false

0001427570

0001427570

2024-10-16

2024-10-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 16, 2024

RESHAPE LIFESCIENCES

INC.

(Exact name of registrant as specified in its charter)

| Delaware |

1-37897 |

26-1828101 |

|

(State or other jurisdiction

of

incorporation) |

(Commission

File Number) |

(I.R.S. Employer

Identification Number) |

| |

|

|

|

18 Technology Drive, Suite 110

Irvine, CA |

92618 |

| (Address of principal executive offices) |

(Zip Code) |

| |

|

|

|

(949) 429-6680

(Registrant’s

telephone number, including area code)

Not applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| | |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| | |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of Class |

Trading

Symbol |

Name

of Exchange on which Registered |

| Common stock, $0.001 par value per share |

RSLS |

The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01 | Entry into a Material

Definitive Agreement. |

In a private transaction, on October 16, 2024,

ReShape Lifesciences Inc. (the “Company”) entered into a securities purchase agreement (the “SPA”) with an institutional

investor (the “Investor”). Pursuant to the SPA, the Company agreed to issue the Investor a senior secured convertible note

in the aggregate original principal amount of $833,333.34 (the “Note”), and also issue to the Investor 7,983 shares of common

stock, par value $0.001, of the Company (“Common Stock”) as “commitment shares” to the Investor.

The Company is the issuer of the Note, and its

respective subsidiaries will guaranty the obligations under the Note pursuant to a Guaranty, dated October 16, 2024 (the “Guaranty”).

The Note will be fully secured by collateral of the Company and its subsidiaries. The security interest in favor of the Investor, as collateral

agent, will cover substantially all assets of the Company including, without limitation, the intellectual property, trademark, and patent

rights of the Company. The parties entered into a Security Agreement (the “Security Agreement”) and certain intellectual property

security agreements granting such security interest in favor of the Investor.

Form of

Note. In connection with the SPA, the Company issued to the Investor the Note on October 16, 2024, which bears

an interest rate of 10% per annum and is due and payable on the earlier of (i) January 16, 2025 and (ii) the date of consummation

or termination of the Company’s previously announced merger with Vyome Therapeutics, Inc. The initial conversion price of the

Note is $5.22 per share of Common Stock. The Note may not be converted by the Investor into shares of Common Stock if such conversion

would result in the Investor and its affiliates owning in excess of 4.99% of the number of shares of the Common Stock outstanding immediately

after giving effect to the issuance of all shares issuable upon conversion of the Note. The Note provides for certain events of default

that are typical for a transaction of this type, including, among other things, any breach of the representations or warranties made by

the Company or its subsidiaries. In connection with any event of default that results in the acceleration of payment of the Note and while

it is continuing, the interest rate on the Note shall accrue at an interest rate equal to the lesser of 24% per annum or the maximum rate

permitted under applicable law.

Registration

Rights Agreement. In connection with the SPA, the Company entered into a Registration Rights Agreement with the Investor,

dated October 16, 2024 (the “RRA”). The RRA provides that the Company will file a registration statement to register

the shares of Common Stock underlying the Note and the commitment shares within 30 days after the date of the SPA and will use its best

efforts to cause the registration statement to be declared effective within 30 days after the filing date.

Lock-Up

Agreement. In connection with the SPA, the directors and officers of the Company each entered into a lock-up

agreement (the “Lock-Up Agreement”), pursuant to which each agreed to, from the date of the Lock-Up Agreement until the Note

is no longer outstanding, subject to certain customary exceptions, not offer, sell, contract to sell, hypothecate, pledge or otherwise

dispose of any shares of Common Stock of the Company or securities convertible, exchangeable or exercisable into, shares of Common Stock

of the Company beneficially owned, held or acquired by the person signing the Lock-Up Agreement.

Leak-Out

Agreement. In connection with the SPA, the Company entered into a Leak-Out Agreement with the Investor, dated October 16,

2024 (the “Leak-Out Agreement”), pursuant to which the Investor agreed that on any trading day while the Note, or shares of

Common Stock issued to the Investor upon conversion of the Note, remains outstanding, the Investor will not, and will cause each of its

trading affiliates not to, sell, dispose or otherwise transfer, in the aggregate, more than 10% of the composite daily trading volume

of the Common Stock as reported by Bloomberg, LP.

The foregoing descriptions of the SPA, the Note,

the RRA, the Security Agreement, the Guaranty, the Lock-Up Agreement and the Leak-Out Agreement do not purport to be complete and are

qualified in their entirety by the terms and conditions of the SPA, the Note, the RRA, the Security Agreement, the Guaranty, the Lock-Up

Agreement and the Leak-Out Agreement, respectively filed as Exhibit 10.1, Exhibit 10.2, Exhibit 10.3, Exhibit 10.4,

Exhibit 10.5, Exhibit 10.6 and Exhibit 10.7 hereto and incorporated by reference herein.

Maxim Group LLC acted as the Company’s

exclusive financial advisor for the transaction.

| Item 2.03 | Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement

of a Registrant. |

The information provided in

Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

| Item 3.02 | Unregistered Sale of

Equity Securities. |

The

information provided in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

| Item 9.01 | Financial Statements

and Exhibits. |

(d) Exhibits

|

Exhibit No. |

|

Description |

| 10.1 |

|

Form of Securities Purchase Agreement, dated as of October 16, 2024 by and between the Company and the Investor |

| 10.2 |

|

Form of Note, dated as of October 16, 2024 |

| 10.3 |

|

Form of Registration Rights Agreement, dated as of October 16, 2024 by and between the Company and the Investor |

| 10.4 |

|

Form of Security Agreement, dated October 16, 2024 |

| 10.5 |

|

Form of Guaranty, dated October 16, 2024 |

| 10.6 |

|

Form of Lock-Up Agreement, dated October 16, 2024 |

| 10.7 |

|

Form of Leak-Out Agreement, dated October 16, 2024 |

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

| |

RESHAPE LIFESCIENCES INC. |

| |

|

|

| |

By: |

/s/ Paul F. Hickey |

| |

|

Paul F. Hickey |

| |

|

Chief Executive Officer |

Dated: October 17,

2024

nullnullnullnullnullnullnull

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

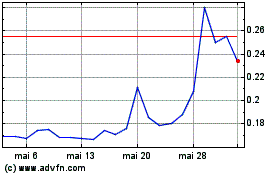

ReShape Lifesciences (NASDAQ:RSLS)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

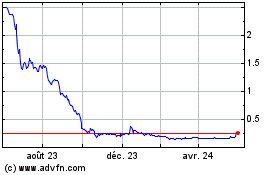

ReShape Lifesciences (NASDAQ:RSLS)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024