series Warrants are not exercisable until we receive Warrant Stockholder Approval. In

addition, in the event Warrant Stockholder Approval is obtained and the Series Warrants are exercised for cash, the Company would

receive up to approximately $36.7 million. Further, pursuant to the Series Warrants, in the event the Company does not

obtain Warrant Stockholder Approval at the Special Meeting, it is obligated to call a meeting every ninety (90) days after its the

Special Meeting until it obtains Warrant Stockholder Approval. If we are able to obtain approval for Proposal No. 1 at the Special

Meeting, we will save time and avoid the expense of having additional meetings to obtain approval.

Nasdaq Stockholder

Approval Requirement; Reasons for the Warrant Issuance Proposal

Nasdaq

Listing Rule 5635(d) requires stockholder approval in connection with a transaction, other than a public offering, involving the sale

or issuance by the issuer of common stock (or securities convertible into or exchangeable for common stock) equal to 20% or more of the

common stock or 20% or more of the voting power of such company outstanding before the issuance for a price that is less than the lower

of: (i) the closing price of the common stock immediately preceding the signing of the binding agreement for the issuance of such securities

and (ii) the average closing price of the common stock for the five trading days immediately preceding the signing of the binding agreement

for the issuance of such securities. Because of Nasdaq Listing Rule 5635(d), the Series Warrants provide that they may not be exercised,

and therefore have no value, unless stockholder approval of their exercise is obtained.

The

Board of Directors Recommends That Stockholders Vote “For” The Warrant Issuance Proposal.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

The

following table sets forth certain information regarding the shares of our Common Stock beneficially owned as of the Record Date, by (i)

each person, or group of affiliated persons, who is known to us to beneficially own 5% or more of the outstanding Common Stock, (ii) each

of our named executive officers and current executive officers, (iii) each of our directors and (iv) all of our current executive officers

and directors as a group.

We have

determined beneficial ownership in accordance with the rules of the SEC, and thus it represents sole or shared voting or investment power

with respect to our securities. Unless otherwise indicated below, to our knowledge, the persons and entities named in the table have sole

voting and sole investment power with respect to all shares that they beneficially owned, subject to community property laws where applicable.

The information does not necessarily indicate beneficial ownership for any other purpose, including for purposes of Sections 13(d)

and 13(g) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

We

have based our calculation of the percentage of beneficial ownership on 9,011,857 shares of our common

stock outstanding on the Record Date. We have deemed shares of Common Stock subject to stock options that are currently exercisable

or exercisable within 60 days of the Record Date to be outstanding and to be beneficially owned by the person holding the stock

option for the purpose of computing the percentage ownership of that person. We did not deem these shares outstanding, however, for

the purpose of computing the percentage ownership of any other person. Unless otherwise indicated below, the address of each

beneficial owner listed in the table below is c/o 50 Health Sciences Drive, Stony Brook, New York 11790. The information in the

table below is based solely on a review of Schedules 13D and 13G as well as the Company’s knowledge of holdings with respect

to its employees and directors.

| |

|

Title of Class |

|

Number of

Shares Owned(1) |

|

|

Percentage

of Class(2) |

|

| Executive Officers and Directors: |

|

|

|

|

|

|

|

|

|

|

| James A. Hayward |

|

Common Stock |

|

|

25,324 |

(3) |

|

|

* |

|

| Yacov A. Shamash |

|

Common Stock |

|

|

8,994 |

(4) |

|

|

* |

|

| Robert B. Catell |

|

Common Stock |

|

|

8,436 |

(8) |

|

|

* |

|

| Joseph D. Ceccoli |

|

Common Stock |

|

|

8,554 |

(5) |

|

|

* |

|

| Beth M. Jantzen |

|

Common Stock |

|

|

6,922 |

(9)(12) |

|

|

* |

|

| Judith Murrah |

|

Common Stock |

|

|

7,763 |

(10)(12) |

|

|

* |

|

| Clay Shorrock |

|

Common Stock |

|

|

6,377 |

(12)(13) |

|

|

* |

|

| Sanford R. Simon |

|

Common Stock |

|

|

8,356 |

(6) |

|

|

* |

|

| Elizabeth Schmalz Shaheen |

|

Common Stock |

|

|

8,373 |

(11) |

|

|

* |

|

| All directors and officers as a group (9 persons) |

|

Common Stock |

|

|

89,099 |

(7) |

|

|

1.00 |

% |

| 5% Stockholder: |

|

|

|

|

|

|

|

|

|

|

| Leviticus Partners, L.P. |

|

Common Stock |

|

|

571,232 |

(14) |

|

|

6.34 |

% |

| L1 Capital Global Opportunities Master Fund, Ltd. |

|

Common Stock |

|

|

900,284 |

(15) |

|

|

9.99 |

% |

| S.H.N. Financial Investments Ltd. |

|

Common Stock |

|

|

900,284 |

(16) |

|

|

9.99 |

% |

* indicates less than one percent

(1) Beneficial ownership is determined in

accordance with the rules of the SEC and generally includes voting or investment power with respect to the shares shown. Except as indicated

by footnote and subject to community property laws where applicable, to our knowledge, the stockholders named in the table have sole voting

and investment power with respect to all shares of Common Stock shown as beneficially owned by them. A person is deemed to be the beneficial

owner of securities that can be acquired by such person within 60 days upon the exercise of options, warrants or convertible securities

(in any case, the “Currently Exercisable Options”).

(2) Based upon 9,011,857

shares of Common Stock outstanding as of June 3, 2024. Each beneficial owner’s percentage ownership is determined by assuming

that the Currently Exercisable Options that are beneficially held by such person (but not those held by any other person) have been exercised

and converted.

(3) Includes 18,615 shares underlying currently

exercisable options.

(4) Includes 8,915 shares underlying currently

exercisable options.

(5) Includes 8,526 shares underlying currently

exercisable options.

(6) Includes 8,352 shares underlying currently

exercisable options.

(7) Includes 74,958 shares underlying currently

exercisable options.

(8) Includes 8,339 shares underlying currently

exercisable options.

(9) Includes 4,872 shares underlying currently

exercisable options.

(10) Includes 5,426 shares underlying currently

exercisable options.

(11) Includes 8,334 shares underlying currently

exercisable options.

(12) Excludes 3,700, 3,750 and 4,063 shares underlying

options for Ms. Jantzen, Mr. Shorrock and Ms. Murrah, respectively that were granted on March 23, 2023 and vest 25%

per year commencing on the first anniversary of grant date.

(13) Includes 3,579 shares underlying currently

exercisable options.

(14) Based on a Schedule 13G/A filed by Leviticus

Partners, L.P., a Delaware limited partnership (“Leviticus”) on June 3, 2024 the securities are directly held by (i)

Leviticus and (ii) AMH Equity, LLC (“AMH”). AMH is the general partner of Leviticus, and as such may be deemed to

be an indirect beneficial owner of the shares held by Leviticus. Leviticus and AMH disclaim beneficial ownership of the reported securities

except to the extent of their respective pecuniary interest therein. The address of each of Leviticus and AMH is 32 Old Mill Road, Great

Neck, NY 11023.

(15) Based on Schedule 13G filed by L1 Capital

Global Opportunities Master Fund, Ltd., an entity organized under the laws of the Cayman Islands (“L1”) on June 7,

2024. Consists of (i) 108,000 shares of Common Stock and (ii) pre-funded warrants to purchase up 792,284 shares of Common Stock. Does not include 625,357 pre-funded warrants, which are subject to a 9.99% beneficial ownership limitation.

Also does not include 1,525,641 Series A Warrants and 1,525,641 Series B Warrants, each to purchase shares of Common Stock, both of which

are subject to a 9.99% beneficial ownership limitation. The address of L1 is 161A Shedden Road, 1 Artillery Court, PO Box 10085, Grand

Cayman, Cayman Islands KY1-1001.

(16) Based on Schedule 13G filed by S.H.N. Financial

Investments Ltd., an entity organized under the laws of Israel (“SHN”) on June 7, 2024. Consists of (i) 108,000 shares

of Common Stock and (ii) pre-funded warrants to purchase up 792,284 shares of Common Stock.

Does not include 625,357 pre-funded warrants, which are subject to a 9.99% beneficial ownership limitation. The Reporting Person sold

all shares of Common Stock including all shares issuable upon exercise of the pre-funded warrants on or after May 28, 2024. Also does

not include 1,525,641 Series A Warrants and 1,525,641 Series B Warrants, each to purchase shares of Common Stock, both of which are subject

to a 9.99% beneficial ownership limitation. The address of SHN is Herzliya Hills, Arik Einstein 3, Israel, 4610301.

HOUSEHOLDING OF

PROXY MATERIALS

The

SEC has adopted rules that permit companies and intermediaries such as brokers to satisfy delivery requirements for proxy materials with

respect to two or more stockholders sharing the same address by delivering a single proxy statement addressed to those stockholders. This

process, which is commonly referred to as “householding,” potentially provides extra convenience for stockholders and cost

savings for companies. The Company, as well as some brokers (or other nominees), household the Company’s proxy materials, which

means that we or they deliver a single proxy statement or notice, as applicable, to multiple stockholders sharing an address unless contrary

instructions have been received from the affected stockholders. Once you have received notice from your broker (or other nominee) or from

us that they or we will be householding materials to your address, householding will continue until you are notified otherwise or until

you revoke your consent. If, at any time, you no longer wish to participate in householding and would prefer to receive a separate proxy

statement in the future, or if you are receiving multiple copies of the proxy statement and wish for only one copy to be delivered to

your household in the future, please notify (i) your broker (or other nominee) if your shares are held in a brokerage or similar account

or (ii) the Company if you hold registered shares in your own name. We will promptly deliver a separate proxy statement to record stockholders

upon written or oral request. You can notify us of your instructions by telephone at 631-240-8800 or

by sending a written request to:

Corporate Secretary

Applied DNA Sciences,

Inc.

50 Health Sciences Drive

Stony Brook, New York

11790

OTHER BUSINESS

We

do not know of any matters that are to be presented for action at the Special Meeting other than those set forth above. If any other matters

properly come before the Special Meeting, the person named in the enclosed proxy card will vote the shares represented by proxies as recommended

by the Board of Directors. If the Board of Directors does not make a recommendation, then they will vote in accordance with their best

judgment.

STOCKHOLDER PROPOSALS

AND NOMINATIONS

In

order for a stockholder proposal to be considered for inclusion in the proxy statement for the 2025 annual meeting of stockholders, the

written proposal must be received by the Corporate Secretary at the address below no earlier than May 22, 2024 and no later than

June 21, 2024. In the event that the annual meeting of stockholders is called for a date that is not within 30 days before or after

the first anniversary of the date of this year’s annual meeting, the proposal must be received no later than a reasonable time before

the Company begins to print and mail its proxy materials. The proposal will also need to comply with the SEC’s regulations under

Rule 14a-8 under the Exchange Act regarding the inclusion of stockholder proposals in company sponsored proxy materials. Proposals should

be addressed to:

Corporate Secretary

Applied DNA Sciences,

Inc.

50 Health Sciences Drive

Stony Brook, New York

11790

For a stockholder

proposal that is not intended to be included in the proxy statement for the 2024 annual meeting of stockholders, or if you want to nominate

a person for election as a director, you must provide written notice to the Corporate Secretary at the address above. The Secretary must

receive this notice not earlier than May 22, 2024 and no later than June 21, 2024. However, if

our 2024 annual meeting of stockholders is held more than 30 days before or more than 60 days after September 19,

2024, then the Secretary must receive this notice not earlier than the close of business on the 120th day prior to the date of our

2024 annual meeting and not later than the close of business on the later of the 90th day prior to such annual meeting or the 10th day

following the day on which we make a public announcement of the date of the meeting. The notice of a proposed item of business must provide

information as required in our bylaws which, in general, require that the notice include for each matter a brief description of the matter

to be brought before the meeting; the reason for bringing the matter before the meeting; the text of the proposal or matter; your name,

address, and number of shares you own beneficially or of record; and any material interest you have in the proposal.

Effective September 1,

2022, Rule 14a-19 under the Exchange Act requires the use of a universal proxy card in contested director elections. Under this “universal

proxy rule,” a stockholder intending to engage in a director election contest with respect to an annual meeting of stockholders

must give the Company notice of its intent to solicit proxies by providing the name(s) of the stockholder’s nominee(s) and certain

other information at least 60 calendar days prior to the anniversary of the previous year’s annual meeting date, or July 22,

2024 (except that, if the Company did not hold an annual meeting during the previous year, or if the date of the meeting has

changed by more than 30 calendar days from the previous year, then notice must be provided by the later of 60 calendar days prior to the

date of the annual meeting or the 10th calendar day following the day on which public announcement of the date of the annual meeting is

first made by the Company).

The notice

of a proposed director nomination must provide information and documentation as required in our bylaws which, in general, require that

the notice of a director nomination include the information about the nominee that would be required to be disclosed in the solicitation

of proxies for the election of a director under federal securities laws; the nominee’s written consent to be named in the proxy

statement as a nominee and to serve as a director if elected; a description of any transaction or arrangement during the last three years

between the stockholder making the nomination and the nominee in which the nominee had a direct or indirect material interest; and a completed

and signed questionnaire, together with a written representation and agreement that such nominee is not and will not become a party to

certain voting commitments. A copy of the bylaw requirements will be provided upon request to the Corporate Secretary at the address above.

ANNUAL REPORT ON

FORM 10-K AND OTHER INFORMATION

A

copy of our Annual Report on Form 10-K for the fiscal year ended September 30, 2023, including financial statements and any financial

statement schedules required to be filed in accordance with SEC rules, will be sent without charge to any stockholder of the Company requesting

it in writing from: Applied DNA Sciences, Inc., 50 Health Sciences Drive, Stony Brook, New York 11790, Attention: Beth Jantzen.

We also make available, free of charge on our website, all of our filings that are publicly filed on the SEC’s EDGAR website, including

Forms 10-K, 10-Q and 8-K, at www.adnas.com.

| |

By

Order of the Board of Directors |

| |

|

| |

/s/

James A. Hayward |

| |

James

A. Hayward |

| |

Chairman,

President and Chief Executive Officer |

Stony

Brook, New York

June

[●], 2024

| APPLIED

DNA SCIENCES, INC. ATTN: BETH JANTZEN 50 HEALTH SCIENCES DRIVE STONY BROOK, NY 11790SCAN

TO VIEW MATERIALS & VOTEVOTE BY INTERNETBefore The Meeting - Go to www.proxyvote.com

or scan the QR Barcode above Use the Internet to transmit your voting instructions and for

electronic delivery of information up until 11:59 P.M. Eastern Time on August 1, 2024, the

day before the meeting date. Have your proxy card in hand when you access the web site and

follow the instructions to obtain your records and to create an electronic voting instruction

form. During The Meeting - Go to www.virtualshareholdermeeting.com/APDN2024SMYou may attend

the meeting via the Internet and vote during the meeting. Have the information that is printed

in the box marked by the arrow available and follow the instructions. VOTE BY PHONE - 1-800-690-6903

Use any touch-tone telephone to transmit your voting instructions up until 11:59 P.M. Eastern

Time on August 1, 2024, the day before the meeting date. Have your proxy card in hand when

you call and then follow the instructions. VOTE BY MAIL Mark, sign and date your proxy card

and return it in the postage-paid envelope we have provided or return it to Vote Processing,

c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717.TO VOTE, MARK BLOCKS BELOW IN BLUE OR

BLACK INK AS FOLLOWS:V53139-S90711KEEP THIS PORTION FOR YOUR RECORDSAPPLIED DNA SCIENCES,

INC.THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED.DETACH AND RETURN THIS PORTION ONLYThe

Board of Directors recommends you vote FOR the following proposal:For Against Abstain1. Approval,

in accordance with Nasdaq Listing Rule 5635(d), of the issuance of certain common stock purchase

warrants in connection ! ! ! with an offering of securities of the Company that occurred

on May 28, 2024.Please sign exactly as your name(s) appear(s) hereon. When signing as attorney,

executor, administrator, or other fiduciary, please give full title as such. Joint owners

should each sign personally. All holders must sign. If a corporation or partnership, please

sign in full corporate or partnership name by authorized officer.Signature [PLEASE SIGN WITHIN

BOX] Date Signature (Joint Owners) Date |

| Important

Notice Regarding the Availability of Proxy Materials for the Special Meeting: The Notice

and Proxy Statement is available at www.proxyvote.com.V53140-S90711APPLIED DNA SCIENCES,

INC. Special Meeting of Stockholders August 2, 2024 10:00 AM This proxy is solicited by the

Board of DirectorsThe stockholder executing and delivering this Proxy hereby appoints Ms.

Judith Murrah and Ms. Beth Jantzen and each of them as proxies (the "proxies"), with full

power of substitution, and hereby authorizes them to represent and vote, as designated on

the reverse side, all shares of common stock, $0.001 par value per share, of Applied DNA

Sciences, Inc. held of record by the undersigned as of June 3, 2024, at the Special Meeting

of Stockholders of Applied DNA Sciences, Inc., to be held virtually at www.virtualshareholdermeeting.com/APDN2024SM

on Friday, August 2, 2024 at 10:00 AM Local Time, or at any postponements or adjournments

of the meeting.This Proxy, when properly executed, will be voted in the manner directed herein

by the undersigned stockholder. If no direction is made, this Proxy will be voted in accordance

with the recommendations of our Board of Directors and for such other matters as may properly

come before the meeting as said proxies deem advisable.THIS PROXY SHOULD BE MARKED, DATED

AND SIGNED BY THE STOCKHOLDER(S) EXACTLY AS SUCH STOCKHOLDER'S NAME APPEARS HEREON AND RETURNED

PROMPTLY IN THE ENCLOSED ENVELOPE. PERSONS SIGNING IN A FIDUCIARY CAPACITY SHOULD SO INDICATE.

IF SHARES ARE HELD BY JOINT TENANTS OR AS COMMUNITY PROPERTY, BOTH SHOULD SIGN.Continued

and to be signed on reverse side |

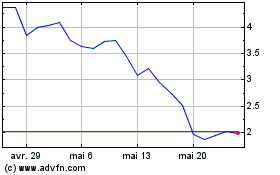

Applied DNA Sciences (NASDAQ:APDN)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Applied DNA Sciences (NASDAQ:APDN)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024