Filed pursuant to Rule 424(b)(5)

Registration No. 333-263922

Prospectus Supplement

(To Prospectus Supplement dated September 22, 2023, to Prospectus dated April 7, 2022)

Up to $1,324,918

Common Stock

This prospectus supplement amends and supplements the information in the prospectus, dated April 7, 2022, filed as a part of our registration statement on Form S-3 (File No. 333-263922), as supplemented by our prospectus supplement dated September 22, 2023 (collectively, the “Prior Prospectus”). We have entered into an at the market offering agreement, or the Sales Agreement, with H.C. Wainwright & Co., LLC, or Wainwright, dated May 20, 2022, relating to the sale of our common stock, par value $0.001 per share, or our Common Stock, offered by this prospectus supplement. In accordance with the terms of the Sales Agreement, we may offer and sell shares of our Common Stock having an aggregate offering price of up to $1,324,918 from time to time through Wainwright acting as agent, or the Sales Agent. This prospectus supplement should be read in conjunction with the Prior Prospectus, and is qualified by reference thereto, except to the extent that the information herein amends or supersedes the information contained in the Prior Prospectus. This prospectus supplement is not complete without, and may only be delivered or utilized in connection with, the Prior Prospectus, and any future amendments or supplements thereto.

Sales of our Common Stock, if any, under this prospectus supplement and the base prospectus will be made in sales deemed to be an “at the market offering” as defined in Rule 415(a)(4) promulgated under the Securities Act of 1933, as amended, or the Securities Act, including sales made directly on or through the Nasdaq Capital Market or any other existing trading market in the United States for our Common Stock, sales made to or through a market maker other than on an exchange or otherwise, directly to Wainwright as principal, in negotiated transactions at market prices prevailing at the time of sale or at prices related to such prevailing market prices and/or in any other method permitted by law. The Sales Agent is not required to sell any specific number or dollar amount of Common Stock, but as instructed by us will make all sales using commercially reasonable efforts, consistent with its normal trading and sales practices and applicable laws and regulations, subject to the terms and conditions of the Sales Agreement on mutually agreed terms. There is no arrangement for funds to be received in any escrow, trust or similar arrangement. The offering of Common Stock pursuant to the Sales Agreement will terminate upon the earlier of (1) the sale of Common Stock pursuant to this prospectus supplement having an aggregate sales price of $1,324,918 and (2) the termination by us or the Sales Agent of the Sales Agreement pursuant to its terms. We provide more information about how the shares of Common Stock will be sold in the section entitled “Plan of Distribution.”

The Sales Agent will be entitled to compensation at a commission rate of 3.0% of the gross proceeds of each sale of shares of our Common Stock sold under the Sales Agreement. In connection with the sale of shares of our Common Stock on our behalf, the Sales Agent will be deemed to be an “underwriter” within the meaning of the Securities Act and the compensation of the Sales Agent will be deemed to be underwriting commissions or discounts. We have also agreed to provide indemnification and contribution to the Sales Agent with respect to certain liabilities, including liabilities under the Securities Act.

Our Common Stock is traded on the Nasdaq Capital Market under the symbol “AVGR.” On October 16, 2024, the closing price of our Common Stock was $0.9036 per share.

The aggregate market value of our outstanding Common Stock held by non-affiliates is $3,974,755, based on 2,988,313 shares of outstanding Common Stock held by non-affiliates as of October 17, 2024 and a price per share of $1.3301, the closing price of our Common Stock on September 16, 2024. We are filing this prospectus supplement to amend the Prior Prospectus to update the maximum amount of shares we are eligible to sell under our Registration Statement pursuant to General Instruction I.B.6 of Form S-3. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we offer to sell, pursuant to the registration statement of which this prospectus supplement forms a part, securities in a public primary offering with a value exceeding one-third of our public float in any 12-month period so long as the aggregate market value of our outstanding Common Stock held by non-affiliates remains below $75 million. During the prior 12-calendar-month period that ends on, and includes, the date of this prospectus supplement, we have sold $0 of shares of Common Stock pursuant to General Instruction I.B.6 of Form S-3.

Except as otherwise indicated, all information in this prospectus supplement gives effect to a 1-for-15 reverse stock split of our Common Stock, which became effective as of September 13, 2023. However, Common Stock share and per share amounts in the Prior Prospectus and certain of the documents incorporated by reference herein have not been adjusted to give effect to the reverse stock split.

Investing in our Common Stock involves a high degree of risk, including that the trading price of our Common Stock has been subject to volatility. Please read the discussion of material risks of investing in our Common Stock in “Risk Factors” beginning on page S-7 of the Prior Prospectus, and in the risks discussed under similar headings in the documents incorporated by reference in this prospectus supplement and the Prior Prospectus, as they may be amended, updated or modified periodically in our reports filed with the Securities and Exchange Commission.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus supplement or the Prior Prospectus. Any representation to the contrary is a criminal offense.

H.C. Wainwright & Co.

The date of this prospectus supplement is October 17, 2024.

PLAN OF DISTRIBUTION

We have entered into a Sales Agreement with Wainwright, pursuant to which we may issue and sell from time to time, shares of our Common Stock through Wainwright as our sales agent. Sales of the shares of Common Stock, if any, will be made by any method permitted by law deemed to be an “at the market offering” as defined in Rule 415 promulgated under the Securities Act. If we and Wainwright agree on any method of distribution other than sales of shares on or through Nasdaq or another existing trading market in the United States at market prices, we will file a further prospectus supplement providing all information about such offering as required by Rule 424(b) under the Securities Act.

Wainwright will offer shares of our Common Stock at prevailing market prices subject to the terms and conditions of the Sales Agreement as agreed upon by us and Wainwright. We will designate the number of shares which we desire to sell, the time period during which sales are requested to be made, any limitation on the number of shares that may be sold in one day and any minimum price below which sales may not be made. Subject to the terms and conditions of the Sales Agreement, Wainwright will use its commercially reasonable efforts consistent with its normal trading and sales practices to sell on our behalf all of the shares requested to be sold by us. We or Wainwright may suspend the offering of the shares of Common Stock being made through Wainwright under the Sales Agreement upon proper notice to the other party.

Settlement for sales of Common Stock will occur on the first trading day or such shorter settlement cycle as may be in effect under Exchange Act Rule 15c6-1 from time to time, following the date on which any sales are made, or on some other date that is agreed upon by us and Wainwright in connection with a particular transaction, in return for payment of the net proceeds to us. Sales of our shares of our Common Stock as contemplated in this prospectus supplement and the base prospectus will be settled through the facilities of The Depository Trust Company or by such other means as we and Wainwright may agree upon. There is no arrangement for funds to be received in an escrow, trust or similar arrangement.

We will pay Wainwright in cash, upon each sale of shares of our Common Stock pursuant to the Sales Agreement, a commission of 3.0% of the gross proceeds from each sale of shares. Because there is no minimum offering amount required as a condition to this offering, the actual total public offering amount, commissions and proceeds to us, if any, are not determinable at this time. Pursuant to the terms of the Sales Agreement, we agreed to reimburse Wainwright for the documented fees and costs of its legal counsel reasonably incurred in connection with entering into the transactions contemplated by the Sales Agreement in an amount not to exceed $50,000 in the aggregate, in addition to up to a maximum of $2,500 per due diligence update session conducted in connection with each such date the Company files its quarterly reports on Form 10-Q and $5,000 per due diligence session conducted in connection with each such date the Company files its annual report on Form 10-K, for Wainwright’s counsel’s fees and any incidental expenses to be reimbursed by us. We will report at least quarterly the number of shares of our Common Stock sold through Wainwright under the Sales Agreement, the net proceeds to us and the compensation paid by us to Wainwright in connection with the sales of shares of our Common Stock.

In connection with the sales of shares of our Common Stock on our behalf, Wainwright will be deemed to be an “underwriter” within the meaning of the Securities Act, and the compensation paid to Wainwright will be deemed to be underwriting commissions or discounts. We have agreed in the Sales Agreement to provide indemnification and contribution to Wainwright against certain liabilities, including liabilities under the Securities Act.

The offering of our shares of our Common Stock pursuant to the Sales Agreement will terminate upon the earlier of the sale of all of the shares of our Common Stock provided for in this prospectus supplement or termination of the Sales Agreement as permitted therein.

To the extent required by Regulation M, Wainwright will not engage in any market making activities involving our Common Stock while the offering is ongoing under this prospectus supplement.

Wainwright and certain of its affiliates have engaged in, and may in the future engage in, investment banking and other commercial dealings in the ordinary course of business with us or our affiliates. Wainwright and such affiliates have received, or may in the future receive, customary fees and expenses for these transactions. In addition, in the ordinary course of its various business activities, Wainwright and its affiliates may make or hold a broad array of investments and actively trade debt and equity securities (or related derivative securities) and financial instruments (which may include bank loans) for their own account and for the accounts of their customers. Such investments and securities activities may involve securities and/or instruments of ours or our affiliates. Wainwright or its affiliates may also make investment recommendations and/or publish or express independent research views in respect of such securities or financial instruments and may hold, or recommend to clients that they acquire, long and/or short positions in such securities and instruments.

In January 2021, Wainwright acted as placement agent for our registered direct offering of an aggregate of 7,600 shares of our Series D Convertible Preferred Stock at an offering price of $1,000 per share, with each share of Series D Convertible Preferred Stock convertible into 8 shares of Common Stock. Concurrently, we agreed to issue to those investors warrants to purchase up to an aggregate of 53,833 shares of the Company’s Common Stock. We also issued to Wainwright warrants to purchase up to an aggregate of 4,433 shares of Common Stock at an exercise price of $150.00 per share. Total gross proceeds from the offering, before deducting placement agent fees and other estimated offering expenses, was $7.6 million.

In August 2022, Wainwright acted as placement agent in the August 2022 financing, in which we issued and sold (i) in a registered direct offering, 46,667 shares of our Common Stock at a purchase price of $26.28 per share and pre-funded warrants to purchase up to an aggregate of 52,268 shares of Common Stock at a purchase price of $26.2785, and (ii) in a concurrent private placement, at the same purchase price as in the registered direct offering, an aggregate of pre-funded warrants to purchase up to an aggregate of 91,324 shares of Common Stock. In addition, we also issued in the August 2022 financing unregistered series A preferred investment options to purchase up to 190,259 additional shares of our Common Stock and series B preferred investment options to purchase up to 190,259 additional shares of our Common Stock. We also issued to Wainwright unregistered preferred investment options to purchase up to an aggregate of 11,416 shares of Common Stock at an exercise price of $32.85 per share. Total gross proceeds from the offering, before deducting placement agent fees and other estimated offering expenses, was $5.0 million.

In June 2024, Wainwright acted as placement agent for our best efforts public offering of an aggregate of (i) 330,000 shares of Common Stock, (ii) pre-funded warrants to purchase up to an aggregate of 3,284,457 shares of Common Stock, (iii) Series A-1 warrants to purchase up to an aggregate of 3,614,457 shares of Common Stock, (iv) Series A-2 warrants to purchase up to an aggregate of 3,614,457 shares of Common Stock, and (v) Series A-3 warrants to purchase up to an aggregate of 3,614,457 shares of Common Stock. Each share of Common Stock or pre-funded warrant was sold together with a Series A-1 warrant, a Series A-2 Warrant and a Series A-3 Warrant at a combined purchase price of $1.66. We also issued to Wainwright warrants to purchase up to an aggregate of 216,867 shares of Common Stock at an exercise price of $2.075 per share. Total gross proceeds from the offering, before deducting placement agent fees and other estimated offering expenses, was $6.0 million.

This prospectus supplement and the base prospectus may be made available in electronic format on a website maintained by Wainwright, and Wainwright may distribute this prospectus supplement and the base prospectus electronically.

The foregoing does not purport to be a complete statement of the terms and conditions of the Sales Agreement. A copy of the Sales Agreement is included as an exhibit to our Current Report on Form 8-K that will be filed with the SEC and incorporated by reference into the registration statement of which this prospectus supplement and the Prior Prospectus form a part. See “Incorporation of Documents by Reference” and “Where You Can Find More Information” in the Prior Prospectus.

Trading Market

Our Common Stock is listed on Nasdaq under the symbol “AVGR.”

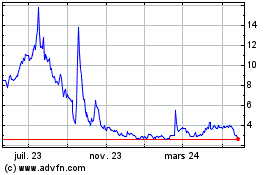

Avinger (NASDAQ:AVGR)

Graphique Historique de l'Action

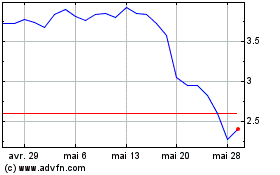

De Nov 2024 à Déc 2024

Avinger (NASDAQ:AVGR)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024