0001145197FALSE00011451972025-03-072025-03-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): March 7, 2025

INSULET CORPORATION

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-33462 | | 04-3523891 |

(State or Other Jurisdiction

of Incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | | | | | | | |

| 100 Nagog Park | |

| Acton | Massachusetts | 01720 | |

| (Address of Principal Executive Offices, including Zip Code) | |

| | | | | | | | | | | | | | |

| Registrant’s telephone number, including area code: | (978) | 600-7000 | |

| | | | | | | | | | | | | | |

| Not Applicable

(Former Name or Former Address, if Changed Since Last Report) | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter)

| | | | | |

| Emerging growth company | ☐ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised accounting standards provided pursuant to Section 13(a) of the Exchange Act | ☐ |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Common Stock, $0.001 Par Value Per Share

| | PODD | | The NASDAQ Stock Market, LLC

|

Item 1.01 – Entry into a Material Definitive Agreement.

On March 7, 2025, Insulet Corporation (the “Company”) and NXP USA, Inc. (“NXP”) entered into an Addendum effective January 1, 2025 (the “2025 Addendum”) to the Purchase Agreement, dated as of October 12, 2017, between the Company and NXP (the “Original Agreement”), as amended by an addendum entered into effective January 1, 2024 (the “2024 Addendum”). Pursuant to the 2025 Addendum, which became effective January 1, 2025, the term of the Original Agreement, as amended, is extended, and certain terms and conditions related to pricing, volume, warranties, product modifications, and other matters are amended.

The foregoing description of the 2025 Addendum is not intended to be complete and is qualified in its entirety by reference to the full text of the 2025 Addendum, filed as Exhibit 10.1 hereto and incorporated by reference herein.

| | | | | |

| Item 9.01. | Financial Statements and Exhibits. |

The following exhibit is filed as part of this report:

| | | | | | | | |

| No. | | Exhibit |

| | Addendum, effective January 1, 2025, to the Purchase Agreement by and between Insulet Corporation and NXP USA, Inc., dated October 12, 2017. |

| | |

| 104 | | Cover Page Interactive Date File (embedded within the Inline XBRL document) |

+ Certain portions of this exhibit are considered confidential and have been omitted as permitted under SEC rules and regulations.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this Current Report on Form 8-K to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| | | | | |

| | | | INSULET CORPORATION |

| | | |

Date: March 10, 2025 | | | | By: | /s/ Patricia K. Dolan |

| | | | | Patricia K. Dolan |

| | | | | Vice President, Secretary |

Exhibit 10.1

CERTAIN INFORMATION HAS BEEN OMITTED FROM THIS DOCUMENT BECAUSE IT IS (I) NOT MATERIAL AND (II) IS THE TYPE THAT THE COMPANY TREATS AS PRIVATE AND CONFIDENTIAL. OMISSIONS ARE MARKED [***]

ADDENDUM

TO THE PURCHASE AGREEMENT

THIS ADDENDUM TO THE PURCHASE AGREEMENT (“2025 Addendum”) is entered into by and between Insulet Corporation (“Insulet”) and NXP USA, Inc. (“NXP”) and effective as of January 1, 2025 (“Addendum Effective Date”). Insulet and NXP may be referred to herein as a “Party” or, collectively, as the “Parties.”

WHEREAS Insulet and NXP entered into that certain Purchase Agreement dated October 12, 2017, as may have been amended from time to time (the “Agreement”); and

WHEREAS the Parties wish to further amend the Agreement on the terms and conditions set forth herein, effective as of the Addendum Effective Date.

NOW, THEREFORE, in consideration of the mutual covenants and agreements herein contained, the Parties mutually agree as follows:

1.Definitions. Unless otherwise defined herein, capitalized terms used herein and not otherwise defined shall have the meaning ascribed to such terms in the Agreement.

2.2024 Addendum. Purchases shipped during Q1 2025 are subject to the 2024 Addendum, entered into by the Parties on January 1, 2024. Accordingly, the Table 1 - Q1 2025 Deliveries (as depicted below) is incorporated into this the 2025 Addendum by reference and will continue in full force and effect through the March 31, 2025. For clarity, Products delivered during Q1 [***].

| | | | | | | | | | | | | | | | | |

| Table 1 - Q1 2025 Delivery Table (M) |

| [***] | [***] | [***] | [***] | [***] | [***] |

| [***] | [***] | [***] | [***] | [***] | [***] |

| [***] | [***] | [***] | [***] | [***] | [***] |

3.2025 Purchase Period & Quantities. Insulet, including its High-Level Suppliers, will purchase [***] during the period covering January 1, 2025 to December 31, 2025 (“2025 Addendum Purchase Period”), subject to the deliveries set out in Table 1 above.

| | | | | | | | | | | | | | | | | |

| Table 2 –2025 Delivery Table (M) |

| Q1 | Q2 | Q3 | Q4 | Total |

| [***] | [***] | [***] | | | [***] |

| [***] | [***] | [***] | [***] | [***] | [***] |

| [***] | [***] | [***] | [***] | [***] | [***] |

As of the Addendum Effective Date, Purchase Orders from Insulet have been placed for Q1 and Q2 2025. Insulet will[***].

4.Pricing. Insulet and NXP have agreed to the following [***]pricing for the Products (in millions) delivered under the 2024 Addendum and 2025 Addendum:

| | | | | | | | |

| Table 3 - [***] |

| Product | Purchase Quantity [***] | Price |

| [***] | [***] | [***] |

| [***] |

| [***] | [***] |

| [***] | [***] | [***] |

| [***] | [***] |

| [***] | [***] |

| [***] | [***] | [***] |

| [***] | [***] |

| [***] | [***] | [***] |

[***].

[***].

5.NHS52SO4 PHX Product Limited Warranty. The following warranty terms only apply to the [***] shipped during the 2024 and 2025 Addendum Purchase Period(s): [***]. THE EXPRESS WARRANTY GRANTED ABOVE EXTENDS ONLY TO INSULET AND NOT TO INSULET’S CUSTOMERS, AGENTS, OR REPRESENTATIVES. THE EXPRESS WARRANTY GRANTED ABOVE IS IN LIEU OF ALL OTHER WARRANTIES, WHETHER EXPRESS OR IMPLIED, INCLUDING WITHOUT LIMITATION ANY IMPLIES WARRANTIES OF FITNESS FOR A PARTICULAR PURPOSE, MERCHANTABILITY, OR NON-INFRINGEMENT OF INTELLECTUAL PROPERTY RIGHTS. ALL OTHER WARRANTIES ARE HEREBY SPECIFICALLY DISCLAIMED BY NXP.

6.Limited Market Release Order Modifications. The Parties acknowledge the unique development timeline for Insulet’s OP5, which includes a Limited Market Release during which the OP5 may be modified (“Limited Market Release” or “LMR”). [***]. If a modification is required, the Parties agree to work together in good faith to address any identifiable issues, including hardware or software issues, and the following limited rights will apply:

6.1[***].

6.2[***].

| | | | | |

[***] |

[***] | [***] |

[***] | [***] |

[***] | [***] |

[***].

7.Higher-Level Suppliers. Insulet’s Higher-Level Suppliers will make the actual purchases required under this 2025 Addendum and all such purchases shall be credited against the order commitment as outlined in this 2025 Addendum as if Insulet were the actual purchaser. [***]. Nothing in this 2025 Addendum shall be deemed to limit Insulet, or its Higher-Level Suppliers, from issuing additional Purchase Orders following the Addendum Effective Date.

8.[***]:

| | | | | | | | | | | |

[***] | [***] | [***] | [***] |

[***] | [***] | [***] | [***] |

[***] | [***] | [***] | [***] |

[***] | [***] | [***] | [***] |

a)For clarity, [***].

b)Insulet will provide NXP with a [***] rolling forecast for planning purposes. The Parties agree to mutual monthly demand reviews to facilitate updates to the respective supply chain.

c)NXP agrees that the Purchase Orders for the [***] Products are subject to the [***].

9.No Other Amendments. Except as modified herein, all other terms of the Agreement shall remain in full force and effect.

10.Conflicts. In the event of a conflict between the Agreement or this 2025 Addendum, this 2025 Addendum shall govern.

11.Counterparts. This 2025 Addendum may be executed in counterparts, each of which shall be deemed to be an original and all of which together shall be deemed to be one and the same instrument.

IN WITNESS WHEREOF, this 2025 Addendum has been executed by the duly authorized representatives of the parties as of the Addendum Effective Date.

| | |

NXP USA, INC. |

By:/s/ Katherine Haight |

Name: Katherine Haight |

Title: VP, Commercial Legal Support |

Date: 3/7/2025 |

|

NXP USA, INC. |

By:/s/ Jaime French |

Name: Jaime French |

Title: Senior Director, Legal |

Date: 3/7/2025 |

| | |

INSULET CORPORATION |

By:/s/ Thomas J. Niglio |

Name: Thomas J. Niglio |

Title: Group Vice President, Chief Procurement Officer |

Date: 2/27/2025 |

Exhibit A – Anticipated Schedule

[***]

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

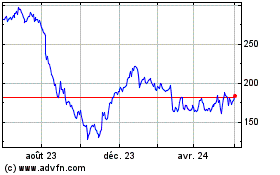

Insulet (NASDAQ:PODD)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

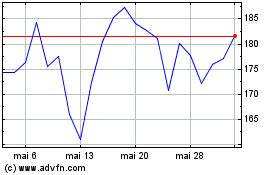

Insulet (NASDAQ:PODD)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025