false

0001427570

0001427570

2024-12-19

2024-12-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

December

19, 2024

RESHAPE LIFESCIENCES

INC.

(Exact name of registrant as specified in its charter)

| Delaware |

1-37897 |

26-1828101 |

|

(State or other jurisdiction of

incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification Number) |

| |

|

|

|

18 Technology Drive, Suite 110

Irvine, CA |

92618 |

| (Address of principal executive offices) |

(Zip Code) |

| |

|

|

|

(949) 429-6680

(Registrant’s

telephone number, including area code)

Not applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| | |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| | |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Act:

| Title

of Class |

Trading

Symbol |

Name

of Exchange on which Registered |

| Common stock, $0.001 par value per share |

RSLS |

The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01 | Entry into a Material Definitive

Agreement. |

On December 19, 2024, ReShape Lifesciences

Inc. (the “Company”) entered into an equity purchase agreement (the “Purchase Agreement”) with a certain

investor (the “Investor”), which provides that, upon the terms and subject to the conditions and limitations set forth

therein, the Company has the right, but not the obligation, to sell to the Investor up to $5,000,000 of shares (the “Investor

Shares”) of the Company’s common stock (the “Common Stock”) from time to time over the 36-month term of the

Purchase Agreement.

The price paid by the Investor for each share

of Common Stock (the “Share Price”) at each closing (each, a “Closing”) shall be 93% of the daily volume-weighted average price of

the Common Stock (“VWAP”) on the previous trading day prior to such Closing; provided, that if 93% the lowest VWAP in

the four trading days following such Closing is lower than such Share Price, then, as a “true-up”, the Company shall

issue additional shares of Common Stock to the Investor so as to ensure that the total number of shares received by the Investor is

equal to the number it would have received for the aggregate purchase price paid at such Closing if the shares of Common Stock had

been valued at such lower number.

The Investor Shares shall be purchased at

Closings that will occur within one trading day of the date the Investor is deemed in receipt of an issuance notice from the Company

(the “Issuance Notice”), so long as certain conditions mutually agreed between the Investor and the Company, are

satisfied; provided, that, Investor Shares issued at any one Closing shall not exceed (a) if the Issuance Notice is received prior

to 8 a.m. Eastern Standard Time, (i) 12.5% of the average daily trading volume of the Common Stock multiplied by the VWAP for that

trading day (the “Daily Value Traded”) of the Common Stock on the 10 trading days immediately preceding the date of such

Closing and (ii) a purchase price of $500,000 and (b) otherwise, (a) the lower of (i) 7.5% of the average Daily Value Traded of

the Common Stock on the 10 trading days immediately preceding the date of such Closing and (ii) a purchase price of $250,000.

Upon the execution of the Purchase Agreement, the

Company issued to the Investor 17,300 shares of Common Stock and a pre-funded warrant to purchase 21,015 shares of Common Stock at an

exercise price of $0.001 per share (together, the “Commitment Shares”), which together represents the fee for the Investor’s

commitment to purchase shares of the Company’s Common Stock under the Purchase Agreement. The Investor has agreed not to cause or

engage, in any manner whatsoever, any direct or indirect short selling or hedging of the Company’s Common Stock. The Purchase Agreement

prohibits the Company from directing the Investor to purchase any shares of Common Stock if those shares, when aggregated with all other

shares of Common Stock then beneficially owned by the Investor (as calculated pursuant to Section 13(d) of the Securities Exchange Act

of 1934, as amended, and Rule 13d-3 thereunder), would result in the Investor beneficially owning more than 9.99% of the then total outstanding

shares of Common Stock.

Under applicable listing rules of the

Nasdaq Capital Market (“Nasdaq”), the Company is prohibited from issuing to the Investor an aggregate number of shares

of Common Stock pursuant to the Purchase Agreement if such shares would exceed 19.9% of the number of issued and outstanding shares

of Common Stock as of the effective date of the Purchase Agreement, calculated in accordance with the applicable Nasdaq rules (such

maximum number of shares, the “Exchange Cap”), provided that the Exchange Cap will not apply (a) if the

Company’s stockholders have approved issuances in excess of the Exchange Cap in accordance with the Nasdaq rules or (b) solely

to the extent that (and only for so long as) the average price of the Investor Shares sold under the Purchase Agreement equals or

exceeds the lower of (i) the Nasdaq Official Closing Price (as reflected on nasdaq.com) immediately preceding the effective date; or

(ii) the average Nasdaq Official Closing Price for the five trading days immediately preceding the effective date. In any event, the

Purchase Agreement specifically provides that the Company is not required or permitted to issue, and the Investor is not required to

purchase, any shares of Common Stock under the Purchase Agreement if the issuance would violate the rules or regulations of

Nasdaq.

The Purchase Agreement may be terminated by (i) the Company at any time, for any reason and without any payment or liability to the Company

upon five days written notice, or (ii) upon mutual written consent of the Investor and Company. The Company may deliver purchase notices under

the Purchase Agreement, subject to market conditions, and in light of the Company’s capital needs, from time to time and under the

limitations contained in the Purchase Agreement. Any proceeds that the Company receives under the Purchase Agreement are expected to be

used for working capital and general corporate purposes, including expenses related to the Company’s previously announced proposed

merger with Vyome Therapeutics, Inc. and sale of substantially all of the Company’s assets to Ninjour Health International Limited,

provided that under the terms of the previously announced Securities Purchase Agreement, dated October 16, 2024, pursuant to which the

Company issued the Investor a senior secured convertible note in the aggregate principal amount of $833,333.34 (the “Note”),

the Company must use 66% of the net proceeds from any issuance of capital stock, including under an equity line of credit, to prepay the

amount the Company owes to the Investor under the Note.

On December 20, 2024, the Company filed a

Registration Statement on Form S-1 (the “Registration Statement”) with the Securities and Exchange Commission relating to

the resale of the Investor Shares and the Commitment Shares. The Company agreed to use its commercially reasonable efforts to have the

Registration Statement declared effective within 30 days of its initial filing.

The foregoing is a summary description of

certain terms of the Purchase Agreement and, by its nature, is incomplete. The form of Purchase Agreement is filed as Exhibit 10.1

hereto. The foregoing description of the Purchase Agreement is qualified in its entirety by reference to such exhibit.

The Purchase Agreement contains customary

representations and warranties, covenants and indemnification provisions that the parties made to, and solely for the benefit of, each

other in the context of all of the terms and conditions of such agreement and in the context of the specific relationship between the

parties thereto. The provisions of the Purchase Agreement, including any representations and warranties contained therein, are not for

the benefit of any party other than the parties thereto and are not intended as documents for investors and the public to obtain factual

information about the current state of affairs of the parties thereto. Rather, investors and the public should look to other disclosures

contained in the Company’s annual, quarterly and current reports the Company may file with the Securities and Exchange Commission.

The information contained in this Current

Report on Form 8-K shall not constitute an offer to sell or the solicitation of an offer to buy the shares of the Company’s Common Stock discussed herein, nor shall there be any offer, solicitation or sale of the shares in any jurisdiction in which such offer, solicitation

or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

| Item 3.02. |

Unregistered Sales of Equity Securities. |

The information provided in Item 1.01 with

respect to the issuances of the of the Investor Shares and Commitment Shares pursuant to the Securities Purchase Agreement is

incorporated herein by reference. The issuance of all such shares by the Company will not be registered under the Securities Act and

are issued in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act and/or Rule 506 of

Regulation D promulgated thereunder, or under any state securities laws, but the resale of such shares will be registered under the

Registration Statement.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

| |

RESHAPE LIFESCIENCES INC. |

| |

|

|

| |

By: |

/s/ Paul F. Hickey |

| |

|

Paul F. Hickey |

| |

|

Chief Executive Officer |

Dated: December

27, 2024

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

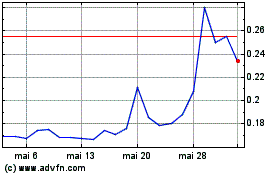

ReShape Lifesciences (NASDAQ:RSLS)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

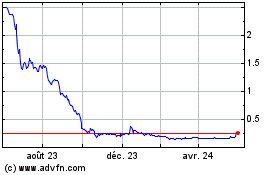

ReShape Lifesciences (NASDAQ:RSLS)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024