SCHEDULE 14-A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant

¨

Check the appropriate box:

¨ Preliminary

Proxy Statement

¨ Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive

Proxy Statement

¨ Definitive

Additional Materials

¨ Soliciting

Material Pursuant to §240.14a-12

Energy Services

of America Corporation

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

Payment of Filing Fee (Check the appropriate

box):

x No

fee required

¨ Fee

paid previously with preliminary materials

¨ Fee computed on table in exhibit required

by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

Energy Services of America Corporation

75 West 3rd Avenue

Huntington, West Virginia 25701

January 13, 2025

Dear Stockholder:

We cordially invite you to

attend the Annual Meeting of Stockholders of Energy Services of America Corporation. The Annual Meeting will be held at the Doubletree

by Hilton, 1001 Third Avenue, Huntington, West Virginia 25701 at 12:00 p.m., local time, on February 19, 2025.

The enclosed Notice of the

Annual Meeting and Proxy Statement describes the formal business to be transacted at the Annual Meeting. During the Annual Meeting we

will also report on the operations of Energy Services of America Corporation. Directors and officers will be present to respond to any

questions that stockholders may have. Also enclosed for your review is our Annual Report to Stockholders, which contains detailed information

concerning our activities and operating performance.

The

business to be conducted at the Annual Meeting consists of the election of eight (8) directors to the Board of Directors, the ratification

of our independent registered public accounting firm and two non-binding proposals. One non-binding proposal is an advisory

vote on executive compensation. The second non-binding vote is an advisory vote relating to the frequency of future advisory

votes on executive compensation. The Board of Directors has determined that the matters to be considered at the Annual Meeting

are in the best interests of Energy Services of America Corporation and our stockholders. For the reasons set forth in the

Proxy Statement, the Board of Directors recommends a vote “FOR” the election of directors, ratification of our independent

registered public accounting firm and the advisory vote on executive compensation. The Board of Directors recommends that you

vote for the “One Year” frequency to vote on executive compensation.

On behalf of the Board of

Directors, we urge you to sign, date and return the enclosed proxy card as soon as possible, even if you currently plan to attend the

Annual Meeting. This will not prevent you from voting in person but will ensure that your vote is counted if you are unable to attend

the Annual Meeting. Your vote is important, regardless of the number of shares that you own.

Sincerely,

Energy Services of America Corporation

75 West 3rd Avenue

Huntington, West Virginia 25701

(304) 522-3868

NOTICE OF

ANNUAL MEETING OF STOCKHOLDERS

To Be Held on February 19, 2025

Notice is hereby given that

the Annual Meeting of Stockholders of Energy Services of America Corporation will be held at the Doubletree by Hilton, 1001 Third Avenue,

Huntington, West Virginia 25701 at 12:00 p.m., local time, on February 19, 2025.

A Proxy Card and a Proxy Statement

for the Annual Meeting are enclosed.

The Annual Meeting is being

held for the purpose of considering and acting upon:

| |

1. |

the election of eight (8) directors to the Board of Directors; |

| |

|

|

| |

2. |

the ratification of our independent registered public accounting firm; |

| |

|

|

| |

3. |

an advisory, non-binding resolution with respect to the executive compensation described in the

Proxy Statement; and, |

| |

|

|

| |

4. |

an advisory, non-binding proposal with respect to the frequency that stockholders will vote on

our executive compensation. |

We will also consider such

other matters as may properly come before the Annual Meeting or any adjournments thereof. The Board of Directors is not aware of any other

business to come before the Annual Meeting.

Any action may be taken on

the foregoing proposals at the Annual Meeting on the date specified above or on any date or dates to which the Annual Meeting may be adjourned.

Stockholders of record at the close of business on January 6, 2025, are the stockholders entitled to vote at the Annual Meeting and

any adjournments thereof.

A list of stockholders entitled

to vote at the Annual Meeting can be requested in writing from the Company’s Secretary at 75 West 3rd Avenue, Huntington, West Virginia

25701 for a period of ten days prior to the Annual Meeting. The list will also be provided to the inspector of election of the Annual

Meeting.

EACH STOCKHOLDER, WHETHER

HE OR SHE PLANS TO ATTEND THE ANNUAL MEETING, IS REQUESTED TO SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD WITHOUT DELAY IN THE

ENCLOSED POSTAGE-PAID ENVELOPE. ANY PROXY GIVEN BY THE STOCKHOLDER MAY BE REVOKED AT ANY TIME BEFORE IT IS EXERCISED. A PROXY MAY BE

REVOKED BY FILING WITH THE CORPORATE SECRETARY A WRITTEN REVOCATION OR A DULY EXECUTED PROXY BEARING A LATER DATE. ANY STOCKHOLDER PRESENT

AT THE ANNUAL MEETING MAY REVOKE HIS OR HER PROXY AND VOTE ON EACH MATTER BROUGHT BEFORE THE ANNUAL MEETING. HOWEVER, IF YOU

ARE A STOCKHOLDER WHOSE SHARES ARE NOT REGISTERED IN YOUR OWN NAME, YOU WILL NEED ADDITIONAL DOCUMENTATION FROM YOUR RECORD HOLDER IN

ORDER FOR YOU TO VOTE AT THE ANNUAL MEETING.

Our proxy statement, annual

report to stockholders on Form 10-K, and proxy card are available on the internet at https://www.cstproxy.com/energyservicesofamerica/2025.

| |

By Order of the Board of Directors |

| |

|

| |

/s/ Charles

Crimmel |

| |

|

| Huntington, West Virginia |

Charles Crimmel |

| January 13, 2025 |

Corporate Secretary |

IMPORTANT:

THE PROMPT RETURN OF PROXIES WILL SAVE ENERGY SERVICES OF AMERICA CORPORATION THE EXPENSE OF FURTHER REQUESTS FOR PROXIES. A SELF-ADDRESSED

ENVELOPE IS ENCLOSED FOR YOUR CONVENIENCE. NO POSTAGE IS REQUIRED IF MAILED WITHIN THE UNITED STATES.

PROXY STATEMENT

Energy Services of America Corporation

75 West 3rd Avenue

Huntington, West Virginia 25701

(304) 522-3868

ANNUAL MEETING OF STOCKHOLDERS

February 19, 2025

This Proxy Statement is furnished

in connection with the solicitation of proxies on behalf of the Board of Directors of Energy Services of America Corporation (“Energy

Services” or the “Company”) to be used at the Annual Meeting of Stockholders, which will be held at the Doubletree by

Hilton, 1001 Third Avenue, Huntington, West Virginia 25701 on February 19, 2025, at 12:00 pm., local time, and all adjournments of

the Annual Meeting. The accompanying Notice of Annual Meeting of Stockholders and this Proxy Statement are first being mailed to stockholders

on or about January 13, 2025.

Stockholders who execute proxies

in the form solicited hereby retain the right to revoke them in the manner described below. Unless so revoked, the shares represented

by such proxies will be voted at the Annual Meeting and all adjournments thereof. Proxies solicited on behalf of the Board of Directors

will be voted in accordance with the directions given thereon. Where no instructions are indicated, validly executed proxies will be

voted “FOR” the proposals set forth in this Proxy Statement for consideration at the Annual Meeting and for the “One

Year” frequency to vote on executive compensation.

The Board of Directors knows

of no additional matters that will be presented for consideration at the Annual Meeting. Execution of a proxy, however, confers on the

designated proxy holder’s discretionary authority to vote the shares in accordance with their best judgment on such other business,

if any, that may properly come before the Annual Meeting or any adjournments thereof.

Proxies may be revoked by

sending written notice of revocation to our Corporate Secretary at the address shown above, delivering to us a duly executed proxy bearing

a later date, or attending the Annual Meeting and voting in person. However, if you are a stockholder whose shares are not registered

in your own name, you will need appropriate documentation from your record holder to vote personally at the Annual Meeting. The presence

at the Annual Meeting of any stockholder who had returned a proxy shall not revoke such proxy unless the stockholder delivers his or her

ballot in person at the Annual Meeting or delivers a written revocation to our Corporate Secretary prior to the voting of such proxy.

| VOTING SECURITIES AND VOTING PROCEDURES |

Holders of record of our common

stock, par value $0.0001 per share, as of the close of business on January 6, 2025, are entitled to one vote for each share then

held. As of the record date, we had 16,705,457 shares outstanding and entitled to vote. The presence at the Annual Meeting or by proxy

of a majority of the outstanding shares of common stock entitled to vote is necessary to constitute a quorum at the Annual Meeting. Broker

non-votes and proxies marked ABSTAIN will be counted for purposes of determining whether a quorum is present. In the event there are not

sufficient votes for a quorum, or to approve or ratify any matter being presented at the time of the Annual Meeting, the Annual Meeting

may be adjourned in order to permit the further solicitation of proxies.

As to the election of directors,

the proxy card being provided by the Board of Directors enables a stockholder to vote FOR the election of the eight (8) nominees

proposed by the independent directors acting as the nominating committee of the Board of Directors or to WITHHOLD AUTHORITY to vote for

one or more of the nominees being proposed. Directors are elected by a plurality of votes cast, without regard to either broker non-votes

or proxies as to which the authority to vote for the nominees being proposed is withheld.

As to the ratification of

our independent registered public accounting firm, stockholders will have the opportunity to vote “FOR” or “AGAINST”

the proposal or to vote “ABSTAIN.” This proposal must be approved by the affirmative vote of a majority of the votes cast

without regard to broker non-votes and proxies marked “ABSTAIN.”

As to the advisory, non-binding

resolution with respect to our executive compensation as described in this proxy statement, a stockholder may vote “FOR” the

resolution, “AGAINST” the resolution, or “ABSTAIN” from voting on the resolution. The affirmative vote of a majority

of the votes cast is required for the approval of this resolution without regard to broker non-votes and proxies marked “ABSTAIN.”

While this vote is required by law, it will be neither binding on Energy Services nor the Board of Directors.

As

to the advisory, non-binding proposal with respect to the frequency that stockholders will vote on a resolution regarding our executive

compensation, a stockholder may vote to consider the resolution every “One Year”, “Two Years” or “Three

Years”, or the shareholder may “ABSTAIN” from voting. The option receiving the greatest number of votes will

be considered the frequency recommended by stockholders. While this vote is required by law, it will be neither binding on

Energy Services nor the Board of Directors.

Proxies solicited hereby will

be returned to us and will be tabulated by an inspector of election designated by the Board of Directors.

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS |

Persons and groups who beneficially

own in excess of five percent of our common stock are required to file certain reports with the Securities and Exchange Commission (the

“SEC”) regarding such ownership. The following table sets forth, as of January 6, 2025, the shares of common stock beneficially

owned by each person who was the beneficial owner of more than five percent of our outstanding shares of common stock, as well as the

shares owned by our directors and executive officers as a group.

| | |

Amount of Shares Owned |

| |

Percent of Shares | |

| | |

and Nature of Beneficial |

| |

of Common Stock | |

| Name and Address of Beneficial Owners | |

Ownership (1) |

| |

Owned | |

| All Directors and Executive Officers as a Group (9 persons) | |

| 4,343,018 |

| |

| 25.9 | % |

| | |

| |

| |

| | |

| Principal Stockholders: | |

| |

| |

| | |

| Marshall T. Reynolds | |

| 1,525,373 |

| |

| 9.1 | % |

| 75 West 3rd Ave. | |

| |

| |

| | |

| Huntington, WV 25701 | |

| |

| |

| | |

| | |

| |

| |

| | |

| Douglas V. Reynolds | |

| 1,913,318 |

(2) | |

| 11.4 | % |

| 75 West 3rd Ave. | |

| |

| |

| | |

| Huntington, WV 25701 | |

| |

| |

| | |

| | |

| |

| |

| | |

| Wax Asset Management, LLC | |

| 1,113,695 |

(3) | |

| 6.6 | % |

| 44 Cherry Lane | |

| |

| |

| | |

| Madison, CT 06443 | |

| |

| |

| | |

| (1) | In accordance with Rule 13d-3 under the Security Exchange

Act of 1934, a person is deemed to be the beneficial owner for purposes of this table of any shares of common stock if he has sole or

shared voting or investment power with respect to such security, or has a right to acquire beneficial ownership at any time within 60

days from the date as of which beneficial ownership is being determined. As used herein, “voting power” is the power to vote

or direct the voting of shares and “investment power” is the power to dispose or direct the disposition of shares. Includes

all shares held directly as well as by spouses and minor children, in trust and other indirect ownership, over which shares the named

individuals effectively exercise sole or shared voting and investment power. |

| (2) | Includes 7,059 common shares related to 401(k) match held

by third party plan administrator and 17,394 unvested restricted stock awards. |

| (3) | This information is based solely upon information contained

in a Schedule 13G/A filed with the Securities and Exchange Commission on February 7, 2024 reporting shared voting and dispositive

power over all the shares by Wax Asset Management, LLC. |

|

PROPOSAL I—ELECTION OF DIRECTORS |

Our Board of Directors currently

is composed of eight members. Under our bylaws, all of our directors are elected annually. Directors are generally elected to serve for

a one-year period and until their respective successors have been elected and shall qualify. The independent members of the Board of Directors

have nominated to serve as directors each of the nominees listed in the table below, each of whom is currently a member of the Board of

Directors and each of whom has been nominated to serve for a one-year period and until his or her successor has been elected and shall

qualify.

The table below sets forth

certain information regarding the composition of our Board of Directors, including the terms of office of board members and our executive

officers. It is intended that the proxies solicited on behalf of the Board of Directors (other than proxies in which the vote is withheld

as to one or more nominees) will be voted at the Annual Meeting for the election of the nominees identified below. If the nominee is unable

to serve, the shares represented by all such proxies will be voted for the election of such substitute as the Board of Directors may recommend.

At this time, the Board of Directors knows of no reason why any of the nominees might be unable to serve, if elected. Except as indicated

herein, there are no arrangements or understandings between any nominee and any other person pursuant to which such nominee was selected.

None of the shares beneficially owned by directors or executive officers have been pledged as security or collateral for any loans.

| | |

| |

| |

| |

| |

Shares of Common | | |

| |

| | |

| |

| |

| |

Current | |

Stock Beneficially | | |

Percent of | |

| | |

| |

| |

Director | |

Term to | |

Owned on Record | | |

Common | |

| Names and Address (1) | |

Age (2) | |

Position Held | |

Since | |

Expire | |

Date (3) | | |

Shares | |

| Directors and Executive Officers: | |

| |

| |

| |

| |

| | | |

| | |

| | |

| |

| |

| |

| |

| | | |

| | |

| Marshall T. Reynolds | |

88 | |

Chairman and Director | |

2006 | |

2025 | |

| 1,525,373 | | |

| 9.1 | % |

| | |

| |

| |

| |

| |

| | | |

| | |

| Douglas V. Reynolds | |

48 | |

Chief Executive Officer, President | |

2008 | |

2025 | |

| 1,913,318 | (4) | |

| 11.4 | % |

| | |

| |

| |

| |

| |

| | | |

| | |

| Amy E. Abraham | |

56 | |

Director | |

2022 | |

2025 | |

| - | | |

| 0.0 | % |

| | |

| |

| |

| |

| |

| | | |

| | |

| Jack M. Reynolds | |

59 | |

Director | |

2006 | |

2025 | |

| 408,385 | | |

| 2.4 | % |

| | |

| |

| |

| |

| |

| | | |

| | |

| Joseph L. Williams | |

79 | |

Director | |

2006 | |

2025 | |

| 90,250 | | |

| 0.5 | % |

| | |

| |

| |

| |

| |

| | | |

| | |

| Frank S. Lucente | |

79 | |

Director | |

2019 | |

2025 | |

| 312,010 | | |

| 1.9 | % |

| | |

| |

| |

| |

| |

| | | |

| | |

| Mark S. Prince | |

68 | |

Director | |

2022 | |

2025 | |

| 79,071 | | |

| 0.5 | % |

| | |

| |

| |

| |

| |

| | | |

| | |

| Patrick J. Farrell | |

50 | |

Director | |

2022 | |

2025 | |

| 10,687 | | |

| 0.1 | % |

| | |

| |

| |

| |

| |

| | | |

| | |

| Charles P. Crimmel | |

51 | |

Chief Financial Officer | |

n/a | |

n/a | |

| 3,924 | (5) | |

| 0.0 | % |

| | |

| |

| |

| |

| |

| | | |

| | |

| All Directors and Executive Officers as a Group (9 persons) | |

| |

| |

| |

| |

| 4,343,018 | | |

| 25.9 | % |

| (1) | The mailing address for each person is 75 West 3rd Ave., Huntington,

WV 25701 |

| (2) | As of September 30, 2024. |

| (3) | In accordance with Rule 13d-3 under the Security Exchange

Act of 1934, a person is deemed to be the beneficial owner for purposes of this table of any shares of common stock if he has sole or

shared voting or investment power with respect to such security, or has a right to acquire beneficial ownership at any time within 60

days from the date as of which beneficial ownership is being determined. As used herein, “voting power” is the power to vote

or direct the voting of shares and “investment power” is the power to dispose or direct the disposition of shares. Includes

all shares held directly as well as by spouses and minor children, in trust and other indirect ownership, over which shares the named

individuals effectively exercise sole or shared voting and investment power. |

| (4) | Includes 7,059 common shares related to 401(k) match held

by third party plan administrator and 17,394 unvested restricted stock awards. |

| (5) | Includes 261 common shares related to 401(k) match held

by third party plan administrator and 2,442 unvested restricted stock awards. |

Directors and Executive Officers

The principal occupation during the past five years

of each director and executive officer is set forth below. All directors and executive officers have held their present positions since

our inception in 2006 unless otherwise stated.

Marshall T. Reynolds

has served as Chairman of the Board of Directors since our inception. Mr. Reynolds has served as Chief Executive Officer

and Chairman of the Board Directors of Champion Industries, Inc., a commercial printer, business form manufacturer and supplier of

office products and furniture, from 1992 to 2016, and sole stockholder from 1972 to 1993; President and General Manager of The Harrah and

Reynolds Corporation, from 1964 (and sole stockholder since 1972) to present; and Chairman of the Board of Directors of McCorkle Machine

and Engineering Company in Huntington, West Virginia. Mr. Reynolds is also Chairman of the Board of Directors of First Guaranty Bancshares, Inc.,

in Hammond, Louisiana, a director of Summit State Bank in Santa Rosa, CA since December 1998, and was Chairman of Premier Financial

Bancorp, Inc. in Huntington, WV from 2011 to 2021. Mr. Reynolds is the father of Jack M. Reynolds and Douglas V. Reynolds. Mr. Reynolds

varied career as a business leader and experience in a number of industries qualifies him to be on the Board of Directors.

Douglas V. Reynolds

was appointed President and Chief Executive Officer of the Company on December 6, 2012 and has served as a Director since

2008. Mr. Reynolds is an attorney for Reynolds & Brown, PLLC. Mr. Reynolds is the President of the Transylvania Corporation,

a director of The Harrah and Reynolds Corporation, and a director of Summit State Bank in Santa Rosa, California since May 2022.

Mr. Reynolds was a director of Peoples Bancorp, Inc. and its banking subsidiary Peoples Bank from 2021 to 2023 and a director

of Premier Financial Bancorp, Inc. from 2020 to 2021. Mr. Reynolds is a graduate of Duke University and holds a law degree from

West Virginia University. Mr. Reynolds is the son of Director Marshall T. Reynolds and brother of Jack M. Reynolds. Mr. Reynolds’

varied experience and senior management roles with other companies make Mr. Reynolds a valuable member of the Board.

Jack M. Reynolds

served as President and Chief Financial Officer from our inception until September 2008 and has been a member of our Board of Directors

since our inception. Mr. Reynolds has been a Vice President of Pritchard Electric Company since 1998. Pritchard is an electrical

contractor providing electrical services to both utility companies as well as private industries. Mr. Reynolds also serves as a Director

of Citizens Deposit Bank of Vanceburg, Kentucky. Mr. Reynolds is the son of Marshall T. Reynolds and the brother of Douglas V. Reynolds.

Mr. Reynolds lengthy service at Pritchard Electric and knowledge of the contracting industry provides hands on expertise to the Board

of Directors.

Joseph L. Williams

has been a director since our inception. Mr. Williams is the Chairman and Chief Executive Officer of Basic Supply Company, Inc.,

which he founded in 1977. Mr. Williams was Chairman, President and Chief Executive Officer of Consolidated Bank & Trust

Co., in Richmond, Virginia from 2007 until it merged with Premier Financial Bancorp, Inc. in 2009. Mr. Williams is a former

member of the West Virginia Governor’s Workforce Investment Council. He is a former Director of Unlimited Future, Inc. (a small

business incubator) and a former Member of the National Advisory Council of the U.S. Small Business Administration. Mr. Williams

is a former Mayor and City Councilman of the City of Huntington, West Virginia. He is a graduate of Marshall University with a degree

in finance and is a former member of its Institutional Board of Governors. Mr. Williams’ investment and management experience provides

the board of directors an important perspective in business development.

Frank Lucente

was appointed to the Board of Directors on June 19, 2019. Mr. Lucente, a retired Naval officer, holds a Masters in Business

Administration (MBA) with a specialty in marketing from Marshall University in Huntington, West Virginia. Mr. Lucente is the founder,

owner and president of Sam’s Hot Dogs, Inc., a franchise with over 45 locations in Virginia, West Virginia, Kentucky, North

Carolina, and Georgia. In addition, Mr. Lucente is the co-founder of Rocco’s Restaurants, Inc. in Ceredo, West Virginia.

From 2005 to 2016, Mr. Lucente served as a city council member in Waynesboro, Virginia and served stints as vice mayor and mayor

during that time. Mr. Lucente has served as the chairman of the board of Rocco’s Italian Specialty Foods, Inc. since 2014.

Mr. Lucente’s business experience makes him a valuable member of the Board.

Amy Abraham

was appointed to the Board of Directors on April 20, 2022. Ms. Abraham currently holds the position of VP of Sales at Rio Tinto,

Chicago, Illinois. From 2015 to 2022, Ms. Abraham served as SVP and Chief Marketing Officer of World Fuel Services, a Fortune

100 company providing energy supply, logistics, energy management, renewable fuels and power sustainability services and technology solutions

in the aviation, marine, government, commercial & industrial, and residential sectors. Ms. Abraham held various executive

positions in the United States and United Kingdom for BP plc, one of the world’s leading oil and gas companies, from 1995 to 2015.

Ms. Abraham earned a B.A. in Economics, Cum Laude from Duke University, and an M.B.A. in Finance from Indiana University Kelley School

of Business. Ms. Abraham also completed executive education programs in leadership, marketing, and strategy at the University of

Chicago and Stanford, Northwestern, and Columbia universities. Ms. Abraham’s business experience and industry knowledge make

her a valuable member of the Board.

Mark Prince

was appointed to the Board of Directors on April 20, 2022, and appointed Audit Committee Chairman and designated Financial Expert.

Mr. Prince served as President and CEO of HB&W, Inc. Financial Services from 2011 until his retirement at the end of 2021.

Mr. Prince was also Managing Director for JPMorgan Chase from 1995 to 2011. Mr. Prince earned a B.A. in Economics from Kenyon

College and graduated with distinction from American Bankers Association Graduate Commercial Lending School. Mr. Prince’s executive

experience along with financial and regulatory expertise makes him a valuable member of the Board.

Patrick Farrell

was appointed to the Board of Directors on April 20, 2022. Mr. Farrell is the founder and president of Savage Grant, a holding

company investing in Appalachia through the energy, infrastructure, and technology industries since 2013. Mr. Farrell co-founded

Mountain Point, a cloud technology consulting firm based in Charlotte, North Carolina, and Central App Technologies, an insourcing software

development company with workers located throughout central Appalachia. Mr. Farrell also acquired and serves as the president of

Service Pump and Supply, an industrial products and services company working to provide access to clean water, deal responsibly with wastewater,

and manage stormwater for mining, industrial, and municipal customers. Mr. Farrell has also been a member of the Marshall University

Board of Governors since 2017 and has served as Chairman of the Board since 2020. Mr. Farrell is a graduate of the United States

Air Force Academy and earned his MBA from the Duke University Fuqua School of Business. Mr. Farrell’s business experience makes

him a valuable member of the Board.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE

“FOR” EACH OF THE NOMINEES FOR DIRECTOR LISTED ABOVE.

Charles P. Crimmel was

appointed as Chief Financial Officer of the Company on November 1, 2013 after serving as Controller from 2008 to 2013. Mr. Crimmel

graduated from West Virginia University in 1995 with a Bachelor of Science degree in Business Administration and Accounting. Mr. Crimmel

was employed by Union Boiler Company as a Field Clerk and Staff Accountant from 1995 to 1996. From 1996-2005, Mr. Crimmel served

as Staff Accountant and Controller for Williams Union Boiler/Williams Service Group. From 2005-2008, Mr. Crimmel was Controller for

Nitro Electric Company.

Board Independence

The Board of Directors consists

of a majority of “independent directors” within the meaning of the Nasdaq corporate governance listing standards. The Board

of Directors has determined that Messrs. Farrell, Prince, Williams, and Lucente and Ms. Abraham are “independent directors”

within the meaning of such standards. There were no transactions not required to be reported under “Certain Relationships and Related

Transactions” that were considered in determining the independence of our directors.

Board Leadership Structure and Risk Oversight

Our board of directors is

chaired by Mr. Marshall T. Reynolds, who is a non-executive director. We separate the roles of Chief Executive Officer and Chairman

of the Board in recognition of the differences between the two roles. The Chief Executive Officer is responsible for overseeing the day-to-day

operations of the Company. The Chairman provides guidance to the Chief Executive Officer and, together with the entire board of directors

helps develop the strategic plan for the Company.

The role of the board of directors

in the Company’s risk oversight process includes receiving reports from senior management on areas of material risk to the Company,

including operational, financial, legal, regulatory, strategic and reputational risk. The full board reviews such reports and follows

up with senior management to best determine how to address such risks.

Board Diversity Matrix

Based upon voluntary self-identification

by each member of the Energy Services Board of Directors, the diversity composition of the Board of Directors for the current year is

disclosed as follows:

| Board Diversity Matrix as of September 30, 2024 |

| |

| Total Number of Directors |

|

8 |

| |

|

Female |

|

Male |

| Part I: Gender Identity |

|

|

|

|

| Directors |

|

1 |

|

7 |

| Part I: Demographic Background |

|

|

|

|

| White |

|

1 |

|

6 |

| Black |

|

0 |

|

1 |

Delinquent Section 16(a) Reports

The Company did not have any

delinquent filings during the fiscal year ended September 30, 2024.

Insider Trading Arrangements

and Policy

The

Company has adopted an Insider Trading Policy governing the purchase, sale, and/or other dispositions of our securities by our directors,

officers and employees as well as by Energy Services itself that we believe is reasonably designed to promote compliance with insider

trading laws, rules and regulations, and the Nasdaq exchange listing standards. A copy of our Insider Trading Policy was filed as

Exhibit 19 to our Annual Report on Form 10-K for the year ended September 30, 2024.

Anti-Hedging Policy

The

Company’s anti-hedging policies are covered in the Company’s Insider Trading Policy. Under the policy, directors and named

executive officers are prohibited from engaging in short sales of Company stock and from engaging in transactions in publicly traded options,

such as puts, calls and other derivative securities based on Company stock including any hedging, monetization or similar transactions

designed to decrease the risks associated with holding Company stock.

Meetings of the Board of Directors

During fiscal 2024, the Board

of Directors held twelve regular meetings and one special meeting. One director, Amy Abraham, attended fewer than 75% in the aggregate

of the total number of board and committee meetings held during their tenure. Although not required, attendance of Board members at the

Annual Meeting of Stockholders is encouraged. All members of our Board of Directors as of the Annual Meeting date attended the 2024 Annual

Meeting of Stockholders.

Board Committees

Audit Committee

The Audit Committee consists

of Messrs. Prince, Lucente, and Farrell, with Mr. Prince acting as chairman of the committee since April 20, 2022. Each

member of the audit committee is financially literate, and the Board of Directors has determined that Mr. Prince qualified as audit

committee financial expert, as such term is defined by Securities and Exchange Commission rules. All the directors appointed to the audit

committee are independent members of the board of directors, as defined by Securities and Exchange Commission rules (Rule 10A-3

of the Securities Exchange Act of 1934) and the Nasdaq corporate governance listing standards. The audit committee met seven times during

the fiscal year ended September 30, 2024. The committee’s charter can be found at: https://energyservicesofamerica.com/about-esa/committees/.

The Audit Committee reviews

the professional services and independence of our independent registered public accounting firm and our accounts, procedures and internal

controls. The audit committee also recommends the firm selected to be our independent registered public accounting firm, reviews and approves

the scope of the annual audit, reviews and evaluates with the independent registered public accounting firm our annual audit and annual

consolidated financial statements, reviews with management the status of internal accounting controls, evaluates problem areas having

a potential financial impact on us that are brought to the committee’s attention by management, the independent registered public

accounting firm or the board of directors, and evaluates all of our public financial reporting documents.

On February 16, 2024,

the Company dismissed Baker Tilly US, LLP (“Baker Tilly”) as the Company’s independent registered public accounting firm.

The decision to dismiss Baker Tilly was approved by the Audit Committee of the Company’s Board of Directors.

The audit reports of Baker

Tilly on the consolidated financial statements of the Company for each of the past two fiscal years ended September 30, 2023 and

September 30, 2022 did not contain an adverse opinion or a disclaimer of opinion and were not qualified or modified as to uncertainty,

audit scope, or accounting principles.

During the Company’s two most

recent fiscal years ended September 30, 2023 and September 30, 2022 and the subsequent interim period from October 1, 2023

through February 16, 2024: (i) there were no disagreements with Baker Tilly on any matter of accounting principles or practices,

financial statement disclosure, or auditing scope or procedures which, if not resolved to Baker Tilly’s satisfaction, would have caused

Baker Tilly to make reference to the subject matter of the disagreement in connection with its reports, and (ii) there were no “reportable

events” as defined in Item 304(a)(1)(v) of Regulation S-K of the SEC.

On February 16, 2024,

the Company engaged Urish Popeck & Co., LLC (“Urish Popeck”) as the Company’s independent registered public accounting

firm for the fiscal year ending September 30, 2024. The selection of Urish Popeck was approved by the Audit Committee of the Company’s

Board of Directors.

During the Company’s

two most recent fiscal years ended September 30, 2023 and September 30, 2022 and the subsequent interim period from October 1,

2023 through February 16, 2024, neither the Company nor anyone on its behalf consulted with Urish Popeck regarding either (i) the

application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might

be rendered on the Company’s consolidated financial statements, and neither a written report nor oral advice was provided to the Company

that Urish Popeck concluded was an important factor considered by the Company in reaching a decision as to any accounting, auditing or

financial reporting issue, or (ii) any matter that was either the subject of a “disagreement” (as defined in SEC Regulation

S-K Item 304(a)(1)(iv)) or a “reportable event” (as defined in SEC Regulation S-K Item 304(a)(1)(v)).

The Audit Committee approved

the appointment of Urish Popeck to be our independent registered public accounting firm for the 2025 fiscal year. A representative of

Urish Popeck is expected to attend the 2025 Annual Meeting of Stockholders and may respond to appropriate questions and make a statement

if he or she so desires.

The following is a summary

of fees paid to Urish Popeck for services rendered in the fiscal year ended September 30, 2024.

Audit Fees

We were billed by Urish Popeck,

our independent registered public accounting firm for fiscal year 2024, $538,000 for the services they have performed in connection with

the audit of our financial statements included in our Annual Report on Form 10-K for fiscal year 2024 and for the review of interim

financial statements included in our quarterly reports on Form 10-Q during these periods.

Audit-Related Fees

We were billed by Urish Popeck,

$35,000 for the services they have performed in connection with the fiscal year 2024 audits of our financial statements included in our

Annual Report on Form 11-K and the Energy Services of America Staff 401(k) Retirement Savings Plan.

Tax Fees

Urish Popeck did not perform

tax compliance services for the Company during the fiscal year ended September 30, 2024.

All Other Fees

During the fiscal year ended

September 30, 2024, we were billed $0 by Urish Popeck for fees billed for products and services provided other than those set forth

above.

Policy on Audit Committee Pre-Approval of

Audit and Non-Audit Services of Independent Registered Public Accounting Firm

The audit committee’s

policy is to pre-approve all audit and non-audit services provided by the independent registered public accounting firm. These services

may include audit services, audit-related services, tax services and other services. Pre-approval is generally provided for up to one

year and any pre-approval is detailed as to the service or category of services and is generally subject to a specific budget. The audit

committee has delegated pre-approval authority to its chairman when expedition of services is necessary. The independent registered public

accounting firm and management are required to periodically report to the full audit committee regarding the extent of services provided

by the independent registered public accounting firm in accordance with this pre-approval, and the fees for the services performed to

date. All the fees paid in the audit-related, tax and all other categories during 2024 and 2023 were approved per the pre-approval policies.

Audit Committee Report

In accordance with rules established by the

Securities and Exchange Commission, the audit committee has prepared the following report for inclusion in this proxy statement:

As part of its ongoing activities, the audit committee

has:

| |

· |

reviewed and discussed with management and the independent registered public accounting firm our audited consolidated financial statements for the fiscal year ended September 30, 2024; |

| |

· |

discussed with the independent registered public accounting firm the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board and the Securities and Exchange Commission; and |

| |

· |

received the written disclosures and the letter from the independent registered public accounting firm required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent registered public accounting firm’s communications with the audit committee concerning independence and has discussed with the independent registered public accounting firm its independence. |

Based on the review and discussions

referred to above, the audit committee recommended to the Board of Directors that the audited consolidated financial statements be included

in our Annual Report on Form 10-K for the fiscal year ended September 30, 2024.

This report shall not be deemed

incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities

Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that we specifically incorporate this

information by reference and shall not otherwise be deemed filed under such Acts.

This report has been provided by the Audit Committee:

| |

Mark S. Prince |

| |

Frank S. Lucente |

| |

Patrick J. Farrell |

Nominating Committee

The Board has determined that

the independent members of the Board of Directors will perform the duties of the nominating committee of the Board of Directors. The nominating

committee does not have a written charter. The nominating committee will (i) identify individuals qualified to become members of

the Board of Directors and recommend to the Board of Directors the nominees for election to the Board of Directors; (ii) recommend

director nominees for each committee to the Board of Directors; and (iii) identify individuals to fill any vacancies on the Board

of Directors. The nominating committee met one time during the fiscal year ended September 30, 2024.

The nominating committee of

the Board identifies nominees by first evaluating the current members of the Board of Directors willing to continue in service. Current

members of the Board of Directors with skills and experience that are relevant to our business and who are willing to continue in service

are first considered for re-nomination, balancing the value of continuity of service by existing members of the Board of Directors with

that of obtaining a new perspective. If any member of the Board of Directors does not wish to continue in service, or if the Board decides

not to re-nominate a member for re-election, or if the size of the Board of Directors is increased, the independent directors will solicit

suggestions for director candidates from all board members.

The independent directors

would seek to identify a candidate who at a minimum satisfies the following criteria:

| · | has the highest personal and professional ethics and integrity and whose values are compatible with ours; |

| · | has experiences and achievements that have given him or her the ability to exercise and develop good business

judgment; |

| · | is willing to devote the necessary time to the work of the Board of Directors and its committees, which

includes being available for board and committee meetings; |

| · | is familiar with the communities in which we operate and/or is actively engaged in community activities; |

| · | is involved in other activities or interests that do not create a conflict with his or her responsibilities

to us and our stockholders; and |

| · | has the capacity and desire to represent the balanced, best interests of our stockholders as a group,

and not primarily a special interest group or constituency. |

The nominating committee will

also consider whether a candidate satisfies the criteria for “independence” under Securities and Exchange Commission or Nasdaq

rules and, if a nominee is sought for service on the audit committee, the financial and accounting expertise of a candidate, including

whether an individual qualifies as an “audit committee financial expert.” The nominating committee will consider diversity

in identifying nominees for director but has no specific policy or established criteria in this regard. The nominating committee seeks

candidates who have a broad range of business experience when considering nominees to the Board of Directors.

Procedures for the Nomination of Directors

by Stockholders

The Board of Directors has

adopted procedures for the submission of director nominees by stockholders. If a determination is made that an additional candidate is

needed for the Board of Directors, the independent members of the Board of Directors will consider candidates submitted by our stockholders.

Stockholders can submit the names of qualified candidates for director by writing to our Corporate Secretary at 75 West 3rd

Ave., Huntington, West Virginia 25701. The Corporate Secretary must receive a submission not less than forty-five (45) days prior to the

anniversary date of our proxy materials for the preceding year’s annual meeting. The submission must include the following information:

| · | a statement that the writer is a stockholder and is proposing a candidate for consideration by our independent

directors; |

| · | the name and address of the stockholder as they appear on our books and number of shares of our common

stock that are owned beneficially by such stockholder (if the stockholder is not a holder of record, appropriate evidence of the stockholder’s

ownership will be required); |

| · | the name, address and contact information for the candidate, and the number of shares of our common stock

that are owned by the candidate (if the candidate is not a holder of record, appropriate evidence of the stockholder’s ownership

should be provided); |

| · | a statement of the candidate’s business and educational experience; |

| · | such other information regarding the candidate as would be required to be included in the proxy statement

pursuant to Securities and Exchange Commission Regulation 14A; |

| · | a statement detailing any relationship between the candidate and Energy Services of America Corporation; |

| · | a statement detailing any relationship between the candidate and any customer, supplier or competitor

of Energy Services of America Corporation; |

| · | detailed information about any relationship or understanding between the proposing stockholder and the

candidate; and |

| · | a statement that the candidate is willing to be considered and willing to serve as a director if nominated

and elected. |

Stockholder Communications

with the Board

A stockholder who wants to

communicate with the Board of Directors or with any individual director can write to the Corporate Secretary at 75 West 3rd Ave., Huntington,

West Virginia 25701, Attention: Corporate Secretary. The letter should indicate that the author is a stockholder and if shares are not

held of record, should include appropriate evidence of stock ownership. Depending on the subject matter, the Secretary will:

| · | forward the communication to the director or directors to whom it is addressed; |

| · | attempt to handle the inquiry directly, i.e. where it is a request for information about us or it is a stock-related matter; or |

| · | not forward the communication if it is primarily commercial in nature, relates to an improper or irrelevant topic, or is unduly hostile,

threatening, illegal or otherwise inappropriate. |

At each board meeting, management

shall present a summary of all communications received since the last meeting that were not forwarded and make those communications available

to the directors.

Compensation Committee

The compensation committee

consists of directors Joseph L. Williams, Frank S. Lucente and Mark S. Prince. Each member of the compensation committee is considered

“independent” as defined in the Nasdaq corporate governance listing standards. The Board of Directors has not adopted a written

charter for the Committee. The compensation committee met one time during the fiscal year ended September 30, 2024.

The compensation committee

is appointed by the Board of Directors to assist the Board in developing compensation philosophy, criteria, goals and policies for our

executive officers that reflect our values and strategic objectives. The committee reviews the performance of our executive officers and

annually recommends to the full Board the compensation and benefits for our executive officers (including the Chief Executive Officer).

The committee administers our equity and long-term incentive plans. The committee establishes the terms of employment and severance agreements/arrangements

for executive officers, if applicable. The committee recommends to the full Board the compensation to be paid to our directors and any

affiliates for their service on the Board. Finally, the committee establishes annual compensation percentage increases for all employees.

Our President and Chief Executive Officer provides recommendations to the compensation committee related to our compensation program.

However, our President and Chief Executive Officer does not vote on and is not present for any discussion of his own compensation.

For 2024, in making compensation

decisions, the compensation committee did not use strict numerical formulas to determine the compensation paid to our executive officers.

However, the committee considered a variety of factors in its deliberations over executive compensation, emphasizing the profitability

and scope of our operations, the experience, expertise and management skills of the named executive officers and their role in our future

success, as well as compensation surveys prepared by professional firms to determine compensation paid to executives performing similar

duties for comparable companies. While the quantitative and non-quantitative factors described above were considered by the committee

in determining the compensation paid to our named executive officers, such factors were not assigned a specific weight in evaluating the

performance of the named executive officers. In determining the Chief Executive Officer’s bonus, the Chairman of the Board also

considers the above factors and makes a recommendation to the committee which may authorize such bonus. For the other named executive

officers, the Chief Executive Officer considers the above factors and makes a recommendation to the committee which may authorize bonuses.

The Company paid $215,000 in bonuses and issued 7,724 in restricted stock awards to the named executive officers during the fiscal year

ended September 30, 2024.

The compensation committee

has authority to approve the engagement of any compensation consultant it uses and the fees for those services. However, the compensation

committee did not engage a compensation consultant to assist in determining the amount or form of executive and director compensation

with respect to the fiscal year ended September 30, 2024.

Code of Ethics

We have adopted a Code of

Ethics that applies to our principal executive officer, principal financial officer, principal accounting officer or controller or persons

performing similar functions. The Code of Ethics was previously filed as an exhibit to our Registration Statement on Form S-1. A

copy of the Code of Ethics will be furnished without charge upon written request to the Corporate Secretary, Energy Services of America

Corporation, 75 West 3rd Ave., Huntington, West Virginia 25701.

Executive and Director Compensation

We have adopted a compensation

committee policy that reflects the compensation philosophy and objectives of the compensation committee.

Compensation Philosophy and Objectives

The compensation committee

believes that an effective executive compensation program rewards the achievement of pre-established short term, long-term and strategic

goals, and aligns executives’ interests with those of our stockholders. The committee regularly evaluates both performance and compensation

relative to other comparable companies. We also manage our named executive officers’ compensation to align with the time horizon

of our growth and development. As we grow, we strive to ensure that our compensation programs and practices remain consistent with our

philosophy to provide competitive, performance-based, and risk appropriate compensation that enables us to attract, motivate and retain

top performers who are essential to our successful growth and performance.

The primary objectives of

our executive compensation program are to:

| · | provide pay for performance utilizing short and long-term incentives; |

| · | be competitive with the marketplace within which we compete for talent; |

| · | ensure compensation programs reward performance while appropriately managing risk; and |

| · | enable us to attract, motivate, and retain top talent. |

We accomplish all these objectives

through a total compensation program that balances fixed and variable (i.e. incentive) compensation with a focus on providing rewards

to named executive officers for their contributions towards achieving core business objectives and furthering our short and long-term

performance. We balance our desire for superior performance with safeguards so that our programs do not result in excessive risk taking

that can threaten our long-term value and stability. We also recognize that our ability to attract and retain top talent has become even

more critical as we grow.

Our executive compensation

philosophy provides competitive ranges for each component of our compensation program and our compensation paid in the aggregate. The

starting point targets market median, but by using performance-based instruments, actual compensation paid to our named executive officers

varies depending on our performance against our stated objectives. We meet our compensation objectives for our named executive officers

through the following components of their total compensation:

| · | Base salaries are targeted at market median, but allow for recognition of everyone’s role, contribution,

performance, and experience. |

| · | Bonuses, which are determined by the compensation committee, reflect market median levels although actual

payouts will vary based on our performance relative to company-wide, team and individual contributions toward our strategic plan. |

| · | Retirement, health, life insurance, disability, severance and other perquisites and benefits are provided,

but their focus and value are intentionally set to be conservatively competitive in order to attract and retain talented individuals. |

| · | Restricted stock awards, which are determined by the compensation committee and will vary based on our

performance relative to company-wide, team and individual contributions toward our strategic plan. |

Executive total compensation

is expected to vary each year and evolve over the long term to reflect our performance relative to our peers and the industry, and to

correspond with stockholder returns.

We review our executive compensation

philosophy and programs annually to ensure that they are achieving desired objectives and supporting our needs as we grow to be a more

complex organization.

Summary Compensation

Table for Named Executive Officers.

Messrs. Reynolds and Crimmel were the only

executive officers who received total compensation in excess of $100,000 for services to Energy Services during the fiscal years ended

September 30, 2024 and 2023.

The following table shows the compensation of the

Company’s named executive officers for the fiscal years ended September 30, 2024 and 2023.

| Summary

Compensation Table | |

| Name and principal position | |

Year | | |

| Salary | | |

| Bonus | | |

| Stock Awards | | |

| All other

compensation (1) | | |

| Total | |

| Douglas V. Reynolds | |

2024 | | |

$ | 89,232 | | |

$ | 135,000 | | |

$ | 40,000 | (2) | |

$ | 5,139 | | |

$ | 269,371 | |

| President and Chief | |

2023 | | |

$ | 80,000 | | |

$ | - | | |

$ | 106,000 | (3) | |

$ | 3,600 | | |

$ | 189,600 | |

| Executive Officer | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Charles P. Crimmel | |

2024 | | |

$ | 160,000 | | |

$ | 80,000 | | |

$ | 20,000 | (4) | |

$ | 10,800 | | |

$ | 270,800 | |

| Secretary/Treasurer and | |

2023 | | |

$ | 150,389 | | |

$ | 25,000 | | |

$ | - | | |

$ | 7,893 | | |

$ | 183,282 | |

| Chief Financial Officer | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| (1) | Other compensation in 2024 includes 401(k) plan matching

contributions of $5,139 for Mr. Reynolds and $10,800 for Mr. Crimmel. Other compensation in 2023 includes 401(k) plan

matching contributions of $3,600 for Mr. Reynolds and $7,893 for Mr. Crimmel. |

| (2) | Restricted Stock Award of 4,061 shares of common stock valued

at $9.85 per share as of the award date, August 21, 2024. Shares vest over three years starting August 21, 2025. |

| (3) | Restricted Stock Award of 40,000 shares of common stock valued

at $2.65 per share as of the award date, February 15, 2023. Shares vest over three years starting February 15, 2024. |

| (4) | Restricted Stock Award of 3,663 shares of common stock valued

at $5.46 per share as of the award date, January 17, 2024. Shares vest over three years starting January 17, 2025. |

Benefit Plans

2022 Equity Incentive Plan

On February 16, 2022,

the Company’s stockholders approved the 2022 Equity Incentive Plan (the “2022 Equity Plan”) to provide officers and

employees of the Company and its subsidiaries with additional incentive to promote the growth and performance of the Company. Subject

to permitted adjustments for certain corporate transactions, the maximum number of shares of Company common stock, in the aggregate, that

may be delivered to participants under the 2022 Equity Plan is 1,500,000 shares (the “Share Limit”). Shares of Company common

stock subject to the Share Limit may be issued pursuant to grants of stock options, restricted stock awards or restricted stock units

such that the Share Limit is reduced, on a one-for-one basis, for each share of common stock subject to a stock option grant, restricted

stock award or restricted stock unit award. If any award granted under the 2022 Equity Plan expires, terminates, is canceled or is forfeited

without being settled or exercised or is settled without the issuance of shares of common stock, shares of Company common stock subject

to such award will be made available for future grant under the 2022 Equity Plan. If any shares are surrendered or tendered to pay the

exercise price of a stock option, such shares will not again be available for grant under the 2022 Equity Plan. In addition, shares of

common stock withheld in payment for purposes of satisfying tax withholding obligations with respect to an award do not become available

for re-issuance under the 2022 Equity Plan.

The 2022 Equity Plan is administered

by the members of the compensation committee. The compensation committee may grant any of the types of awards described above subject

to performance-based vesting conditions. Such awards are referred to as performance awards. The compensation committee shall specify the

vesting schedule or conditions of each award. At least ninety-five percent (95%) of the awards available under the 2022 Equity Plan are

subject to a minimum vesting period of one year from the date of grant. Notwithstanding the foregoing, vesting (including the reduction

or elimination of any restrictions) may be accelerated in the event of death, disability, or upon involuntary termination of employment

following a change in control.

Outstanding Equity Awards

The Outstanding Equity Awards

table displays the unvested equity for each NEO as of the Company’s fiscal year ended September 30, 2024:

| | |

Stock Awards | |

| Name | |

| Number of shares or

units of stock that have

not vested (1) | | |

| Market value of

shares or units of

stock that have not

vested (2) | |

| Douglas Reynolds, PEO | |

| 30,727 | | |

$ | 291,907 | |

| Charles Crimmel, Non-PEO | |

| 3,663 | | |

| 34,799 | |

| | |

| 34,390 | | |

$ | 326,705 | |

| (1) | All awards vest in approximately 33% increments on the first,

second, and third anniversary from the date of grant. |

| (2) | Market value is calculated on the basis of $9.50 per share.

This is based on the closing sales price for our common stock as reported on the Nasdaq Capital Market on September 30, 2024, which

was the last business day of the fiscal year. |

We have not historically granted

stock options or similar awards as part of our equity compensation programs and did not grant any stock options during the year ended

September 30, 2024. If stock options or similar awards are granted in the future, our policy is to not grant stock options or similar

awards in anticipation of the release of material nonpublic information that is likely to result in changes to the price of our common

stock, such as a significant positive or negative earnings announcement, and not time the public release of such information based on

stock option grant dates. In addition, it is our policy to not grant stock options or similar awards during periods in which there is

material nonpublic information about the Company, including during “blackout” periods or at any time during the four business

days prior to or the one business day following the filing of our periodic reports or the filing or furnishing of a Form 8-K that

discloses material nonpublic information. These restrictions do not apply to restricted stock awards or other types of equity awards that

do not include an exercise price related to the market price of our common stock on the date of grant.

Energy Services 401(k) Plan

401(k) Retirement Plans

In 2024 and 2023, C. J. Hughes

maintained a tax-qualified 401(k) retirement plan for union employees. Employees can contribute up to 15% of eligible wages, provided

the compensation deferred for a plan year does not exceed the indexed dollar amount set by the Internal Revenue Service which was $23,000

for 2024 and $22,500 for 2023. C. J. Hughes matches $0.25 on each dollar contributed up to 6% of eligible wages.

C. J. Hughes contributed $37,000

and $17,000 to the union plan for the fiscal years September 30, 2024 and 2023, respectively. Additionally, each plan year,

C. J. Hughes may make a discretionary profit-sharing contribution for participants who are actively employed on the last day of the plan year.

No discretionary profit-sharing contribution was made for the 2024 or 2023 plan year.

Effective January 1,

2010, Energy Services became the successor plan sponsor of the C. J. Hughes Construction Company, Inc. 401(k) Plan for non-union

employees (the “Plan”). The Plan was renamed the Energy Services of America Staff 401(k) Retirement Savings Plan. Employees

are eligible to participate in the Plan upon completion of six months of service but must wait until a quarterly entry to join the

Plan. In addition, participants who are age 50 or older by the end of the Plan year may elect to defer up to an additional $7,500 into

the Plan for 2024.

Energy Services may make annual

discretionary matching contributions and/or profit-sharing contributions to the Plan. The matching contribution formula for the Plan was

100% of each dollar contributed for the first 3% of eligible wages and 50% of each dollar contributed for the next 3% of eligible wages.

The Company’s matching contribution is used by the Plan’s third-party administrator to purchase Energy Services of America

common stock from the open market. No restrictions on the match exist after it has been contributed. No profit-sharing contribution was

made for the 2024 or 2023 plan year.

Energy Services and its wholly

owned subsidiaries contributed $864,000 and $599,000, respectively, for the fiscal years ended September 30, 2024, and 2023

to the Plan.

Pay Versus Performance Disclosures

The federal securities laws

and SEC regulations require Energy Services to provide the following information about the relationship between “compensation actually

paid” to our principal executive officer (“PEO”) and to our Non-PEO named executive officers (“NEOs”) and

certain financial performance measures of Energy Services. Compensation actually paid, as determined under SEC requirements, does not

reflect the actual amount of compensation earned by or paid to the executive officers during a covered year.

| Year | |

Summary

Compensation Table

Total for PEO (1) | | |

Compenation Actually Paid

to PEO (2) | | |

Average Summary

Compensation Table Total for

Non-PEO NEOs (3) | | |

Average Compensation

Actually Paid to Non-PEO

NEOs (4) | | |

Value of Initial Fixed $100

Investment Based on Total

Shareholder Return (5) | | |

Net Income (6) | |

| 2024 | |

$ | 269,371 | | |

$ | 471,817 | | |

$ | 270,800 | | |

$ | 285,599 | | |

$ | 572 | | |

$ | 25,105,010 | |

| 2023 | |

$ | 189,600 | | |

$ | 245,600 | | |

$ | 183,282 | | |

$ | 183,282 | | |

$ | 244 | | |

$ | 7,401,420 | |

| 2022 | |

$ | 83,600 | | |

$ | 83,600 | | |

$ | 155,730 | | |

$ | 155,730 | | |

$ | 172 | | |

$ | 3,750,315 | |

| (1) | Douglas V. Reynolds served as PEO for each year presented in the above table. Compensation actually paid to Mr. Reynolds for

each year presented in the table, as calculated in accordance with SEC regulations and presented in the Summary Compensation Table (“SCT”),

was as follows: |

| (2) | Compensation Actually Paid to PEO Determination |

| | |

2024 | | |

2023 | | |

2022 | |

| Total Compensation as Reported in SCT | |

$ | 269,371 | | |

$ | 189,600 | | |

$ | 83,600 | |

| Fair value of equity awards granted during fiscal year | |

| (40,000 | ) | |

| (106,000 | ) | |

| — | |

| Fair value of equity compensation granted in current year at year end | |

| 38,580 | | |

| 162,000 | | |

| — | |

| Change in fair value from end of prior fiscal year to end of current fiscal year for awards made in prior fiscal years that were unvested at end of current fiscal year | |

| 145,330 | | |

| — | | |

| — | |

| Change in fair value from end of prior fiscal year to vesting date for awards made in prior fiscal years that vested during current fiscal year | |

| 58,536 | | |

| — | | |

| — | |

| Fair value of awards forfeited in current fiscal year determined at end of prior fiscal year | |

| — | | |

| — | | |

| — | |

| Compensation Actually Paid to PEO | |

$ | 471,817 | | |

$ | 245,600 | | |

$ | 83,600 | |

Fair value was computed in

accordance with Energy Services’ methodology used for financial reporting purposes.

| (3) | The non-PEO NEO for the fiscal years ended September 30, 2024 and 2023 was Charles P. Crimmel. The non-PEO NEOs for the fiscal

year ended September 30, 2022 were Charles P. Crimmel and Robert N. Riddle, Jr. The average compensation actually paid to the

non-PEO NEOs for each year presented in the table, as calculated in accordance with SEC regulations, was as follows: |

| (4) | Average Compensation Actually Paid to Non-PEO NEOs Determination |

| | |

2024 | | |

2023 | | |

2022 | |

| Average Compensation as Reported in SCT | |

$ | 270,800 | | |

$ | 183,282 | | |

$ | 155,730 | |

| Fair value of equity awards granted during fiscal year | |

| (20,000 | ) | |

| — | | |

| — | |

| Fair value of equity compensation granted in current year at year end | |

| 34,799 | | |

| — | | |

| — | |

| Change in fair value from end of prior fiscal year to end of current fiscal year for awards made in prior fiscal years that were unvested at end of current fiscal year | |

| — | | |

| — | | |

| — | |

| Change in fair value from end of prior fiscal year to vesting date for awards made in prior fiscal years that vested during current fiscal year | |

| — | | |

| — | | |

| — | |

| Fair value of awards forfeited in current fiscal year determined at end of prior fiscal year | |

| — | | |

| — | | |

| — | |

| Average Compensation Actually Paid to Non-PEO NEOs | |

$ | 285,599 | | |

$ | 183,282 | | |

$ | 155,730 | |

Fair value was computed in

accordance with Energy Services’ methodology used for financial reporting purposes.

| (5) | Total shareholder return (“TSR”) value represents Energy Services’ cumulative TSR based on an initial $100 investment

on September 30, 2021, assuming the reinvestment of dividends. |

| (6) | Net income is calculated in accordance with GAAP and reflects the amounts reported in Energy Services’ Annual Report on Form 10-K,

as amended for the applicable year. |

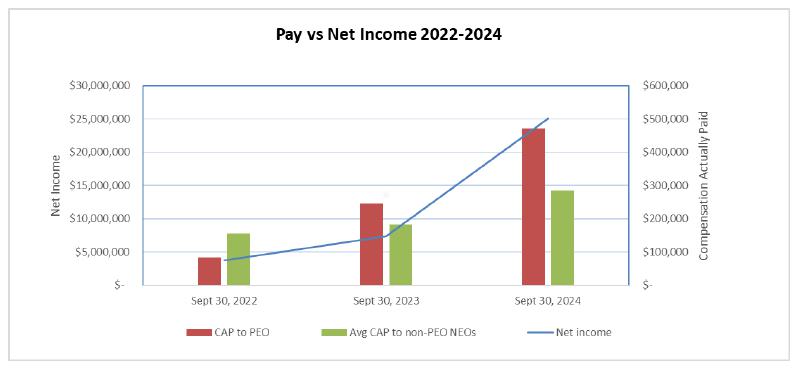

The following chart illustrates

the relationship between compensation actually paid to the NEOs and TSR for the fiscal years ended September 30, 2022, 2023, and

2024:

The following chart illustrates

the relationship between compensation actually paid to the NEOs and net income for the fiscal years ended September 30, 2022, 2023,

and 2024:

Directors’ Compensation

Director Compensation.

The table set forth below shows the compensation of our non-executive directors for the fiscal year ended September 30, 2024.

We did not make any non-equity incentive plan awards to directors during the fiscal year ended September 30, 2024, and there were

no outstanding stock awards or stock options for any directors as of September 30, 2024. Each Director received retainer fees of

$2,000 per month beginning in November 2023 and $1,000 for October 2023. No fee payments were made for committee participation.

| Name | |

Fees earned or paid in

cash ($) | | |

Stock Awards ($) | | |

All other

compensation ($) | | |

Total | |

| Marshall T. Reynolds | |

$ | 23,000 | | |

$ | - | | |

$ | - | | |

$ | 23,000 | |

| Samuel G. Kapourales (1) | |

| 21,000 | | |

| - | | |

| - | | |

| 21,000 | |

| Jack M. Reynolds | |

| 23,000 | | |

| - | | |

| - | | |

| 23,000 | |

| Joseph L. Williams | |

| 23,000 | | |

| - | | |

| - | | |

| 23,000 | |

| Frank S. Lucente | |

| 23,000 | | |

| - | | |

| - | | |

| 23,000 | |

| Amy E. Abraham | |

| 23,000 | | |

| - | | |

| - | | |

| 23,000 | |

| Patrick J. Farrell | |

| 23,000 | | |

| - | | |

| - | | |

| 23,000 | |

| Mark S. Prince | |

| 23,000 | | |

| - | | |

| - | | |

| 23,000 | |

| Total | |

$ | 182,000 | | |

$ | - | | |

$ | - | | |

$ | 182,000 | |

(1) Resigned Septeber 18, 2024

Certain Relationships and Related Transactions

The Company intends that all transactions between

us and our executive officers, directors, holders of 10% or more of the shares of any class of our common stock and affiliates thereof,

will be on terms no less favorable than those terms given to unaffiliated third parties and will be approved by a majority of our independent

outside directors not having any interest in the transaction.

On April 29, 2022, the

Company entered into a $1.0 million promissory note agreement with Corns Enterprises as partial consideration for the purchase of Tri-State

Paving. This four-year agreement requires $250,000 principal installment payments on or before the end of each twelve (12) full calendar

month period beginning April 29, 2022. Interest payments due shall be calculated on the principal balance remaining and shall be

at the stated rate of 3.5% per year. The Company has made $750,000 in principal payments on this note as of September 30, 2024.

Subsequent to the April 29,

2022 acquisition of Tri-State Paving, the Company entered into an operating lease for facilities in Hurricane, West Virginia with Corns

Enterprises. This thirty-six-month lease is treated as a right-of-use asset and has payments of $7,000 per month. The total net present

value at inception was $236,000 with a carrying value of $46,000 at September 30, 2024.

SQP made an equity investment

of $156,000 in 1030 Quarrier Development, LLC (“Development”) in August 2022. Development is a variable interest entity

(“VIE”) that is 75% owned by 1030 Quarrier Ventures, LLC (“Ventures”) and 25% owned by SQP. SQP is not the primary

beneficiary of the VIE and therefore will not consolidate Development into its consolidated financial statements. Instead, SQP will apply

the equity method of accounting for its investment in Development. Development, a 1% owner, and United Bank, a 99% owner, formed 1030

Quarrier Landlord, LLC (“Landlord”). Landlord decided to pursue the following development project (the “Project”):

a historical building at 1030 Quarrier Street, Charleston, West Virginia as well as associated land (the “Property”) was purchased

to be developed/rehabilitated into a commercial project including apartments and commercial space. Upon the completion of development,

the Property will be used to generate rental income. SQP has been awarded the construction contract for the Project. United Bank provided

$5.0 million in loans to fund the Project. SQP and Ventures have jointly provided an unconditional guarantee for the $5.0 million of obligations

associated with the Project.

CJ Hughes entered into an

agreement, cancelable at any time, with Construction Specialty Services (“CSS”), which is owned by Chuck Austin, the President

of CJ Hughes. CSS rents equipment, periodically, to and as requested by CJ Hughes. The equipment rental rates are below the rates that

the equipment can be rented from any unaffiliated rental company. CJ Hughes is not obliged to rent any equipment and does so only when

CJ Hughes does not have equipment available of its own and would otherwise need to rent such equipment as the demand increases throughout

the construction season. In the fiscal years 2023 and 2024, the rental amounts for these specific years were $387,000, and $318,000, respectively.

Other than mentioned above,

there were no new material related party transactions entered into during the fiscal year ended September 30, 2024.

Certain Energy Services subsidiaries

routinely engage in transactions in the normal course of business with each other, including sharing employee benefit plan coverage, payment

for insurance and other expenses on behalf of other affiliates, and other services incidental to business of each of the affiliates. All

revenue and related expense transactions, as well as the related accounts payable and accounts receivable have been eliminated in consolidation.

| PROPOSAL II—RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

Our independent registered

public accounting firm for the year ended September 30, 2024 was Urish Popeck & Co., LLC. Our Audit Committee has approved

the engagement of Urish Popeck to be our independent registered public accounting firm for the year ending September 30, 2025, subject