NextDecade Corporation (NextDecade or the Company) (NASDAQ:

NEXT) today provided an update on developmental and strategic

activities for the fourth quarter 2023 and early 2024.

CEO Commentary

"We are committed to maximizing long-term value for NextDecade's

shareholders by executing our business strategy efficiently and

effectively," said Matt Schatzman, NextDecade's Chairman and Chief

Executive Officer. "We are focused on constructing Phase 1 at the

Rio Grande LNG Facility safely, on time, and on budget, and

delivering a positive FID of our fully permitted expansion capacity

to meet growing global demand for cleaner energy sources including

LNG."

"We have a steadfast commitment to upholding the highest

standards of safety and excellence in project management and are

working alongside our EPC partner, Bechtel, and other

counterparties to ensure that construction activities proceed

smoothly and in line with contractual schedules. Through rigorous

planning, diligent execution, and proactive risk management,

together we are seeking to maximize the efficiency of construction

efforts."

"We are also actively working to capitalize on market

opportunities and position the Company for sustained growth through

expansion of our operational footprint. With regulatory approvals

in place, our Train 4 and 5 expansion capacity is well-positioned

to meet growing global demand for LNG. Supportive market conditions

provide tailwinds to continue progressing toward FID of Train 4,

which is well underway. Commercial discussions with various

potential counterparties and the FEED and EPC contracting processes

are proceeding well. Our progress remains aligned with our goal of

reaching a positive final investment decision for Train 4 in the

second half of this year."

"Through disciplined execution on Phase 1 and our expansion

capacity at the Rio Grande LNG Facility, we are poised to achieve

our long-term objective of becoming a leading provider of LNG to

customers around the globe while also delivering sustainable growth

and value creation for our shareholders."

Significant Recent Developments

Development and Construction

Under the EPC contracts with Bechtel Energy Inc. (Bechtel),

Phase 1 progress is tracked for Train 1, Train 2, and the common

facilities on a combined basis and Train 3 on a separate basis. As

of January 2024:

- The overall project completion percentage for Trains 1 and 2

and the common facilities of the Rio Grande LNG Facility was 14.3%,

which is in line with the schedule under the EPC contract. Within

this project completion percentage, engineering was 47.9% complete,

procurement was 26.8% complete, and construction was 1.0%

complete.

- The overall project completion percentage for Train 3 of the

Rio Grande LNG Facility was 4.4%, based on preliminary schedules,

which is also in line with the schedule under the EPC contract.

Within this project completion percentage, engineering was 3.4%

complete, procurement was 10.6% complete, and construction was 0.0%

complete.

Strategic and Commercial

- The Company has started the front-end engineering and design

(FEED) and EPC contract processes with Bechtel for Train 4 and are

progressing numerous discussions with potential buyers of LNG to

provide commercial support for Train 4. The EPC contracting process

and commercial discussions are progressing at a pace consistent

with the Company's target of reaching a positive final investment

decision (FID) of Train 4 in the second half of 2024.

Financial

- As of December 2023, Rio Grande’s outstanding fixed-rate debt

and executed interest rate swaps have reduced its exposure to

movements in interest rates for approximately 84% of the debt

currently projected to be incurred in support of Phase 1

construction.

- In December 2023, Rio Grande LNG, LLC (Rio Grande) entered into

a credit agreement with a group of lenders for $251 million of

senior secured loans to finance a portion of Phase 1. The senior

secured loans were disbursed in one advance of $251 million on

December 28, 2023, which resulted in a reduction in the commitments

outstanding under Rio Grande's existing bank credit facilities for

Phase 1. These senior secured loans will be amortized over a period

of approximately 18 years beginning in mid-2029, with a final

maturity in September 2047. These senior secured loans bear

interest at a fixed rate of 7.11% and rank pari passu to Rio

Grande's existing senior secured financings.

- In January 2024, the Company's wholly-owned subsidiary

NextDecade LNG, LLC entered into a credit agreement that provides

for a $50 million senior secured revolving credit facility with

additional capacity of $12.5 million to cover interest. Borrowings

under the revolving credit facility may be used for general

corporate purposes, including development costs related to Train 4

at the Rio Grande LNG Facility. Borrowings will bear interest at

SOFR or the base rate plus an applicable margin as defined in the

credit agreement. The revolving credit facility and interest term

loan mature at the earlier of two years from the closing date or 10

business days after a positive FID on Train 4.

- In February 2024, Rio Grande issued and sold $190 million of

senior secured notes in a private placement transaction to finance

a portion of Phase 1. The senior secured notes were issued on

February 9, 2024 and resulted in a reduction in the commitments

outstanding under Rio Grande's existing bank credit facilities for

Phase 1. These senior secured notes will be amortized over a period

of approximately 18 years beginning in mid-2029, with a final

maturity in June 2047. The senior secured notes bear interest at a

fixed rate of 6.85% and rank pari passu to Rio Grande's existing

senior secured financings.

- Rio Grande has syndicated a portion of its bank credit facility

commitments, resulting in a supporting lender group of

approximately 40 international banks.

Rio Grande LNG Facility

NextDecade is constructing and developing the Rio Grande LNG

Facility on the north shore of the Brownsville Ship Channel in

south Texas through its partially-owned subsidiary Rio Grande. The

site is located on 984 acres of land which has been leased

long-term and includes 15,000 feet of frontage on the Brownsville

Ship Channel. The Rio Grande LNG Facility has received necessary

approvals and authorizations required for construction, including

those from the Federal Energy Regulatory Commission (FERC) and the

Department of Energy (DOE), which allow for development,

construction, and operation of up to five trains and 27 million

tonnes per annum (MTPA) of LNG exports.

Phase 1 (Trains 1-3)

Phase 1 at the Rio Grande LNG Facility is under construction.

Phase 1 includes three liquefaction trains with a total nameplate

capacity of 17.61 MTPA of LNG production, two 180,000 cubic meter

full containment LNG storage tanks, and two jetty berthing

structures designed to load LNG carriers up to 216,000 cubic meters

in capacity. Phase 1 also includes associated site infrastructure

and common facilities including feed gas pretreatment facilities,

electric and water utilities, two totally enclosed ground flares

for the LNG tanks and marine facilities, two ground flares for the

liquefaction trains, roads, levees surrounding the entire site, and

warehouses, administrative, operations control room, and

maintenance buildings.

As of January 2024, progress on Trains 1 through 3 is in line

with the schedule under the EPC Contracts. Recent construction

activities have included the start of Train 1 foundation concrete

pours, piling activity for the LNG tanks, and construction of the

levee and marine offloading facility. Additionally, the civil works

program has progressed via the deep soil mixing program, and

meaningful progress has been made on the shoreline restoration

program, with the majority of shoreline reclamation nearing

completion, and shoreline protection work has commenced. Bechtel

has also made meaningful progress on purchase orders for Train

3.

NextDecade holds equity interests in the Phase 1 joint venture

that entitle it to receive up to 20.8% of the distributions of

available cash during operations.

Final Investment Decision on Train 4 and Train 5

NextDecade is targeting a positive FID and commencement of

construction of Train 4 and related infrastructure at the Rio

Grande LNG Facility in the second half of 2024, and subsequently

Train 5 and related infrastructure. Achieving a positive FID of

this fully permitted expansion capacity at the Rio Grande LNG

Facility will be subject to, among other things, finalizing and

entering into EPC contracts, entering into appropriate commercial

arrangements, and obtaining adequate financing to construct each

train and related infrastructure.

The Company has commenced certain pre-FID activities for Train

4, including the FEED and EPC contract processes with Bechtel. The

Company expects to finalize the Train 4 EPC contract in the first

half of 2024.

TotalEnergies SE (TotalEnergies) has LNG purchase options of 1.5

MTPA for each of Train 4 and Train 5. If TotalEnergies exercises

its LNG purchase options, the Company currently estimates that an

additional approximately 3 MTPA of LNG must be contracted on a

long-term basis for each of Train 4 and Train 5 prior to making a

positive FID for the respective train. The Company continues to

advance commercial discussions with various potential

counterparties and expects to finalize commercial arrangements for

Train 4 in the coming months to support an FID of Train 4 in the

second half of 2024.

The Company expects to finance construction of Train 4 utilizing

a combination of debt and equity funding. The Company expects to

enter into bank facilities for the debt portion of the funding. In

connection with consummating the Rio Grande Phase 1 equity joint

venture, the Company's equity partners each have options to invest

in Train 4 and Train 5 equity, which, if exercised, would provide

approximately 60% of the equity funding required for each of Train

4 and Train 5. Inclusive of these options, NextDecade currently

expects to fund 40% of the equity commitments for each of Train 4

and Train 5, and to have an initial economic interest of 40% in

each of Train 4 and Train 5, increasing to 60% after its equity

partners achieve certain returns on their investments in each of

the respective trains. The Company expects to undertake the

financing process for Train 4 after the EPC contract and commercial

arrangements are finalized.

Investor Presentation

NextDecade has posted an updated investor presentation to its

website concurrently with this release. A copy of this release and

the investor presentation can be found on its website at

www.next-decade.com.

About NextDecade Corporation

NextDecade Corporation is an energy company accelerating the

path to a net-zero future. Leading innovation in more sustainable

LNG and carbon capture solutions, NextDecade is committed to

providing the world access to cleaner energy. Through our

subsidiaries Rio Grande LNG and NEXT Carbon Solutions, we are

developing a 27 MTPA LNG export facility in South Texas along with

one of the largest carbon capture and storage projects in North

America. We are also working with third-party customers around the

world to deploy our proprietary processes to lower the cost of

carbon capture and storage and reduce CO2 emissions at their

industrial-scale facilities. NextDecade’s common stock is listed on

the Nasdaq Stock Market under the symbol “NEXT.” NextDecade is

headquartered in Houston, Texas. For more information, please visit

www.next-decade.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of U.S. federal securities laws. The words

“anticipate,” “contemplate,” “estimate,” “expect,” “project,”

“plan,” “intend,” “believe,” “may,” “might,” “will,” “would,”

“could,” “should,” “can have,” “likely,” “continue,” “design,”

“assume,” “budget,” “guidance,” “forecast,” and "target," and other

words and terms of similar expressions are intended to identify

forward-looking statements, and these statements may relate to the

business of NextDecade and its subsidiaries. These statements have

been based on assumptions and analysis made by NextDecade in light

of current expectations, perceptions of historical trends, current

conditions and projections about future events and trends and

involve a number of known and unknown risks, which may cause actual

results to differ materially from expectations expressed or implied

in the forward-looking statements. These risks include NextDecade’s

progress in the development of its LNG liquefaction and export

projects and CCS projects and the timing of that progress; the

timing of achieving a final investment decision on future trains at

the Rio Grande LNG Facility and the project costs thereof; the

availability and frequency of cash distributions available to

NextDecade from its joint venture which owns Phase 1 of the Rio

Grande LNG Facility; the ability to generate sufficient cash flow

to satisfy Rio Grande’s significant debt service obligations or to

refinance such obligations ahead of their maturity; restrictions

imposed by Rio Grande’s and NextDecade's debt agreements that limit

flexibility in operating its business; increases in interest rates

increasing the cost of servicing Rio Grande’s indebtedness;

reliance on third-party contractors to successfully complete the

Rio Grande LNG Facility, the pipeline to supply gas to the Rio

Grande LNG Facility and any CCS projects; ability to develop NEXT

Carbon Solutions’ business though implementation of CCS projects;

ability to secure additional debt and equity financing in the

future to complete the Rio Grande LNG Facility and CCS projects on

commercially acceptable terms; accuracy of estimated costs for the

Rio Grande LNG Facility and CCS projects; ability to achieve

operational characteristics of the Rio Grande LNG Facility and CCS

projects, when completed, including liquefaction capacities and

amount of CO2 captured and stored, and any differences in such

operational characteristics from expectations; development risks,

operational hazards and regulatory approvals applicable to

NextDecade’s development, construction and operation activities and

those of its third-party contractors and counterparties;

technological innovation which may lessen NextDecade’s anticipated

competitive advantage or demand for its offerings; global demand

for and price of LNG; availability of LNG vessels worldwide;

changes in legislation and regulations relating to the LNG and CCS

industries, including environmental laws and regulations that

impose significant compliance costs and liabilities; scope of

implementation of carbon pricing regimes aimed at reducing

greenhouse gas emissions; global development and maturation of

emissions reduction credit markets; adverse changes to existing or

proposed carbon tax incentive regimes; global pandemics, including

the 2019 novel coronavirus pandemic, the Russia-Ukraine conflict

and hostilities in the Middle East, other sources of volatility in

the energy markets and their impact on NextDecade’s business and

operating results, including any disruptions in its operations or

development of the Rio Grande LNG Facility and the health and

safety of its employees, and on its customers, the global economy

and the demand for LNG; risks related to doing business in and

having counterparties in foreign countries; NextDecade’s ability to

maintain the listing of our securities on the Nasdaq Capital Market

or another securities exchange or quotation medium; changes

adversely affecting the businesses in which NextDecade is engaged;

management of growth; general economic conditions; ability to

generate cash; the result of future financing efforts and

applications for customary tax incentives; and other matters

discussed in the “Risk Factors” section of NextDecade’s most recent

Annual Report on Form 10-K and subsequent reports filed with the

Securities and Exchange Commission. Additionally, any development

of subsequent trains at the Rio Grande LNG Facility or CCS projects

remains contingent upon execution of definitive commercial and

financing agreements, securing all financing commitments and

potential tax incentives, achieving other customary conditions and

making a final investment decision to proceed. The forward-looking

statements in this press release speak as of the date of this

release. Although NextDecade believes that the expectations

reflected in these forward-looking statements are reasonable, it

can give no assurance that the expectations will prove to be

correct. NextDecade may from time to time voluntarily update its

prior forward-looking statements, however, it disclaims any

commitment to do so except as required by securities laws.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240311902166/en/

Investors Megan Light mlight@next-decade.com

832-981-6583

Media Susan Richardson srichardson@next-decade.com

832-413-6400

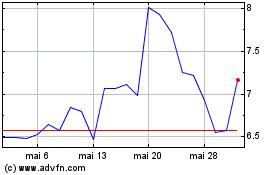

NextDecade (NASDAQ:NEXT)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

NextDecade (NASDAQ:NEXT)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025