UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934

(Amendment No. )

| Filed by the Registrant |

☒ |

| |

|

| Filed by a Party other than the Registrant |

☐ |

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| |

|

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

|

| ☐ |

Definitive Proxy Statement |

| |

|

| ☒ |

Definitive Additional Materials |

| |

|

| ☐ |

Soliciting Material Pursuant to §240.14a-12 |

INPIXON

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other

than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ |

No fee required |

| |

|

| ☐ |

Fee paid previously with preliminary materials. |

| |

|

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Inpixon

2479 E. Bayshore Road, Suite 195

Palo Alto, CA 94303

(408) 702-2167

Dear Inpixon Stockholders:

You recently received proxy

materials relating to several proposals to be voted on by stockholders of Inpixon (the “Company”) at a Special Meeting of

Stockholders originally scheduled to be held on August 3, 2023. You were previously notified that the Special Meeting was postponed to

September 8, 2023, and then further postponed to October 2, 2023. This important notice is to inform you that the Special Meeting has

been rescheduled to September 29, 2023, at 10:00 a.m., Pacific Time. The Special Meeting will still be completely virtual, the record

date for the Special Meeting remains June 21, 2023 (the “Record Date”), and the live audio webcast for the Special Meeting

will be available by visiting www.virtualshareholdermeeting.com/INPX2023.

The information in this letter

is intended to supplement and amend certain information included in the definitive proxy statement relating to the Special Meeting, which

was filed with the Securities and Exchange Commission (the “SEC”) on July 3, 2023 (the “Proxy Statement”), and

the additional definitive proxy information filed from time to time with the SEC (the “Additional Proxy Information”). Capitalized

terms used and not otherwise defined herein have the meanings ascribed to them in the Proxy Statement.

Reduced Quorum Requirement

The purpose of this letter

is to provide new information about the quorum requirement for the Special Meeting. On September 18, 2023, our Board of Directors adopted

resolutions to amend our amended and restated bylaws (our “Bylaws”) to provide that the holders of one-third (33⅓%)

of the shares entitled to vote, present in person or by proxy, will constitute a quorum at all meetings of our stockholders for the

transaction of business (the “Reduced Quorum Requirement”), including at the Special Meeting. Our Bylaws previously provided

that the holders of a majority of the shares entitled to vote, present in person or by proxy, would constitute a quorum at all meetings

of our stockholders for the transaction of business. We adopted the Reduced Quorum Requirement as the vast majority of our stockholders

hold their shares in “street name” in brokerage accounts. This means brokers are responsible for voting the shares unless

the underlying stockholder specifically provides instructions to their broker, and many brokers have put in place policies of not voting

such shares on “discretionary” or “routine” matters, thus resulting in an inability of companies such as ours

to achieve quorum. As a result, many of these shares remain unvoted.

Votes Needed to Hold the Special Meeting

Based on 40,296,799 shares

of Common Stock outstanding as of the Record Date, 13,432,267 shares of Common Stock must be present at the Special Meeting, as postponed,

virtually or by proxy, for there to be a quorum. The 13,432,267 shares of Common Stock now required for there to be a quorum represents

6,716,133 fewer shares than prior to the effectiveness of the Reduced Quorum Requirement.

Revised Vote Requirement for Proposal One

(the Reverse Split Proposal)

As a result of the amendment

to NRS, 78.2055, which was approved by the Nevada Legislature effective May 30, 2023 pursuant to Assembly Bill No. 126, the vote required

for approval of Proposal One has changed. The affirmative vote of the holders of shares of Common Stock representing a majority of the

votes cast by the holders of all of the shares of Common Stock present or represented and entitled to vote at the Special Meeting will

be required for approval of Proposal One. Abstentions will not be treated as votes cast for or against the proposal, and therefore will

have no effect on the outcome of the proposal. Brokers generally have discretionary authority to vote on the amendment to our Articles

of Incorporation to effect a reverse stock split of our outstanding Common Stock.

Impact on Proposals of Reduced Quorum Requirement

The approval of each of Proposal

One (the Reverse Split proposal), Proposal Three (approval of the issuance of shares of Common Stock upon exercise of the Warrants in

accordance with Nasdaq Listing Rule 5635(d)) and Proposal Four (the adjournment proposal) each requires the affirmative vote of the holders

of shares of Common Stock representing a majority of the votes cast by the holders of shares of Common Stock present virtually or represented

by proxy and entitled to vote at the Special Meeting. As a result of the Reduced Quorum Requirement, fewer shares present or represented

and entitled to vote will be required to constitute a quorum at the Special Meeting. This means that, if the number of shares present

or represented at the Special Meeting satisfies the new quorum requirement but is less than a majority of our outstanding shares entitled

to vote, the affirmative vote of fewer shares will be required to approve each of Proposals One, Three and Four than if the Reduced Quorum

Requirement had not been approved.

In contrast, because the approval

of Proposal Two (the Authorized Share Increase proposal) requires the affirmative vote of the holders of shares of Common Stock representing

a majority of the issued and outstanding shares of Common Stock entitled to vote at the Special Meeting (regardless of whether such shares

are present or represented at the Special Meeting), the Reduced Quorum Requirement does not impact the voting requirement for Proposal

Two.

Additional Information

This letter should be read

in conjunction with the Proxy Statement and the Additional Proxy Information, which we encourage you to read carefully and in its entirety

before making a voting decision. To the extent that information in this letter differs from or updates information contained in the Proxy

Statement, the information contained herein supersedes the information contained in the Proxy Statement.

Your vote is very important.

Whether or not you plan to attend the Special Meeting, we encourage you to read the Proxy Statement and the Additional Proxy Information,

as supplemented hereby, and submit your proxy or voting instructions as soon as possible. For instructions on how to vote your shares,

please refer to the Proxy Statement or, if your shares are held in street name, the instructions provided by your bank, broker, or nominee.

We look forward to seeing

you at the Special Meeting.

If you need assistance with

voting your Inpixon shares, please call our proxy solicitation agent, D.F. King toll-free at (800) 829-6551. On behalf of your Board of

Directors, we thank you for your ongoing support of, and continued interest in, Inpixon.

| |

Sincerely yours, |

| |

|

| |

/s/ Nadir Ali |

| |

Nadir Ali |

| |

Chief Executive Officer |

Dated: September 19, 2023

2

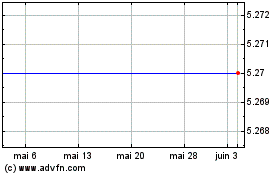

Inpixon (NASDAQ:INPX)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Inpixon (NASDAQ:INPX)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024