NI Stockholders Approve Transaction with Emerson

29 Juin 2023 - 10:05PM

Business Wire

NI (Nasdaq: NATI) (“NI” or the “Company”) announced that at NI’s

Special Meeting of Stockholders (the “Special Meeting”) held

earlier today, the Company’s stockholders voted to adopt the

proposed Agreement and Plan of Merger (the “merger agreement”),

whereby NI will be acquired by Emerson (NYSE: EMR). As previously

announced, under the terms of the merger agreement, NI stockholders

will receive $60 per share in cash for every share of NI common

stock they own immediately prior to the effective time of the

merger.

“Today’s vote by our stockholders validates our belief that this

transaction represents the best outcome for all NI stakeholders,”

said Eric Starkloff, NI's Chief Executive Officer. “We thank our

stockholders for their support and look forward to accelerating our

position as a leading provider of software-connected automated test

and measurement systems in this next chapter as part of

Emerson."

The proposed transaction is expected to close in the first half

of Emerson’s fiscal year 2024, subject to the completion of

customary closing conditions. The final voting results of the

Special Meeting will be set forth in a Form 8-K filed with the U.S.

Securities and Exchange Commission following certification by NI’s

inspector of election.

Advisors

BofA Securities is serving as exclusive financial advisor to NI

and Wachtell, Lipton, Rosen & Katz is serving as legal

advisor.

About NI

At NI, we bring together people, ideas and technology so forward

thinkers and creative problem solvers can take on humanity's

biggest challenges. From data and automation to research and

validation, we provide the tailored, software-connected systems

engineers and enterprises need to Engineer Ambitiously™ every

day.

Forward-Looking

Statements

This press release contains “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Exchange Act that are subject to

risks and uncertainties. These statements include those set forth

above relating to the proposed transaction as well as those that

may be identified by words such as “believe,” “expect,” “plan,”

“may,” “could,” “will,” “intend to,” “project,” “predict,”

“anticipate,” “continue,” “seek to,” “strive to,” “endeavor to,”

“are committed to,” “remain committed to,” “focus on,” “are

encouraged by,” “remain cautious,” “remain optimistic” or

“estimate”; statements of “goals,” “initiatives,” “commitments,”

“strategy”, “focus” or “visions”; or other variations thereof or

comparable terminology or the negative thereof. All forward-looking

statements are based on current expectations and projections of

future events. We claim the protection of the safe harbor for

forward-looking statements contained in the Private Securities

Litigation Reform Act of 1995 for all forward-looking statements.

Although we believe that the expectations reflected in the

forward-looking statements are reasonable, forward-looking

statements are not guarantees of performance and actual results

could differ materially from those projected in the forward-looking

statements as a result of a number of important factors which could

affect our future results and could cause those results or other

outcomes to differ materially from those expressed or implied in

the forward-looking statements. Risks and uncertainties include

without limitation: the global shortage of key components; effect

of the global economic and geopolitical conditions; our

international operations and foreign economies; adverse public

health matters, including epidemics and pandemics such as the

COVID-19 pandemic; our ability to effectively manage our partners

and distribution channels; interruptions in our technology systems

or cyber-attacks on our systems; the dependency of our product

revenue on certain industries and the risk of contractions in such

industries; concentration of credit risk and uncertain conditions

in the global financial markets; our ability to compete in markets

that are highly competitive; our ability to release successful new

products or achieve expected returns; the risk that our

manufacturing capacity and a substantial majority of our

warehousing and distribution capacity are located outside of the

U.S.; our dependence on key suppliers and distributors; longer

delivery lead times from our suppliers; risk of product liability

claims; dependence on our proprietary rights and risks of

intellectual property litigation; the continued service of key

management, technical personnel and operational employees; our

ability to comply with environmental laws and associated costs; our

ability to maintain our website; the risks of bugs,

vulnerabilities, errors or design flaws in our products; our

restructuring activities; our exposure to large orders; our shift

to more system orders; our ability to effectively manage our

operating expenses and meet budget; fluctuations in our financial

results due to factors outside of our control; our outstanding

debt; the interest rate risk associated with our variable rate

indebtedness; seasonal variation in our revenues; our ability to

comply with laws and regulations; changes in tax rates and exposure

to additional tax liabilities; our ability to make certain

acquisitions or dispositions, integrate the companies we acquire or

separate the companies we sold and/or enter into strategic

relationships; risks related to currency fluctuations; provisions

in charter documents and Delaware law that delay or prevent our

acquisition; the timing, receipt and terms and conditions of any

required governmental and regulatory approvals of the proposed

transaction that could cause the parties to terminate the merger

agreement; the occurrence of any event, change or other

circumstances that could give rise to the termination of the merger

agreement entered into pursuant to the proposed transaction; the

risk that the parties to the merger agreement may not be able to

satisfy the conditions to the proposed transaction in a timely

manner or at all; risks related to disruption of management time

from ongoing business operations due to the proposed transaction;

the risk that any announcements relating to the proposed

transaction could have adverse effects on the market price of our

common stock; the risk of any unexpected costs or expenses

resulting from the proposed transaction; the risk of any litigation

relating to the proposed transaction; the risk that the proposed

transaction and its announcement could have an adverse effect on

the ability of the Company to retain customers and retain and hire

key personnel and maintain relationships with customers, suppliers,

employees, stockholders and other business relationships and on its

operating results and business generally; and the risk the pending

proposed transaction could distract management of the Company. The

Company directs readers to its Form 10-K for the year ended

December 31, 2022 and the other documents it files with the SEC for

other risks associated with the Company’s future performance. These

documents contain and identify important factors that could cause

our actual results to differ materially from those contained in our

forward-looking statements. All information in this press release

is as of the date above. The Company undertakes no duty to update

any forward-looking statement to conform the statement to actual

results or changes in the Company’s expectations.

National Instruments, NI and ni.com and Engineer Ambitiously are

trademarks of National Instruments Corporation. Other product and

company names listed are trademarks or trade names of their

respective companies. (NATI-F)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230629201570/en/

Investor Relations Marissa Vidaurri Vice President,

Investor Relations, NI 512-773-0856 marissa.vidaurri@NI.com

Media John Christiansen / Pete Siwinski / Danya Al-Qattan

FGS Global NI@fgsglobal.com

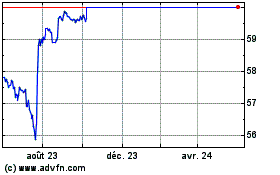

National Instruments (NASDAQ:NATI)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

National Instruments (NASDAQ:NATI)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025