First Trust Advisors L.P. Announces Distributions for Exchange-Traded Funds

20 Mars 2013 - 9:36PM

Business Wire

First Trust Advisors L.P. (“FTA”) announces the declaration of

the regular monthly and quarterly distributions for 60 of 75

exchange-traded funds advised by FTA.

The following dates apply to today’s distribution

declarations:

Expected Ex-Dividend

Date: March 21, 2013 Record Date: March

25, 2013 Payable Date: March 28, 2013

Ordinary Income Per Share

Ticker

Exchange

Fund Name

Frequency

Amount

ACTIVELY MANAGED EXCHANGE-TRADED

FUNDS

First Trust Exchange-Traded Fund

III

FPE NYSE Arca First Trust Preferred Securities and Income ETF

Monthly $0.0858

First Trust Exchange-Traded Fund

IV

EMLP NYSE Arca First Trust North American Energy Infrastructure

Fund Quarterly $0.1721

INDEX EXCHANGE-TRADED FUNDS

First Trust Exchange-Traded

Fund

FDM NYSE Arca First Trust Dow Jones Select MicroCap IndexSM Fund

Quarterly $0.0321 FDL NYSE Arca First Trust Morningstar Dividend

LeadersSM Index Fund Quarterly $0.1806 FPX NYSE Arca First Trust US

IPO Index Fund Quarterly $0.0262 FDV NYSE Arca First Trust

Strategic Value Index Fund Quarterly $0.0778 FVI NYSE Arca First

Trust Value Line® Equity Allocation Index Fund Quarterly $0.0483

FVD NYSE Arca First Trust Value Line® Dividend Index Fund Quarterly

$0.1067 FRI NYSE Arca First Trust S&P REIT Index Fund Quarterly

$0.0711 FIW NYSE Arca First Trust ISE Water Index Fund Quarterly

$0.0237 FCG NYSE Arca First Trust ISE-Revere Natural Gas Index Fund

Quarterly $0.0210 QQEW NASDAQ First Trust NASDAQ-100 Equal Weighted

IndexSM Fund Quarterly $0.0199 QTEC NASDAQ First Trust

NASDAQ-100-Technology Sector IndexSM Fund Quarterly $0.0383 QCLN

NASDAQ First Trust NASDAQ® Clean Edge® Green Energy Index Fund

Quarterly $0.0111 QABA NASDAQ First Trust NASDAQ® ABA Community

Bank Index Fund Quarterly $0.0503 VIXH NYSE Arca First Trust CBOE

S&P 500 VIX Tail Hedge Fund Quarterly $0.0679

First Trust Exchange-Traded Fund

II

FDD NYSE Arca First Trust STOXX® European Select Dividend Index

Fund Quarterly $0.0316 FFR NYSE Arca First Trust FTSE EPRA/NAREIT

Developed Markets Real Estate Index Fund Quarterly $0.1109 FGD NYSE

Arca First Trust Dow Jones Global Select Dividend Index Fund

Quarterly $0.1106 FAN NYSE Arca First Trust ISE Global Wind Energy

Index Fund Quarterly $0.0050 GRID NASDAQ First Trust NASDAQ® Clean

Edge® Smart Grid Infrastructure Index Fund Quarterly $0.0163 BICK

NASDAQ First Trust BICK Index Fund Quarterly $0.0768 CU NASDAQ

First Trust ISE Global Copper Index Fund Quarterly $0.0462 PLTM

NASDAQ First Trust ISE Global Platinum Index Fund Quarterly $0.0050

FONE NASDAQ First Trust NASDAQ CEA Smartphone Index Fund Quarterly

$0.0220

First Trust Exchange-Traded Fund

VI

MDIV NASDAQ Multi-Asset Diversified Income Index Fund Monthly

$0.0756 TDIV NASDAQ First Trust NASDAQ Technology Dividend Index

Fund Quarterly $0.2197

First Trust Exchange-Traded

AlphaDEX® Fund

FEX NYSE Arca First Trust Large Cap Core AlphaDEX® Fund Quarterly

$0.0804 FNX NYSE Arca First Trust Mid Cap Core AlphaDEX® Fund

Quarterly $0.0544 FYX NYSE Arca First Trust Small Cap Core

AlphaDEX® Fund Quarterly $0.0225 FTA NYSE Arca First Trust Large

Cap Value AlphaDEX® Fund Quarterly $0.1072 FTC NYSE Arca First

Trust Large Cap Growth AlphaDEX® Fund Quarterly $0.0431 FAB NYSE

Arca First Trust Multi Cap Value AlphaDEX® Fund Quarterly $0.0833

FAD NYSE Arca First Trust Multi Cap Growth AlphaDEX® Fund Quarterly

$0.0219 FXD NYSE Arca First Trust Consumer Discretionary AlphaDEX®

Fund Quarterly $0.0125 FXG NYSE Arca First Trust Consumer Staples

AlphaDEX® Fund Quarterly $0.0489 FXN NYSE Arca First Trust Energy

AlphaDEX® Fund Quarterly $0.0494 FXO NYSE Arca First Trust

Financials AlphaDEX® Fund Quarterly $0.0539 FXZ NYSE Arca First

Trust Materials AlphaDEX® Fund Quarterly $0.0476 FXU NYSE Arca

First Trust Utilities AlphaDEX® Fund Quarterly $0.1213 FXL NYSE

Arca First Trust Technology AlphaDEX® Fund Quarterly $0.0098 FNK

NYSE Arca First Trust Mid Cap Value AlphaDEX® Fund Quarterly

$0.0397 FYT NYSE Arca First Trust Small Cap Value AlphaDEX® Fund

Quarterly $0.0077 FMK NYSE Arca First Trust Mega Cap AlphaDEX® Fund

Quarterly $0.0556

First Trust Exchange-Traded

AlphaDEX® Fund II

FEM NYSE Arca First Trust Emerging Markets AlphaDEX® Fund Quarterly

$0.0591 FBZ NYSE Arca First Trust Brazil AlphaDEX® Fund Quarterly

$0.0762 FDT NYSE Arca First Trust Developed Markets Ex-US AlphaDEX®

Fund Quarterly $0.0768 FEP NYSE Arca First Trust Europe AlphaDEX®

Fund Quarterly $0.1010 FJP NYSE Arca First Trust Japan AlphaDEX®

Fund Quarterly $0.0182 FLN NYSE Arca First Trust Latin America

AlphaDEX® Fund Quarterly $0.1263 FPA NYSE Arca First Trust Asia

Pacific Ex-Japan AlphaDEX® Fund Quarterly $0.1871 FKO NYSE Arca

First Trust South Korea AlphaDEX® Fund Quarterly $0.0629 FGM NYSE

Arca First Trust Germany AlphaDEX® Fund Quarterly $0.0091 FCAN NYSE

Arca First Trust Canada AlphaDEX® Fund Quarterly $0.0693 FAUS NYSE

Arca First Trust Australia AlphaDEX® Fund Quarterly $0.3376 FKU

NYSE Arca First Trust United Kingdom AlphaDEX® Fund Quarterly

$0.0778 FHK NYSE Arca First Trust Hong Kong AlphaDEX® Fund

Quarterly $0.0778 FSZ NYSE Arca First Trust Switzerland AlphaDEX®

Fund Quarterly $0.0088 FDTS NYSE Arca First Trust Developed Markets

ex-US Small Cap AlphaDEX® Fund Quarterly $0.0991 FEMS NYSE Arca

First Trust Emerging Markets Small Cap AlphaDEX® Fund Quarterly

$0.0893

First Trust Advisors L.P., the Funds’ investment advisor, along

with its affiliate First Trust Portfolios L.P., are privately-held

companies which provide a variety of investment services, including

asset management and financial advisory services, with collective

assets under management or supervision of approximately $69 billion

as of February 28, 2013, through unit investment trusts,

exchange-traded funds, closed-end funds, mutual funds and separate

managed accounts.

You should consider the investment objectives, risks, charges

and expenses of a Fund before investing. Prospectuses for the Funds

contain this and other important information and are available free

of charge by calling toll-free at 1-800-621-1675 or visiting

www.ftportfolios.com. A prospectus should be read

carefully before investing.

Past performance is no assurance of future results. Principal

Risk Factors: A Fund’s shares will change in value, and you could

lose money by investing in a Fund. An investment in a Fund involves

risk similar to those of investing in any fund of equity securities

traded on exchanges. The risks of investing in each Fund are

spelled out in its prospectus, shareholder report, and other

regulatory filings.

A Fund may invest in small capitalization and mid capitalization

companies. Such companies may experience greater price volatility

than larger, more established companies. A Fund that is

concentrated in securities of companies in a certain sector or

industry involves additional risks, including limited

diversification. A Fund which invests in foreign securities may be

subject to additional risks not associated with domestic

securities. Such risks may be heightened in the case of securities

of emerging markets countries. An index ETF seeks investment

results that correspond generally to the price and yield of an

index. You should anticipate that the value of a Fund’s shares will

decline, more or less, in correlation with any decline in the value

of the index. A Fund’s return may not match the return of the

index. Unlike a Fund, the indices do not actually hold a portfolio

of securities and therefore do not incur the expenses incurred by a

Fund.

An actively managed ETF is subject to management risk because it

is an actively managed portfolio. In managing such a Fund’s

investment portfolio, the portfolio managers will apply investment

techniques and risk analyses that may not have the desired result.

There can be no guarantee that a Fund will meet its investment

objective. Preferred Securities are subject to credit risk,

interest rate risk and income risk. Credit Risk may be heightened

if a Fund invests in “high yield” or “junk” debt. Companies engaged

in the energy sector, which includes MLPs and utilities companies,

are subject to certain risks, including price and supply

fluctuations caused by international politics, energy conservation,

taxes, price controls, and other regulatory policies of various

governments.

Investors buying or selling Fund shares on the secondary market

may incur brokerage commissions. Investors who sell Fund shares may

receive less than the share’s net asset value. Unlike shares of

open-end mutual funds, investors are generally not able to purchase

Fund shares directly from the Fund and individual shares are not

redeemable. However, specified large blocks of shares called

“creation units” can be purchased from, or redeemed to, the

Fund.

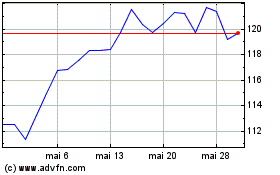

First Trust NASDAQ Clean... (NASDAQ:GRID)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

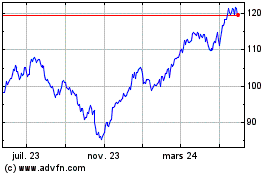

First Trust NASDAQ Clean... (NASDAQ:GRID)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024