FY

true

0001807887

0001807887

2023-01-01

2023-12-31

0001807887

2023-06-30

0001807887

2024-04-10

0001807887

2023-12-31

0001807887

2022-12-31

0001807887

2022-01-01

2022-12-31

0001807887

us-gaap:PreferredStockMember

2021-12-31

0001807887

us-gaap:CommonStockMember

2021-12-31

0001807887

LASE:SharesToBeIssuedMember

2021-12-31

0001807887

us-gaap:TreasuryStockCommonMember

2021-12-31

0001807887

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001807887

us-gaap:RetainedEarningsMember

2021-12-31

0001807887

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2021-12-31

0001807887

2021-12-31

0001807887

us-gaap:PreferredStockMember

2022-12-31

0001807887

us-gaap:CommonStockMember

2022-12-31

0001807887

LASE:SharesToBeIssuedMember

2022-12-31

0001807887

us-gaap:TreasuryStockCommonMember

2022-12-31

0001807887

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001807887

us-gaap:RetainedEarningsMember

2022-12-31

0001807887

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-12-31

0001807887

us-gaap:PreferredStockMember

2022-01-01

2022-12-31

0001807887

us-gaap:CommonStockMember

2022-01-01

2022-12-31

0001807887

LASE:SharesToBeIssuedMember

2022-01-01

2022-12-31

0001807887

us-gaap:TreasuryStockCommonMember

2022-01-01

2022-12-31

0001807887

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-12-31

0001807887

us-gaap:RetainedEarningsMember

2022-01-01

2022-12-31

0001807887

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-01-01

2022-12-31

0001807887

us-gaap:PreferredStockMember

2023-01-01

2023-12-31

0001807887

us-gaap:CommonStockMember

2023-01-01

2023-12-31

0001807887

LASE:SharesToBeIssuedMember

2023-01-01

2023-12-31

0001807887

us-gaap:TreasuryStockCommonMember

2023-01-01

2023-12-31

0001807887

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-12-31

0001807887

us-gaap:RetainedEarningsMember

2023-01-01

2023-12-31

0001807887

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-01-01

2023-12-31

0001807887

us-gaap:PreferredStockMember

2023-12-31

0001807887

us-gaap:CommonStockMember

2023-12-31

0001807887

LASE:SharesToBeIssuedMember

2023-12-31

0001807887

us-gaap:TreasuryStockCommonMember

2023-12-31

0001807887

us-gaap:AdditionalPaidInCapitalMember

2023-12-31

0001807887

us-gaap:RetainedEarningsMember

2023-12-31

0001807887

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-12-31

0001807887

srt:ScenarioPreviouslyReportedMember

2022-12-31

0001807887

srt:RevisionOfPriorPeriodReclassificationAdjustmentMember

2022-12-31

0001807887

LASE:AsRestatedMember

2022-12-31

0001807887

srt:ScenarioPreviouslyReportedMember

2022-01-01

2022-12-31

0001807887

srt:RevisionOfPriorPeriodReclassificationAdjustmentMember

2022-01-01

2022-12-31

0001807887

LASE:AsRestatedMember

2022-01-01

2022-12-31

0001807887

srt:ScenarioPreviouslyReportedMember

2021-12-31

0001807887

srt:RevisionOfPriorPeriodReclassificationAdjustmentMember

2021-12-31

0001807887

LASE:AsRestatedMember

2021-12-31

0001807887

us-gaap:WarrantMember

2023-01-01

2023-12-31

0001807887

us-gaap:EmployeeStockOptionMember

2022-01-01

2022-12-31

0001807887

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

LASE:TwoCustomersMember

2022-01-01

2022-12-31

0001807887

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

LASE:NoCustomersMember

2023-01-01

2023-12-31

0001807887

LASE:OneCustomersMember

2022-01-01

2022-12-31

0001807887

LASE:OneCustomersMember

2023-01-01

2023-12-31

0001807887

LASE:OfficeFurnitureAndFixturesMember

srt:MinimumMember

2023-12-31

0001807887

LASE:OfficeFurnitureAndFixturesMember

srt:MaximumMember

2023-12-31

0001807887

us-gaap:MachineryAndEquipmentMember

srt:MinimumMember

2023-12-31

0001807887

us-gaap:MachineryAndEquipmentMember

srt:MaximumMember

2023-12-31

0001807887

us-gaap:FiniteLivedIntangibleAssetsMember

2023-12-31

0001807887

us-gaap:MachineryAndEquipmentMember

2023-12-31

0001807887

us-gaap:MachineryAndEquipmentMember

2022-12-31

0001807887

LASE:OfficeFurnitureAndComputerEquipmentMember

2023-12-31

0001807887

LASE:OfficeFurnitureAndComputerEquipmentMember

2022-12-31

0001807887

us-gaap:VehiclesMember

2023-12-31

0001807887

us-gaap:VehiclesMember

2022-12-31

0001807887

us-gaap:InProcessResearchAndDevelopmentMember

2023-12-31

0001807887

us-gaap:InProcessResearchAndDevelopmentMember

2022-12-31

0001807887

us-gaap:LeaseholdImprovementsMember

2023-12-31

0001807887

us-gaap:LeaseholdImprovementsMember

2022-12-31

0001807887

LASE:DemostrationEquipmentMember

2023-12-31

0001807887

LASE:DemostrationEquipmentMember

2022-12-31

0001807887

us-gaap:CustomerRelationshipsMember

2023-12-31

0001807887

us-gaap:CustomerRelationshipsMember

2022-12-31

0001807887

LASE:EquipmentDesignDocumentationMember

2023-12-31

0001807887

LASE:EquipmentDesignDocumentationMember

2022-12-31

0001807887

LASE:OperationalSoftwareAndWebsiteMember

2023-12-31

0001807887

LASE:OperationalSoftwareAndWebsiteMember

2022-12-31

0001807887

us-gaap:TrademarksMember

2023-12-31

0001807887

us-gaap:TrademarksMember

2022-12-31

0001807887

LASE:LicenseAndPatentsMember

2023-12-31

0001807887

LASE:LicenseAndPatentsMember

2022-12-31

0001807887

2022-10-04

2022-10-04

0001807887

LASE:ICTInvestmentsLLCMember

2022-12-31

0001807887

LASE:ICTInvestmentsLLCMember

LASE:DmitriyNikitinMember

2023-12-31

0001807887

LASE:LongTermLiabilitiesMember

LASE:ICTPromissoryNoteTwoMember

2020-10-31

0001807887

LASE:LongTermLiabilitiesMember

LASE:ICTPromissoryNoteTwoMember

2020-10-01

2020-10-31

0001807887

LASE:ICTPromissoryNoteMember

2022-09-30

0001807887

LASE:ICTPromissoryNoteMember

2022-09-01

2022-09-30

0001807887

srt:ChiefFinancialOfficerMember

2023-04-01

2023-04-30

0001807887

LASE:FononTechnologiesIncMember

2023-10-01

2023-10-31

0001807887

LASE:FononTechnologiesMember

2023-10-01

2023-10-31

0001807887

LASE:DmitriyNikitinMember

2023-01-01

2023-12-31

0001807887

LASE:DmitriyNikitinMember

2022-01-01

2022-12-31

0001807887

LASE:ICTInvestmentsMember

2023-01-01

2023-12-31

0001807887

LASE:ICTInvestmentsMember

2022-01-01

2022-12-31

0001807887

us-gaap:SubsequentEventMember

LASE:JadeBarnwellMember

2024-02-02

2024-02-02

0001807887

us-gaap:StockOptionMember

2023-01-01

2023-12-31

0001807887

us-gaap:StockOptionMember

2023-12-31

0001807887

LASE:TraDigitalMember

2023-04-01

2023-06-30

0001807887

LASE:TimSchickMember

2023-04-01

2023-06-30

0001807887

LASE:FononTechnologiesIncMember

2023-10-01

2023-12-31

0001807887

2022-10-01

2022-12-31

0001807887

2023-10-01

2023-10-31

0001807887

2023-10-31

0001807887

LASE:AlexanderCapitalMember

2022-12-12

0001807887

2021-10-31

0001807887

2021-10-01

2021-10-31

0001807887

2022-12-01

2022-12-31

0001807887

2020-01-01

0001807887

us-gaap:SubsequentEventMember

LASE:JadeBarnwellMember

2024-02-02

0001807887

srt:ScenarioPreviouslyReportedMember

2023-12-31

0001807887

srt:RevisionOfPriorPeriodReclassificationAdjustmentMember

2023-12-31

0001807887

srt:ScenarioPreviouslyReportedMember

2023-01-01

2023-12-31

0001807887

srt:RevisionOfPriorPeriodReclassificationAdjustmentMember

2023-01-01

2023-12-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

utr:sqft

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

10-K/A

Amendment

No. 2

| ☒ |

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR

THE FISCAL YEAR ENDED DECEMBER 31, 2023

OR

| ☐ |

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR

THE TRANSITION PERIOD FROM __________ TO __________

COMMISSION

FILE NUMBER 001-41515

| Laser

Photonics Corporation |

| (Exact

name of registrant as specified in its charter) |

| Delaware

|

|

84-3628771 |

State

or other jurisdiction of

Incorporation

or Organization |

|

I.R.S. Employer

Identification No. |

1101

N. Keller Road, Suite G

Orlando,

FL |

|

32810 |

| Address

of Principal Executive Offices |

|

Zip

Code |

(407)

804 1000

Registrant’s

Telephone Number, Including Area Code

________________________________________________________________

Former

Name, Former Address and Former Fiscal Year, if Changed Since Last Report

SECURITIES

REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT: NONE

SECURITIES

REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT:

COMMON

STOCK, $0.001 PAR VALUE

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

LASE |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed be Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data

File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding

12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (Section 229.405 of this chapter) is not contained

herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated

by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company,

or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| Non-accelerated

Filer |

☒ |

Smaller

reporting company |

☒ |

| |

|

Emerging

growth company |

☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒.

As

of December 31, 2023, and as of the date this Form 10-K is filed with the Securities and Exchange Commission, the Registrant’s

common stock is trading on the NASDAQ under the ticker symbol “LASE”.

0

As

of April 10, 2024, there were 9,270,419 shares of the registrant’s Common Stock outstanding.

EXPLANATORY

NOTE

Laser

Photonics Corporation (the “Company”) is filing this Amendment No. 2 (“Amendment No. 2”) to its

Annual Report on Form 10-K for the year ended December 31, 2023, as filed with the Securities Exchange Commission (“SEC”)

on April 9, 2024 (the “Original Filing”) and as amended by Amendment No. 1 as filed with the SEC on August 28, 2024

(“Amendment No. 1”) in response to a comment letter dated September 4, 2024, from the SEC and to add “restated”

to the columns in our restated financial statements, make clear that internal controls over financial reporting and disclosure controls

and procedures were not effective as of December 31, 2023, and to update the certifications of our Chief Executive Officer and Chief

Financial Officer (Exhibits 31.1, 31.2, 32.1 and 32.2), as required under Sections 302 and 906 of the Sarbanes-Oxley Act of 2002.

This Amendment No. 2 continues to speak as of the

date of Amendment No. 1 and does not reflect events that may have occurred subsequent to the filing date of Amendment No. 1 and does not

modify or update in any way disclosures made in Amendment No. 1 except as set forth above.

FORWARD

LOOKING STATEMENTS

The

Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for forward-looking statements, which are identified

by the words “believe,” “expect,” “anticipate,” “intend,” “plan” and similar

expressions. The statements contained herein which are not based on historical facts are forward-looking statements that involve known

and unknown risks and uncertainties that could significantly affect our actual results, performance or achievements in the future and,

accordingly, such actual results, performance or achievements may materially differ from those expressed or implied in any forward-looking

statements made by or on our behalf. These risks and uncertainties include, but are not limited to, risks associated with our ability

to successfully develop and protect our intellectual property, our ability to raise additional capital to fund future operations and

compliance with applicable laws and changes in such laws and the administration of such laws. These risks are described below and in

“Item 1. Business,” Item 1A “Risk Factors,” “Item 7. Management’s Discussion and Analysis of Financial

Condition and Results of Operations,” and “Item 7A. Quantitative and Qualitative Disclosures About Market Risk” included

in this Form 10-K. Readers are cautioned not to place undue reliance on these forward-looking statements which speak only as of the date

the statements were made.

TABLE

OF CONTENT

PART

I

ITEM

1. BUSINESS

OVERVIEW

We

are pioneering a new generation of laser blasting technologies focused on disrupting the sandblasting and abrasives blasting markets.

We offer a full portfolio of integrated laser blasting solutions for corrosion control, rust removal, de-coating, pre- and post-welding,

laser cleaning and surface conditioning. Our solutions span use cases throughout product lifecycles, from product fabrication to maintenance

and repair, as well as aftermarket operations. Our laser blasting solutions are applicable in every industry dealing with materials processing,

including automotive, aerospace, healthcare, consumer products, shipbuilding, aerospace, heavy industry, machine manufacturing, nuclear

maintenance and de-commissioning and surface coating.

We

believe that our laser cleaning technology, which we refer to as Laser Blasting™, is one of the most exciting and transformational

innovations of our time. It has the capacity to change the way society combats corrosion, nuclear contamination (transmutation), material

surface preparation, rust removal, equipment and engine maintenance and repair, as well as myriad number of other industrial processes,

currently employing unhealthy, dangerous, and environmentally hazardous old technologies. Our mission is to make laser blasting accessible

to operation personnel in every industry involved in any type of material treatment. In doing so, we believe we will empower businesses

to adopt radical new approach to design, produce, maintain and repair equipment utilizing cleaner, safer, energy efficient and more cost-effective

laser-based technologies to outcompete and outperform competitors using obsolete 19th century technologies. With our state-of- the-art

technology, small service companies working in high-growth industries can achieve superior financial results that will propel future

global economic growth.

At

this moment, “do no harm” corporate social responsibility initiatives have combined with legislative and social initiatives

to safeguard the health of workers, while protecting the environment, and lowering carbon emissions. In the case of the world’s

largest single market for industrial laser cleaning—the United States—legislative and regulatory crackdown on the use of

abrasives blasting, coupled with official government policy requiring government agencies to Buy American products whenever possible

are barriers to entry for most companies trying to compete in the industrial laser cleaning equipment market.

By

introducing our cleaner, safer, energy efficient, and more cost-effective laser-based technologies to replace antiquated hazard-prone

abrasives blasting methods—sandblasting, abrasive blasting, grinding, chemical etching and the use of toxic chemical solvents—

we believe that we are positioned with the right technology, at the right time, and in the right place to provide the solution that will

disrupt the abrasives blasting industry.

In

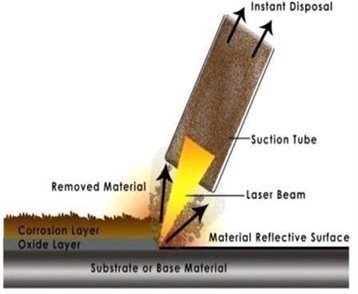

contrast to abrasive cleaning, laser cleaning is a non-contact and non-abrasive process to remove contaminants or impurities on the surface

of metals by physically removing the upper layer of the substrate using laser irradiation and where a desired depth can be achieved with

a high degree of accuracy and throughput. We expect to introduce the new laser-based transmutation process into maintenance and decommissioning

of nuclear facilities, as studies have shown that metal surfaces in those facilities have been exposed to radiation and that the radioactivity

is primarily located in the oxide layer. Accordingly, we propose to develop the decontamination of metallic surfaces by laser ablation

which consists of ejecting surface contamination using high energy pulses and trapping ablated matter (the impurities removed from the

metal’s surface) in a filter to avoid its release into the environment. We believe that laser cleaning has many advantages over

abrasive cleaning methods such as the minimization of secondary waste, the absence of effluents and the reduction of the exposure of

workers to toxic waste through automation of the cleaning process.

Our

potential to capitalize on this significant opportunity set is rooted in our deep experience in, and our commitment to, research and

development. Our engineering efforts are led by a team of world-renowned experts in advanced manufacturing, material science and engineering.

Our in-house R&D team is led by Igor Vodopiyanov, a PhD particle physicist who served as a lead subject matter expert at the CERN

Large Hadron Collider, and who managed the Hadron Calorimeter Calibration and Condition Group of the CMS Collaboration, members of the

particle physics community from across the globe in a quest to advance humanity’s knowledge of the very basic laws of our Universe.

Our

announced laser blasting solutions are as follows:

Handheld

Laser Blasting™: We offer the widest line of Class IV handheld laser blasting equipment in the world, from 20W (watt) to 3000W

system, including the world’s most powerful production Laser Blaster™ on the market—the Jobsite 2000—to the even

more powerful JobSite 3000 which debuts at Aviation Week’s MRO Americas 21 trade show at the end of April 2021. We have under development

our most powerful laser blasting equipment, our 4000W handheld system.

Laser

Blasting Cabinet: This affordable and safe solution is configured as a fully enclosed Class 1 workspace, designed to replace sandblasting

enclosures, along with their noise, dust, media storage, replenishment, and clean-up requirements. The Blasting Cabinet is ideal for

companies of any size that use abrasive blasting or chemical baths to clean parts or prepare materials.

Class

I Laser Blasting Systems: Our Mega Center and Titan lines of Class I Laser Blasting Systems are designed with mass production in mind.

These production line-capable systems are designed with automation control and automated materials-loading capabilities to allow for

maximum throughput on assembly lines for high production/high precision environments.

Robotic

Laser Blasting Cells with AI: Robots are intended to lighten the workload for us humans. We achieve this with user programmable AI (UPAI)

driving our C-Robots. Line workers can quickly and easily program these precision robots to complete complex and repetitive tasks in

high throughput production environments.

We

initiated our sales effort in December 2019. By December 31, 2022, we had gross sales of $5,078,539 and net sales of $4,954,689. We sell

our products globally to end users, and principally to Fortune 1000 companies, as well as to agencies of the U.S. Government.

Our

vertically integrated operations allow us to reduce development and advanced laser equipment manufacturing time, offer better prices,

control quality, and protect our proprietary knowhow and technology compared to other laser cleaning companies and companies with competing

technologies.

We

market our products globally through our direct sales force located in the United States and a few sales representatives located in Europe,

Japan and South Asia.

We

have an exclusive license agreement with ICT Investments. Under the terms of this agreement, we have a perpetual, worldwide, exclusive

license to sell the Laser Photonics™ branded equipment for laser cleaning and rust removal. Through our affiliation with ICT, its

portfolio companies, and their customers, we have instant access to more than 1,500 high profile Fortune 5000 customer prospects as well

as recognition as a global leader in manufacturing premium laser equipment. In addition, through the expertise and reputation of our

officers, Board members and advisors, we have the foundation of our technologically advanced, disruptive laser systems specifically suited

for most material processes with specific cleaning requirements and challenges.

At

our core, we are a company of innovators. We are led by visionary technologists and a team of proven leaders with experience bringing

emerging technologies to market across the hardware, materials, and software sectors. We believe that our technologies have the potential

to empower engineers and designers to adopt laser blasting as the only known alternative to sand blasting and to drive new application

discovery as well as to provide manufacturers with reliable and high-performance solutions that will facilitate their production capabilities

and maintenance, repair, and operations (“MRO”).

Our

principal executive offices are located at 1101 N. Keller Rd., Suite G, Orlando, Florida 32810, and our telephone number is (407) 804-1000.

Our

Market

Our

market encompasses industrial de-painting, surface preparation, coating and corrosion control space. This includes media blasting or

sandblasting, dry ice blasting and laser cleaning or laser blasting. According to Global Market Insights, the laser cleaning market value

is estimated at $9 billion in 2021 and projected to be $12 billion by 2025, which includes laser cleaning for maintenance repair operations.

Market growth is driven by the increasing demand for robotic cleaning technology, growth in the automotive industry, as well as demand

in construction and metalworking industries.

In

addition, we see the greatest opportunity for growth in the disruption of the global abrasives blasting media and equipment markets,

cumulatively worth $46 billion. Media blasting is used in nearly every heavy industry, but for health, environmental and safety reasons,

media blasting is being regulated into obsolescence. A safer alternative, albeit not without risks, is dry ice blasting. It is expensive

to operate, and like media blasting, it is prone to equipment failure.

Considering

the regulatory pressures on media blasting and the higher costs of both media blasting and dry ice blasting, we believe that efficient

laser cleaning or laser blasting will disrupt the blast cleaning market and emerge as the clean, efficient and low-cost alternative blast

cleaning method.

We

offer the latest generation of laser material processing equipment for a variety of industrial markets and applications, including for

defense, space exploration, aerospace, automotive, medical, industrial, electronic and agriculture markets.

We

believe that the laser cleaning equipment market has even a greater potential for growth considering the size of the $10 billion abrasive

cleaning market, and the ancillary $1 billion sandblasting media market, which are being pressured into obsolescence from regulatory

agencies and the demands of labor tasked with cleaning industrial equipment. These market pressures, driven by health, safety and environmental

concerns, are accelerating the replacement of abrasive blasting and laser cleaning is emerging as the safe, clean, efficient and affordable

alternative.

The

growth of the laser cleaning market is attributable to the benefits it provides over traditional cleaning methods, such as abrasive media

blasting, dry-ice blasting, and chemical cleaning processes, all of which are inherently hazardous to the health of workers, as well

as to the environment since they generate a considerable amount of potentially harmful waste.

Our

laser cleaning equipment also facilitates our customers’ compliance with the Occupational Safety and Health Administration (OSHA)

and the Environmental Protection Agency (EPA) regulations to protect the health of workers using conventional abrasive blasting equipment.

The current OSHA permissible exposure limit (PEL) for respirable crystalline silica (quartz) is 100µg/m3 as an 8-hour time-weighted

average (TWA).

All

our Class I product enclosures are built and labeled to meet or exceed the guidelines established by the Food and Drug Administration’s

(FDA) Center for Devices and Radiological Health (CDRH) that regulates the manufacture of radiation emitting electronic products. The

CDRH does not issue certificates of compliance. Instead, the CDRH relies on a system of self-certification. That certification of compliance

is based on a prescribed testing program that ensures that safety standards have been met. In accordance with HHS Publication FDA 86-8260,

COMPLIANCE GUIDE FOR LASER PRODUCTS, we follow the FDA CDRH published reporting guidelines for the testing and certification of laser

products. This includes submitting required reports to CDRH, including Annual Reports summarizing required records, including product

names, model numbers, and lasers medium or wavelengths. In compliance with CDRH guidelines, we maintain records of each product produced

and sold.

Our

Market Opportunity

Just

one of the global markets, the MRO industry, has a total market value of $150.64 billion as of 2021, with forecast revenue of $178.85

billion for 2028. Annual Pentagon spending on corrosion control alone is forecast to be $22 billion.

The

North America MRO distribution market size was valued at $142.65 billion in 2020 and is expected to grow at a compound annual growth

rate (CAGR) of 2.9% from 2021 to 2028 according to a report by Grand View Research, Inc. Various initiatives by manufacturers to attain

optimum efficiency are expected to drive market growth over the forecast period. MRO distribution is one of the critical components of

the industry, which is necessary to eliminate downtime. As a result, industries initiate multiple scheduled and preventive maintenance

processes. Industries, where supply activities have little direct accountability, might be driven by stock-outs rather than to any overarching

supply chain plan.

Of

the anticipated $178.85 billion MRO market in North America in 2028, $46 billion is spent on corrosion control using media blasting and

chemical processes that are under regulatory and market pressures to be phased out because of their known harmful effects on workers

and the environment. These pressures, driven by health, safety, and environmental concerns, are accelerating the replacement of abrasive

blasting and laser cleaning is emerging as the safe, clean, efficient, and affordable alternative.

The

company started the Service Partners Network, (or SPN), as a program to mobilize demonstration units as an outreach to better connect

the customers with the technology and product. In efforts to help those interested in starting a mobile laser cleaning service or rental

service as a member of our Service Partners Network. This would also generate equipment sales and at the same time show the capabilities

of the product and technology. As being part of the Service Partners Network, Laser Photonics Corp Marketing arm would provide leads

to these members at a fee to also help generate long-term revenue opportunity.

Our

business is disruptive and in the very beginning of its lifespan and expansion. We have a unique opportunity to displace abrasives and

dry-ice blasting with an accepted and readily adopted alternative. We believe that we have taken very effective actions to develop and

offer to the market the broadest range of laser cleaning and blasting equipment in the very beginning of the unfolding of this market

opportunity. We believe that we will be rewarded for this strategy through explosive growth of sales, together with the expansion of

the market in accordance with the wide acceptance of laser blasting as a new industry standard.

Industry

Background

Conventional

sandblasting processes have numerous shortcomings. For this reason, the abrasives blasting (sandblasting) market in North America is

under extreme pressure to phase out the nineteenth-century sandblasting method of industrial cleaning to safeguard both workers and the

environment. In 2019 alone there were 2,500 violations of respirator protection which were included in OSHA’s top ten violations.

Government regulators (EPA, FDA, and OSHA) all recognize the term “silica” refers broadly to the mineral compound silicon

dioxide (SiO2), which can be crystalline or amorphous in molecular structure. The Silica standards apply only to crystalline silica -

not amorphous silica. Quartz is the most common form of crystalline silica, and cristobalite is also sometimes encountered in the workplace.

OSHA’s focus was on the issues related to the inhalation of respirable dust, which is generally defined as particles that can reach

the pulmonary region of the lung (i.e., particles less than 10 microns (µm) in aerodynamic diameter), in the form of either quartz

or cristobalite. Exposure to crystalline forms of silica is associated with several health effects, including silicosis derived from

the use of abrasive sand blasting are severely curtailing media blasting activities. They are quick to levy hefty fines for non-compliance.

Crystalline

Silica dust has been identified by the EPA as a human lung carcinogen. In reaction to the greater awareness of its dangers, OSHA has

targeted silica sand blasting as a primary, yet preventable, source for silicosis disease. Their efforts at enforcement of current regulations,

as well as new, and tighter laws, mean any contractor attempting to use silica-based media (sand) will be targeted. Accordingly, the

use of “sand” blasting has declined over the years. Now, with OSHA’s new standard looming, those that are still relying

on this technology are scrambling to find alternatives that meet these new particulate limits. Recently, Levi Strauss & Co. and H&M

announced a global ban on sandblasting in all their product lines, across all of their brands. In addition, some countries, such as the

United Kingdom, and major cities, including Victoria, Canada and Queensland, Australia, have banned abrasive sandblasting.

For

centuries, the techniques and equipment used for surface cleaning or renewal in industrial applications have remained the same. The demand

for improvements, however, has grown dramatically in recent years. Laser technology is now replacing conventional abrasive and chemical

processes in many applications, such as rust removal, de-painting, degreasing, activation, restoration, pre-/post-welding joint cleaning,

surface preparation, decontamination, and rejuvenation. As a cleaning technique, lasers are increasingly popular because they are precise,

controllable, and efficient, and they generate low waste. Additionally, low waste and high efficiency are the primary reasons that laser

cleaning is now considered the “greenest” or most environmentally friendly approach to surface cleaning. The only waste created

is dust particles, which can be easily collected and removed.

Our

Growth Strategy

Our

strategy is to expand our product offerings with a focus on integrated solutions that make laser blasting suitable for production applications

and accessible to a broad audience. The key elements of our strategy for growth include the following:

New

Product Development

We

intend to target new applications early in the development cycle and drive adoption by leveraging our strong customer relationships,

engineering expertise and competitive production costs.

Multi-market

and Multi-product Approach

We

intend to develop and manufacture laser systems for a variety of markets to reduce the financial impact that a downturn in any one market

would have with an emphasis developing standard systems applicable for a variety of markets and applications. We expect to increase sales

through an industry recognized expertise in clearly defined markets with substantial sales demand such as rust removal equipment for

the shipbuilding industry, laser de-contamination equipment for the nuclear industry and laser blasting cabinets for the general manufacturing

industry.

Extend

Our Distribution Channels and Reach.

We

have an inside sales force actively marketing in the Americas (North, Central and South America). In addition, we have a network of outside

sales reps in North America, as well as international representation in Europe (based in Czech Republic), Asia (based in Japan), and

the Middle East and North Africa (based in UAE). We intend to add distributors based on geographic coverage and sales capacity, as well

as to develop industry-specific expertise to drive penetration in vertical markets such as automotive, aerospace, defense, energy and

manufacturing. We expect to continue building out sales channels for capital equipment by partnering with additional volume distributors

of equipment and hardware, as well as to expand our internal sales infrastructure and online sales presence. To augment the reach of

our distribution network, we intend to grow our direct sales efforts focused primarily on serving major accounts and expanding our footprint

within Fortune 500 companies and government organizations worldwide.

Broaden

Our Diverse, Global Customer Base.

We

expect to develop a globally diversified customer base and broaden customer relationships in a variety of industries. We seek to differentiate

ourselves from our competitors through superior product pricing, performance, and service. We believe that a global presence and investments

in application engineering and support will create competitive advantages in serving multinational and local companies.

Promote

Awareness Through Training and Education.

As

businesses increasingly embrace laser blasting over the next decade, we intend to educate the market on best practices for adoption of

the technology across the entire product life cycle. Our leadership position provides a platform to deliver this education both for our

existing customers and the market. Such an education is a critical component of our sales and marketing efforts. We believe businesses

that are well-informed or that have firsthand experience of the benefits of our laser blasting solutions relative to conventional manufacturing

are more likely to purchase and expand their use of our products and services over time. To drive such awareness, we are developing rich

laser blasting content and curricula for delivery through both online and in-person media, including classes, programs, certifications,

and professional services. We also intend to develop global centers of excellence, leveraging our own headquarters in conjunction with

our distribution network’s presences, to serve as showrooms, learning facilities and focal points for laser blasting-focused professional

services.

Pursue

Strategic Acquisitions and Partnerships.

We

intend to selectively pursue acquisitions and/or equity investments in businesses that represent a strategic fit and are consistent with

our overall growth strategy. Such partnerships would allow us to accelerate market penetration of our laser blasting solutions by enabling

expansion of our product portfolio, access to new markets, and a stronger value proposition for our customers while delivering margin

improvements and increased customer lifetime value. We believe that because of our core focus on engineering and technology development

as well as our unique distribution network, we will be able to integrate and drive adoption of new technologies and capabilities acquired

via strategic partnerships.

Service

Partner Network

The

company started the Service Partners Network, (or SPN), as a program to mobilize demonstration units as an outreach to better connect

the customers with the technology and product. In efforts to help those interested in starting a mobile laser cleaning service or rental

service as a member of our Service Partners Network. This would also generate equipment sales and at the same time show the capabilities

of the product and technology. As being part of the Service Partners Network, Laser Photonics Corp Marketing arm would provide leads

to these members at a fee to also help generate long-term revenue opportunity. We intend to further develop the SPN to enhance our Equipment

Demo and Training capabilities throughout the Nation.

Our

Competitive Strengths

We

are an early pioneer in the laser blasting industry with a mission to make the technology accessible to all material processing manufacturers

and maintenance and repair facilities in both commercial and military applications. We believe our collective expertise coupled with

the following competitive strengths, will allow us to maintain and extend a leadership position in the next generation of laser blasting

equipment and expand our market opportunities.

We

also have established a base of customers among several U.S. Government agencies which we expect to expand. Each branch of the U.S. military,

including the Army, Air Force, Navy, Marines, and the Coast Guard, has purchased laser cleaning systems from us. In addition, NASA and

the Veteran’s Administration are also among our customers. We believe that our laser cleaning equipment has been well-received

by our current U.S. Government customers from which we are already receiving repeat orders. As the only U.S.-based manufacturer of high-powered,

portable industrial laser cleaning systems capable of addressing the Pentagon’s never-ending battle with rust, we believe that

we are well-positioned to increase our sales to the U.S. Government, especially in light of the Pentagon alone having to spend between

$21 billion to $22.9 billion per year on rust control, and corrosion-related repairs on equipment, from trucks and tanks to aircraft

and other ships. See https://www.bloomberg.com/news/articles/2011-06-02/the-high-cost-of-waging-war-on-rust The U.S. Navy alone spends

$3 billion per year fighting corrosion. See https://www.military.com/daily-news/2020/01/13/battle-against-rust-3-billion-problem-navy.html.

The U.S. military is proving to be not only a receptive early adopter of the technology, but also as a proving ground and showcase for

our products. This arises from the need to continually maintain, repair and overhaul equipment (MRO) while eliminating maintenance delays

that affect force readiness. Corrosion and the lack of spare parts are among the most significant maintenance issues for the Pentagon.

A

Recognized Pioneer and Leading Developer of Fiber Laser Material Processing Technology

As

a pioneer and technology leader in laser material processing, combined with our deep knowledge of material properties, we can develop

laser cleaning products that reduce its operating costs for our customers and drive the proliferation of lasers to address existing and

new applications.

Track

Record of World Class Product Development and Commercialization

Through

their combined engineering and operational experience in the laser photonics industry, our C-level management team and board members

have accumulated decades of relevant and practical industrial laser equipment development experience. They have developed and advanced

several materials processing technologies applicable to the laser photonics industry and our vertical markets.

Vertically

Integrated Application Center, Equipment Development and Manufacturing

We

develop and manufacture most of our critical assemblies, subassemblies, and components, including motion systems, integrated lasers,

specialty components, frames, cabinets and proprietary optical assemblies. We also develop our software for use with our laser systems.

We have our own engineering, procurement, manufacturing, and assembly operations as a part of our vertically integrated manufacturing

process. The integration of our application and research and development groups with our manufacturing capability provides our customers

with a competitive edge in achieving their manufacturing goals using our laser material processing systems.

Accumulated

Diversified Expertise

We

have extensive know-how in mathematical and physical processes of materials behavior and equipment modeling, industrial electronics,

laser systems, materials and computer science which enables us to make our market-specific laser material processing equipment, machine

operating software, motion and vision systems and other critical assemblies, subassemblies and components.

Manufacturing

Scale

We

have invested extensively in our production and lean manufacturing capabilities allowing us to deliver large volumes of lasers systems

in short delivery cycles, which provides us with a competitive advantage.

Diverse

Customer Base, End Markets and Applications

We

intend to further develop our diverse customer base, multi-market and multi-product business model given the broad application of our

laser cleaning equipment, its competitive pricing and high quality that will not have us dependent on the performance of a specific market

sector.

Broad

Product Portfolio

Our

diverse lines of laser cleaning equipment are used in work environments to improve and promote programs to address significant concerns

about the exposure of employees to toxic airborne materials to reduce the risk of lung cancer and silicosis triggered by inhalation

of crystalline silica dust released from abrasive blasting. We offer our customers a range of solutions spanning multiple price points,

throughput levels, operating environments, and technologies to enable businesses to find and use the laser blasting solution for

their specific goals. Our broad product portfolio covers a spectrum of use cases, scaling with customer needs from entry-level, office-friendly

laser blasting systems for high surface integrity finishing of components to high-end, high throughput industrial laser blasting

systems for low-cost mass production applications. In addition, it eliminates the need for customers to source products for different

processes from multiple vendors, giving us a market advantage relative to competitors that have a more limited set of products and

solutions.

The

Only U.S. Manufacturer with a Wide Range of Laser Blasting Equipment

Although

no single publication lists all the companies manufacturing industrial laser cleaning equipment, to our knowledge all laser cleaning

products of the other companies selling laser cleaning equipment are manufactured abroad. Of our competitors, only Laserax manufactures

in North America, but in Canada, not the United States. Our success will depend on investment in marketing resources and the successful

implementation of our marketing plan. Our marketing plan may include attendance at trade shows and making private demonstrations,

advertising and promotional materials and advertising campaigns in print and/or broadcast media. To our knowledge, only Laser Photonics

designs, manufactures, sells, and services industrial laser cleaning onshore in the United States. |

|

|

On

January 25, 2021, President Biden signed an executive order to further his “Buy American” agenda which aims to bolster U.S.

manufacturing through the federal procurement process. Our “Made in America” industrial laser systems meet the President’s

“Buy American” requirement for U.S. Government agencies to contract with U.S. companies whenever possible. Currently, our

products are the only industrial laser cleaning systems designed and built in the United States. As the only industrial laser cleaning

equipment manufacturer currently meeting the “Buy American” requirement, we expect to benefit from preferential consideration

over the few other companies competing in the laser cleaning systems market.

Diversified

and Proprietary Technology Platform and Knowhow

We

were able to secure through our affiliation with ICT Investments a diverse portfolio of knowhow, trade secrets and proprietary technologies.

We believe that we possess the design documentation for the largest array of laser-based systems for material processing in North America.

Core

Technologies Underlying Each Product

Fiber

laser cleaning technology or laser ablation which we market under the Laser Blasting™ brand, is a proven, state-of-the-art, 21st

Century replacement for hazardous 19th century abrasives blasting (or sandblasting). It is a non-contact, environmentally friendly process

that removes surface coatings from metals, concrete and delicate substrates such as composites—with minimal impact on the base

material. Laser Blasting works by aiming brief pulses of high-power laser energy (in the µs–ms range) at a surface to be

prepared or cleaned of paint, rust, or other contaminants. The energy applied to the layer being removed doesn’t dissipate. Instead,

it blasts off the substrate material being cleaned. Most or all of the material being removed is vaporized, resulting in a much cleaner

process than other cleaning methods. Whatever removed material has not been vaporized may be suctioned away and filtered out of the air

as particle dust.

We

are recognized as a pioneer and an industry leader with our CleanTech™ Laser Blasting™ technology. Laser Blasting can replace

sandblasting or dry ice blasting in nearly every industry and every application where an abrasive blasting is used. It is effective on

glass, ceramics, metals, concrete, plastics and much more, and provides greater control and precision than possible with the legacy technologies

it is designed to replace. LP portable Laser Blasting systems incorporate proprietary autofocusing C-Optics technology that allows for

greater precision on uneven or contoured surfaces, even from handheld Laser Blasting systems. This innovation expands laser cleaning

from the production floor to the field. Laser Blasting is effective on small parts and sensitive materials, as well as surfaces of ships,

bridges, aircraft, pipelines, large vehicles, and trains, among others.

Our

Product Platforms

Since

our founding in 2019, and through IP received from ICT Investments, we have developed an extensive portfolio of products based on proprietary

technologies that form the foundation of our laser blasting equipment manufacturing solutions, which are comprised of hardware, equipment

design documentation, bills of materials, software, materials, and service practices.

Designed

in-house by industry-recognized laser scientists and inventors, our expansive product portfolio covers a broad spectrum of applications

across key industries, including maritime and shipbuilding, oil and gas, automotive manufacturing, rail transport, aerospace, defense,

and space exploration. Our CleanTech™ line scales with customer needs, starting with low price-point handheld Laser Blasters™

designed to tackle simple cleaning and surface predation jobs, to high-end AI-controlled, user-programmable C-Robotics™ made for

complex, precision production environments.

Our

state-of-the-art, performance-based “Made in America” Laser Blasting™ products are industrial-grade laser cleaning

systems developed to disrupt and displace hazardous legacy abrasives blasting (a.k.a. sandblasting) and chemical cleaning methods that

have been in common usage since the 19th century. Laser Blasting is cleaner to operate, more cost effective to own and safer for the

worker and the environment. We believe that Laser Blasting is right on time as industry is increasingly coming under pressure to phase

out abrasive blasting and chemical cleaning methods in compliance with health, environmental and safety regulations designed to protect

laborers and the environment.

Since

our founding in 2019, we have developed an extensive portfolio of proprietary equipment and technologies that formed the base for our

broad product offering, starting from relatively simple handheld devices to fully automatic and operated by AI robotic systems.

Our

diverse lines of laser cleaning equipment are used in a variety of industries to improve and promote programs to address significant

concerns about the exposure of employees to toxic airborne materials to reduce the risk of lung cancer and silicosis triggered by inhalation

of crystalline silica dust released from abrasive blasting. Laser cleaning uses photons emissions, thus eliminating the need for abrasive

media, including silica. The chart below provides information on several industries to indicate the need for laser cleaning equipment

and how our technology meets those industries’ requirements. This chart was developed by us in the last few months to allow our

salespeople to identify the specific model of our CleanTech laser blasting equipment that matches target industries and the surface integrity

parameters familiar to prospective customers. We want to demonstrate our capability to address the specific cleaning applications that

such customers require. The industry terminology is explained in our footnotes to the chart.

Below

is the description of abbreviations and definitions used in Laser Photonics Laser Blaster products qualification chart:

| |

● |

Roughing-Rough

surface condition for thick material |

| |

● |

Mid-Range-Normal

level below roughest surface condition for medium material thickness |

| |

● |

Finishing-Least

amount of roughness on a surface for thin materials |

| |

● |

Gauge-indication

of a measurement of industrial materials. |

| |

● |

Grit-indication

of roughness to apply to a surface for preparation prior to coating. |

| |

● |

CAML-grade

of abrasive media used for the sandblasting industry. |

| |

● |

DPI-Dots

per inch |

| |

● |

LPI-Lines

per inch |

| |

● |

Laser

Grade-Designated choice of laser for best results |

| |

● |

Strip

Rate in Ft Squared per hour is calculated as follows: 2X (laser power in KW) / (coating thickness in mils, where one mill= .001),

X 60 minutes. Source: Robotic Laser Coating Removal System ESTCP Project WP- 0526 apps.dtic.mil |

Our

current Laser Blasting solutions are as follows:

Handheld

Laser Blasting™:

We

offer the widest line of Class IV handheld laser blasting equipment in the world, from 20W (watts) to the 3000W system, including the

world’s most powerful production Laser Blaster™ on the market—the Jobsite 2000—to a more powerful JobSite 3000

which debuted during Aviation Week’s MRO Americas 21 trade show in April 2021. We are developing an even more powerful 4000W handheld

system. The CleanTech™ 2000-CTH Jobsite is a 2000W handheld laser cleaning machine and surface preparation system designed to remove

rust, paint and other impurities from steel, aluminum, iron, and many more surface types. The 2000-CTH Jobsite provides five different

pulse laser patterns that provide flexibility when operating the laser in different applications across different surface types.

We

also offer the CleanTech™ EZ-Rider Handheld Roughing & Finishing Lasers which are a high-performance, military-grade, fast,

and efficient laser cleaning tool. The EZ-RIDER is based on next-generation technology. Laser Photonics designed the EZ-RIDER to be a

heavy-duty industrial grade laser cleaning and surface treatment system for large areas requiring cleaning, de-painting, and other surface

preparations. The system starts immediately when the key is turned ON and the touch screen allows you to choose from five pre-programmed

cleaning patterns for control and flexibility. The CleanTech™ EZ-Rider is based on our years of experience building handheld lasers

for marking and engraving applications. Our systems are designed to be standalone units, so no personal computer is required. The CleanTech™

EZ-Rider can be coupled with industrial robots and placed inside safety work cells with interlocks for full compliance with OSHA and

FDA CDRH regulations.

Laser

Blasting Cabinet

The

laser blasting cabinet is configured as a fully enclosed Class 1 workspace designed to replace sandblasting enclosures, along with their

noise, dust, media storage, replenishment, and clean-up requirements. The Blasting Cabinet is intended to serve companies of any size

that use abrasive blasting or chemical baths to clean parts or prepare materials. The CleanTech™ Laser Blaster Cabinet is a self-contained,

industrial-grade laser cleaning machine. This system is the only laser cleaning machine in the world that incorporates the exclusive

power of a fiber laser with a handheld laser-blasting head inside a fully enclosed 30” x 26” workspace. This system is designed

for speed, precision, safety, and flexibility. It is the only laser-blasting cabinet manufactured in compliance with CDRH FDA and OSHA

regulatory compliance. With the CleanTech™ Laser Blaster Cabinet, companies can eliminate harmful dust, noise, hazardous chemicals,

and contaminants caused by use of abrasive blasting or chemical baths.

Class

I Laser Blasting Systems

Our

Mega Center and Titan lines of Class I Laser Blasting Systems are designed with mass production in mind. These production line-capable

systems are designed with automation control and automated materials-loading capabilities to allow for maximum throughput on assembly

lines for high production, high precision environments. The CleanTech Titan Series Laser Blasting System is a high power, large format

laser parts cleaning, rust removal, and surface conditioning system with up to 6′ x12′ working envelope. The industrial,

turn-key laser cleaning system operates as a standalone unit or can be easily integrated into a production line environment. Included

in the CleanTech product line are the CleanTech Titan Express, CleanTech MegaCenter and the portable CleanTech Handheld which is useful

in the field or on the factory floor. The CleanTech Systems operate in full compliance with OSHA, FDA and CDRH staconforming to “Push

a Button” laser safety industrial operation. The CleanTech Systems offer CE Certified Class 1 enclosure for the Class 4 lasers.

CleanTech™

Laser Cleaning Robot with AI

With

our user programmable AI (UPAI) incorporated in our C-Robots, factory line workers can quickly and easily program these precision robots

to complete complex and repetitive tasks in high throughput production environments. The CleanTech™ Laser Cleaning Robot is the

first commercially available collaborative, easily programmable, AI-capable laser cleaning system in the United States. Designed for

precise positioning and tight focusing of the laser beam, laser cleaning processes are optimized to operate on much lower laser powers

than those used by handheld laser cleaners. This allows for dramatic cost reduction of laser cleaning, making it affordable for most

industrial companies. It also reduces concerns over safety for the factory line workers since the robot can perform multiple tasks at

the same time when equipped with AI module, 3D scanner and visualizer, vision system and Class 1 Safety shroud or enclosure.

Customers

Our

intent is to establish additional relationships with Fortune 1000 customers primarily within the United States and with select Fortune

1000 customers around the globe and represent a broad array of industries, including automotive, aerospace, healthcare, consumer products,

heavy industry, machine design, research, and others. No single customer has accounted for more than 10% of our total revenue from inception

to date.

Research,

Development and Engineering

The

principal focus of our research and development activity is the development of our proprietary laser-based cleaning equipment to replace

global sand blasting and abrasive blasting applications in a large number of markets discussed below.

Marketing

and Sales

For

the year ended December 31, 2023, we employed 8 direct salesmen and 2 distributors in Japan and Australia. 2023 was a year of investments

into sales and marketing activity and we invested near $4M in development of sales and marketing operation. Our pipeline We have a marketing

and sales budget equal to 10% of our gross sales, and a new product promotional budget of $1.2M for 2024.

Product

Warranty and Support

We

offer for sale with our equipment a two-year limited warranty against defects in materials and workmanship under normal use and service

conditions following delivery of our equipment to our customers.

We

also warrant the owners of our custom laser systems that they are designed and manufactured in accordance with agreed-upon specifications.

In resolving claims under both the defects and performance warranties, we have the option of either repairing or replacing the covered

laser cleaning equipment. Our warranties are automatically transferred from the original purchaser of our laser cleaning equipment and

optical components to subsequent purchasers upon delivery of our finished laser systems.

In

general, our products carry a warranty against defects, depending on the product type and customer negotiations. The costs associated

with these warranty obligations are not expected to be significant and no such costs have been recorded in our financial statements.

Competition

In

the laser cleaning market, the competition is fragmented with a few competitors that are small or privately owned, or which compete with

us on a limited geographic, industry, or application specific basis. Nonetheless, our markets are highly competitive and characterized

by rapid advances in technology, evermore demanding customer requirements, and reduced average selling prices as smaller, integrated

components replace aging technologies. Our most significant competitors are P-Laser and Clean-Lasersysteme GmbH (operating through the

distributor Adapt Laser Systems in the United States) as well as smaller companies, including Laserax and 4 Jet. Some of our competitors

are increasing the output power of their fiber lasers to compete with our high-powered, industrial grade products.

We

also compete with end-users that produce laser technology, as well as with manufacturers of non-laser methods and tools, such as traditional

abrasives blasting (referred to as sandblasting), non-laser welding, cutting dies, mechanical cutters, and plasma cutters in the materials

processing market. Some of our competitors are larger, with considerably more financial, managerial, and technical resources, as well

as more extensive sales, distribution, and service networks, and greater marketing capacity.

Our

primary focus is to provide diversified industrial-grade laser-based cleaning machinery in a variety of markets. Each market has a different

group of competitors subject to rapidly changing technologies and materials, a customer base with continuously changing requirements

and geographical outsourcing challenges.

We

believe that our future success is dependent on our flexibility to adapt to changes in the marketplace, expanding our existing products

and services targeting application specific systems for each industry we serve. We continuously introduce new products and services on

a timely and cost-effective basis identifying both standard and niche laser-systems opportunities enhancing our ability to penetrate

new customers and new emerging markets.

Primary

competitive factors in our markets include:

| |

● |

Price

and value |

| |

● |

Ability

to design, manufacture, and deliver new products on a cost-effective and timely basis. |

| |

● |

Ability

of our suppliers to produce and deliver components in a timely manner, in the quantity desired and at the budgeted prices |

| |

● |

Product

performance and reliability |

| |

● |

Service

support. |

| |

● |

Product

mix |

| |

● |

Ability

to meet customer specifications. |

| |

● |

Ability

to respond quickly to changes in market demand and technology developments. |

In

the materials processing market, the competition is fragmented with a large number of competitors that are small or privately owned or

compete with us on a limited geographic, industry, or application specific basis including Trumpf GmbH, Clean Laser GMBH, P-Laser. Advanced

Laser Technology, Anilox Roll Cleaning Systems, General Lasertronics, IPGPhotonics, Laserax, and White Lion Dry Ice & Laser Cleaning

Technology. We believe that none of our competitors compete in all the industries, applications, and geographical markets which we serve

and that our products compete favorably with respect to their laser cleaning equipment.

Intellectual

Property and License Rights

We

believe that our success depends, in part, on our ability to maintain and protect our proprietary technology and to conduct our business

without infringing on the proprietary rights of others.

We

rely primarily on a combination of trademarks and trade secrets, as well as associate and third-party confidentiality agreements, to

safeguard our intellectual property.

With

respect to proprietary know-how that is not patentable and processes for which patents are difficult to enforce, we rely on, among other

things, trade secret protection and confidentiality agreements to safeguard our interests. We believe that many elements of our laser

system manufacturing process, including our unique materials sourcing, involve proprietary know-how, technology, or data that are not

covered by patents or patent applications, including technical processes, equipment designs, algorithms, and procedures. We have taken

security measures to protect these elements. All our research and development personnel will have to sign confidentiality and proprietary

information agreements with us. These agreements address intellectual property protection issues and require our associates to assign

to us all the inventions, designs, and technologies they develop during the course of employment with us. We also require our customers

and business partners to enter into confidentiality agreements before we disclose any sensitive aspects of our modules, technology, or

business plans.

Employees

and Human Capital

As

of March 1st, 2024, we had 56 full time employees and no part-time employees. Our human capital resources objectives include, as applicable,

identifying, recruiting, retaining, incentivizing, and integrating our existing and new employees, advisors and consultants.

Government

Regulation

Our

current and contemplated activities and the products and processes that will result from such activities are subject to substantial government

regulation, both in the United States and internationally.

Government

Contracts and Regulations

Our

U.S Government business is heavily regulated. We contract with several U.S. Government agencies and entities, principally all branches

of the U.S. military. We must comply with, and are affected by, laws and regulations relating to the formation, administration, and performance

of U.S. Government contracts. These laws and regulations, among other things:

| |

● |

require

certification and disclosure of all cost or pricing data in connection with certain types of contract negotiations; |

| |

|

|

| |

● |

impose

specific and unique cost accounting practices that may differ from U.S. generally accepted accounting principles (GAAP); |

| |

|

|

| |

● |

impose

acquisition regulations, which may change or be replaced over time, that define which costs can be charged to the U.S. Government,

how and when costs can be charged, and otherwise govern our right to reimbursement under certain U.S. Government contracts; |

| |

|

|

| |

● |

require

specific security controls to protect U.S. Government controlled unclassified information and restrict the use and dissemination

of information classified for national security purposes and the export of certain products, services and technical data; and compliance

with cyber security regulations by our supply chain; and |

| |

|

|

| |

● |

require

the review and approval of contractor business systems, defined in the regulations as: (i) Accounting System; (ii) Estimating System;

(iii) Earned Value Management System, for managing cost and schedule performance on certain complex programs; (iv) Purchasing System;

(v) Material Management and Accounting System, for planning, controlling and accounting for the acquisition, use, issuing and disposition

of material; and (vi) Property Management System. |

The

U.S. Government may terminate any of our government contracts and subcontracts either at its convenience or for default based on our

performance. If a contract is terminated for convenience, we generally are protected by provisions covering reimbursement for costs incurred

on the contract and profit on those costs. If a contract is terminated for default, we generally are entitled to payments for our work

that has been accepted by the U.S. Government or other governments; however, the U.S. Government could make claims to reduce the contract

value or recover its procurement costs and could assess other special penalties. For more information regarding the U.S. Government’s

right to terminate our contracts and government contracting laws and regulations, see “Risk Factors”.

Radiation

Control for Health and Safety Act

We

are subject to the laser radiation safety regulations of the Radiation Control for Health and Safety Act administered by the National

Center for Devices and Radiological Health, a branch of the United States Food and Drug Administration. Among other things, those regulations

require laser manufacturers to file new product and annual reports, to maintain quality control and sales records, to perform product

testing, to distribute appropriate operating manuals, to incorporate design and operating features in lasers sold to end-users and to

certify and label each laser sold to end-users as one of four classes (based on the level of radiation from the laser that is accessible

to users). Various warning labels must be affixed, and certain protective devices installed depending on the class of product. The National

Center for Devices and Radiological Health is empowered to seek fines and other remedies for violations of the regulatory requirements.

CE

Marking

We

are subject to certain regulations in Europe as administered by the European Commission. CE Marking is required for products marketed

within the European Economic Area (EEA) and confirms that the manufacturer meets certain safety, health and environmental protection

requirements administered by the European Union. Non-compliance with these regulations could result in warnings, penalties, or fines.

We believe that we are currently in compliance with these regulations.

United

States Food and Drug Administration

Certain

products manufactured by us are integrated into systems by our customers that are subject to certain regulations administered by the

United States Food and Drug Administration. We must comply with certain quality control measurements for our products to be effectively

used in our customers’ end products. Non-compliance with quality control measurements could result in loss of business with our

customers, fines and penalties.

Facility

On

December 1, 2019, we entered a sub-lease with ICT Investments for 5,000 sf of manufacturing space on a month-to-month basis at $4,050

per month. In January 2020, we expanded the lease with ICT Investments to include the entire facility of 18,000 sf. In October of 2021,

a direct lease was signed with the landlord for three years, terminating on October 31, 2024. The facility is currently equipped with

three of our latest advanced laser cleaning demonstration models. It includes a materials stock room, a ramp and high dock, loading and

moving equipment, a machine shop, an electronics room, and an equipment assembly area. The monthly rent for this facility is currently

$15,549.

In

December 2022, we entered into an agreement with 2701 Maitland Building Associates to rent 8,000 sf of additional office space nearby

the main facility, for our growing sales and marketing program. The monthly rent for this space is currently $14,805.

Our

facility is currently equipped with three of our latest advanced laser cleaning demonstration models.

Laser

Blaster Systems

Implications

of Being an Emerging Growth Company

We

are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”),

and therefore we intend to take advantage of certain exemptions from various public company reporting requirements, including not being

required to have our internal controls over financial reporting audited by our independent registered public accounting firm pursuant

to Section 404 of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”), reduced disclosure obligations regarding executive

compensation in our periodic reports and proxy statements and exemptions from the requirements of holding a nonbinding advisory vote

on executive compensation and any golden parachute payments. We may take advantage of these exemptions until we are no longer an “emerging

growth company.” In addition, the JOBS Act provides that an “emerging growth company” can delay adopting new or revised

accounting standards until such time as those standards apply to private companies. We have elected to use the extended transition period

for complying with new or revised accounting standards under the JOBS Act. This election allows us to delay the adoption of new or revised

accounting standards that have different effective dates for public and private companies until those standards apply to private companies.

As a result of this election, our financial statements may not be comparable to companies that comply with public company effective dates.

We will remain an “emerging growth company” until the earlier of (1) the last day of the fiscal year: (a) following the fifth

anniversary of the completion of our initial public offering; (b) in which we have total annual gross revenue of at least $1.235 billion;

or (c) in which we are deemed to be a large accelerated filer, which means the market value of our common stock that is held by non-affiliates

exceeded $700.0 million as of the prior June 30th, and (2) the date on which we have issued more than $1.0 billion in non-convertible

debt during the prior three-year period. References herein to “emerging growth company” have the meaning associated with

that term in the JOBS Act.

ITEM

1A. RISK FACTORS

Summary

of Risk Factors

An

investment in our securities involves a high degree of risk. The occurrence of one or more of the events or circumstances described in

the section titled “Risk Factors,” alone or in combination with other events or circumstances, may materially adversely affect

our business, financial condition, and operating results. In that event, the trading price of our securities could decline, and you could

lose all or part of your investment. Such risks include, but are not limited to:

We

have a limited operating history so there is a lack of historical data on which to determine whether we can be a commercially viable

company.

We

are competing in a highly competitive market and to compete effectively we must be able to adapt to technology changes and to implement

innovative technology applications.

ICT