0001798270

false

0001798270

2023-06-23

2023-06-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of report (date of earliest event reported): June 23, 2023

Assure Holdings Corp.

(Exact name of registrant as specified in its charter)

| Nevada |

|

001-40785 |

|

82-2726719 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

7887 East Belleview Avenue, Suite 500

Denver, CO |

|

80111 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: 720-287-3093

_____________________________________________

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

|

IONM |

|

NASDAQ Capital Market |

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01. Entry into a Material Definitive

Agreement

On June 23, 2023, Assure Holdings Corp. (the “Company”)

entered into a binding letter of intent with Innovation Neuromonitoring LLC (“Innovation”), dated effective June 22, 2023,

pursuant to which the Company anticipates purchasing certain assets of Innovation, currently used and/or necessary for the business operations

as currently conducted by Innovation (the “Purchased Assets”), including, without limitation, five (5) IONM monitoring machines,

computer records, customer lists, books and records, goodwill, materials, supplies, transferable licenses, business names, contract rights

(other than contracts excluded under the definitive agreement to be finalized between the parties), software and software licenses (to

the extent assignable), trade secrets, trademarks, patents, intellectual property, tradenames, telephone numbers, websites, domain names,

email addresses and other assets used in connection with the operation of Innovation, along with all on-hand inventory, to be delivered

free and clear of all liens and indebtedness. In connection with the Company’s purchase of the Purchased Assets, the Company shall

assume no liabilities.

The Purchased Assets shall be conveyed to the

Company, free and clear of all liens and encumbrances of any kind or nature. The Parties agreed that the target close date for the transactions

would be on or after July 1, 2023.

The total purchase price is $1,200,000 (the “Purchase

Price”). The Purchase Price shall be paid as follows based upon the operations of the acquired business performing a minimum of

3,000 surgeries for the 12 months following the closing date of the transaction with a commercial payor mix of at least 45%. If the operations

perform more than 3,000 procedures with a commercial payor mix of at least 45%, the Company will compensate former shareholders of Innovation

$400 per procedure. Further, if the acquired assets perform fewer than 3,000 procedures during the 12 months following the closing date

of the transaction, the Purchase Price – Cash Over Time (as defined below) shall be reduced by $400 per procedure.

$400,000 of the Purchase Price shall be paid in

common stock of the Company, issued at closing to Innovation. The common stock received by Innovation shall be subject to a 6 month lock-up.

$300,000 of the Purchase Price shall be paid in cash, $100,000 issued on June 23, 2023, $200,000 issued at the closing to Innovation (“Purchase

Price – Cash”). $500,000 of the Purchase Price shall be paid in cash, issued over 24 monthly equal installments to Innovation,

on the first day of each month, beginning on August 1, 2023 (“Purchase Price – Cash Over Time”). The Purchase Price

– Cash Over Time, shall be subject to set off pursuant to the terms and conditions set forth in the definitive agreement for breaches

by Innovation of its obligations under the definitive agreement, including, without limitation, breaches of representations and warranties

and claims in indemnity. The initial $100,000 shall be secured by all the assets of Innovation and related companies and shall accrue

interest at an annualize rate of 15%.

The Parties agreed to memorialize all of their

agreements related to the transactions contemplated in the letter of intent through their mutual execution of a definitive asset purchase

agreement. The definitive agreement shall contain customary covenants, representations, warranties, indemnities and set offs. The Parties

agreed to execute the definitive agreement on or before July 23, 2023.

The consummation of the transactions contemplated

by the letter of intent are subject to the satisfaction of certain customary conditions including the Company's satisfactory completion

of a due diligence review of Innovation, its business operations and the Purchased Assets.

Innovation agreed that it will not directly or

indirectly, through any officer, director, equity holder, partner, member, employee, representative, advisor, or agent of Innovation (each

a “Target Representative”), negotiate with or solicit offers from any potential purchaser of Innovation (or its assets) after

the execution of the letter of intent until the termination of the letter of intent (“Exclusivity Period”). In the event Innovation

receives any inquiry from a party other than Purchaser regarding an acquisition of the equity or assets of Innovation, or otherwise related

to a transaction that would result in a merger of, partnership or joint venture with, or acquisition of Innovation, Innovation shall notify

Purchaser in writing of the details ofsuch inquiry within 48 hours

The letter of intent may be terminated (i) at

any time upon the mutual written consent of the Parties; (ii) by the Company at any time in the event (a) it is not able to obtain the

requisite approvals, or (b) any of the conditions set forth in the letter of intent, including satisfactory completion of diligence, are

not met or waived; or (iii) on July 31, 2023. In the event of a termination of the letter of intent, Innovation will continue to be bound

by its obligations for the repayment of the $100,00 advance and related interest, due within 30 days of termination.

The above is a summary of the material terrms

of the letter of intent and is qualified in its entirety by the letter of intent which is filed as exhibit 10.1 hereto and incorporated

by reference herein.

Item 9.01 Financial

Statements and Exhibits

SIGNATURE

Pursuant to the requirement of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

ASSURE HOLDINGS CORP. |

| |

|

|

| Date: June 29, 2023 |

By: |

/s/ John Price |

| |

Name: |

John Price |

| |

Title: |

Chief Financial Officer |

Exhibit 10.1

June 22, 2023

Anthony Casarez CNIM

President

Innovation Neuromonitoring LLC

Dear Mr. Casarez,

By means of

this Letter of Intent (this “LOI”), Assure Holdings Corp. (“AHC”), on behalf of its to be formed subsidiary (“Purchaser”)

wishes to express its interest to purchase the assets (the “Transaction”) of Innovation Neuromonitoring LLC, (“Innovation”).

Innovation and Purchaser may each be referred to herein as, a “Party” and collectively as, the “Parties” to this

LOI.

The following terms and conditions are intended

to establish the core business and legal terms of the prospective Transaction. The terms and conditions of this LOI shall be binding,

unless otherwise expressly stated herein.

| 1. | Transaction: The Parties anticipate the Transaction taking the form of an asset purchase. Notwithstanding, in the event AHC determines,

during the course of its due diligence review, that an equity purchase transaction would better achieve the Parties goals and objectives

with respect to the contemplated business transactions, the Parties agree to structure the Transaction as an equity purchase. In such

event, the terms and conditions outlined herein shall be included, to the extent possible, and additional and customary terms and conditions

shall be included in the definitive agreements to achieve the intent of the Parties. |

| 2. | Purchased Assets: Purchaser will purchase certain assets of Innovation (those assets expressly included under the Definitive Agreement,

as defined below) currently used and/or necessary for the business operations as currently conducted by Innovation (the “Purchased

Assets”), including, without limitation, five (5) IONM monitoring machines, computer records, customer lists, books and records,

goodwill, materials, supplies, transferable licenses, business names, contract rights (other than contracts excluded under the Definitive

Agreement), software and software licenses (to the extent assignable), trade secrets, trademarks, patents, intellectual property, tradenames,

telephone numbers, websites, domain names, email addresses and other assets used in connection with the operation of Innovation, along

with all on-hand inventory, to be delivered free and clear of all liens and indebtedness. The Purchased Assets shall be conveyed to Purchaser,

free and clear of all liens and encumbrances of any kind or nature. The Parties hereby agree that the target close date for the transactions

contemplated herein (the “Closing”) shall be on or after July 1, 2023. The Parties agree to memorialize all of their

agreements related to the transactions contemplated herein through their mutual execution of a definitive asset purchase agreement (the

“Definitive Agreement”), which agreement will be mutually drafted by the Parties, with the initial draft documents being provided

by Purchaser and its counsel. The Definitive Agreement shall contain customary covenants, representations, warranties, indemnities and

set offs. The Parties acknowledge and agree that the Definitive Agreement may contain such provisions, terms, and conditions as required

to ensure Purchaser’s compliance with applicable law and exchange requirements. The initial Definitive Agreement shall be delivered

by Purchaser to Innovation within 15 days of the Parties mutual execution of this LOI. The Parties mutually agree to execute the Definitive

Agreement on or before July 23, 2023. |

| 3. | Assumed Liabilities: In connection with Purchaser’s purchase of the Purchased Assets, Purchaser shall assume no liabilities. |

| 4. | Purchase Price: The total purchase price is $1,200,000 (the “Purchase Price”) as further outlined herein. The Purchase

Price shall be paid as follows based upon the operations of the acquired business performing a minimum of 3,000 surgeries for the 12 months

following the closing date of this transaction with a commercial payor mix of at least 45%. If the operations perform more than 3,000

procedures with a commercial payor mix of at least 45%, Assure will compensate former shareholders of Innovation $400 per procedure. Further,

if the acquired assets perform fewer than 3,000 procedures during the 12 months following the closing date of this transaction, the Purchase

Price – Cash Over Time shall be reduced by $400 per procedure. For illustrative purposes, if the operations of the acquired assets

perform 3,100 procedures during the twelve months following the closing date of this transaction, with a commercial payor mix of at least

45%, Assure shall pay an additional $40,000. If the operations of the acquired assets perform 2,900 procedures during the twelve months

following the closing date of this transaction, Assure shall withhold $40,000 from the remaining term of Purchase Price – Cash Over

Time. |

$400,000 of the Purchase Price shall

be paid in common stock of AHC, issued at Closing to Innovation. The common stock received by Innovation shall be subject to a 6 month

lock up and shall otherwise be governed by and restricted in accordance with the governing documents of AHC and all applicable laws and

regulations (“Purchase Price – Stock”).

$300,000 of the Purchase Price

shall be paid in cash, $100,000 issued on June 23, 2023, $200,000 issued at the Closing to Innovation (“Purchase Price

– Cash”).

$500,000 of the Purchase Price shall

be paid in cash, issued over 24 monthly equal installments to Innovation, on the first day of each month, beginning on August 1,

2023 (“Purchase Price – Cash Over Time”). The Purchase Price – Cash Over Time, shall be subject to set off pursuant

to the terms and conditions set forth in the Definitive Agreement for breaches by Innovation of its obligations under the Definitive Agreement,

including, without limitation, breaches of representations and warranties and claims in indemnity. The initial $100,000 shall be secured

by all the assets of Innovation and related companies and shall accrue interest at an annualize rate of 15%.

| 5. | Conditions: The consummation of the transactions contemplated by the LOI will be subject to the satisfaction of the following conditions: |

| • | Purchaser's satisfactory completion of a due diligence review of Innovation, its business operations and the Purchased Assets; |

| • | Collaboration between the Innovation and Purchaser to establish a business plan and business model for the balance of 2023; |

| • | Innovation making available to Purchaser all information necessary for Purchaser to conduct its due diligence

review, including, without limitation, financial information, on or before July 1, 2023; |

| • | Innovation obtaining all required corporate approvals, including, without limitation, approval of Innovation, its members/shareholders

and any other party required to approve under the pertinent governing documents; |

| • | The negotiation, execution and delivery of the Definitive Agreement and any related agreements; |

| • | Satisfactory Non-Compete Agreement for Innovation (and any other principals or owners of Innovation, including,

without limitation Anthony Casarez and Jason Ehrhardt (3 years and in the states of Texas, South Carolina, and Arizona). With the exception,

the principals are permitted to personally operate as CNIM providing services to surgeons or hospital facilities not working with Assure,

with the intention of maintaining license requirement; |

| • | Innovation having conducted its operations only in the ordinary course of business and in compliance with

applicable law; |

| • | The absence of any event that would reasonably be expected to have a material adverse effect on Innovation; |

| • | The receipt of required consents from third parties and governmental authorities, including, without limitation,

all third-party consents required for contract assignments, vendor accounts and other similar business relationships Innovation relies

on to conduct its business in the ordinary course; |

| • | Reasonable cooperation between Purchaser and Innovation regarding the allocation of the Purchase Price; |

| • | Approval of any US regulatory bodies/agencies having authority over the Transaction; |

| • | Approval of the board of directors of AHC; |

| • | Approval by Purchaser and Purchaser, including, without limitation, all approvals required under the governing documents of Purchaser

and Purchaser; |

| • | Purchaser’s satisfactory review of Blue Cross Blue Shield, Cigna and United Health Care processes and procedures regarding claims,

including, without limitation, payments and fulfilment; and |

| • | Purchaser’s negotiation of terms of employment with Key Personnel, and negotiation of service agreements with key service providers

and facility providers for post transaction services. |

| 6. | Costs: Each Party will bear its own costs and expenses in connection with this transaction. Notwithstanding the forgoing, in the event

Innovation elects not to proceed with the Transaction, Innovation shall be obligated to pay Purchaser $500,000 as reimbursement for

the costs and expenses incurred by Purchaser in connection with the Transaction. Purchaser and Innovation acknowledge and agree that the

payment contemplated under this Section 5 is the mutually agreeable amount determined by the Parties to be the fair and equitable

payment to compensation Purchaser for the resources invested by Purchaser toward the Transaction. This Section 5 shall be binding

and shall survive the termination of this LOI. |

| 7. | Familiarization: Anthony Casarez and Jason Ehrhardt (the “Key Personnel”) shall, without additional cost to Purchaser,

familiarize and acquaint Purchaser with all material aspects of the business of Innovation (the “Transition Services”) for

30 calendar days from the day of Closing during normal business hours. For the avoidance of doubt, the Transition Services shall include

familiarization with operations, sales, marketing, administration, insurance, customer service, pricing, strategy, and all other transition

training reasonably requested by Purchaser. Following 30 calendar days, the Key Personnel and Purchaser shall mutually agree upon the

terms and conditions of the Key Personnel’s continued performance of services on behalf of Purchaser, to be memorialized in a mutually

agreeable form of agreement that details the scope of services and compensation. Innovation acknowledges and agrees that it is the expectation

of Purchaser that the Key Personnel continue to be involved and participate in the going concern business post-closing. Purchaser and

the Key Individuals shall, in good faith and in advance of Closing, agree upon terms of post-transaction employment, including mutually

agreeable offer letters, that include and reflect terms of employment consistent with Purchaser’s or AHC’s existing employment

structure. |

| 8. | Intent of the Parties: It is understood and agreed that this

LOI, when executed by all of the Parties hereto, constitutes a statement of mutual intentions with respect to the proposed Transaction,

does not contain all matters upon which agreement must be reached in order for the proposed transaction to be consummated but certain

terms are considered a binding agreement with respect to the proposed transaction itself. The Definitive Agreement is subject to the

terms and conditions to be expressed therein. This LOI may be terminated (i) at any time upon the mutual written consent of the

Parties; (ii) by Purchaser at any time in the event (a) it is not able to obtain the requisite approvals, or (b) any of

the conditions set forth in paragraph 5 are not met or waived; or (iii) on July 31, 2023. In the event of a termination of

this LOI, the Parties shall have no continuing obligations to each other, provided however that each Party will continue to be bound

by its obligations of confidentiality set forth in the Non-Disclosure Agreement, a copy of which is attached hereto as Exhibit A,

and Innovation will continue to be bound by its obligations under Section 6 and repayment of the $100,00 advance and related interest,

due within 30 days of termination. This LOI and the Non-Disclosure Agreement may be executed in one or more counterparts. This LOI, the

Non-Disclosure Agreement and the Definitive Agreement shall be governed by Colorado law and each Party hereto hereby submits to the jurisdiction

of the Federal and State Courts sitting in Denver, Colorado. |

| 9. | Innovation agrees that it will not directly or indirectly, through any officer, director, equity holder, partner, member, employee,

representative, advisor, or agent of Innovation (each a “Target Representative”), negotiate with or solicit offers from any

potential purchaser of Innovation (or its assets) after the execution of this LOI until the termination of this LOI (“Exclusivity

Period”). In the event Innovation receives any inquiry from a party other than Purchaser regarding an acquisition of the equity

or assets of Innovation, or otherwise related to a transaction that would result in a merger of, partnership or joint venture with, or

acquisition of Innovation, Innovation shall notify Purchaser in writing of the details of such inquiry within 48 hours. |

| 10. | No Party shall issue any press

release or make any public announcement relating to the subject matter of this LOI prior to Closing without the prior written approval

of the other Party, except as necessary to comply with applicable law, comply with regulatory or exchange requirements or to enforce

a Party's rights hereunder. |

| 11. | In the event that a formal Definitive

Agreement is not executed, each Party agrees to return or destroy any materials delivered to it under this LOI. |

[Signature page follows]

In Witness Whereof, the undersigned

have executed this LOI as of the date first set forth above, notwithstanding the actual date of execution. Each of the undersigned represents

to the other Parties hereto that such Party has the authority to enter into this LOI.

| |

Purchaser: |

|

| |

|

|

| |

Assure Holdings Corp. |

|

| |

|

|

| |

|

|

| |

By: |

/s/ John Farlinger |

|

| |

Name: John Farlinger |

|

| |

Title: Chairman and CEO |

|

This LOI shall remain open for acceptance by Innovation

Neuromonitoring LLC until 5:00pm Mountain Time on June 23, 2023. If not accepted by such time, this LOI shall be void,

terminated and no longer open for acceptance.

| |

Accepted: |

|

| |

|

|

| |

Innovation Neuromonitoring LLC |

|

| |

|

|

| |

|

|

| |

By: |

/s/ Anthony Casarez |

|

| |

Name: |

Anthony Casarez |

|

| |

Title: |

President |

|

| |

|

|

| |

|

|

| |

By: |

/s/ Jason Ehrhardt |

|

| |

Name: |

Jason Ehrhardt |

|

| |

Title: |

Executive Director |

|

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

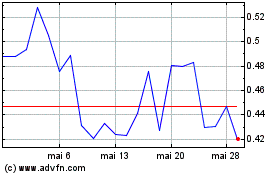

Assure (NASDAQ:IONM)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Assure (NASDAQ:IONM)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025