0001595097false00015950972024-08-152024-08-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): August 15, 2024 |

CORBUS PHARMACEUTICALS HOLDINGS, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-37348 |

46-4348039 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

500 River Ridge Drive |

|

Norwood, Massachusetts |

|

02062 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (617) 963-0100 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.0001 per share |

|

CRBP |

|

The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Director Resignation

On August 15, 2024, Avery W. Catlin submitted his resignation from the Board of Directors (the “Board”) of Corbus Pharmaceuticals Holdings, Inc. (the “Company”), effective as of August 15, 2024. Mr. Catlin also resigned from his positions on the Board’s Audit Committee and Compensation Committee. Mr. Catlin’s resignation was not the result of any disagreement with the Company on any matters relating to the Company’s operations, policies or practices.

Director Appointment

Effective August 16, 2024, the Board, upon the recommendation of the Nominating and Corporate Governance Committee of the Board, appointed Winston W. Kung, age 49, to serve as a member of the Board. Mr. Kung will hold this position until the next annual meeting of the Company’s stockholders or until his successor is elected and qualified, subject to his earlier resignation or removal. Mr. Kung will also serve as the chair of the Audit Committee. The Board has determined that Mr. Kung is independent within the meaning of the Nasdaq Listing Rules and Rule 10A-3 under the Securities Exchange Act of 1934, as amended. In addition, the Board has determined that Mr. Kung qualifies as an audit committee financial expert within the meaning of SEC regulations and the Nasdaq Listing Rules.

Mr. Kung has served as the Chief Financial Officer and Treasurer of ArriVent BioPharma, Inc., a biopharmaceutical company, since January 2024. Mr. Kung has served as a member of the board of Janux Therapeutics, Inc. (Nasdaq: JANX), a public clinical-stage biopharmaceutical company, since September 2022 and has served as a member of the audit committee since June 2023. From December 2017 to January 2024, Mr. Kung served as the Chief Operating Officer and Chief Financial Officer of PMV Pharmaceuticals, Inc. (Nasdaq: PMVP), a public precision oncology company. From April 2013 to November 2017, Mr. Kung held multiple positions at Celgene Corporation, a global biopharmaceutical company (acquired by Bristol-Myers Squibb), including Vice President of Business Development and Global Alliances, and Chief Business Officer at Celgene Cellular Therapeutics (a wholly-owned subsidiary of Celgene Corporation). Prior to Celgene, Mr. Kung worked at Citigroup from June 2010 to April 2013 in its Global Healthcare Investment Banking group and at Lehman Brothers (which was subsequently acquired by Barclays) from May 2007 to June 2010 in its Global Mergers and Acquisition Group. From August 2004 to May 2007, Mr. Kung worked at Amgen, a public biopharmaceutical company, as a co-founder of the Alliance Management group, and served as the deal lead on multiple acquisitions as part of the Corporate Development group. Mr. Kung also worked at Genentech Inc., a biotechnology company (acquired by Roche Holding AG), from November 1999 to September 2002 as part of the Business and Corporate Development group. Mr. Kung received a B.A. in Biology and International Relations from Brown University and a M.B.A. from Harvard Business School.

Mr. Kung will participate in the Company’s standard non-employee director compensation plan, including an initial option grant to purchase 5,566 shares of the Company’s common stock, par value $0.0001 per share (“Common Stock”) and a grant of 5,566 restricted stock units upon joining the Board, an annual cash retainer fee of $40,000 for board members and $20,000 for serving as chair of the Audit Committee (each pro-rated for the current year), and an annual grant of equity awards.

There are no transactions between Mr. Kung and the Company that would be reportable under Item 404(a) of Regulation S-K.

Concurrently with the appointment, the Company entered into an indemnification agreement with Mr. Kung (the “Indemnification Agreement”), in the form previously entered into by the Company with each of the Company’s directors and executive officers, the form of which was filed as Exhibit 10.15 to the Amendment No. 1 to Company’s Registration Statement on Form S-1 filed with the Securities and Exchange Commission on September 30, 2014. The Indemnification Agreement, subject to limitations contained therein, will obligate the Company to indemnify Mr. Kung, to the fullest extent permitted by applicable law, for certain expenses, including attorneys’ fees, judgments, penalties, fines and settlement amounts actually and reasonably incurred by him in any threatened, pending or completed action, suit, claim, investigation, inquiry, administrative hearing, arbitration or other proceeding arising out of his services as a director. Subject to certain limitations, the Indemnification Agreement provides for the advancement of expenses incurred by the indemnitee, and the repayment to the Company of the amounts advanced to the extent that it is ultimately determined that the indemnitee is not entitled to be indemnified by the Company. The Indemnification Agreement also creates certain rights in favor of the Company, including the right to assume the defense of claims and to consent to settlements. The Indemnification Agreement does not exclude any other rights to indemnification or advancement of expenses to which the indemnitee may be entitled under applicable law, the certificate of incorporation or bylaws of the Company, any agreement, a vote of stockholders or disinterested directors, or otherwise.

The foregoing is a summary of the material terms of the Indemnification Agreement and does not purport to be complete.

Item 7.01 Regulation FD Disclosure.

On August 20, 2024, the Company issued a press release announcing the appointment of Mr. Kung to its Board of Directors. A copy of the press release is furnished as Exhibit 99.1 hereto and shall not be deemed “filed” for the purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Exchange Act or the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) The following exhibit is furnished with this report:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

Corbus Pharmaceuticals Holdings, Inc. |

|

|

|

|

Date: |

August 20, 2024 |

By: |

/s/ Yuval Cohen |

|

|

|

Name: Yuval Cohen

Title: Chief Executive Officer |

Exhibit 99.1

Corbus Pharmaceuticals Strengthens Board of Directors with

Appointment of Winston Kung

Norwood, MA, August 20, 2024 (GLOBE NEWSWIRE) -- Corbus Pharmaceuticals Holdings, Inc. (NASDAQ: CRBP) (“Corbus” or the “Company”), today announced the appointment of Winston Kung to its Board of Directors. The appointment was effective as of August 16, 2024. Mr. Kung will also chair the Audit Committee.

“With this track record of success in both the pharma industry and on Wall Street, Winston has earned a well-deserved reputation for his leadership and financial acumen,” said Alan F. Holmer, Chairman of the Corbus Board of Directors. “We are delighted to welcome someone of Winston’s stature and expertise to our Board and we look forward to his insights and guidance.”

“Winston brings an extensive background in life science industry business development and the capital markets, perspectives that will serve Corbus well as we continue to make progress across our pipeline,” added Yuval Cohen, Ph.D., Chief Executive Officer of Corbus. “We look forward to working with him as we advance our lead programs to the next phases of their development.”

“Corbus is developing an intriguing asset portfolio in attractive areas of medicine, and has assembled an outstanding leadership team,” said Mr. Kung. “I am delighted to join the Corbus Board at such a pivotal moment in the Company’s development, and look forward to helping realize this portfolio’s full potential.

Mr. Winston Kung is an industry veteran with over 20 years of leadership experience across life sciences and investment banking. Currently, Mr. Kung serves as Chief Financial Officer of Arrivent BioPharma, a clinical-stage company dedicated to accelerating the global development of innovative biopharmaceutical therapeutics. Prior to Arrivent, Mr. Kung was Chief Financial Officer and Chief Operating Officer at PMV Pharmaceuticals. Prior to joining PMV Pharma, Mr. Kung was Vice President of Business Development and Global Alliances at Celgene, and previously held the position of Chief Business Officer at Celgene Cellular Therapeutics. Before his role at Celgene, Mr. Kung held senior positions at Citigroup’s Global Healthcare Investment Banking group and at Lehman Brothers’ Global Mergers and Acquisition group. Mr. Kung also led multiple transactions as part of Genentech’s and Amgen’s Business and Corporate Development groups. Mr. Kung earned his M.B.A from Harvard Business School and a B.A. in Biology and International Relations from Brown University.

The Company also announced that Avery “Chip” Catlin has resigned from the Board and as Chair of the Audit Committee after serving on the Corbus Board for over ten years. “We wish Chip the best in his future endeavors, and we thank him for his dedication to Corbus during his years of service at Corbus”, stated Mr. Holmer.

About Corbus

Corbus Pharmaceuticals Holdings, Inc. is an oncology company with a diversified portfolio and is committed to helping people defeat serious illness by bringing innovative scientific approaches to well understood biological pathways. Corbus’ pipeline includes CRB-701, a next-generation antibody drug conjugate that targets the expression of Nectin-4 on cancer cells to release a cytotoxic payload, CRB-601, an anti-integrin monoclonal antibody which blocks the activation of TGFβ expressed on cancer cells, and

CRB-913, a highly peripherally restricted CB1 inverse agonist for the treatment of obesity. Corbus is headquartered in Norwood, Massachusetts. For more information on Corbus, visit corbuspharma.com. Connect with us on Twitter, LinkedIn and Facebook.

Forward-Looking Statements

This press release contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 and Private Securities Litigation Reform Act, as amended, including those relating to the Company’s trial results, product development, clinical and regulatory timelines, including timing for completion of trials and presentation of data, market opportunity, competitive position, possible or assumed future results of operations, business strategies, potential growth opportunities and other statements that are predictive in nature. These forward-looking statements are based on current expectations, estimates, forecasts and projections about the industry and markets in which we operate and management’s current beliefs and assumptions.

These statements may be identified by the use of forward-looking expressions, including, but not limited to, “expect,” “anticipate,” “intend,” “plan,” “believe,” “estimate,” “potential,” “predict,” “project,” “should,” “would” and similar expressions and the negatives of those terms. These statements relate to future events or our financial performance and involve known and unknown risks, uncertainties, and other factors on our operations, clinical development plans and timelines, which may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include those set forth in the Company’s filings with the Securities and Exchange Commission. Prospective investors are cautioned not to place undue reliance on such forward-looking statements, which speak only as of the date of this press release. The Company undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise.

All product names, logos, brands and company names are trademarks or registered trademarks of their respective owners. Their use does not imply affiliation or endorsement by these companies.

INVESTOR CONTACT:

Sean Moran

Chief Financial Officer

Corbus Pharmaceuticals

smoran@corbuspharma.com

Bruce Mackle

Managing Director

LifeSci Advisors, LLC

bmackle@lifesciadvisors.com

v3.24.2.u1

Document and Entity Information

|

Aug. 15, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 15, 2024

|

| Entity Registrant Name |

CORBUS PHARMACEUTICALS HOLDINGS, INC.

|

| Entity Central Index Key |

0001595097

|

| Entity File Number |

001-37348

|

| Entity Tax Identification Number |

46-4348039

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

500 River Ridge Drive

|

| Entity Address, City or Town |

Norwood

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02062

|

| City Area Code |

617

|

| Local Phone Number |

963-0100

|

| Entity Information, Former Legal or Registered Name |

Not Applicable

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

CRBP

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

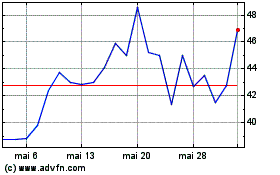

Corbus Pharmaceuticals (NASDAQ:CRBP)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Corbus Pharmaceuticals (NASDAQ:CRBP)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024