CPS Technologies Corporation Announces Third Quarter 2023 Financial Results

01 Novembre 2023 - 9:01PM

CPS Technologies Corporation (NASDAQ:CPSH) (“CPS” or the “Company”)

today announced financial results for the fiscal third quarter

ended September 30, 2023.

Third Quarter Highlights

- Revenue of $6.3

million for the third quarter of 2023 versus $6.7 million in the

prior-year period, reflecting a shift in certain orders into the

fourth quarter, as previously discussed

- Gross margin of

19.7 percent versus 27.9 percent in the third quarter of 2022,

primarily due to lower revenue year-over-year

- Operating profit of

$0.1 million for the quarter ended September 30, 2023, compared to

$0.7 million in the prior-year period

- Company recently

announced a new contract, valued at approximately $7.7 million, to

provide power module components and related solutions to a European

customer, as well as the Company’s first SBIR grant funded by the

Department of Energy

“As anticipated, revenue during the period was

negatively impacted by certain shipments being delayed into the

fourth quarter, which is looking to be particularly strong,” said

Brian Mackey, President and CEO. “I’m excited that we remain in

solid shape to finish fiscal 2023 with a record-setting

performance, setting the stage for continued success going forward.

We recently announced two major wins for CPS that will positively

impact fiscal 2024, including a new SBIR award, complemented by a

$7.7 million contract with one of our larger customers.

“Now with three months under my belt at CPS, I

am upbeat about the future of the Company, as we focus on R&D

investment and business development initiatives to drive higher

returns and top line expansion. CPS provides unique, cutting-edge

solutions across many fast-growing industries, and we are well

positioned to take the Company to the next level in terms of both

size and scope. I look forward to executing on a strategic plan

that accelerates growth, improves operating performance, and

enhances value for our shareholders.”

Results of OperationsCPS reported revenue of

$6.3 million for the third quarter of fiscal 2023 versus $6.7

million in the prior-year period, reflecting order timing. Gross

profit was to $1.2 million, or 19.7 percent of revenue, versus $1.9

million, or 27.9 percent of revenue, in the fiscal 2022 third

quarter. The lower gross margin year-over-year reflects lower

overall sales.

Operating profit was $0.1 million in the fiscal

2023 third quarter, compared with $0.7 million in the prior-year

period. Reported net income was $0.2 million, or $0.01 per diluted

share, versus $1.0 million, or $0.07 per diluted share, in the

quarter ended October 1, 2022.

Conference CallThe Company will be hosting its

third quarter 2023 earnings call at 9:00 am on Thursday, November

2. Those interested in participating in the conference call should

dial the following:

Call in Number: 1-844-943-2942Participant

Passcode: 230366The Company encourages those who wish to

participate to call in 10 minutes before the scheduled start time

to ensure the operator can connect all participants.

About CPSCPS is a technology and manufacturing

leader in producing high-performance energy management components

that facilitate the electrification of the economy. Our products

and intellectual property include critical pieces of the technology

puzzle for electric trains and subway cars, wind turbines, hybrid

vehicles, electric vehicles, the smart electric grid, 5G

infrastructure, and others. CPS' armor products provide exceptional

ballistic protection and environmental durability at a very light

weight. CPS also assembles housings and packages for hybrid

circuits. CPS is committed to innovation and to

supporting our customers in building solutions to this planet's

problems.

Safe HarborStatements made in this document that

are not historical facts or which apply prospectively, including

those relating to 2023 financial results, are forward-looking

statements that involve risks and uncertainties. These

forward-looking statements are identified by the use of terms and

phrases such as "will," "intends," "believes," "expects," "plans,"

"anticipates" and similar expressions. Investors should not rely on

forward looking statements because they are subject to a variety of

risks and uncertainties and other factors that could cause actual

results to differ materially from the company's expectation.

Additional information concerning risk factors is contained from

time to time in the company's SEC filings, including its Annual

Report on Form 10-K and other periodic reports filed with the SEC.

Forward-looking statements contained in this press release speak

only as of the date of this release. Subsequent events or

circumstances occurring after such date may render these statements

incomplete or out of date. The company expressly disclaims any

obligation to update the information contained in this release.

CPS Technologies Corporation

111

South Worcester Street Norton, MA 02766

www.cpstechnologysolutions.com

Investor Relations:Chris

Witty646-438-9385cwitty@darrowir.com

CPS TECHNOLOGIES

CORP.Statements of Operations

(Unaudited)

| |

Fiscal Quarters Ended |

|

|

Nine Months Ended |

|

| |

September 30, |

|

|

October 1, |

|

|

September 30, |

|

|

October 1, |

|

| |

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Product sales |

$ |

6,285,041 |

|

|

$ |

6,748,117 |

|

|

$ |

20,803,447 |

|

|

$ |

20,471,574 |

|

|

Total Revenues |

|

6,285,041 |

|

|

|

6,748,117 |

|

|

|

20,803,447 |

|

|

|

20,471,574 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of product sales |

|

5,049,177 |

|

|

|

4,864,876 |

|

|

|

15,126,621 |

|

|

|

14,796,206 |

|

|

Gross Profit |

|

1,235,864 |

|

|

|

1,883,241 |

|

|

|

5,676,826 |

|

|

|

5,675,368 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Selling, general and

administrative expense |

|

1,105,227 |

|

|

|

1,174,581 |

|

|

|

4,121,099 |

|

|

|

3,750,131 |

|

|

Operating income (loss) |

|

130,637 |

|

|

|

708,660 |

|

|

|

1,555,727 |

|

|

|

1,925,237 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest income (expense),

net |

|

78,181 |

|

|

|

(1,892 |

) |

|

|

176,325 |

|

|

|

(6,245 |

) |

| Other income (expense),

net |

|

(1,228 |

) |

|

|

645,594 |

|

|

|

(4,130 |

) |

|

|

649,628 |

|

| Net income (loss) before

income tax expense |

|

207,590 |

|

|

|

1,352,362 |

|

|

|

1,727,922 |

|

|

|

2,568,620 |

|

| Income tax provision

(benefit) |

|

36,509 |

|

|

|

364,497 |

|

|

|

497,137 |

|

|

|

706,211 |

) |

|

Net income |

$ |

171,081 |

|

|

$ |

987,865 |

|

|

$ |

1,230,785 |

|

|

$ |

1,862,409 |

|

| Net income per basic common

share |

$ |

0.01 |

|

|

$ |

0.07 |

|

|

$ |

0.08 |

|

|

$ |

0.13 |

|

| Weighted average number of

basic common shares outstanding |

|

14,517,364 |

|

|

|

14,434,468 |

|

|

|

14,487,873 |

|

|

|

14,417,995 |

|

| Net income per diluted common

share |

$ |

0.01 |

|

|

$ |

0.07 |

|

|

$ |

0.08 |

|

|

$ |

0.13 |

|

| Weighted average number of

diluted common shares outstanding |

|

14,636,241 |

|

|

|

14,686,476 |

|

|

|

14,632,591 |

|

|

|

14,683,632 |

|

CPS TECHNOLOGIES

CORP.Balance Sheets (Unaudited)

| |

September 30, |

|

|

December 31, |

|

| |

2023 |

|

|

2022 |

|

|

ASSETS |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

8,778,856 |

|

|

$ |

8,266,753 |

|

|

Accounts receivable-trade, net |

|

5,006,451 |

|

|

|

3,777,975 |

|

|

Accounts receivable-other |

|

17.043 |

|

|

|

685,668 |

|

|

Inventories, net |

|

4,827,957 |

|

|

|

4,875,901 |

|

|

Prepaid expenses and other current assets |

|

337,476 |

|

|

|

211,242 |

|

|

Total current assets |

|

18,967,783 |

|

|

|

17,817,539 |

|

| Property and equipment: |

|

|

|

|

|

|

|

|

Production equipment |

|

11,195,993 |

|

|

|

10,770,427 |

|

|

Furniture and office equipment |

|

952,883 |

|

|

|

952,883 |

|

|

Leasehold improvements |

|

985,649 |

|

|

|

985,649 |

|

|

Total cost |

|

13,134,525 |

|

|

|

12,708,959 |

|

| |

|

|

|

|

|

|

|

|

Accumulated depreciation and amortization |

|

(11,810,209 |

) |

|

|

(11,446,901 |

) |

|

Construction in progress |

|

206,693 |

|

|

|

64,910 |

|

|

Net property and equipment |

|

1,531,009 |

|

|

|

1,326,968 |

|

| Right-of-use lease asset |

|

367,000 |

|

|

|

466,000 |

|

| Deferred taxes, net |

|

1,645,467 |

|

|

|

2,069,436 |

|

|

Total assets |

$ |

22,511,259 |

|

|

$ |

21,679,943 |

|

| |

October 1, |

|

|

December 31, |

|

| |

2022 |

|

|

2022 |

|

|

LIABILITIES AND STOCKHOLDERS` EQUITY |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

Note payable, current portion |

|

57,457 |

|

|

|

43,711 |

|

|

Accounts payable |

|

2,151,127 |

|

|

|

1,836,865 |

|

|

Accrued expenses |

|

1,067,293 |

|

|

|

820,856 |

|

|

Deferred revenue |

|

1,675,086 |

|

|

|

2,521,128 |

|

|

Lease liability, current portion |

|

159,000 |

|

|

|

157,000 |

|

| Total current liabilities |

|

5,109,963 |

|

|

|

5,379,560 |

|

| Note payable less current

portion |

|

8,655 |

|

|

|

54,847 |

|

| Deferred revenue-long

term |

|

31,277 |

|

|

|

231,020 |

|

| Long term lease liability |

|

208,000 |

|

|

|

309,000 |

|

| Total liabilities |

|

5,357,895 |

|

|

|

5,974,427 |

|

| |

|

|

|

|

|

|

|

| Commitments (note 4) |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Stockholders` equity: |

|

|

|

|

|

|

|

|

Common stock, $0.01 par value, authorized 20,000,000 shares; issued

14,601487 and 14,460,486, respectively; outstanding 14,519,215 and

14,450,470, respectively; at September 30, 2023 and December 31,

2022; |

|

146,015 |

|

|

|

144,605 |

|

|

Additional paid-in capital |

|

40,151,794 |

|

|

|

39,726,851 |

|

|

Accumulated deficit |

|

(22,894,307 |

) |

|

|

(24,125,092 |

) |

|

Less cost of 82,272 and 10,016 common shares repurchased,

respectively; at September 30, 2023 and December 31, 2022 |

|

(250,138 |

) |

|

|

(40,848 |

) |

| Total stockholders`

equity |

|

17,153,364 |

|

|

|

15,705,516 |

|

| Total liabilities and

stockholders` equity |

$ |

22,511,259 |

|

|

$ |

21,679,943 |

|

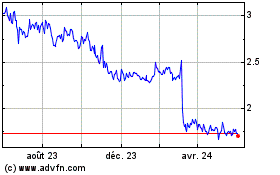

CPS Technologies (NASDAQ:CPSH)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

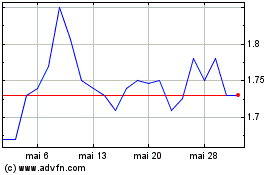

CPS Technologies (NASDAQ:CPSH)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024