Medallion Financial Corp. Reports 2024 Third Quarter Results

29 Octobre 2024 - 9:05PM

Medallion Financial Corp. (NASDAQ: MFIN, “Medallion” or the

“Company”), a specialty finance company that originates and

services loans in various consumer and commercial industries, as

well as offers loan products and services through fintech strategic

partners, announced today its results for the quarter ended

September 30, 2024.

2024 Third Quarter

Highlights

- Net income was $8.6 million, or $0.37 per share, compared to

$11.2 million, or $0.48 per share, in the prior year quarter.

- Net interest income grew 8% to $52.7 million from $48.8 million

in the prior year quarter.

- Net interest margin on gross loans was 8.11%, compared to 8.35%

in the prior year quarter, and on net loans it was 8.42%, compared

to 8.64% in the prior year quarter.

- Loan originations were $275.6 million, compared to $217.4

million in the prior year quarter.

- Loans grew 13% to $2.5 billion as of September 30, 2024,

compared to $2.2 billion a year ago.

- The credit loss provision increased to $20.2 million from $14.5

million in the prior year quarter.

- The Company repurchased 122,344 shares of common stock at an

average cost of $7.89 per share.

- Subsequent to September 30, 2024, the Board of Directors

increased the quarterly cash dividend 10% to $0.11 per share.

Executive Commentary – Andrew Murstein,

President of Medallion

"We continue to be pleased with our quarterly

performance. The earnings were strong despite lower taxi medallion

related recoveries and the absence of equity gains, both of which

we experienced in the prior year quarter. At $0.37 per share, our

earnings included approximately $0.07 per share of additional

allowance tied to the growth of our consumer lending segments,

which saw recreation and home improvement loans grow 4% and 5% from

the previous quarter to a combined $2.4 billion, with over $235

million in originations this quarter. We continue to be comfortable

with the overall credit performance of these two consumer segments,

which carry weighted average coupons of 14.92% for recreation loans

and 9.76% for home improvement loans. During the quarter we

originated recreation loans at an average rate of 16.33% and home

improvement loans at an average rate of 10.75%.

Our net interest income reached $52.7 million

during the quarter, up 6% from just a quarter ago. We remain

cautiously optimistic that the solid performance of our loan

portfolio will continue. Our net interest margin during the quarter

was 8.11%, decreasing only 1 basis point from the prior quarter, as

we continue to increase our yield to offset the rise in our average

cost of borrowings.

Our total interest income of $76.4 million, net

interest income of $52.7 million, and total assets of $2.9 billion

were all record highs. Our fintech strategic partnership program at

Medallion Bank had its highest volume quarter ever with $40 million

of new loans, up from $24 million in the second quarter of this

year. As a result, we are optimistic about the quarters ahead

and are hopeful to continue delivering meaningful growth in

origination volumes in our newest business line.

Lastly, we are pleased to announce that our

board of directors has authorized an increase of our quarterly

dividend to $0.11 per share beginning with the upcoming payment

next month, reflecting our strong financial performance and ongoing

commitment to delivering value to our shareholders. This increase

underscores our confidence in the Company’s future growth and

stability, as well as our focus on returning capital to

investors."

Business Segment Highlights

Recreation Lending Segment

- Originations were $139.1 million during the quarter, compared

to $92.6 million a year ago.

- Recreation loans grew 15% to $1.6 billion as of September 30,

2024, compared to $1.3 billion a year ago.

- Recreation loans were 63% of total loans as of September 30,

2024, compared to 61% a year ago.

- Net interest income grew 9% to $38.9 million for the quarter,

from $35.6 million in the prior year quarter.

- The average interest rate was 14.92% at quarter-end, compared

to 14.73% a year ago.

- Recreation loans 90 days or more past due were $7.5 million, or

0.50% of gross recreation loans, as of September 30, 2024, compared

to $5.9 million, or 0.45%, a year ago.

- Allowance for credit loss rate was 4.53% as of September 30,

2024, compared to 4.24% a year ago.

Home Improvement Lending Segment

- Originations were $96.5 million during the quarter, compared to

$79.3 million a year ago.

- Home improvement loans grew 8% to $814.1 million as of

September 30, 2024, compared to $750.5 million a year ago.

- Home improvement loans were 33% of total loans as of September

30, 2024, compared to 34% a year ago.

- Net interest income grew 5% to $12.0 million for the quarter,

from $11.4 million in the prior year quarter.

- The average interest rate was 9.76% at quarter-end, compared to

9.38% a year ago.

- Home improvement loans 90 days or more past due were $1.6

million, or 0.19% of gross home improvement loans, as of September

30, 2024, compared to $1.0 million, or 0.13%, a year ago.

- Allowance for credit loss rate was 2.42% as of September 30,

2024, compared to 2.31% a year ago.

Commercial Lending Segment

- Commercial loans were $110.1 million at September 30, 2024,

compared to $100.3 million a year ago.

- The average interest rate on the portfolio was 12.90%, compared

to 12.91% a year ago.

Taxi Medallion Lending Segment

- The Company collected $4.1 million of cash on taxi

medallion-related assets during the quarter.

- Total net taxi medallion assets declined to $8.8 million

(comprised of $1.9 million of loans net of allowance for credit

losses and $6.9 million of loan collateral in process of

foreclosure), a 46% reduction from a year ago, and represented less

than half a percent of the Company’s total assets as of September

30, 2024.

Capital Allocation

Quarterly Dividend

- The Board of Directors declared a quarterly dividend of $0.11

per share, payable on November 27, 2024 to shareholders of record

at the close of business on November 15, 2024.

Stock Repurchase Plan

- During the third quarter, the Company repurchased 122,344

shares of its common stock at an average cost of $7.89 per share,

for a total of $1.0 million.

- As of September 30, 2024, the Company had $15.4 million

remaining under its $40 million share repurchase program.

Conference Call Information

The Company will host a conference call to

discuss its third quarter financial results tomorrow, Wednesday,

October 30, 2024 at 9:00 a.m. Eastern time.

In connection with its earnings release, the

Company has updated its quarterly supplement presentation, which is

now available at www.medallion.com.

How to Participate

- Date: Wednesday, October 30, 2024

- Time: 9:00 a.m. Eastern time

- U.S. dial-in number: (833) 816-1412

- International dial-in number: (412)

317-0504

- Live webcast: Link to Webcast of 3Q24 Earnings

Call

A link to the live audio webcast of the

conference call will also be available at the Company’s IR

website.

Replay Information

The webcast replay will be available at the

Company's IR website until the next quarter’s results are

announced.

The conference call replay will be available

following the end of the call through Wednesday, November 6.

- U.S. dial-in number: (844) 512-2921

- International dial-in number: (412)

317-6671

- Access ID: 1019 3247

About Medallion Financial

Corp.

Medallion Financial Corp. (NASDAQ:MFIN) and its

subsidiaries originate and service a growing portfolio of consumer

loans and mezzanine loans in various industries. Key industries

served include recreation (towable RVs and marine) and home

improvement (replacement roofs, swimming pools, and windows).

Medallion Financial Corp. is headquartered in New York City, NY,

and its largest subsidiary, Medallion Bank, is headquartered in

Salt Lake City, Utah. For more information, please visit

www.medallion.com.

Forward-Looking

StatementsPlease note that this press release contains

forward-looking statements that involve risks and uncertainties

relating to business performance, cash flow, net interest income

and expenses, other expenses, earnings, growth, and our growth

strategy. These statements are often, but not always, made using

words or phrases such as “will” and “continue” or the negative

version of those words or other comparable words or phrases of a

future or forward-looking nature. These statements relate to future

public announcements of our earnings, the impact of the pending SEC

litigation, expectations regarding our loan portfolio, including

collections on our medallion loans, the potential for future asset

growth, and market share opportunities. Medallion’s actual results

may differ significantly from the results discussed in such

forward-looking statements. For example, statements about the

effects of the current economy, whether inflation or the risk of

recession, operations, financial performance and prospects

constitute forward-looking statements and are subject to the risk

that the actual impacts may differ, possibly materially, from what

is reflected in those forward-looking statements due to factors and

future developments that are uncertain, unpredictable and in many

cases beyond Medallion’s control. In addition to risks relating to

the current economy, a description of certain risks to which

Medallion is or may be subject, including risks related to the

pending SEC litigation, please refer to the factors discussed under

the heading “Risk Factors” in Medallion’s 2023 Annual Report on

Form 10-K.

Company Contact:Investor

Relations212-328-2176InvestorRelations@medallion.com

| MEDALLION

FINANCIAL CORP. |

| CONSOLIDATED

BALANCE SHEETS |

|

(UNAUDITED) |

| |

|

(Dollars in thousands, except share and per share data) |

|

September 30, 2024 |

|

|

December 31, 2023 |

|

|

September 30, 2023 |

|

| Assets |

|

|

|

|

|

|

|

|

|

|

Cash, cash equivalents, and federal funds sold |

|

$ |

187,929 |

|

|

$ |

149,845 |

|

|

$ |

127,642 |

|

|

Investment and equity securities |

|

|

66,651 |

|

|

|

65,712 |

|

|

|

63,717 |

|

|

Loans |

|

|

2,485,279 |

|

|

|

2,215,886 |

|

|

|

2,203,038 |

|

|

Allowance for credit losses |

|

|

(96,518 |

) |

|

|

(84,235 |

) |

|

|

(79,133 |

) |

|

Net loans receivable |

|

|

2,388,761 |

|

|

|

2,131,651 |

|

|

|

2,123,905 |

|

|

Goodwill and intangible assets, net |

|

|

170,311 |

|

|

|

171,394 |

|

|

|

171,755 |

|

|

Property, equipment, and right-of-use lease asset, net |

|

|

14,172 |

|

|

|

14,076 |

|

|

|

13,278 |

|

|

Accrued interest receivable |

|

|

14,108 |

|

|

|

13,538 |

|

|

|

13,593 |

|

|

Loan collateral in process of foreclosure |

|

|

8,818 |

|

|

|

11,772 |

|

|

|

15,923 |

|

|

Other assets |

|

|

29,302 |

|

|

|

29,839 |

|

|

|

28,814 |

|

| Total

assets |

|

$ |

2,880,052 |

|

|

$ |

2,587,827 |

|

|

$ |

2,558,627 |

|

| Liabilities |

|

|

|

|

|

|

|

|

|

|

Deposits |

|

$ |

2,108,132 |

|

|

$ |

1,866,657 |

|

|

$ |

1,855,096 |

|

|

Long-term debt |

|

|

232,037 |

|

|

|

235,544 |

|

|

|

218,137 |

|

|

Short-term borrowings |

|

|

49,000 |

|

|

|

8,000 |

|

|

|

18,489 |

|

|

Deferred tax liabilities, net |

|

|

20,598 |

|

|

|

21,207 |

|

|

|

23,131 |

|

|

Operating lease liabilities |

|

|

5,534 |

|

|

|

7,019 |

|

|

|

7,075 |

|

|

Accrued interest payable |

|

|

6,888 |

|

|

|

6,822 |

|

|

|

4,624 |

|

|

Accounts payable and accrued expenses |

|

|

26,687 |

|

|

|

30,804 |

|

|

|

34,813 |

|

| Total

liabilities |

|

|

2,448,876 |

|

|

|

2,176,053 |

|

|

|

2,161,365 |

|

| Total stockholders’

equity |

|

|

362,388 |

|

|

|

342,986 |

|

|

|

328,474 |

|

| Non-controlling interest in

consolidated subsidiaries |

|

|

68,788 |

|

|

|

68,788 |

|

|

|

68,788 |

|

| Total

equity |

|

|

431,176 |

|

|

|

411,774 |

|

|

|

397,262 |

|

| Total liabilities and

equity |

|

$ |

2,880,052 |

|

|

$ |

2,587,827 |

|

|

$ |

2,558,627 |

|

| Number of shares outstanding |

|

|

23,084,277 |

|

|

|

23,449,646 |

|

|

|

23,363,731 |

|

| Book value per

share |

|

$ |

15.70 |

|

|

$ |

14.63 |

|

|

$ |

14.06 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| MEDALLION

FINANCIAL CORP. |

| CONSOLIDATED

STATEMENTS OF OPERATIONS |

|

(UNAUDITED) |

| |

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

(Dollars in thousands, except share and per share data) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Total interest income |

|

$ |

76,409 |

|

|

$ |

65,886 |

|

|

$ |

214,183 |

|

|

$ |

183,455 |

|

| Total interest

expense |

|

|

23,672 |

|

|

|

17,102 |

|

|

|

63,661 |

|

|

|

44,379 |

|

| Net interest

income |

|

|

52,737 |

|

|

|

48,784 |

|

|

|

150,522 |

|

|

|

139,076 |

|

|

Provision for credit losses |

|

|

20,151 |

|

|

|

14,532 |

|

|

|

55,929 |

|

|

|

27,045 |

|

| Net interest income after

provision for credit losses |

|

|

32,586 |

|

|

|

34,252 |

|

|

|

94,593 |

|

|

|

112,031 |

|

| Other income

(loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

(Loss) gain on equity investments |

|

|

(519 |

) |

|

|

2,180 |

|

|

|

3,136 |

|

|

|

2,189 |

|

|

Gain on sale of loans and taxi medallions |

|

|

340 |

|

|

|

1,417 |

|

|

|

1,170 |

|

|

|

4,578 |

|

|

Write-down of loan collateral in process of foreclosure |

|

|

(19 |

) |

|

|

(30 |

) |

|

|

(19 |

) |

|

|

(303 |

) |

|

Other income |

|

|

785 |

|

|

|

739 |

|

|

|

2,802 |

|

|

|

1,868 |

|

| Total other income,

net |

|

|

587 |

|

|

|

4,306 |

|

|

|

7,089 |

|

|

|

8,332 |

|

| Other

expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

Salaries and employee benefits |

|

|

9,456 |

|

|

|

9,630 |

|

|

|

28,347 |

|

|

|

27,805 |

|

|

Loan servicing fees |

|

|

2,790 |

|

|

|

2,501 |

|

|

|

7,951 |

|

|

|

7,084 |

|

|

Collection costs |

|

|

1,673 |

|

|

|

1,583 |

|

|

|

4,799 |

|

|

|

4,729 |

|

|

Regulatory fees |

|

|

961 |

|

|

|

1,021 |

|

|

|

2,826 |

|

|

|

2,484 |

|

|

Professional fees |

|

|

818 |

|

|

|

1,148 |

|

|

|

3,434 |

|

|

|

4,223 |

|

|

Rent expense |

|

|

664 |

|

|

|

629 |

|

|

|

2,019 |

|

|

|

1,855 |

|

|

Amortization of intangible assets |

|

|

361 |

|

|

|

361 |

|

|

|

1,084 |

|

|

|

1,084 |

|

|

Other expenses |

|

|

2,272 |

|

|

|

2,216 |

|

|

|

6,755 |

|

|

|

7,220 |

|

| Total other

expenses |

|

|

18,995 |

|

|

|

19,089 |

|

|

|

57,215 |

|

|

|

56,484 |

|

| Income before income

taxes |

|

|

14,178 |

|

|

|

19,469 |

|

|

|

44,467 |

|

|

|

63,879 |

|

|

Income tax provision |

|

|

4,055 |

|

|

|

6,727 |

|

|

|

14,196 |

|

|

|

18,582 |

|

| Net income after

taxes |

|

|

10,123 |

|

|

|

12,742 |

|

|

|

30,271 |

|

|

|

45,297 |

|

|

Less: income attributable to the non-controlling interest |

|

|

1,512 |

|

|

|

1,512 |

|

|

|

4,535 |

|

|

|

4,536 |

|

| Total net income

attributable to Medallion Financial Corp. |

|

$ |

8,611 |

|

|

$ |

11,230 |

|

|

$ |

25,736 |

|

|

$ |

40,761 |

|

|

Basic net income per share |

|

$ |

0.38 |

|

|

$ |

0.50 |

|

|

$ |

1.14 |

|

|

$ |

1.81 |

|

|

Diluted net income per share |

|

$ |

0.37 |

|

|

$ |

0.48 |

|

|

$ |

1.09 |

|

|

$ |

1.77 |

|

| Weighted average common

shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

22,490,792 |

|

|

|

22,596,982 |

|

|

|

22,576,446 |

|

|

|

22,469,968 |

|

|

Diluted |

|

|

23,447,929 |

|

|

|

23,392,901 |

|

|

|

23,555,065 |

|

|

|

23,067,944 |

|

|

Dividends declared per common share |

|

$ |

0.10 |

|

|

$ |

0.08 |

|

|

$ |

0.30 |

|

|

$ |

0.24 |

|

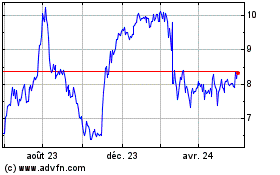

Medallion Financial (NASDAQ:MFIN)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

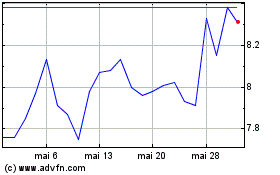

Medallion Financial (NASDAQ:MFIN)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025