Pacira BioSciences, Inc. (Nasdaq: PCRX), the industry leader in the

delivery of innovative, non-opioid pain therapies, today reported

financial results for the third quarter of 2024.

Third Quarter 2024 Financial Highlights

- Total revenues of $168.6 million

- Net product sales of $132.0 million for EXPAREL, $28.4 million

for ZILRETTA, and $5.7 million for iovera°

- Net loss of $143.5 million, or $3.11 per share (basic and

diluted)

- Adjusted earnings before interest, taxes, depreciation and

amortization (EBITDA) of $54.7 million

See “Non-GAAP Financial Information” below.

“2024 continues to be highlighted by important progress across

both our clinical pipeline and commercial portfolio of

best-in-class opioid-sparing products that delivered solid third

quarter sales,” said Frank D. Lee, chief executive officer of

Pacira BioSciences. “Looking at the remainder of the year, we

intend to build on this momentum by advancing our strategy for

long-term growth and value creation, which includes investing in a

best-practice commercial organization and innovative pipeline of

potentially transformational assets, such as PCRX-201.”

“The work we have completed this year positions us to enter 2025

from a new place of focus, commitment, and strategic strength. We

are confident the investments we are making will support and expand

our leadership in non-opioid pain management and ensure we are

positioned for sustainable success,” continued Mr. Lee.

Recent Business Highlights

- Final CMS Rule Issued for EXPAREL and iovera° in

Outpatient Settings. In November 2024, the CMS issued its

final Medicare Hospital Outpatient Prospective Payment System

(OPPS) and Medicare Ambulatory Surgical Center (ASC) Payment System

rule for 2025, which implements the Non-Opioids Prevent Addiction

in the Nation (NOPAIN) Act that mandates separate Medicare payment

for qualifying non-opioid drugs and devices. In the final rule, CMS

confirmed that both EXPAREL and iovera° qualify as eligible

non-opioid pain management products under the NOPAIN Act. Hospital

outpatient departments (HOPDs) and ASCs that use these products

will receive additional Medicare reimbursement beginning January 1,

2025.

- Shawn Cross Appointed as Chief Financial

Officer. In October 2024, the company appointed Shawn

Cross as Chief Financial Officer. Mr. Cross brings more than 25

years of experience as a biotechnology executive, board member and

investment banker. Most recently, Mr. Cross served in executive

positions of increasing responsibility at Applied Molecular

Transport, Inc. (AMT) where he was ultimately named Chief Executive

Officer to lead the company’s merger with Cyclo Therapeutics, Inc.,

where he currently serves on the Board of Directors. His

biopharmaceutical investment banking career includes senior

leadership roles at JMP Securities, Inc., Deutsche Bank Securities

Inc., and Wells Fargo Securities, LLC.

- New Product-Specific J-Code for EXPAREL. In

October 2024, the company announced that the Centers for Medicare

and Medicaid Services (CMS) established a permanent

product-specific Healthcare Common Procedure Coding System (HCPCS)

J-code for EXPAREL. The new J-code for EXPAREL, J0666, becomes

effective January 1, 2025, and will supersede the current C-code

(C9290), which has been in place since 2019. In addition to the

separate CMS reimbursement EXPAREL will receive in outpatient

settings with the implementation of NOPAIN in January 2025, this

new J-code will also provide reimbursement when EXPAREL is used in

the office setting and for office-based surgeries.

- Presentation of Two-year Safety and Efficacy Data

Following Local Administration of PCRX-201 for Moderate to Severe

Osteoarthritis of the Knee. In September 2024, Pacira

announced the upcoming presentation of new data in support of its

gene therapy candidate, PCRX-201. The data will be presented at the

American College of Rheumatology's annual ACR Converge meeting,

being held in Washington, D.C. The data will be presented on

Sunday, November 17 in a poster session taking place from 10:30AM

to 12:30PM ET by Stanley Cohen, MD, a board-certified

rheumatologist and Co-Medical Director of the Metroplex Clinical

Research Center in Dallas, TX.

Third Quarter 2024 Financial Results

- Total revenues were $168.6 million in the third quarter of

2024, versus $163.9 million reported for the third quarter of

2023.

- EXPAREL net product sales were $132.0 million in the third

quarter of 2024, versus $128.7 million reported for the third

quarter of 2023. Third quarter volume growth of 3 percent and a net

price increase of 1 percent was partially offset by a shift in vial

mix. There were the same number of selling days in the third

quarters of 2024 and 2023.

- ZILRETTA net product sales were $28.4 million in the third

quarter of 2024, versus $28.8 million reported for the third

quarter of 2023.

- Third quarter 2024 iovera° net product sales were $5.7 million,

versus $5.3 million reported for the third quarter of 2023.

- Sales of bupivacaine liposome injectable suspension to

third-party licensees were $1.6 million in the third quarter of

2024, versus $0.9 million reported for the third quarter of

2023.

- Total operating expenses were $308.1 million in the third

quarter of 2024, compared to $146.2 million in the third quarter of

2023. The third quarter of 2024 includes a goodwill impairment of

$163.2 million based upon an assessment that the fair value of

goodwill is less than its carrying value.

- Research and development (R&D) expenses were $19.1 million

in the third quarter of 2024, compared to $20.8 million in the

third quarter of 2023. R&D expenses included $7.2 million and

$9.4 million of product development and manufacturing capacity

expansion costs in the third quarters of 2024 and 2023,

respectively.

- Selling, general and administrative (SG&A) expenses were

$74.3 million in the third quarter of 2024, compared to $67.9

million in the third quarter of 2023.

- GAAP net loss was $143.5 million, or $3.11 per share (basic and

diluted) in the third quarter of 2024, compared to GAAP net income

of $10.9 million, or $0.23 per share (basic and diluted) in the

third quarter of 2023. Included in GAAP net loss in the third

quarter of 2024 was a $163.2 million impairment of goodwill based

upon an assessment that the fair value of goodwill is less than its

carrying value.

- Non-GAAP net income was $38.2 million, or $0.83 per share

(basic) and $0.79 per share (diluted) in the third quarter of 2024,

compared to $36.6 million, or $0.79 per share (basic) and $0.72 per

share (diluted), in the third quarter of 2023.

- Adjusted EBITDA was $54.7 million in the third quarter of 2024,

compared to $52.9 million in the third quarter of 2023.

- Pacira ended the third quarter of 2024 with cash, cash

equivalents and available-for-sale investments (“cash”) of $453.8

million. Cash provided by operations was $53.9 million in the third

quarter of 2024, compared to $44.4 million in the third quarter of

2023.

- Pacira had 46.1 million basic and diluted weighted average

shares of common stock outstanding in the third quarter of

2024.

- For non-GAAP measures, Pacira had 49.0 million diluted weighted

average shares of common stock outstanding in the third quarter of

2024.

See “Non-GAAP Financial Information” below.

2024 Financial Guidance

Today the company is reiterating its full-year 2024 financial

guidance as follows:

- Total revenue of $680 million to $705 million;

- Non-GAAP gross margin of 74% to 76%;

- Non-GAAP R&D expense of $70 million to $80 million;

- Non-GAAP SG&A expense of $245 million to $265 million;

and

- Stock-based compensation of $50 million to $55 million.

See “Non-GAAP Financial Information” below.

Today’s Conference Call and Webcast

Reminder

The Pacira management team will host a conference call to

discuss the company’s financial results and recent developments

today, Wednesday, November 6, 2024, at 4:30 p.m. ET. For

listeners who wish to participate in the question-and-answer

session via telephone, please pre-register at

investor.pacira.com/upcoming-events. All registrants will receive

dial-in information and a PIN allowing them to access the live

call. In addition, a live audio of the conference call will be

available as a webcast. Interested parties can access the event

through the “Events” page on the Pacira website at

investor.pacira.com.

Non-GAAP Financial Information

This press release contains financial measures that do not

comply with U.S. generally accepted accounting principles (GAAP),

such as non-GAAP gross margin, non-GAAP cost of goods sold,

non-GAAP research and development (R&D) expense, non-GAAP

selling, general and administrative (SG&A) expense, non-GAAP

goodwill impairment, non-GAAP net income, non-GAAP net income per

common share, non-GAAP weighted average diluted common shares

outstanding, EBITDA (earnings before interest, taxes, depreciation

and amortization) and adjusted EBITDA, because these non-GAAP

financial measures exclude the impact of items that management

believes affect comparability or underlying business trends.

These measures supplement the company’s financial results

prepared in accordance with GAAP. Pacira management uses these

measures to better analyze its financial results, estimate its

future cost of goods sold, R&D expense and SG&A expense

outlook for 2024 and to help make managerial decisions. In

management’s opinion, these non-GAAP measures are useful to

investors and other users of the company’s financial statements by

providing greater transparency into the ongoing operating

performance of Pacira and its future outlook. Such measures should

not be deemed to be an alternative to GAAP requirements or a

measure of liquidity for Pacira. The non-GAAP measures presented

here are also unlikely to be comparable with non-GAAP disclosures

released by other companies. See the tables below for a

reconciliation of GAAP to non-GAAP measures.

Inducement Grants Under Nasdaq Listing Rule

5635(c)(4)

Pacira today announced the granting of inducement awards on

November 4, 2024 to 11 new employees under Pacira’s Amended and

Restated 2014 Inducement Plan as a material inducement to each

employee's entry into employment with the company. In accordance

with Nasdaq Listing Rule 5635(c)(4), the awards were approved by

the Compensation Committee of the Board of Directors.

4 employees received stock options to purchase an aggregate of

19,200 shares of Pacira common stock and 11 employees received

restricted stock units for an aggregate of 36,000 shares of Pacira

common stock.

The stock options have a 10-year term and a four-year vesting

schedule with 25 percent of the underlying shares vesting on the

first anniversary of the recipient’s first day of employment and in

successive equal quarterly installments over the 36 months

thereafter. The stock options have an exercise price of $16.45 per

share, the closing trading price of Pacira common stock on the

Nasdaq Global Select Market on the date of grant. Each restricted

stock unit represents the contingent right to receive one share of

Pacira common stock and the restricted stock unit awards vest

annually in four equal installments beginning on the first

anniversary of November 1, 2024.

Vesting of the equity awards is subject to the employee’s

continued employment with Pacira. Each equity award is also subject

to the terms and conditions of an award agreement.

About Pacira

Pacira delivers innovative, non-opioid pain therapies to

transform the lives of patients. Pacira has three commercial-stage

non-opioid treatments: EXPAREL® (bupivacaine liposome injectable

suspension), a long-acting local analgesic currently approved for

infiltration, fascial plane block, and as an interscalene brachial

plexus nerve block, an adductor canal nerve block, and a sciatic

nerve block in the popliteal fossa for postsurgical pain

management; ZILRETTA® (triamcinolone acetonide extended-release

injectable suspension), an extended-release, intra-articular

injection indicated for the management of osteoarthritis knee pain;

and ioveraº®, a novel, handheld device for delivering immediate,

long-acting, drug-free pain control using precise, controlled doses

of cold temperature to a targeted nerve. The company is also

advancing the development of PCRX-201, a novel locally administered

gene therapy with the potential to treat large prevalent diseases

like osteoarthritis. To learn more about Pacira, visit

www.pacira.com.

About EXPAREL® (bupivacaine liposome injectable

suspension)

EXPAREL is indicated to produce postsurgical local analgesia via

infiltration in patients aged 6 years and older, and postsurgical

regional analgesia via an interscalene brachial plexus block in

adults, a sciatic nerve block in the popliteal fossa in adults, and

an adductor canal block in adults. The safety and effectiveness of

EXPAREL have not been established to produce postsurgical regional

analgesia via other nerve blocks besides an interscalene brachial

plexus nerve block, a sciatic nerve block in the popliteal fossa,

or an adductor canal block. The product combines bupivacaine with

multivesicular liposomes, a proven product delivery technology that

delivers medication over a desired time period. EXPAREL represents

the first and only multivesicular liposome local anesthetic that

can be utilized in the peri- or postsurgical setting. By utilizing

the multivesicular liposome platform, a single dose of EXPAREL

delivers bupivacaine over time, providing significant reductions in

cumulative pain scores with up to a 78 percent decrease in opioid

consumption; the clinical benefit of the opioid reduction was not

demonstrated. Additional information is available at

www.EXPAREL.com.

Important Safety Information about EXPAREL for

Patients

EXPAREL should not be used in obstetrical paracervical block

anesthesia. In studies in adults where EXPAREL was injected into a

wound, the most common side effects were nausea, constipation, and

vomiting. In studies in adults where EXPAREL was injected near a

nerve, the most common side effects were nausea, fever, and

constipation. In the study where EXPAREL was given to children, the

most common side effects were nausea, vomiting, constipation, low

blood pressure, low number of red blood cells, muscle twitching,

blurred vision, itching, and rapid heartbeat. EXPAREL can cause a

temporary loss of feeling and/or loss of muscle movement. How much

and how long the loss of feeling and/or muscle movement depends on

where and how much of EXPAREL was injected and may last for up to 5

days. EXPAREL is not recommended to be used in patients younger

than 6 years old for injection into the wound, for patients younger

than 18 years old, for injection near a nerve, and/or in pregnant

women. Tell your health care provider if you or your child has

liver disease, since this may affect how the active ingredient

(bupivacaine) in EXPAREL is eliminated from the body. EXPAREL

should not be injected into the spine, joints, or veins. The active

ingredient in EXPAREL can affect the nervous system and the

cardiovascular system; may cause an allergic reaction; may cause

damage if injected into the joints; and can cause a rare blood

disorder.

About ZILRETTA® (triamcinolone acetonide

extended-release injectable suspension)

On October 6, 2017, ZILRETTA was approved by the U.S. Food and

Drug Administration as the first and only extended-release

intra-articular therapy for patients confronting osteoarthritis

(OA)- related knee pain. ZILRETTA employs proprietary microsphere

technology combining triamcinolone acetonide—a commonly

administered, short-acting corticosteroid—with a poly

lactic-co-glycolic acid (PLGA) matrix to provide extended pain

relief. The pivotal Phase 3 trial on which the approval of ZILRETTA

was based showed that ZILRETTA significantly reduced OA knee pain

for 12 weeks, with some people experiencing pain relief through

Week 16. Learn more at www.zilretta.com.

Indication and Select Important Safety Information for

ZILRETTA

Indication: ZILRETTA is indicated as an

intra-articular injection for the management of OA pain of the

knee. Limitation of Use: The efficacy and safety of repeat

administration of ZILRETTA have not been demonstrated.

Contraindication: ZILRETTA is contraindicated

in patients who are hypersensitive to triamcinolone acetonide,

corticosteroids or any components of the product.

Warnings and Precautions:

- Intra-articular Use Only: ZILRETTA has not

been evaluated and should not be administered by epidural,

intrathecal, intravenous, intraocular, intramuscular, intradermal,

or subcutaneous routes. ZILRETTA should not be considered safe for

epidural or intrathecal administration.

- Serious Neurologic Adverse Reactions with Epidural and

Intrathecal Administration: Serious neurologic events have

been reported following epidural or intrathecal corticosteroid

administration. Corticosteroids are not approved for this use.

- Hypersensitivity reactions: Serious reactions

have been reported with triamcinolone acetonide injection.

Institute appropriate care if an anaphylactic reaction occurs.

- Joint infection and damage: A marked increase

in joint pain, joint swelling, restricted motion, fever and malaise

may suggest septic arthritis. If this occurs, conduct appropriate

evaluation and if confirmed, institute appropriate antimicrobial

treatment.

Adverse Reactions: The most commonly reported

adverse reactions (incidence ≥1%) in clinical studies included

sinusitis, cough, and contusions.

Please see ZILRETTALabel.com for full Prescribing

Information.

About iovera°®

The iovera° system uses the body’s natural response to cold to

treat peripheral nerves and immediately reduce pain without the use

of drugs. Treated nerves are temporarily stopped from sending pain

signals for a period of time, followed by a restoration of

function. Treatment with iovera° works by applying targeted cold to

a peripheral nerve. A precise cold zone is formed under the skin

that is cold enough to immediately prevent the nerve from sending

pain signals without causing damage to surrounding structures. The

effect on the nerve is temporary, providing pain relief until the

nerve regenerates and function is restored. Treatment with iovera°

does not include injection of any substance, opioid, or any other

drug. The effect is immediate and can last up to 90 days. The

iovera° system is not indicated for treatment of central nervous

system tissue. Additional information is available at

www.iovera.com.

Indication and Select Important Safety Information for

iovera°®

Indication: iovera° applies freezing cold to

peripheral nerve tissue to block and/or relieve pain for up to 90

days. It should not be used to treat central nervous system

tissue.

Important Safety Information

- Do not receive treatment with iovera° if you experience

hypersensitivity to cold or have open and/or infected wounds near

the treatment site.

- You may experience bruising, swelling, inflammation and/or

redness, local pain and/or tenderness, and altered feeling at the

site of application.

- In treatment area(s), you may experience damage to the skin,

skin darkening or lightening, and dimples in the skin.

- You may experience a temporary loss of your ability to use your

muscles normally outside of the treatment area.

- Talk to your doctor before receiving treatment with

iovera°.

Forward-Looking Statements

Any statements in this press release about Pacira’s future

expectations, plans, trends, outlook, projections and prospects,

and other statements containing the words “anticipate,” “believe,”

“can,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,”

“project,” “should,” “will,” “would,” and similar expressions,

constitute forward-looking statements within the meaning of Section

21E of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), and the Private Securities Litigation Reform Act

of 1995, including, without limitation, statements related to our

future outlook, our intellectual property and patent terms, our

growth and future operating results and trends, our strategy,

plans, objectives, expectations (financial or otherwise) and

intentions, future financial results and growth potential,

including our plans with respect to the repayment of our

indebtedness, anticipated product portfolio, development programs,

development of products, strategic alliances, plans with respect to

the Non-Opioids Prevent Addiction in the Nation (“NOPAIN”) Act and

other statements that are not historical facts. For this purpose,

any statement that is not a statement of historical fact should be

considered a forward-looking statement. We cannot assure you that

our estimates, assumptions and expectations will prove to have been

correct. Actual results may differ materially from those indicated

by such forward-looking statements as a result of various important

factors, including risks relating to, among others: the integration

of our new chief executive officer; risks associated with

acquisitions, such as the risk that the acquired businesses will

not be integrated successfully, that such integration may be more

difficult, time-consuming or costly than expected or that the

expected benefits of the transaction will not occur; our

manufacturing and supply chain, global and U.S. economic conditions

(including inflation and rising interest rates), and our business,

including our revenues, financial condition, cash flow and results

of operations; the success of our sales and manufacturing efforts

in support of the commercialization of EXPAREL, ZILRETTA and

iovera°; the rate and degree of market acceptance of EXPAREL,

ZILRETTA and iovera°; the size and growth of the potential markets

for EXPAREL, ZILRETTA and iovera° and our ability to serve those

markets; our plans to expand the use of EXPAREL, ZILRETTA and

iovera° to additional indications and opportunities, and the timing

and success of any related clinical trials for EXPAREL, ZILRETTA

and iovera°; the commercial success of EXPAREL, ZILRETTA and

iovera°; the related timing and success of U.S. Food and Drug

Administration supplemental New Drug Applications and premarket

notification 510(k)s; the related timing and success of European

Medicines Agency Marketing Authorization Applications; our plans to

evaluate, develop and pursue additional product candidates

utilizing our proprietary multivesicular liposome (“pMVL”) drug

delivery technology; the approval of the commercialization of our

products in other jurisdictions; clinical trials in support of an

existing or potential pMVL-based product; our commercialization and

marketing capabilities; our ability to successfully complete

capital projects; the outcome of any litigation; the ability to

successfully integrate any future acquisitions into our existing

business; the recoverability of our deferred tax assets;

assumptions associated with contingent consideration payments;

assumptions used for estimated future cash flows associated with

determining the fair value of the Company; the anticipated funding

or benefits of our share repurchase program; and factors discussed

in the “Risk Factors” of our most recent Annual Report on Form 10-K

and in other filings that we periodically make with the Securities

and Exchange Commission (the “SEC”). In addition, the

forward-looking statements included in this press release represent

our views as of the date of this press release. Important factors

could cause actual results to differ materially from those

indicated or implied by forward-looking statements, and as such we

anticipate that subsequent events and developments will cause our

views to change. Except as required by applicable law, we undertake

no intention or obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise, and readers should not rely on these forward-looking

statements as representing our views as of any date subsequent to

the date of this press release.

(Tables to Follow)

Pacira BioSciences,

Inc.Condensed Consolidated Balance

Sheets(in

thousands)(unaudited)

| |

September 30, 2024 |

|

December 31, 2023 |

| ASSETS |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

245,965 |

|

$ |

153,298 |

|

Short-term available-for-sale investments |

|

207,845 |

|

|

125,283 |

|

Accounts receivable, net |

|

100,653 |

|

|

105,556 |

|

Inventories, net |

|

111,865 |

|

|

104,353 |

|

Prepaid expenses and other current assets |

|

23,641 |

|

|

21,504 |

|

Total

current assets |

|

689,969 |

|

|

509,994 |

| Noncurrent available-for-sale

investments |

|

— |

|

|

2,410 |

| Fixed assets, net |

|

166,852 |

|

|

173,927 |

| Right-of-use assets, net |

|

53,830 |

|

|

61,020 |

| Goodwill |

|

— |

|

|

163,243 |

| Intangible assets, net |

|

440,292 |

|

|

483,258 |

| Deferred tax assets |

|

134,022 |

|

|

144,485 |

| Investments and other

assets |

|

36,726 |

|

|

36,049 |

|

Total

assets |

$ |

1,521,691 |

|

$ |

1,574,386 |

| |

|

|

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

19,367 |

|

$ |

15,698 |

|

Accrued expenses |

|

76,377 |

|

|

64,243 |

| Lease

liabilities |

|

9,191 |

|

|

8,801 |

|

Current portion of convertible senior notes, net |

|

201,466 |

|

|

8,641 |

|

Total

current liabilities |

|

306,401 |

|

|

97,383 |

| Convertible senior notes,

net |

|

278,867 |

|

|

398,594 |

| Long-term debt, net |

|

107,024 |

|

|

115,202 |

| Lease liabilities |

|

47,875 |

|

|

54,806 |

| Contingent consideration |

|

19,157 |

|

|

24,698 |

| Other liabilities |

|

12,784 |

|

|

13,573 |

| Total stockholders’

equity |

|

749,583 |

|

|

870,130 |

|

Total

liabilities and stockholders’ equity |

$ |

1,521,691 |

|

$ |

1,574,386 |

| |

|

|

|

|

|

Pacira BioSciences,

Inc.Condensed Consolidated Statements of

Operations(in thousands, except per share

amounts)(unaudited)

| |

Three Months Ended |

|

Nine Months Ended |

| |

September 30, |

|

September 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net product sales: |

|

|

|

|

|

|

|

|

EXPAREL |

$ |

132,004 |

|

|

$ |

128,667 |

|

|

$ |

401,286 |

|

|

$ |

394,202 |

|

|

ZILRETTA |

|

28,420 |

|

|

|

28,798 |

|

|

|

84,966 |

|

|

|

82,393 |

|

|

iovera° |

|

5,655 |

|

|

|

5,260 |

|

|

|

16,359 |

|

|

|

13,645 |

|

|

Bupivacaine liposome injectable suspension |

|

1,643 |

|

|

|

858 |

|

|

|

7,322 |

|

|

|

2,241 |

|

| Total net product sales |

|

167,722 |

|

|

|

163,583 |

|

|

|

509,933 |

|

|

|

492,481 |

|

| Royalty revenue |

|

851 |

|

|

|

343 |

|

|

|

3,780 |

|

|

|

1,253 |

|

| Total revenues |

|

168,573 |

|

|

|

163,926 |

|

|

|

513,713 |

|

|

|

493,734 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Cost of goods sold |

|

38,864 |

|

|

|

39,750 |

|

|

|

130,542 |

|

|

|

136,977 |

|

|

Research and development |

|

19,104 |

|

|

|

20,830 |

|

|

|

57,680 |

|

|

|

56,794 |

|

|

Selling, general and administrative |

|

74,333 |

|

|

|

67,947 |

|

|

|

214,485 |

|

|

|

203,640 |

|

|

Amortization of acquired intangible assets |

|

14,322 |

|

|

|

14,322 |

|

|

|

42,966 |

|

|

|

42,966 |

|

|

Goodwill impairment |

|

163,243 |

|

|

|

— |

|

|

|

163,243 |

|

|

|

— |

|

|

Contingent consideration (gains) charges, restructuring charges and

other |

|

(1,766 |

) |

|

|

3,356 |

|

|

|

2,872 |

|

|

|

(1,150 |

) |

|

Total

operating expenses |

|

308,100 |

|

|

|

146,205 |

|

|

|

611,788 |

|

|

|

439,227 |

|

| (Loss) income from

operations |

|

(139,527 |

) |

|

|

17,721 |

|

|

|

(98,075 |

) |

|

|

54,507 |

|

| Other income (expense): |

|

|

|

|

|

|

|

|

Interest income |

|

5,482 |

|

|

|

2,766 |

|

|

|

14,134 |

|

|

|

8,019 |

|

|

Interest expense |

|

(4,689 |

) |

|

|

(3,464 |

) |

|

|

(11,889 |

) |

|

|

(16,918 |

) |

|

Gain (loss) on early extinguishment of debt |

|

— |

|

|

|

— |

|

|

|

7,518 |

|

|

|

(16,926 |

) |

|

Other, net |

|

(122 |

) |

|

|

(422 |

) |

|

|

(320 |

) |

|

|

(701 |

) |

|

Total other

income (expense), net |

|

671 |

|

|

|

(1,120 |

) |

|

|

9,443 |

|

|

|

(26,526 |

) |

| (Loss) income before income

taxes |

|

(138,856 |

) |

|

|

16,601 |

|

|

|

(88,632 |

) |

|

|

27,981 |

|

|

Income tax expense |

|

(4,610 |

) |

|

|

(5,743 |

) |

|

|

(26,969 |

) |

|

|

(10,896 |

) |

| Net (loss) income |

$ |

(143,466 |

) |

|

$ |

10,858 |

|

|

$ |

(115,601 |

) |

|

$ |

17,085 |

|

| |

|

|

|

|

|

|

|

| Net (loss) income per common

share: |

|

|

|

|

|

|

|

|

Basic and diluted net (loss) income per common share |

$ |

(3.11 |

) |

|

$ |

0.23 |

|

|

$ |

(2.50 |

) |

|

$ |

0.37 |

|

| Weighted average common shares

outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

46,134 |

|

|

|

46,416 |

|

|

|

46,269 |

|

|

|

46,151 |

|

|

Diluted |

|

46,134 |

|

|

|

52,067 |

|

|

|

46,269 |

|

|

|

46,343 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pacira BioSciences,

Inc.Reconciliation of GAAP to Non-GAAP Financial

Information(in thousands, except per share

amounts)(unaudited)

| |

Three Months Ended |

|

Nine Months Ended |

| |

September 30, |

|

September 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| GAAP net (loss) income |

$ |

(143,466 |

) |

|

$ |

10,858 |

|

|

$ |

(115,601 |

) |

|

$ |

17,085 |

|

| |

|

|

|

|

|

|

|

| Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

Contingent consideration (gains) charges, restructuring charges and

other: |

|

|

|

|

|

|

|

|

Changes in the fair value of contingent consideration |

|

(3,244 |

) |

|

|

2,793 |

|

|

|

(5,541 |

) |

|

|

(3,847 |

) |

|

Restructuring charges(1) (2) |

|

403 |

|

|

|

173 |

|

|

|

4,207 |

|

|

|

1,109 |

|

|

Acquisition-related expenses(3) |

|

285 |

|

|

|

390 |

|

|

|

689 |

|

|

|

1,588 |

|

|

Goodwill impairment(4) |

|

163,243 |

|

|

|

— |

|

|

|

163,243 |

|

|

|

— |

|

|

Step-up of acquired Flexion Therapeutics, Inc. fixed assets and

inventory to fair value and other |

|

— |

|

|

|

1,318 |

|

|

|

— |

|

|

|

5,152 |

|

| Stock-based compensation |

|

13,230 |

|

|

|

12,530 |

|

|

|

38,905 |

|

|

|

35,475 |

|

|

Chief Executive Officer transition costs(5) |

|

174 |

|

|

|

— |

|

|

|

745 |

|

|

|

— |

|

| (Gain) loss on early

extinguishment of debt |

|

— |

|

|

|

— |

|

|

|

(7,518 |

) |

|

|

16,926 |

|

| Amortization of debt

discount |

|

23 |

|

|

|

25 |

|

|

|

70 |

|

|

|

728 |

|

|

Amortization of acquired intangible assets |

|

14,322 |

|

|

|

14,322 |

|

|

|

42,966 |

|

|

|

42,966 |

|

| Tax impact of non-GAAP

adjustments(6) |

|

(6,813 |

) |

|

|

(5,778 |

) |

|

|

(8,703 |

) |

|

|

(20,249 |

) |

| Total non-GAAP

adjustments |

|

181,623 |

|

|

|

25,773 |

|

|

|

229,063 |

|

|

|

79,848 |

|

| |

|

|

|

|

|

|

|

| Non-GAAP net income |

$ |

38,157 |

|

|

$ |

36,631 |

|

|

$ |

113,462 |

|

|

$ |

96,933 |

|

| |

|

|

|

|

|

|

|

| GAAP basic and diluted net

(loss) income per common share |

$ |

(3.11 |

) |

|

$ |

0.23 |

|

|

$ |

(2.50 |

) |

|

$ |

0.37 |

|

| |

|

|

|

|

|

|

|

| GAAP net (loss) income used for

basic earnings per common share |

$ |

(143,466 |

) |

|

$ |

10,858 |

|

|

$ |

(115,601 |

) |

|

$ |

17,085 |

|

| Interest expense on convertible

senior notes, net of tax |

|

— |

|

|

|

1,029 |

|

|

|

— |

|

|

|

— |

|

| GAAP net (loss) income used for

diluted earnings per common share |

$ |

(143,466 |

) |

|

$ |

11,887 |

|

|

$ |

(115,601 |

) |

|

$ |

17,085 |

|

| |

|

|

|

|

|

|

|

| Non-GAAP basic net income per

common share |

$ |

0.83 |

|

|

$ |

0.79 |

|

|

$ |

2.45 |

|

|

$ |

2.10 |

|

| Non-GAAP diluted net income

per common share |

$ |

0.79 |

|

|

$ |

0.72 |

|

|

$ |

2.29 |

|

|

$ |

1.93 |

|

| |

|

|

|

|

|

|

|

| Non-GAAP net income |

$ |

38,157 |

|

|

$ |

36,631 |

|

|

$ |

113,462 |

|

|

$ |

96,933 |

|

| Interest expense on convertible

senior notes, net of tax(7) |

|

518 |

|

|

|

1,029 |

|

|

|

2,308 |

|

|

|

3,086 |

|

| Non-GAAP net income used for

diluted earnings per common share(7) |

$ |

38,675 |

|

|

$ |

37,660 |

|

|

$ |

115,770 |

|

|

$ |

100,019 |

|

| |

|

|

|

|

|

|

|

| Weighted average common shares

outstanding - basic |

|

46,134 |

|

|

|

46,416 |

|

|

|

46,269 |

|

|

|

46,151 |

|

| Weighted average common shares

outstanding - diluted |

|

46,134 |

|

|

|

52,067 |

|

|

|

46,269 |

|

|

|

46,343 |

|

| Non-GAAP weighted average common

shares outstanding - basic |

|

46,134 |

|

|

|

46,416 |

|

|

|

46,269 |

|

|

|

46,151 |

|

| Non-GAAP weighted average common

shares outstanding - diluted(7) |

|

48,971 |

|

|

|

52,067 |

|

|

|

50,568 |

|

|

|

51,951 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pacira BioSciences, Inc.Reconciliation of

GAAP to Non-GAAP Financial Information

(continued)(unaudited) |

| (1) In February

2024, the Company initiated a restructuring plan to ensure it is

well positioned for long-term growth. The restructuring plan

includes: (i) reshaping the Company’s executive team; (ii)

reallocating efforts and resources from the Company’s ex-U.S. and

certain early-stage development programs to its commercial

portfolio in the U.S. market; and (iii) reprioritizing investments

to focus on commercial readiness for the implementation of separate

Medicare reimbursement for EXPAREL at average sales price plus 6

percent in outpatient settings beginning in January 2025 and

broader commercial initiatives in key areas, such as strategic

national accounts, marketing and market access and reimbursement.

The charges related to employee termination benefits, severance,

and, to a lesser extent, other employment-related termination

costs. |

| (2) Approximately

$0.8 million and $3.5 million of restructuring charges were

excluded from this line item as they are included in the

stock-based compensation line item for the three and nine months

ended September 30, 2024, respectively. |

| (3)

Acquisition-related expenses related to vacant and underutilized

leases assumed from the acquisition of Flexion Therapeutics, Inc.

(“Flexion”). |

| (4) During the three

months ended September 30, 2024, the United States Food and Drug

Administration approved a generic competitor to EXPAREL and a U.S.

District Court ruled that one of our patents was not valid. Due to

these events and a subsequent decrease in our common stock price,

it was determined these qualitative factors indicated it was more

likely than not that the fair value of goodwill may be less than

its carrying value. Accordingly, we performed a quantitative

assessment through a discounted cash flow model (or income

approach), which resulted in the carrying value of the Company

exceeding its fair value by more than the goodwill balance. As a

result, the goodwill balance of $163.2 million was fully

impaired during the three months ended September 30, 2024. |

| (5) The Company

appointed a new chief executive officer (“CEO”) effective January

2, 2024. CEO transition costs include compensation costs related to

the transition of the former CEO who remains an advisor to the

Company in a consulting capacity. |

| (6) The tax impact

of non-GAAP adjustments is computed by: (i) applying the statutory

tax rate to the income or expense adjusted items; (ii) applying a

zero-tax rate to adjusted items where a valuation allowance exists;

and (iii) excluding discrete tax benefits and expenses, primarily

associated with tax deductible and non-deductible stock-based

compensation. For the three and nine months ended

September 30, 2024, the GAAP effective income tax rates were

approximately (3)% and (30)%, respectively, and the non-GAAP

effective income tax rates for the three and nine months ended

September 30, 2024 were approximately 23% and 24%,

respectively, with the difference from GAAP primarily related to

the impact of excluding discrete tax expense related to

non-deductible goodwill impairment charges. The nine months ended

September 30, 2024 also reflected a difference from GAAP related to

excluding discrete tax expense for non-deductible stock-based

compensation, mainly related to expired stock options. For the

three and nine months ended September 30, 2023, the GAAP effective

income tax rates were approximately 35% and 39%, respectively, and

the non-GAAP effective income tax rates for both periods was

approximately 24%, with the difference from GAAP primarily due to

the impact of excluding discrete tax expenses associated with

non-deductible stock-based compensation and tax expenses related to

executive compensation. |

| (7) For the three

months ended September 30, 2023, there were no non-GAAP adjustments

when calculating the diluted weighted average common shares

outstanding or the interest expense add back under the

“if-converted” method. For the three and nine months ended

September 30, 2024 and the nine months ended September 30, 2023,

the 0.75% convertible senior notes due 2025, or 2025 Notes, were

excluded from diluted net income per common share on a GAAP basis

as the impact would have been antidilutive. These potential

securities resulted in a dilutive impact on diluted net income per

common share reported on a non-GAAP basis. For the three and nine

months ended September 30, 2024 and the nine months ended September

30, 2023, non-GAAP adjustments to diluted weighted average shares

outstanding included the impact of the 2025 Notes as if they

converted on the first day of the period presented, which resulted

in an additional 2.8 million, 4.2 million and 5.6 million common

shares, respectively, upon an assumed conversion and added back

$0.5 million, $2.3 million and $3.1 million of interest expense,

net of tax, to non-GAAP net income. The Company has the option to

settle its 2025 Notes in cash, shares of the Company’s common stock

or a combination of cash and shares of the Company’s common

stock. |

| |

|

Pacira BioSciences, Inc.Reconciliation of

GAAP to Non-GAAP Financial Information

(continued)(in thousands, except

percentages)(unaudited)

|

| |

Three Months Ended |

|

Nine Months Ended |

| |

September 30, |

|

September 30, |

| |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Cost of goods sold

reconciliation: |

|

|

|

|

|

|

|

| GAAP cost of goods sold |

$ |

38,864 |

|

|

$ |

39,750 |

|

|

$ |

130,542 |

|

|

$ |

136,977 |

|

|

Step-up of acquired Flexion fixed assets and inventory to fair

value and other |

|

— |

|

|

|

(1,318 |

) |

|

|

— |

|

|

|

(5,152 |

) |

| Stock-based compensation |

|

(1,509 |

) |

|

|

(1,272 |

) |

|

|

(3,896 |

) |

|

|

(4,432 |

) |

| Non-GAAP cost of goods

sold |

$ |

37,355 |

|

|

$ |

37,160 |

|

|

$ |

126,646 |

|

|

$ |

127,393 |

|

| |

|

|

|

|

|

|

|

| Gross margin

reconciliation: |

|

|

|

|

|

|

|

| Total revenues |

$ |

168,573 |

|

|

$ |

163,926 |

|

|

$ |

513,713 |

|

|

$ |

493,734 |

|

| GAAP gross margin |

$ |

129,709 |

|

|

$ |

124,176 |

|

|

$ |

383,171 |

|

|

$ |

356,757 |

|

| GAAP gross margin

percentage |

|

77 |

% |

|

|

76 |

% |

|

|

75 |

% |

|

|

72 |

% |

| Adjustments to GAAP gross

margin: |

|

|

|

|

|

|

|

|

Step-up of acquired Flexion fixed assets and inventory to fair

value and other |

|

— |

|

|

|

1,318 |

|

|

|

— |

|

|

|

5,152 |

|

|

Stock-based compensation |

|

1,509 |

|

|

|

1,272 |

|

|

|

3,896 |

|

|

|

4,432 |

|

| Non-GAAP gross margin |

$ |

131,218 |

|

|

$ |

126,766 |

|

|

$ |

387,067 |

|

|

$ |

366,341 |

|

| Non-GAAP gross margin

percentage |

|

78 |

% |

|

|

77 |

% |

|

|

75 |

% |

|

|

74 |

% |

| |

|

|

|

|

|

|

|

| Research and

development reconciliation: |

|

|

|

|

|

|

|

| GAAP research and

development |

$ |

19,104 |

|

|

$ |

20,830 |

|

|

$ |

57,680 |

|

|

$ |

56,794 |

|

| Stock-based compensation |

|

(1,794 |

) |

|

|

(2,220 |

) |

|

|

(5,522 |

) |

|

|

(5,817 |

) |

| Non-GAAP research and

development |

$ |

17,310 |

|

|

$ |

18,610 |

|

|

$ |

52,158 |

|

|

$ |

50,977 |

|

| |

|

|

|

|

|

|

|

| Selling, general and

administrative reconciliation: |

|

|

|

|

|

|

|

| GAAP selling, general and

administrative |

$ |

74,333 |

|

|

$ |

67,947 |

|

|

$ |

214,485 |

|

|

$ |

203,640 |

|

|

CEO transition costs |

|

(174 |

) |

|

|

— |

|

|

|

(745 |

) |

|

|

— |

|

| Stock-based compensation |

|

(9,137 |

) |

|

|

(9,038 |

) |

|

|

(25,970 |

) |

|

|

(25,226 |

) |

| Non-GAAP selling, general and

administrative |

$ |

65,022 |

|

|

$ |

58,909 |

|

|

$ |

187,770 |

|

|

$ |

178,414 |

|

| |

|

|

|

|

|

|

|

| Weighted average

common shares outstanding - diluted reconciliation: |

|

|

|

|

|

|

|

| GAAP weighted average common

shares outstanding - diluted |

|

46,134 |

|

|

|

52,067 |

|

|

|

46,269 |

|

|

|

46,343 |

|

|

Dilutive common shares associated with the 2025 Notes(1) |

|

2,821 |

|

|

|

— |

|

|

|

4,184 |

|

|

|

5,608 |

|

|

Dilutive common shares associated with stock options,

restricted stock units and employee stock purchase plan |

|

16 |

|

|

|

— |

|

|

|

115 |

|

|

|

— |

|

| Non-GAAP weighted average

common shares outstanding - diluted |

|

48,971 |

|

|

|

52,067 |

|

|

|

50,568 |

|

|

|

51,951 |

|

| (1) For the three

and nine months ended September 30, 2024 and the nine months ended

September 30, 2023, potential common shares of the 2025 Notes were

excluded from diluted net (loss) income per common share on a GAAP

basis because they would have been antidilutive. These potential

securities resulted in a dilutive impact on diluted net income per

common share reported on a non-GAAP basis. |

Pacira BioSciences, Inc.

Reconciliation of GAAP Net (Loss) Income

to Adjusted EBITDA (Non-GAAP)(in

thousands)(unaudited)

| |

Three Months Ended |

|

Nine Months Ended |

| |

September 30, |

|

September 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| GAAP net (loss) income |

$ |

(143,466 |

) |

|

$ |

10,858 |

|

|

$ |

(115,601 |

) |

|

$ |

17,085 |

|

| |

|

|

|

|

|

|

|

| Interest

income |

|

(5,482 |

) |

|

|

(2,766 |

) |

|

|

(14,134 |

) |

|

|

(8,019 |

) |

| Interest expense

(1) |

|

4,689 |

|

|

|

3,464 |

|

|

|

11,889 |

|

|

|

16,918 |

|

| Income tax

expense |

|

4,610 |

|

|

|

5,743 |

|

|

|

26,969 |

|

|

|

10,896 |

|

| Depreciation

expense |

|

5,931 |

|

|

|

4,111 |

|

|

|

14,576 |

|

|

|

14,123 |

|

| Amortization of

acquired intangible assets |

|

14,322 |

|

|

|

14,322 |

|

|

|

42,966 |

|

|

|

42,966 |

|

| EBITDA |

|

(119,396 |

) |

|

|

35,732 |

|

|

|

(33,335 |

) |

|

|

93,969 |

|

| |

|

|

|

|

|

|

|

| Other adjustments: |

|

|

|

|

|

|

|

|

Contingent consideration (gains) charges, restructuring charges and

other: |

|

|

|

|

|

|

|

|

Changes in the fair value of contingent consideration |

|

(3,244 |

) |

|

|

2,793 |

|

|

|

(5,541 |

) |

|

|

(3,847 |

) |

|

Restructuring charges (2) |

|

403 |

|

|

|

173 |

|

|

|

4,207 |

|

|

|

1,109 |

|

|

Acquisition-related expenses |

|

285 |

|

|

|

390 |

|

|

|

689 |

|

|

|

1,588 |

|

|

Goodwill impairment |

|

163,243 |

|

|

|

— |

|

|

|

163,243 |

|

|

|

— |

|

|

Step-up of acquired Flexion inventory to fair value and other |

|

— |

|

|

|

1,318 |

|

|

|

— |

|

|

|

3,884 |

|

|

Stock-based compensation |

|

13,230 |

|

|

|

12,530 |

|

|

|

38,905 |

|

|

|

35,475 |

|

|

CEO transition costs |

|

174 |

|

|

|

— |

|

|

|

745 |

|

|

|

— |

|

|

(Gain) loss on early extinguishment of debt |

|

— |

|

|

|

— |

|

|

|

(7,518 |

) |

|

|

16,926 |

|

| Adjusted EBITDA |

$ |

54,695 |

|

|

$ |

52,936 |

|

|

$ |

161,395 |

|

|

$ |

149,104 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Includes amortization of debt discount and debt issuance

costs.(2) Approximately $0.8 million and $3.5 million of

restructuring charges were excluded from this line item as they are

included in the stock-based compensation line item for the three

and nine months ended September 30, 2024, respectively.

Pacira BioSciences,

Inc.Reconciliation of GAAP to Non-GAAP 2024

Financial Guidance(dollars in

millions)

|

GAAP to Non-GAAP Financial Guidance |

|

GAAP |

|

Impact of GAAP to Non-GAAP Adjustments (1) |

|

Non-GAAP |

| Total revenues |

|

$680 to $705 |

|

— |

|

$680 to $705 |

| Gross margin |

|

73% to 75% |

|

Approximately 1% |

|

74% to 76% |

| Research and development

expense |

|

$78 to $90 |

|

$8 to $10 |

|

$70 to $80 |

| Selling, general and

administrative expense |

|

$280 to $310 |

|

$35 to $45 |

|

$245 to $265 |

| Stock-based compensation |

|

$50 to $55 |

|

— |

|

— |

(1) The full-year impact of GAAP to Non-GAAP adjustments

primarily relates to stock-based compensation.

Investor Contact:

Susan Mesco, (973) 451-4030

susan.mesco@pacira.com

Media Contact:

Sara Marino, (973) 370-5430

sara.marino@pacira.com

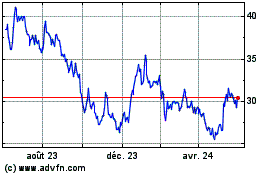

Pacira BioSciences (NASDAQ:PCRX)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

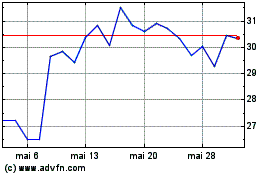

Pacira BioSciences (NASDAQ:PCRX)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024