Assembly Biosciences Reports Third Quarter 2023 Financial Results and Recent Updates

08 Novembre 2023 - 10:05PM

Assembly Biosciences, Inc. (Nasdaq: ASMB), a biotechnology company

developing innovative antiviral therapeutics targeting serious

viral diseases, today reported financial results for the third

quarter ended September 30, 2023, and recent corporate updates.

“The Assembly Bio team has made exceptional progress in building

a portfolio of promising antiviral candidates for herpesviruses,

hepatitis B and hepatitis D,” said Jason Okazaki, chief executive

officer and president of Assembly Bio. “With our new long-term

partnership with Gilead, a pioneer in virology, we are excited by

the opportunity to accelerate progress on our antiviral pipeline to

bring next-generation therapeutics to individuals living with

serious viral infections. We believe that the financial and

scientific resources provided by the collaboration position us well

to reach critical short- and long-term milestones and deliver value

for patients and our shareholders. We are also pleased to announce

the addition of Dr. Anuj Gaggar to our leadership team as chief

medical officer as we look ahead to having multiple antiviral

candidates in the clinic next year.”

Third Quarter 2023 and Recent Updates

- Entered a long-term partnership with Gilead Sciences to advance

discovery and development of novel antiviral therapies.

- Collaboration combines Assembly Bio’s advanced virology

research capabilities with Gilead’s established development and

commercialization expertise in antiviral medicines to create a

synergistic partnership focused on propelling scientific innovation

and delivering new treatments to patients with significant unmet

need.

- Partnership includes Gilead opt-in rights on Assembly Bio’s

current and future pipeline candidates, including two contributed

Gilead herpesvirus programs.

- $100 million upfront investment by Gilead, including equity

investment, plus potential for future regulatory, commercial,

opt-in and collaboration extension payments, provides runway to

drive portfolio growth and support advancement of company’s current

and future clinical and preclinical programs.

- Strengthened the leadership team with the naming of Anuj

Gaggar, MD, PhD, as chief medical officer, as announced separately

today. Dr. Gaggar is an infectious disease specialist who has

focused on the development of new therapies in viral diseases

including chronic hepatitis B virus (HBV), hepatitis C virus and

hepatitis D virus (HDV) infections.

- Nominated first development candidate for the treatment of

chronic HDV infection. ABI-6250, an orally bioavailable small

molecule entry inhibitor, is moving toward IND-enabling studies

with the goal of beginning clinical studies by the end of

2024.

- Presented preclinical data in two oral and one poster

presentation highlighting the progress of multiple HBV and HDV

pipeline programs at the 2023 International HBV Meeting held

September 19-23, 2023.

Anticipated Milestones

Assembly Bio anticipates having four candidates in clinical

studies by the end of 2024:

- ABI-5366, a long-acting helicase-primase inhibitor targeting

high-recurrence genital herpes, is expected to enter the clinic by

mid-2024.

- The herpes simplex virus (HSV) helicase-primase inhibitor

candidate contributed by Gilead is expected to enter the clinic by

the end of 2024.

- ABI-4334, a potent next-generation capsid assembly modulator

for HBV, has completed Phase 1a development and is expected to

enter Phase 1b by mid-2024.

- ABI-6250, a HDV entry inhibitor, is expected to enter the

clinic by the end of 2024.

Upcoming Conferences

- Preclinical and clinical data from the company’s viral

hepatitis portfolio will be highlighted in two presentations at the

American Association for the Study of Liver Diseases (AASLD), The

Liver Meeting®, taking place November 10-14, 2023, in Boston.

Third Quarter 2023 Financial Results

- Cash, cash equivalents and marketable

securities were $46.2 million as of September 30, 2023,

compared to $59.8 million as of June 30, 2023. With the $100

million received from Gilead in October, Assembly Bio’s cash

position is projected to fund operations into the second half of

2025.

- Research and development expenses were $10.8

million for the three months ended September 30, 2023, compared to

$18.1 million for the same period in 2022. The decrease is due to

completion of the clinical trials for ABI-3733 and ABI-4334,

discontinued development of vebicorvir and ABI-2158, and decreases

in employee and contractor-related expenses.

- General and administrative expenses were $4.2

million for the three months ended September 30, 2023, compared to

$5.3 million for the same period in 2022. The decrease is due to

overall cost-saving initiatives.

- Net loss attributable to common stockholders

was $14.4 million, or $0.27 per basic and diluted share, for the

three months ended September 30, 2023, compared to $23.1 million,

or $0.48 per basic and diluted share, for the same period in

2022.

About Assembly BiosciencesAssembly

Biosciences is a biotechnology company dedicated to the development

of innovative small-molecule antiviral therapeutics designed to

change the path of serious viral diseases and improve the lives of

patients worldwide. Led by an accomplished team of leaders in

virologic drug development, Assembly Bio is committed to improving

outcomes for patients struggling with the serious, chronic impacts

of herpesvirus, hepatitis B virus (HBV) and hepatitis delta virus

(HDV) infections. For more information,

visit assemblybio.com.

Forward-Looking StatementsThe information in

this press release contains forward-looking statements that are

subject to certain risks and uncertainties that could cause actual

results to materially differ. These risks and uncertainties

include: Assembly Bio’s ability to realize the potential benefits

of its collaboration with Gilead, including all financial aspects

of the collaboration and equity investments; Assembly Bio’s ability

to initiate and complete clinical studies involving its therapeutic

product candidates, including studies contemplated by Assembly

Bio’s collaboration with Gilead, in the currently anticipated

timeframes or at all; the occurrence of any event, change or other

circumstance that could give rise to the termination of Assembly

Bio’s collaboration with Gilead; safety and efficacy data from

clinical or nonclinical studies may not warrant further development

of Assembly Bio’s product candidates; clinical and nonclinical data

presented at conferences may not differentiate Assembly Bio’s

product candidates from other companies’ candidates; results of

nonclinical studies may not be representative of disease behavior

in a clinical setting and may not be predictive of the outcomes of

clinical studies; and other risks identified from time to time in

Assembly Bio’s reports filed with the U.S. Securities and Exchange

Commission (the SEC). You are urged to consider statements that

include the words may, will, would, could, should, might, believes,

hopes, estimates, projects, potential, expects, plans, anticipates,

intends, continues, forecast, designed, goal or the negative of

those words or other comparable words to be uncertain and

forward-looking. Assembly Bio intends such forward-looking

statements to be covered by the safe harbor provisions contained in

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. More

information about Assembly Bio’s risks and uncertainties are more

fully detailed under the heading “Risk Factors” in Assembly Bio’s

filings with the SEC, including its most recent Annual Report on

Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on

Form 8-K. Except as required by law, Assembly Bio assumes no

obligation to update publicly any forward-looking statements,

whether as a result of new information, future events or

otherwise.

ContactsInvestor and

Corporate: Shannon Ryan SVP, Investor Relations,

Corporate Affairs and Alliance Management (415)

738-2992 sryan@assemblybio.com

Media: Sam Brown Inc.Hannah Hurdle(805)

338-4752ASMBMedia@sambrown.com

|

ASSEMBLY BIOSCIENCES, INC. |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

(In thousands except for share amounts and par value) |

|

|

|

|

|

|

|

|

|

September 30, |

|

December 31, |

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

|

(Unaudited) |

|

|

|

ASSETS |

|

|

|

|

|

Current assets |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

26,656 |

|

|

$ |

52,418 |

|

|

Marketable securities |

|

|

19,554 |

|

|

|

39,192 |

|

|

Accounts receivable from collaboration |

|

|

— |

|

|

|

944 |

|

|

Prepaid expenses and other current assets |

|

|

3,462 |

|

|

|

4,413 |

|

|

Total current assets |

|

|

49,672 |

|

|

|

96,967 |

|

|

|

|

|

|

|

|

Property and equipment, net |

|

|

561 |

|

|

|

743 |

|

|

Operating lease right-of-use assets |

|

|

844 |

|

|

|

3,195 |

|

|

Other assets |

|

|

552 |

|

|

|

889 |

|

|

Total assets |

|

$ |

51,629 |

|

|

$ |

101,794 |

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

Current liabilities |

|

|

|

|

|

Accounts payable |

|

$ |

758 |

|

|

$ |

2,493 |

|

|

Accrued research and development expenses |

|

|

1,619 |

|

|

|

3,122 |

|

|

Other accrued expenses |

|

|

3,886 |

|

|

|

7,317 |

|

|

Operating lease liabilities - short-term |

|

|

869 |

|

|

|

3,364 |

|

|

Total current liabilities |

|

|

7,132 |

|

|

|

16,296 |

|

|

|

|

|

|

|

|

Deferred revenue |

|

|

2,733 |

|

|

|

2,733 |

|

|

Operating lease liabilities - long-term |

|

|

50 |

|

|

|

101 |

|

|

Total liabilities |

|

|

9,915 |

|

|

|

19,130 |

|

|

|

|

|

|

|

|

Commitments and contingencies |

|

|

|

|

|

|

|

|

|

|

|

Stockholders' equity |

|

|

|

|

|

Preferred stock, $0.001 par value; 5,000,000 shares authorized; no

shares issued or outstanding |

|

|

— |

|

|

|

— |

|

|

Common stock, $0.001 par value; 150,000,000 shares authorized as of

September 30, 2023 and December 31, 2022; 52,614,194 and

48,894,973 shares issued and outstanding as of September 30,

2023 and December 31, 2022, respectively |

|

|

53 |

|

|

|

49 |

|

|

Additional paid-in capital |

|

|

816,722 |

|

|

|

807,938 |

|

|

Accumulated other comprehensive loss |

|

|

(275 |

) |

|

|

(803 |

) |

|

Accumulated deficit |

|

|

(774,786 |

) |

|

|

(724,520 |

) |

|

Total stockholders' equity |

|

|

41,714 |

|

|

|

82,664 |

|

|

Total liabilities and stockholders' equity |

|

$ |

51,629 |

|

|

$ |

101,794 |

|

| |

|

|

|

|

|

ASSEMBLY BIOSCIENCES, INC. |

|

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND

COMPREHENSIVE LOSS |

|

(In thousands except for share and per share amounts) |

|

(Unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

Operating expenses |

|

|

|

|

|

|

|

|

|

Research and development |

|

$ |

10,824 |

|

|

$ |

18,130 |

|

|

$ |

37,894 |

|

|

$ |

53,127 |

|

|

General and administrative |

|

|

4,224 |

|

|

|

5,271 |

|

|

|

14,201 |

|

|

|

18,009 |

|

|

Total operating expenses |

|

|

15,048 |

|

|

|

23,401 |

|

|

|

52,095 |

|

|

|

71,136 |

|

|

Loss from operations |

|

|

(15,048 |

) |

|

|

(23,401 |

) |

|

|

(52,095 |

) |

|

|

(71,136 |

) |

|

|

|

|

|

|

|

|

|

|

|

Other income |

|

|

|

|

|

|

|

|

|

Interest and other income, net |

|

|

628 |

|

|

|

256 |

|

|

|

1,829 |

|

|

|

439 |

|

|

Total other income |

|

|

628 |

|

|

|

256 |

|

|

|

1,829 |

|

|

|

439 |

|

|

Net loss |

|

$ |

(14,420 |

) |

|

$ |

(23,145 |

) |

|

$ |

(50,266 |

) |

|

$ |

(70,697 |

) |

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive loss |

|

|

|

|

|

|

|

|

|

Unrealized gain (loss) on marketable securities |

|

|

50 |

|

|

|

(1 |

) |

|

|

528 |

|

|

|

(580 |

) |

|

Comprehensive loss |

|

$ |

(14,370 |

) |

|

$ |

(23,146 |

) |

|

$ |

(49,738 |

) |

|

$ |

(71,277 |

) |

|

|

|

|

|

|

|

|

|

|

|

Net loss per share, basic and diluted |

|

$ |

(0.27 |

) |

|

$ |

(0.48 |

) |

|

$ |

(0.97 |

) |

|

$ |

(1.46 |

) |

|

Weighted average common shares outstanding, basic and diluted |

|

|

52,565,333 |

|

|

|

48,448,399 |

|

|

|

51,951,123 |

|

|

|

48,289,501 |

|

| |

|

|

|

|

|

|

|

|

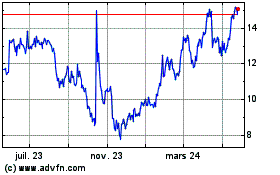

Assembly Biosciences (NASDAQ:ASMB)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

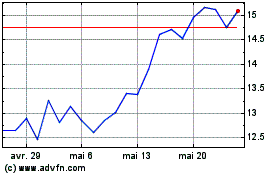

Assembly Biosciences (NASDAQ:ASMB)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024