0001738021 False 0001738021 2025-01-08 2025-01-08 iso4217:USD xbrli:shares iso4217:USD xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 8, 2025

_______________________________

Compass Therapeutics, Inc.

(Exact name of registrant as specified in its charter)

_______________________________

| Delaware | 001-39696 | 82-4876496 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

80 Guest Street, Suite 601

Boston, Massachusetts 02135

(Address of Principal Executive Offices) (Zip Code)

(617) 500-8099

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

_______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | CMPX | NASDAQ Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

The information contained in Item 8.01 of this Current Report, to the extent required, is incorporated into this Item 2.02 by reference.

Item 8.01. Other Events.

On January 8, 2025, Compass Therapeutics, Inc. (the “Company”) issued a press release titled “Compass Therapeutics Provides Corporate Update and Announces Advancement of a New Drug Candidate ". A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The Company disclosed its estimate that cash, cash equivalents and marketable securities were approximately $127 million as of December 31, 2024. This amount is unaudited and preliminary and is subject to the completion of financial closing procedures. As a result, this amount may differ materially from the amount that will be reflected in the Company’s financial statements as of and for the year ended December 31, 2024.

Item 9.01. Financial Statements and Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | Compass Therapeutics, Inc. |

| | | |

| | | |

| Date: January 8, 2025 | By: | /s/ Neil Lerner |

| | | Neil Lerner |

| | | Vice President Finance |

| | | |

EXHIBIT 99.1

Compass Therapeutics Provides Corporate Update and Announces Advancement of a New Drug Candidate

- Top-line Phase 2/3 data readout for CTX-009, now named tovecimig (a DLL4 x VEGF-A bispecific), in patients with biliary tract cancer (BTC) is on track for end of Q1 2025.

- CTX-10726 (a novel PD-1 x VEGF-A bispecific) is advancing as a new drug candidate after a year of preclinical development, with YE 2025 IND expected.

- Two Phase 2 biomarker trials are expected to initiate in mid-2025: tovecimig (in DLL4-positive colorectal cancer) and CTX-471 (in NCAM/CD56 expressing tumors).

- Fully enrolled the third dosing cohort of the Phase 1 dose-escalation study of CTX-8371 (PD-1 x PD-L1 bispecific) with preliminary data expected in the second half of 2025.

- Estimated $127 million in cash and marketable securities at YE 2024, which is expected to provide cash runway into Q1 2027.

BOSTON, Jan. 08, 2025 (GLOBE NEWSWIRE) -- Compass Therapeutics, Inc. (Nasdaq: CMPX), a clinical-stage, oncology-focused biopharmaceutical company developing proprietary antibody-based therapeutics to treat multiple human diseases, today announced a corporate and financial update.

“We are approaching a key catalyst for the company with the top-line data readout at the end of the first quarter for our Phase 2/3 combination study of tovecimig, which is our new nonproprietary name for CTX-009, in patients with advanced BTC,” said Thomas Schuetz, MD, PhD, CEO of Compass and Vice Chairman of the Board of Directors. “In addition, we are very excited to announce our new drug candidate, CTX-10726, a novel PD-1 x VEGF-A bispecific antibody. CTX-10726 builds on our deep VEGF-IO expertise and our research team has been rigorously advancing this candidate for the past year. We expect to submit an IND by year-end with initial proof-of-concept clinical data in 2026.”

“Finally, we are making good progress on designing our two new Phase 2 biomarker studies with tovecimig and CTX-471 and continue to expect initiation of these clinical trials in mid-2025.”

DEVELOPMENT PIPELINE UPDATES:

Tovecimig (CTX-009 - DLL4 x VEGF-A bispecific antibody)

- Top-line data readout in the U.S. on track for the end of Q1 2025 for COMPANION-002, the Company’s Phase 2/3 randomized trial of tovecimig in combination with paclitaxel in patients with advanced BTC (see press release).

- Continuing to design and plan a Phase 2 study in patients with DLL4-positive colorectal cancer in the second-line setting in combination with chemotherapy, which is expected to initiate in mid-2025.

- An IST (investigator sponsored study) of tovecimig in patients with BTC in the first-line setting at The University of Texas MD Anderson Cancer Center is being initiated in Q1 2025. Tovecimig will be added to the standard first-line regimen of gemcitabine, cisplatin, and durvalumab (see press release).

CTX-471 (CD137 agonist antibody)

- Phase 2 trial initiation of CTX-471 in patients with tumors expressing neural cell adhesion molecule (NCAM or CD56) is expected in mid-2025.

- Presented CTX-471 clinical data at multiple scientific meetings in 2024, including data demonstrating durable clinical responses in Phase 1 presented at the American Society of Clinical Oncology (ASCO) Annual Meeting and data showing a correlation between levels of NCAM (CD56) expression and disease control presented at the 39th Society for Immunotherapy of Cancer 2024 Annual Meeting.

CTX-8371 (PD-1 x PD-L1 bispecific antibody)

- CTX-8371 is a next generation bispecific checkpoint inhibitor that simultaneously targets PD-1 and PD-L1 and exhibits a unique mechanism-of-action that involves cleavage of cell surface PD-1.

- The third dosing cohort in the Phase 1 dose-escalation study of CTX-8371 is fully enrolled; no dose limiting toxicities (DLTs) have been observed to date.

CTX-10726 (PD-1 x VEGF-A bispecific antibody)

- CTX-10726 is a tetravalent PD-1 x VEGF-A bispecific antibody discovered and engineered at Compass. CTX-10726 is designed to synergistically deliver VEGF-A blockade and checkpoint inhibition, potentially applicable to multiple solid tumor indications.

- The bispecific antibody demonstrates a highly stable structure with high affinity target binding. CTX-10726 exhibits more potent PD-1 blockade compared with data reported for other drugs in the class.

- IND-enabling studies have been ongoing, and we expect to submit an IND by the end of 2025.

- Compass’s deep experience in discovery, pre-clinical, and clinical work focused on complementary bispecific approaches that simultaneously target angiogenesis and immuno-oncology uniquely positions us to rapidly progress this candidate to an IND filing and Phase 1 clinical development.

In addition, the Company had an estimated $127 million in cash and marketable securities as of December 31, 2024, which is expected to provide cash runway into Q1 2027.

About Compass Therapeutics

Compass Therapeutics, Inc. is a clinical-stage oncology-focused biopharmaceutical company developing proprietary antibody-based therapeutics to treat multiple human diseases. Compass’s scientific focus is on the relationship between angiogenesis, the immune system, and tumor growth. The company pipeline of novel product candidates is designed to target multiple critical biological pathways required for an effective anti-tumor response. These include modulation of the microvasculature via angiogenesis-targeted agents, induction of a potent immune response via activators on effector cells in the tumor microenvironment, and alleviation of immunosuppressive mechanisms used by tumors to evade immune surveillance. Compass plans to advance its product candidates through clinical development as both standalone therapies and in combination with proprietary pipeline antibodies based on supportive clinical and nonclinical data. The company was founded in 2014 and is headquartered in Boston, Massachusetts. For more information, visit the Compass Therapeutics website at https://www.compasstherapeutics.com.

Forward-Looking Statements

This press release contains forward-looking statements. Statements in this press release that are not purely historical are forward-looking statements. Such forward-looking statements include, among other things, references to Compass’s financial position to continue advancing its product candidates, expectations about cash runway, business and development plans, and statements regarding Compass’s product candidates, including their development and clinical trial milestones such as the expected trial design, timing of enrollment, patient dosing and data readouts, regulatory plans with respect to Compass’s product candidates and the therapeutic potential thereof. Actual results could differ from those projected in any forward-looking statements due to numerous factors. Such factors include, among others, Compass’s ability to raise the additional funding it will need to continue to pursue its business and product development plans, the inherent uncertainties associated with developing product candidates and operating as a development stage company, Compass’s ability to identify additional product candidates for development, Compass’s ability to develop, complete clinical trials for, obtain approvals for and commercialize any of its product candidates, competition in the industry in which Compass operates and market conditions. These forward-looking statements are made as of the date of this press release, and Compass assumes no obligation to update the forward-looking statements, or to update the reasons why actual results could differ from those projected in the forward-looking statements, except as required by law. Investors should consult all of the information set forth herein and should also refer to the risk factor disclosure set forth in the reports and other documents Compass files with the U.S. Securities and Exchange Commission (SEC) available at www.sec.gov, including without limitation Compass’s latest Annual Report on Form 10-K, Quarterly Report on Form 10-Q and subsequent filings with the SEC.

Investor Contact

ir@compasstherapeutics.com

Media Contact

Anna Gifford, Chief of Staff

media@compasstherapeutics.com

617-500-8099

v3.24.4

Cover

|

Jan. 08, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 08, 2025

|

| Entity File Number |

001-39696

|

| Entity Registrant Name |

Compass Therapeutics, Inc.

|

| Entity Central Index Key |

0001738021

|

| Entity Tax Identification Number |

82-4876496

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

80 Guest Street, Suite 601

|

| Entity Address, City or Town |

Boston

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02135

|

| City Area Code |

617

|

| Local Phone Number |

500-8099

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value per share

|

| Trading Symbol |

CMPX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

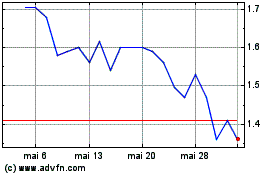

Compass Therapeutics (NASDAQ:CMPX)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Compass Therapeutics (NASDAQ:CMPX)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025